- USDT saw an increase in activity following regulatory scrutiny.

- However, a common trading strategy that could have benefited BTC failed to materialize.

The US government has reportedly launched a new investigation into Tether [USDT]a move that some are calling the latest “Tether FUD” tactic.

The timing is raising eyebrows, with some speculating that this is an orchestrated attempt to spread fear and shake up the market in the face of a potential Bitcoin. [BTC] outbreak.

Considering that more than 70% of cryptocurrency transactions involve USDT pairs, analysts at AMBCrypto warn of the risks associated with Tether’s centralization.

Any disruption to USDT could send shockwaves through the entire market. Especially as BTC enters the final week of the ‘Uptober’ frenzy.

USDT’s dominance is reaching new highs, but there’s a catch

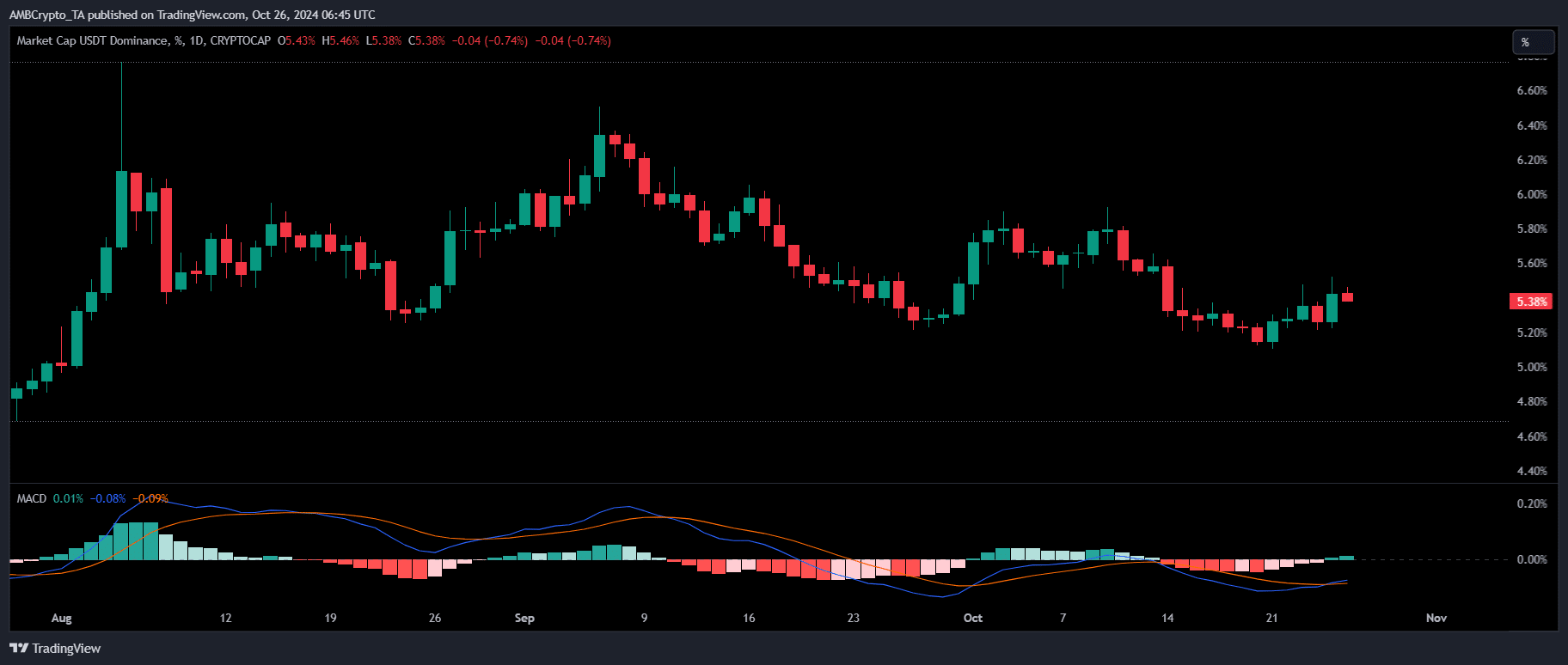

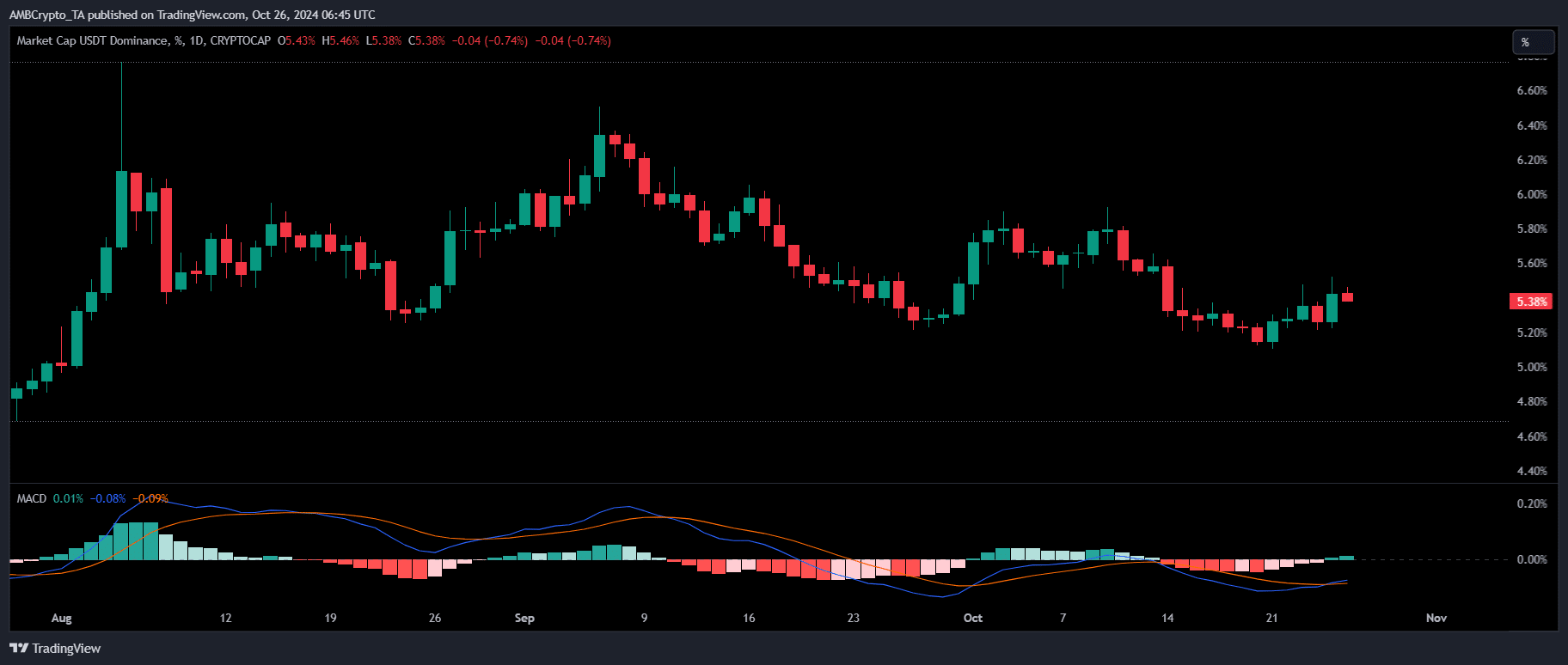

Over the past week, USDT’s dominance has steadily increased, with daily gains exceeding 2%. Historically, a rise in USDT dominance often coincides with BTC reaching market tops.

This was reminiscent of the previous closing price of almost $70,000.

However, the surge in demand for USDT, driven by rising panic, has put significant downward pressure on BTC, which is currently trading at $67,000.

This situation underlines USDT’s growing influence on Bitcoin’s price dynamics. Therefore, it is crucial to closely monitor the effects of the recent research on Tether.

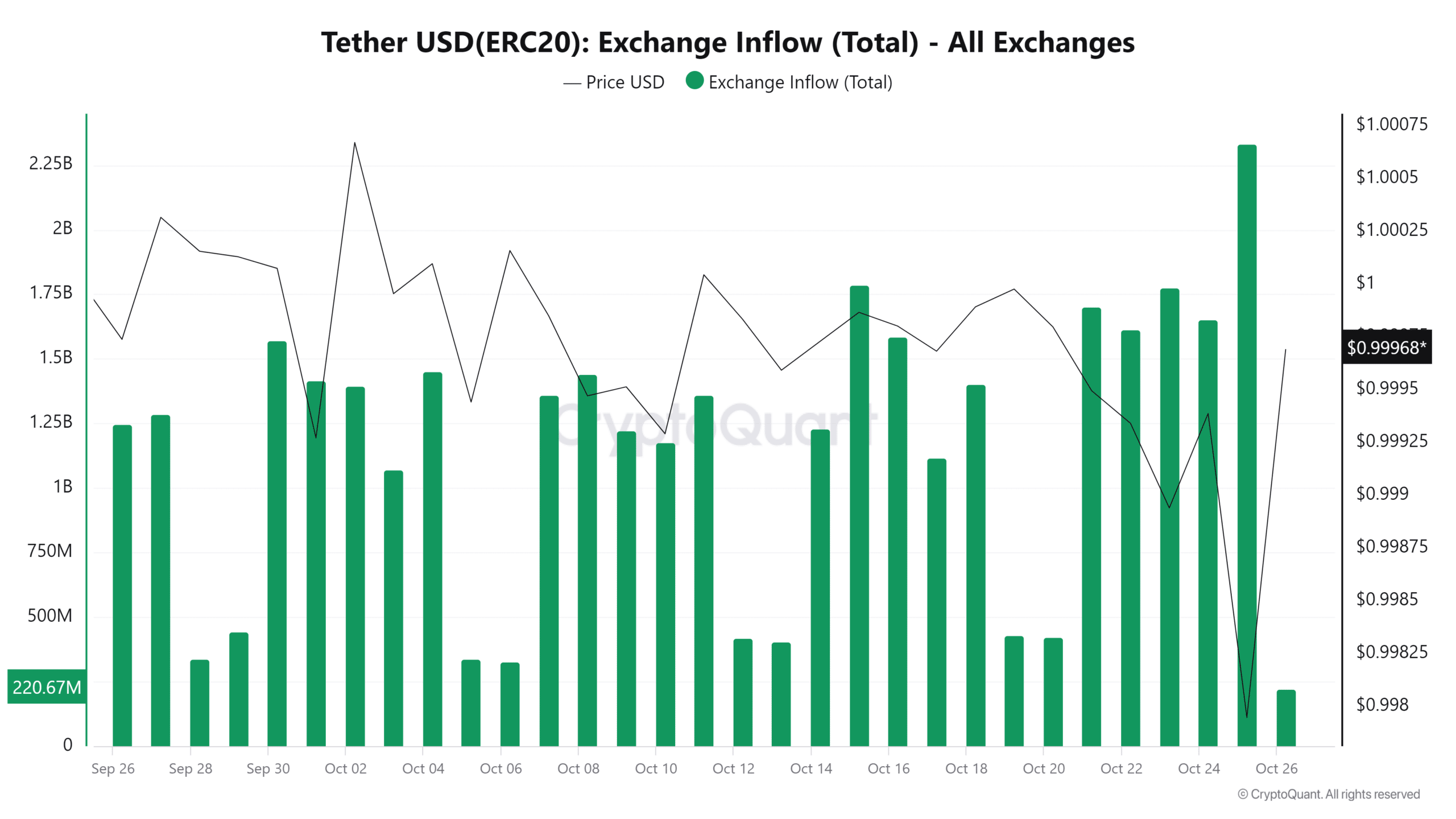

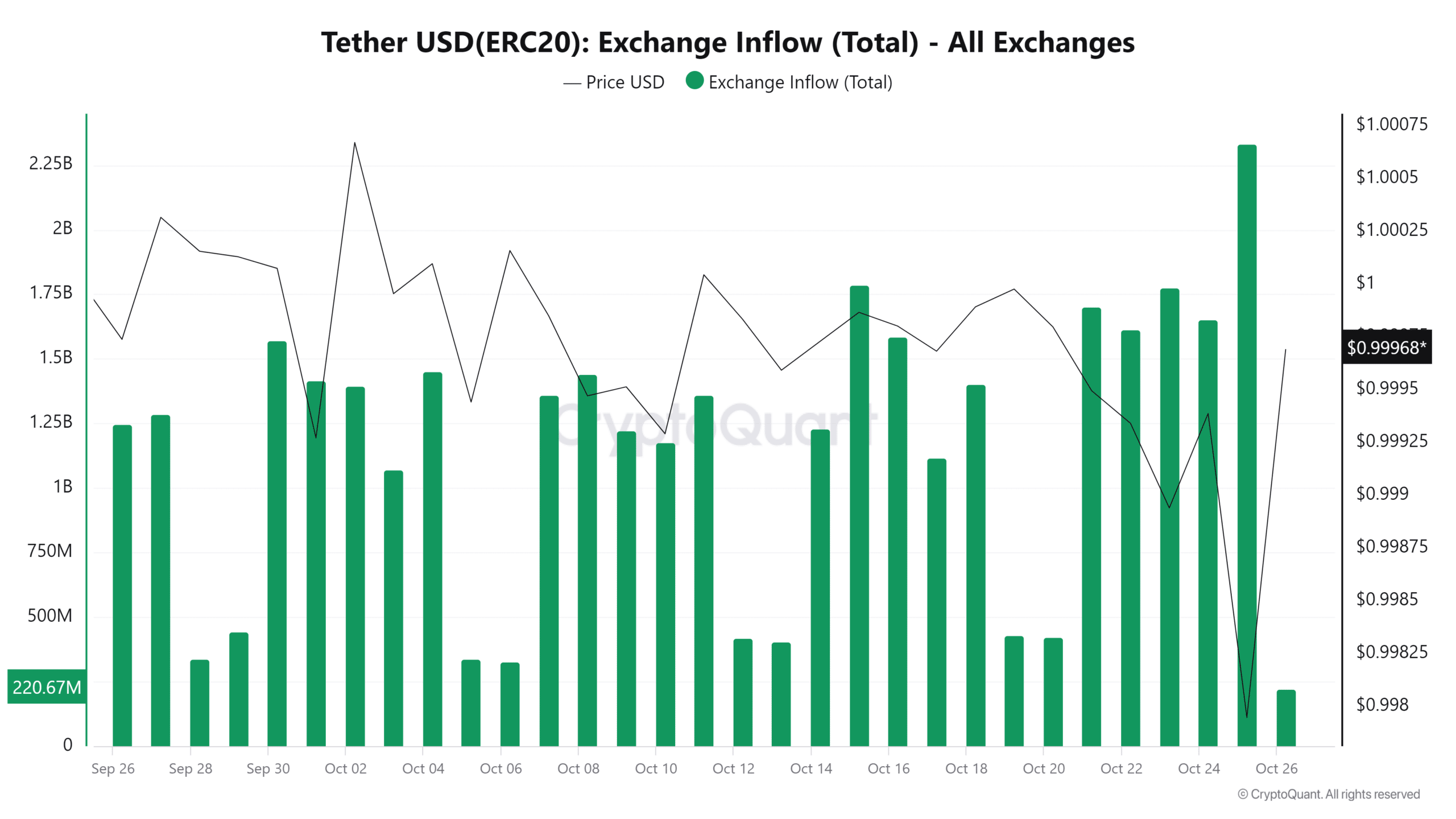

Source: CryptoQuant

Interestingly, during the late trading hours when the news circulated, USDT inflows into the exchanges increased dramatically, reaching a two-month high of over $2.3 billion.

Despite this spike, USDT’s dominance remained strong, with daily gains of almost 3%. This suggests that many traders viewed the news as exaggerated or misleading and chose to maintain their net imports.

However, there is a high chance that USDT deposits on exchanges could exceed net outflows in the coming days.

If the current BTC price proves to be a market bottom, it could attract significant liquidity, potentially pushing the price higher.

On the other hand, stakeholders could shift their assets to other high-cap altcoins or memecoins, seizing the opportunity to exchange USDT for more affordable alternatives.

The last week of October could see more activity in the crypto market, with several coins poised for a potential parabolic rally.

Chance of capital shift to BTC

Currently, USDT is at a crossroads. The research news caused panic among investors and enormous selling pressure. Still, the daily chart showed a bullish MACD crossover for USDT dominance.

Source: TradingView

Increased market volatility – fueled by Bitcoin’s dip to nearly $67,000 – has fueled the price speculation about a possible pullback to $64K, where the next bottom could form.

Furthermore, despite the fact that 12 hours have passed since the news broke, which typically prompts investors to swap USDT for BTC, traders have yet to hit the lows.

This scenario strengthens the potential for a retracement, making the current price a less attractive entry point.

Is your portfolio green? Check out the BTC profit calculator

The coming week is crucial for BTC as its fate depends on the market’s reaction to USDT. Currently, the chances of investors planning a parabolic rally appear limited.

This could reduce the chances of the crypto market ending October on a bullish note.