- Bitcoin rose above $68,000 for the first time since late July.

- The key metrics peaked at an ATH.

Bitcoin [BTC] Taureans are having a great day as their Uptober dreams appear to be coming true. This week, the king coin made a remarkable comeback and broke through critical resistance levels.

On October 16, the king coin climbed to $68,424, marking the highest price in almost three months. MicroStrategy co-founder and chairman Michael Saylor commented on the excitement, stating:

‘To the moon.’

His words reflected the optimism among crypto enthusiasts, as the rise of Bitcoin brought renewed confidence and excitement.

At the time of writing, the coin had retreated slightly to $67,458, but continued to rise 0.97% over the past day and 10% over the past week.

Is There a Bitcoin Supply Shock Coming?

In addition to the positive price movement, supply-side developments have fueled traders’ expectations for further gains.

First, Bitcoin miners only produce 450 BTC per day, which does not meet the rising demand driven by the continued accumulation of institutional investors.

For example, BlackRock recently added $391.8 million worth of Bitcoin to its holdings.

It’s worth noting that spot Bitcoin ETFs hold total net assets of $64.46 billion, which represents 4.82% of Bitcoin’s market cap, according to facts from SoSo Value.

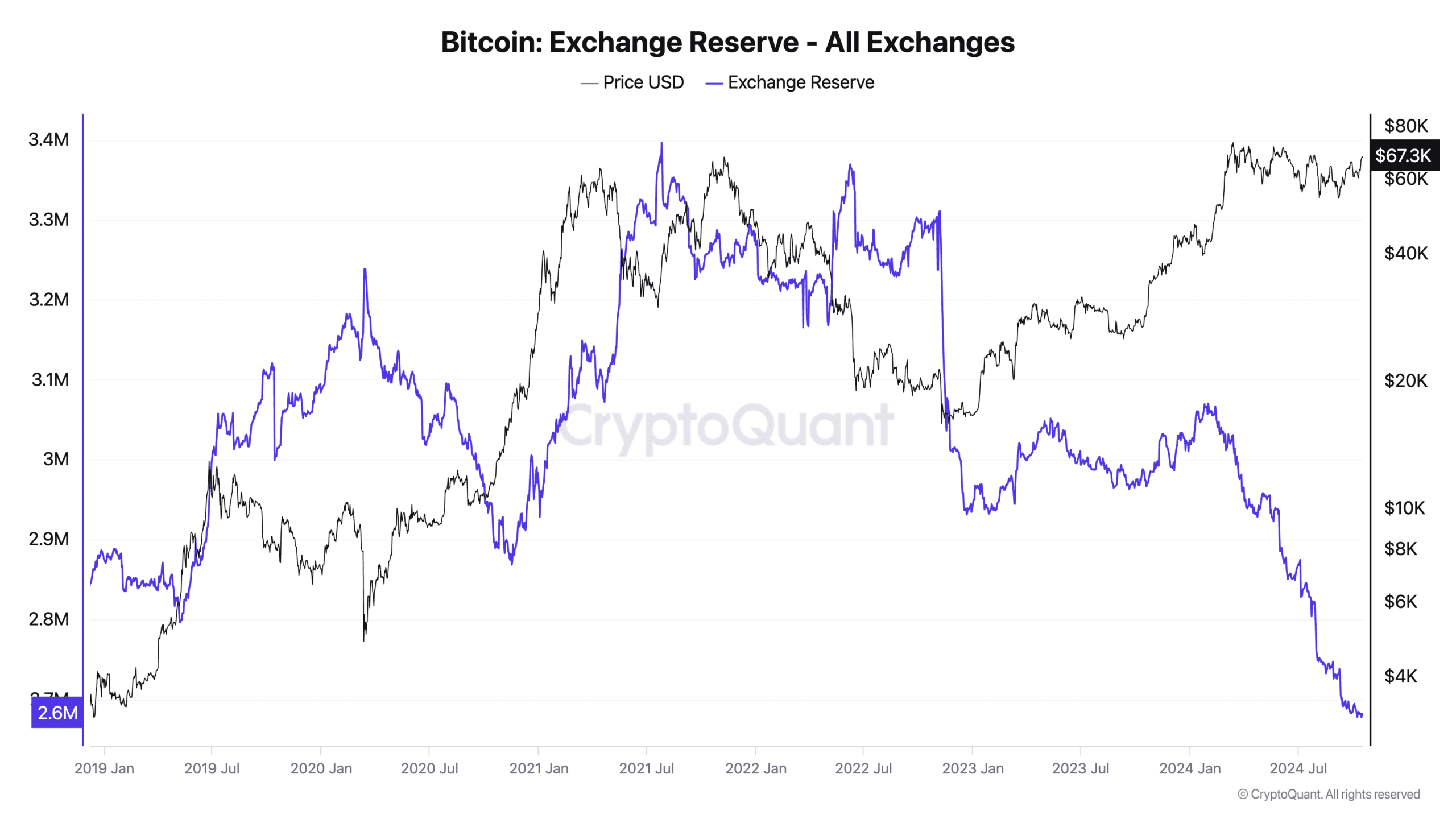

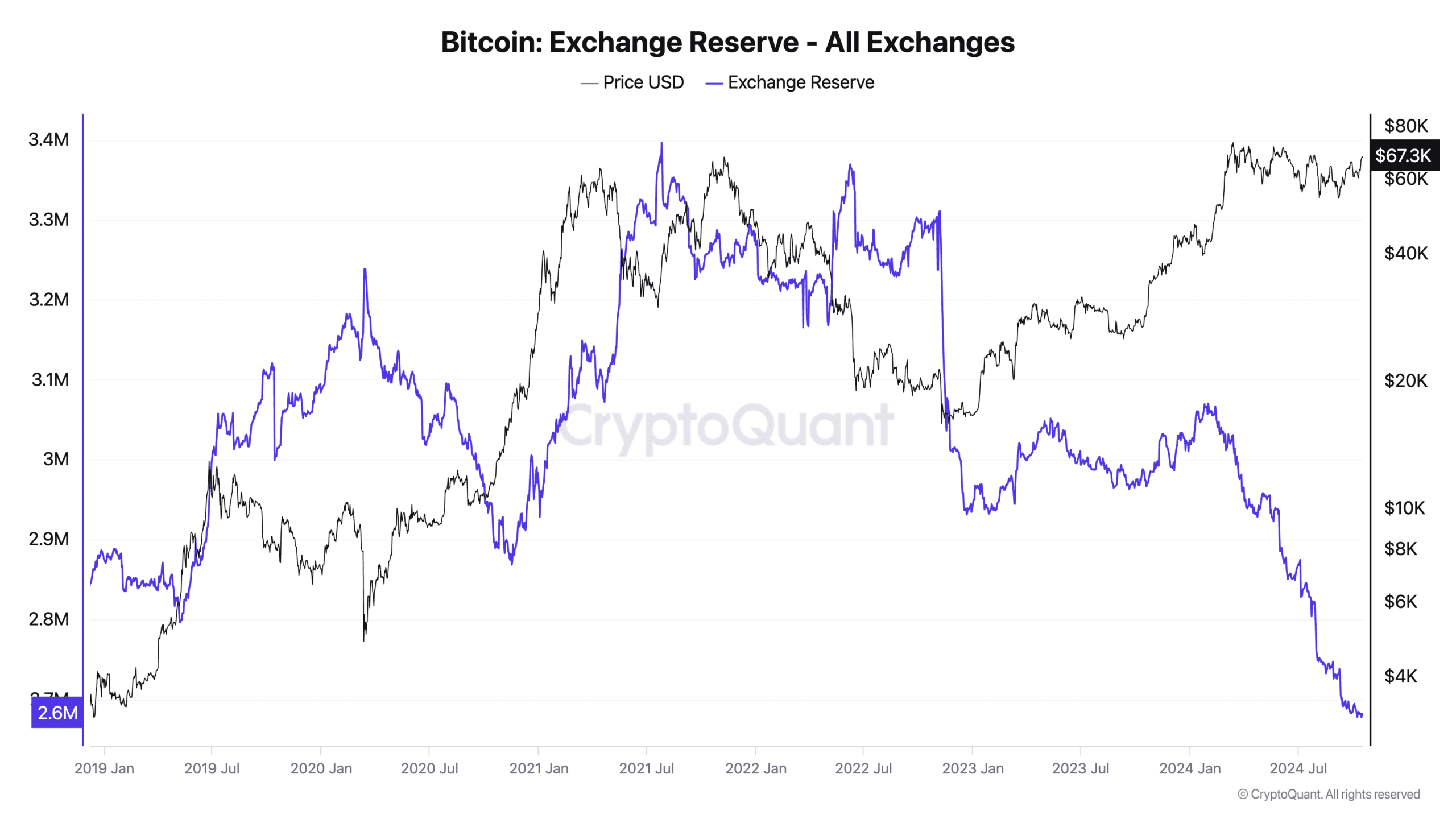

Furthermore, Bitcoin’s circulating supply has reached 19.77 million, accounting for 94.14% of the total supply. Finally, according to CryptoQuant, the Exchange reserve has fallen to a five-year low of just 2.6 million BTC.

As a result of these factors, the likelihood of a supply shock appears increasingly imminent.

Source: CryptoQuant

What does the derived data say?

To gain deeper insight into market sentiment surrounding Bitcoin, AMBCrypto analyzed the derivative’s data.

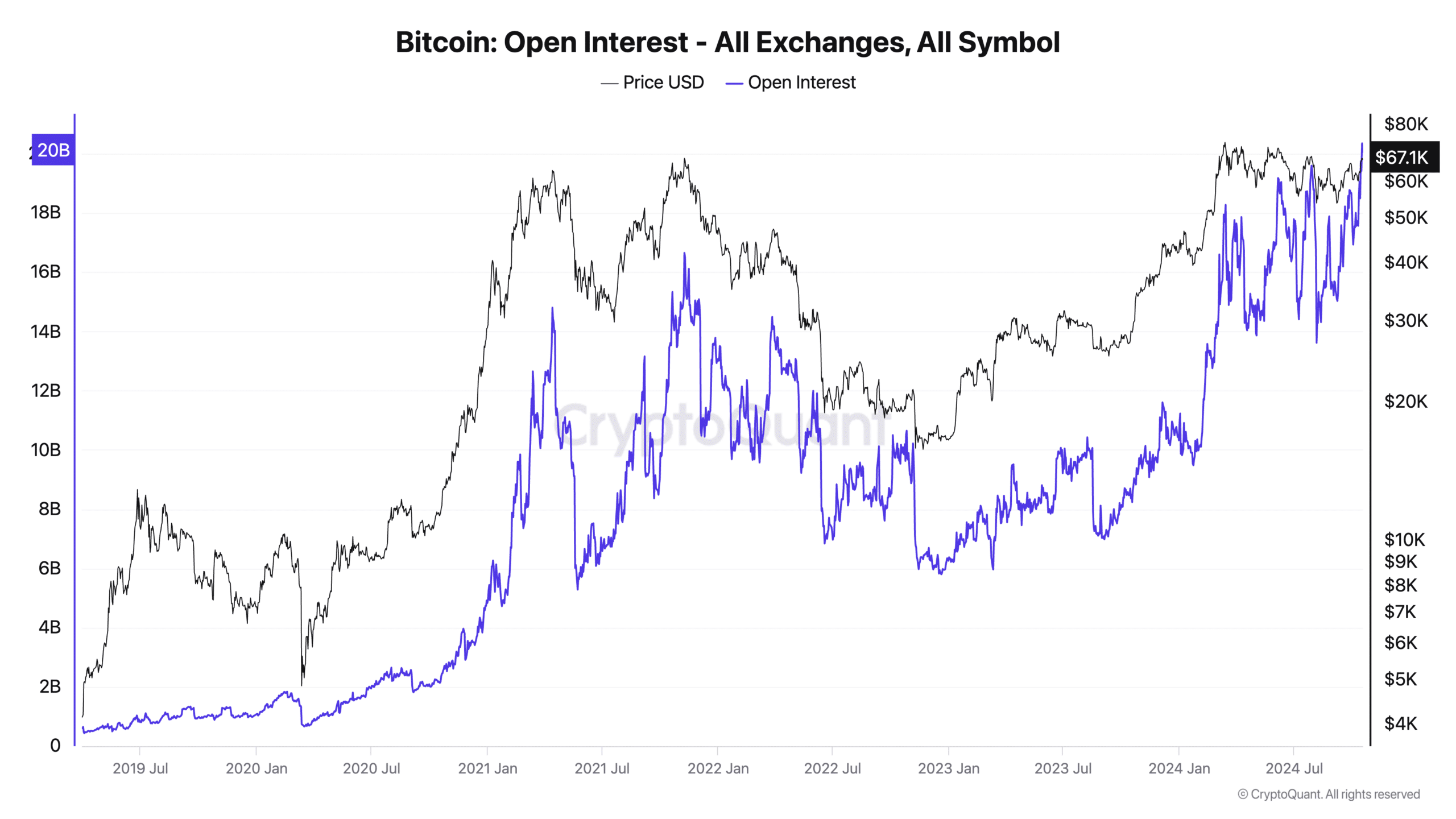

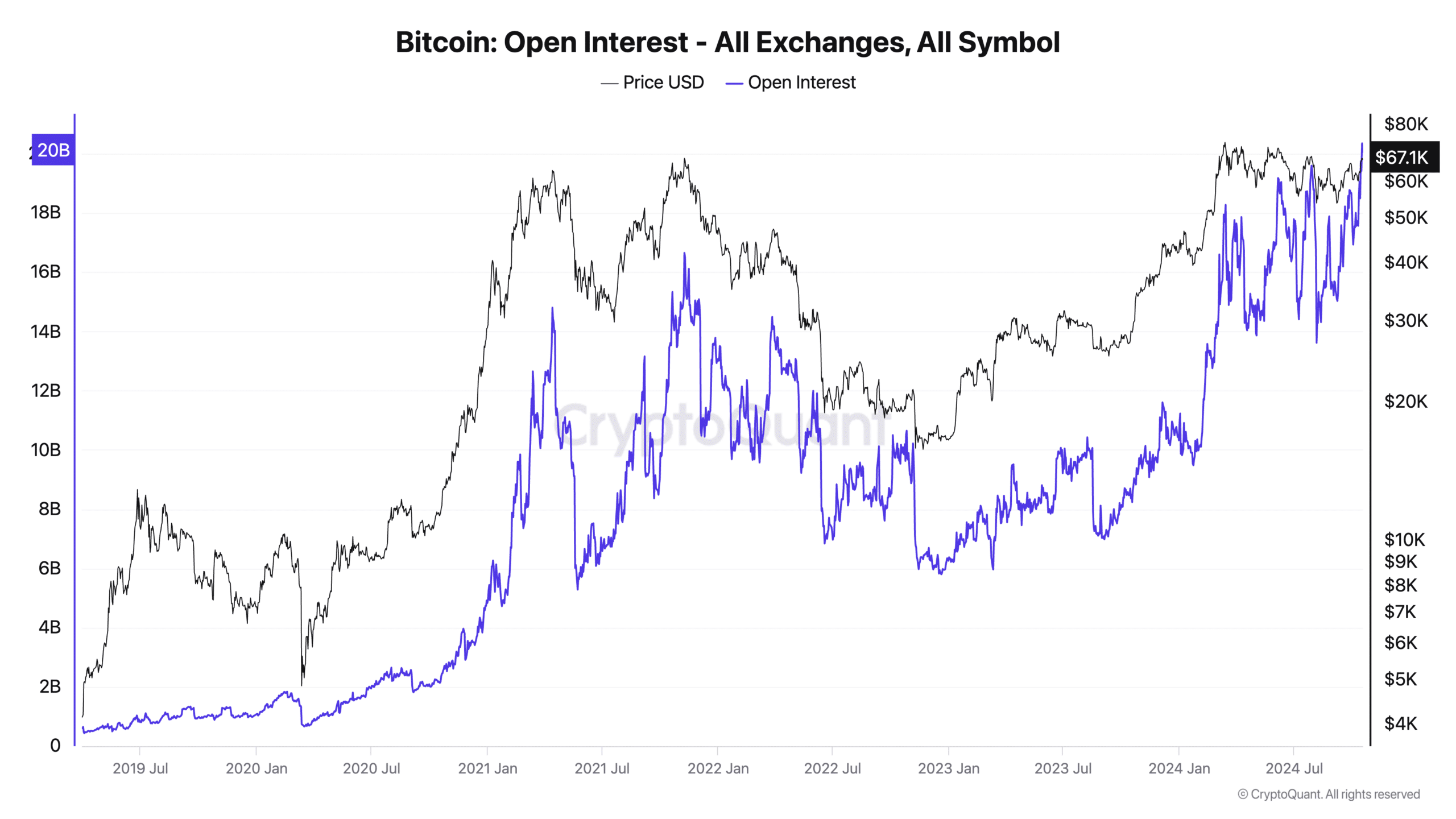

According to CryptoQuant, Bitcoin is Open interest (OI) recently reached an all-time high of $20 billion, indicating increased participation and interest.

Source: CryptoQuant

CME Bitcoin Futures OI also reached a record high, reflecting growing institutional involvement. Moreover, the financing rate was positive at the time of going to press.

Data from Coinglass showed a Long/short ratio of 1.02, indicating a slight preference for long positions. These figures suggested general optimism in the market.

BTC is approaching $70,000

Amid the favorable market environment, with Saylor looking at the moon, it appears the moon could be around $70,000.

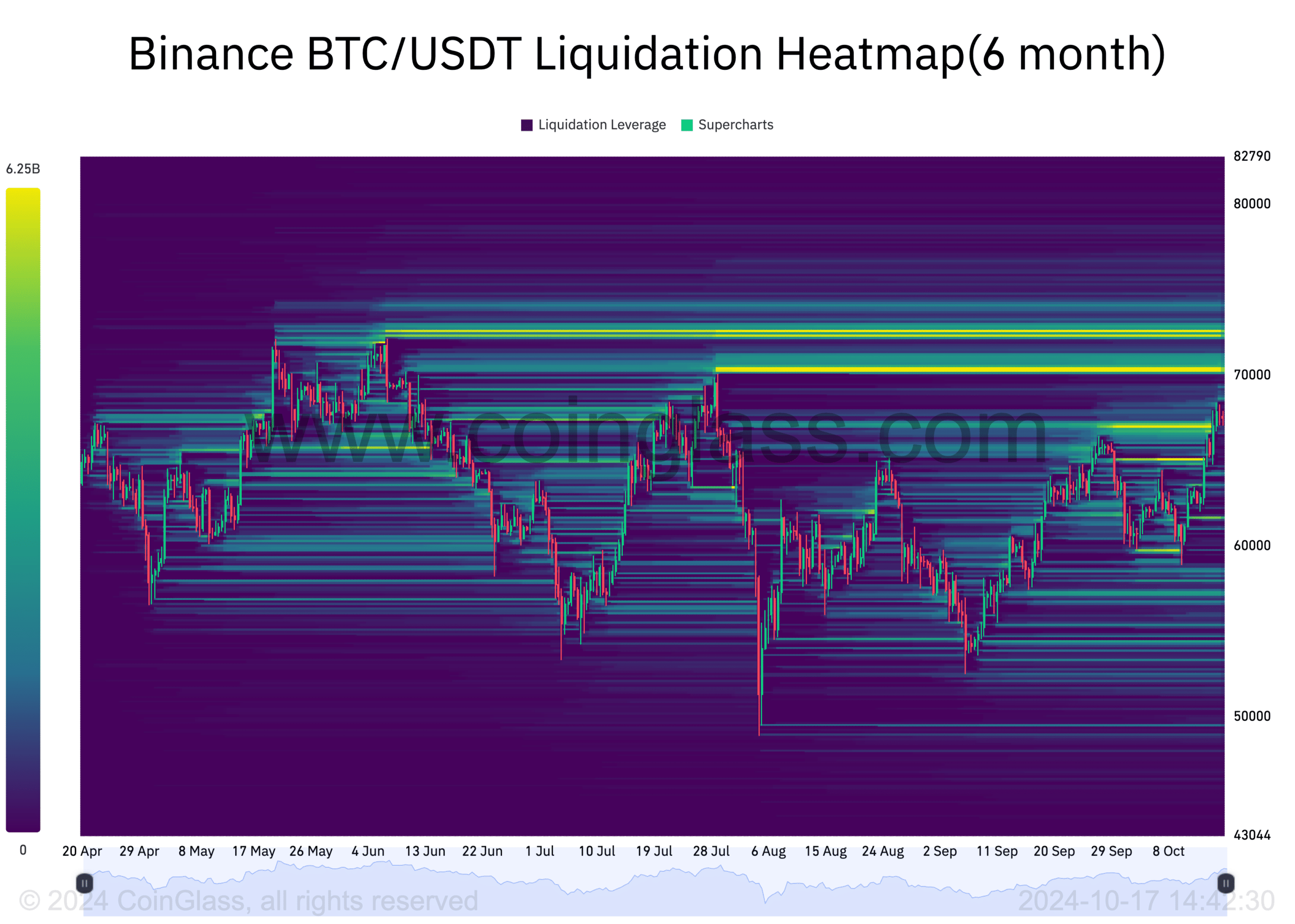

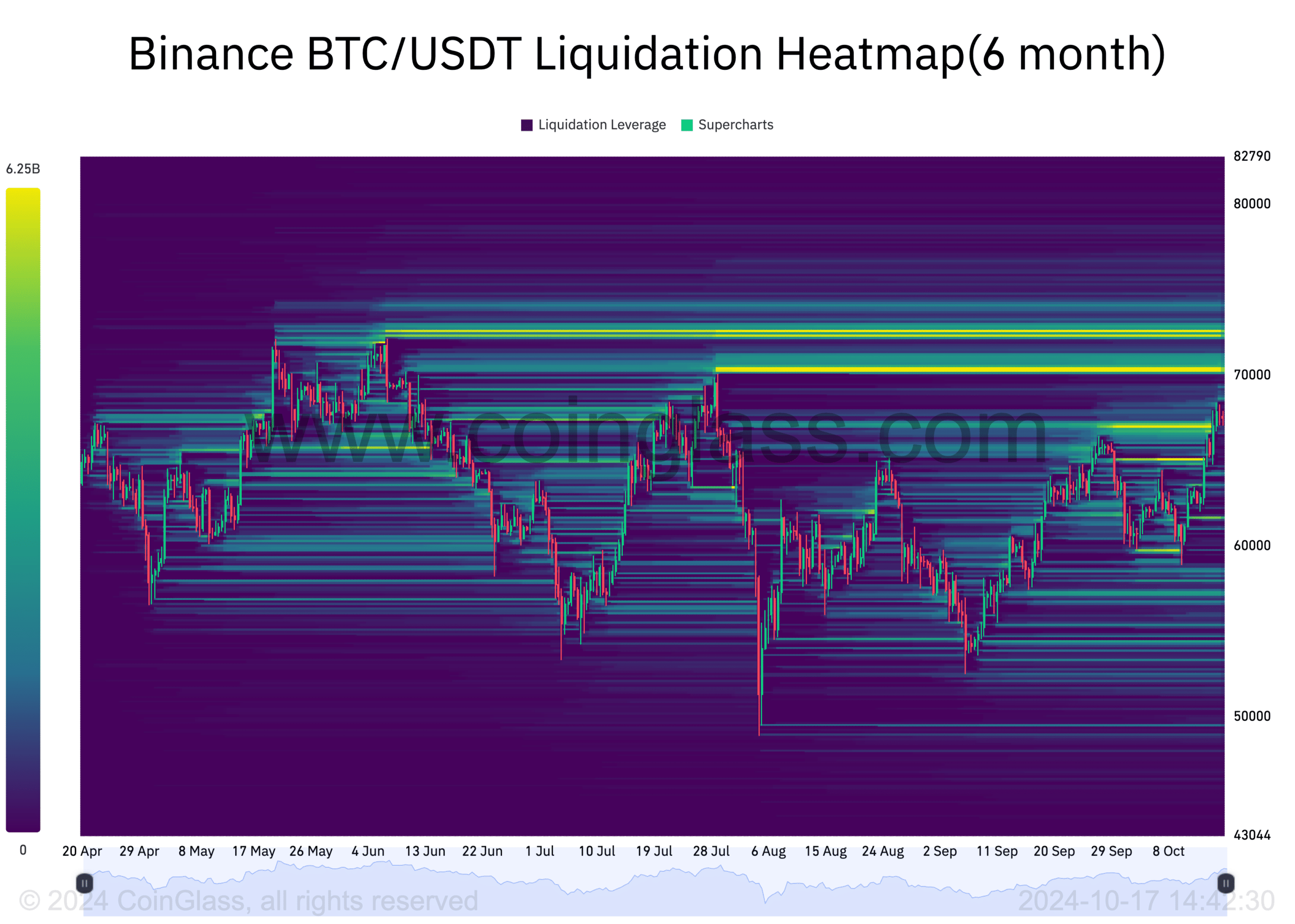

The 6 months liquidation heatmap from Coinglass revealed a substantial liquidity cluster at this level, with $72,300 and $72,600 emerging as the next magnetic zones likely to attract the price.

On the other hand, significant liquidity was concentrated around $67,000 and $65,000. If BTC falls to reach these levels, a recovery could follow.

Source: Coinglass

So, given Bitcoin’s trajectory, bulls remain hopeful of recapturing March’s record highs.