- BTC’s momentum turned bullish for the first time in the second half of 2024.

- Will the upward trend continue and follow historical trends before the US elections?

Last week was a great and bullish week for Bitcoin [BTC]. It rose almost 10%, rising from $62.5K to $69.4K thanks to strong demand in the spot market.

The recent rally left BTC just 7% away from the ATH of $73.7K it reached in March.

According to analyst Stockmoney Lizards, last week’s rally has turned BTC’s momentum bullish and could be accelerated by historic uptrends tied to the US elections.

He noted that BTC’s momentum turned bullish for the first time in the second half of 2024.

“Momentum is turning bullish”

Source:

For perspective, the SMI (Stochastic Momentum Index) is a momentum indicator that measures a BTC price relative to a recent midpoint. It shows whether it is overbought or oversold.

The current reading on the 2-week chart has seen a recovery above the neutral 50 level, indicating that a bullish reversal was in play.

This was similar to the 2020 trend, just before BTC broke its reaccumulation range and could signal a likely bullish breakout.

BTC: US trend before the election

Source:

The analyst added that BTC’s explosive gains related to the US primaries could happen again.

In 2016 and 2020, two weeks before the US elections, BTC rose 10% and 18% respectively.

If the trend repeats in 2024, Stockmoney Lizards predicted a new ATH before the US elections could be likely.

“For 2024, this would mean we could see a new ATH (+10% = $74,000) before the election with a huge pump in November and December.”

But are the on-chain metrics also leaning towards this bullish outlook?

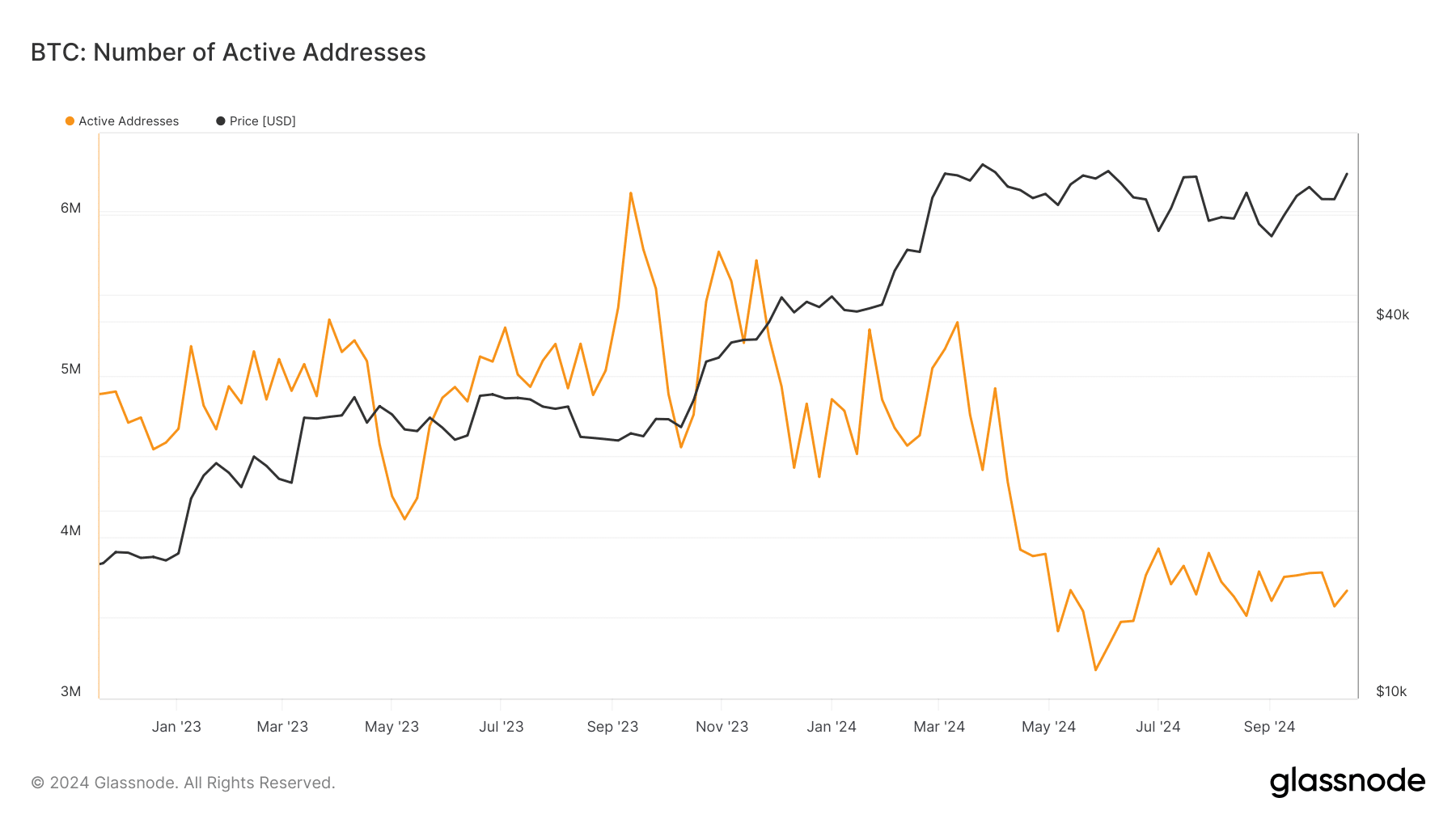

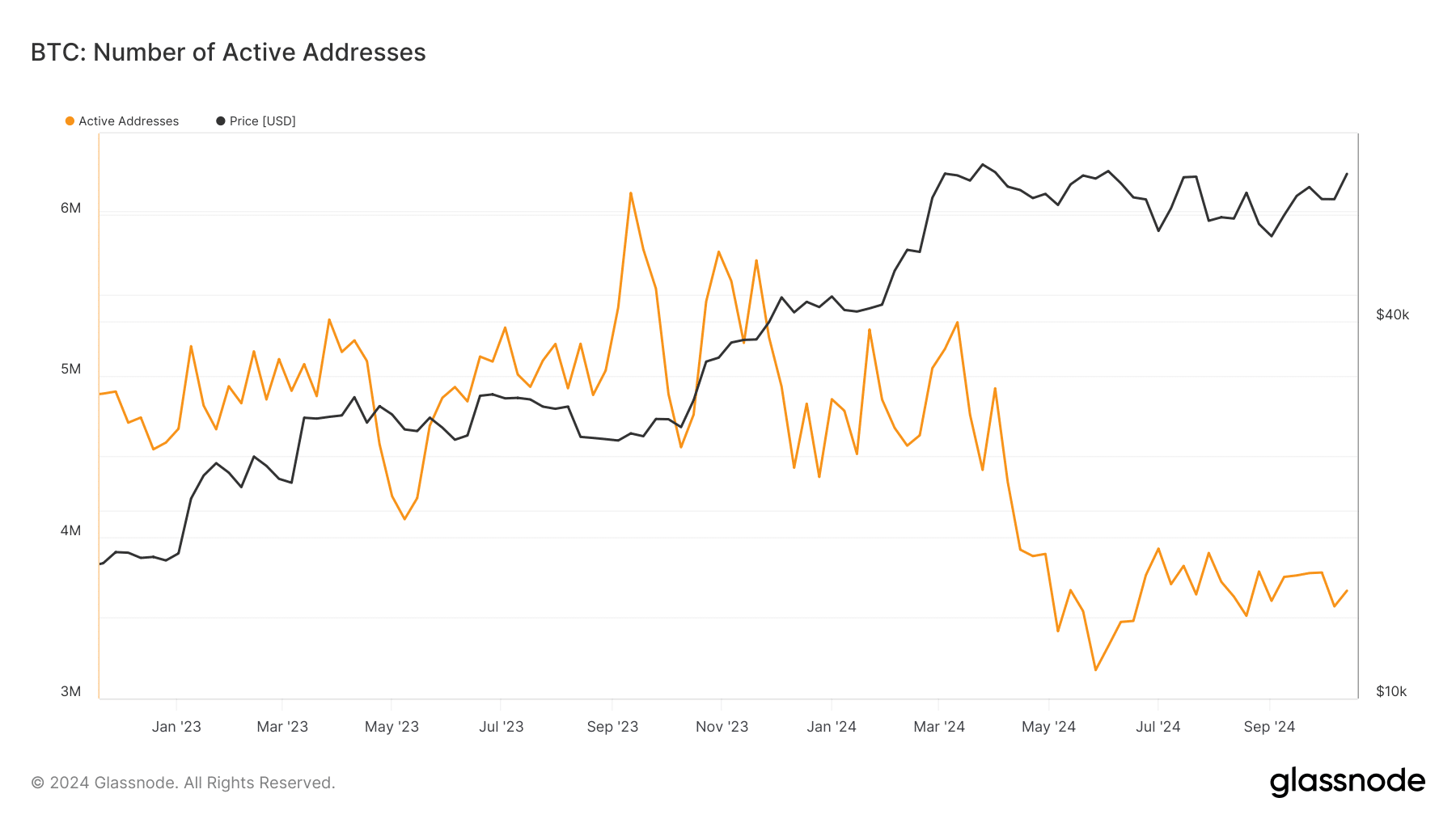

Source: Glassnode

Since July, overall interest and network growth in BTC has stagnated, as evidenced by daily active addresses.

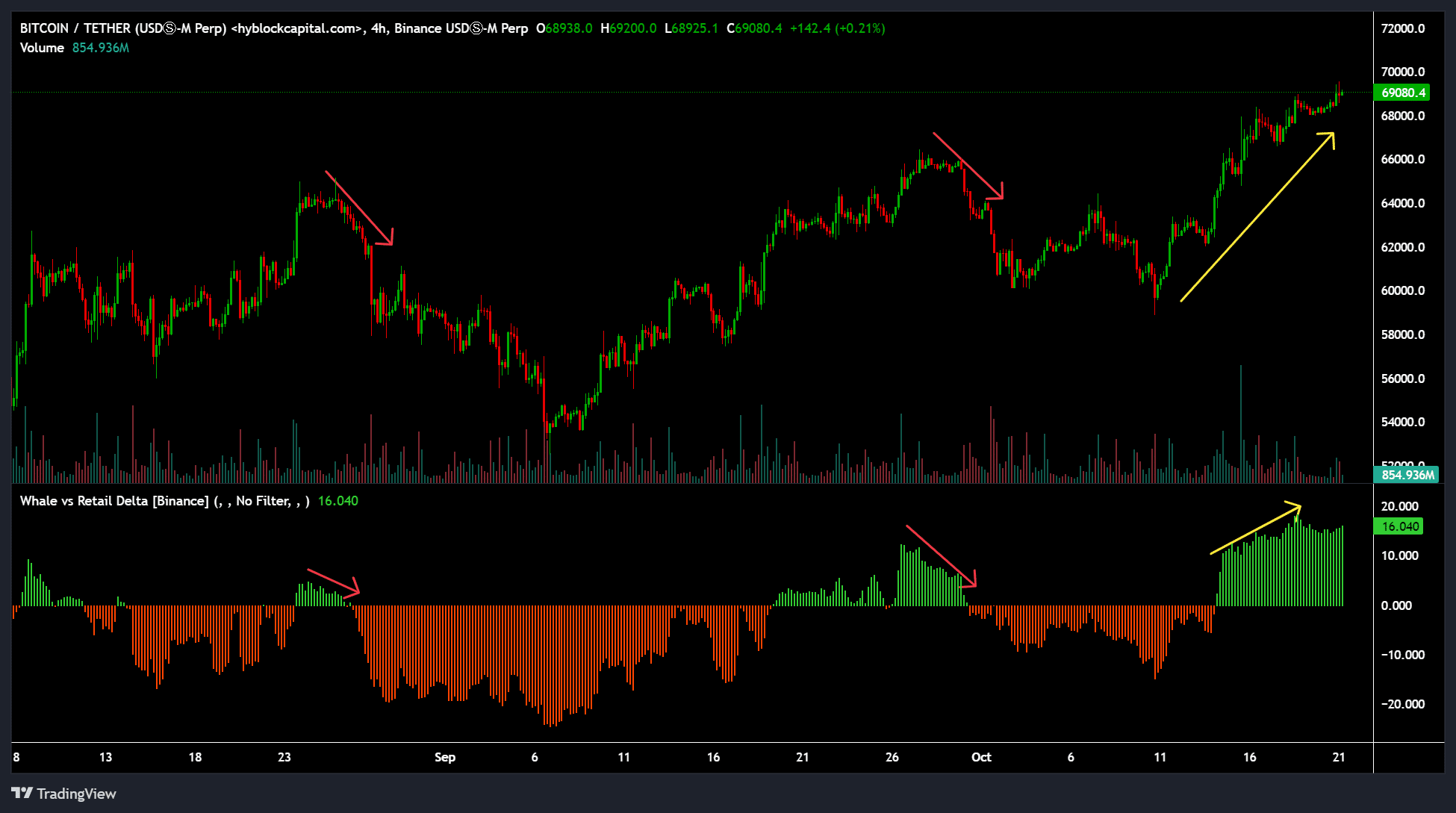

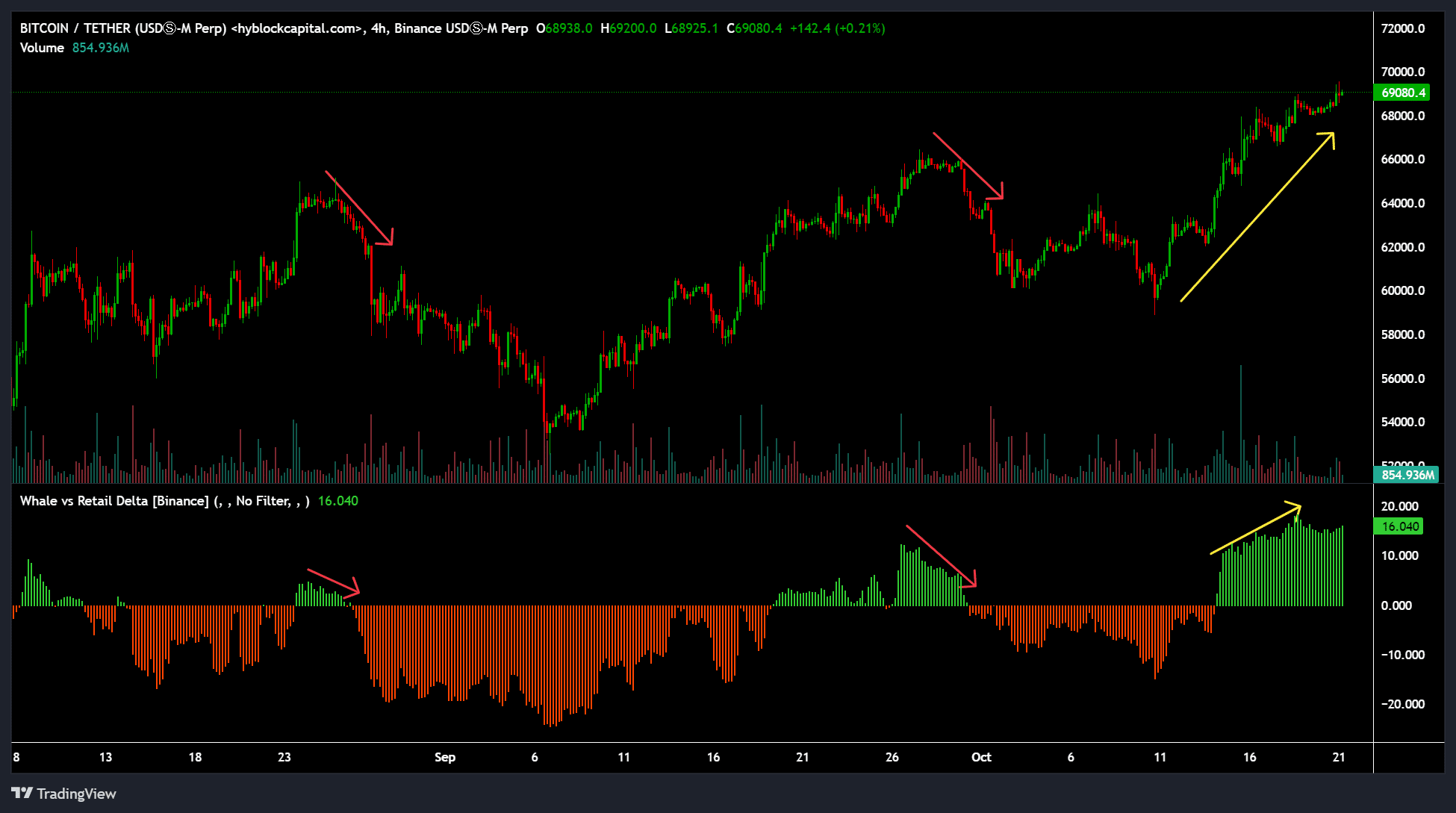

While this could derail an explosive breakout for BTC, whales added positions en masse.

Since last week, whales have taken more BTC positions than retailers, according to the positive Whale vs. Retail Delta Metric. This suggested that whales were mass accumulating and confident of a price increase.

Source: Hyblock

However, a drop in the metric could indicate a potential BTC retracement, with $66K being a key interest level if a short term withdrawal follows.