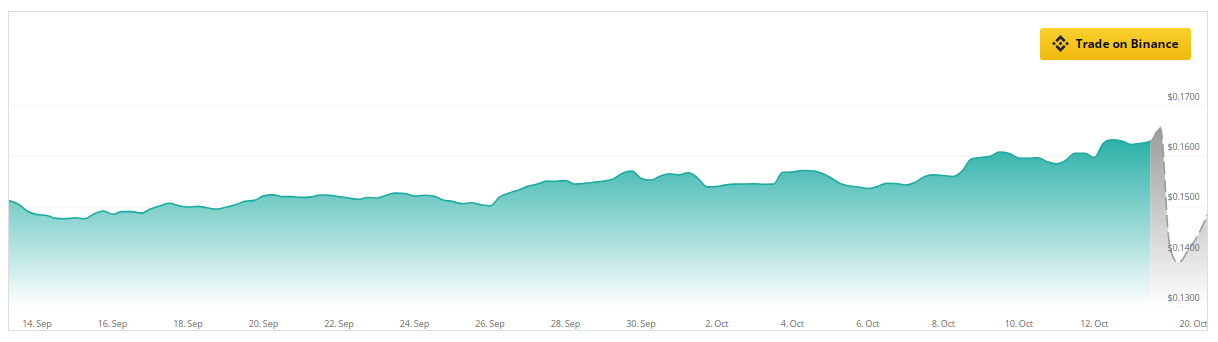

TRON (TRX) recently caught the attention of burning more than 10 million tokensdemonstrating its commitment to a deflationary approach designed to increase its value. Currently TRX is trading at approximately $0.1605, indicates a small increase.

Analysts are optimistic about TRON’s future and predict a Price increase of 57% over the next three months, and an even more remarkable increase of 208% over six months, according to figures from CoinCheckup. This optimistic outlook indicates that TRX may be poised for a substantial upward trajectory in the cryptocurrency market.

A robust technical foundation

The technical indicators for TRX are converging towards positive sentiment. The price chart shows a modest uptrend, while the Relative Strength Index (RSI) currently stands at 57.58. This statistic indicates that TRX is approaching overbought territory, but there is still potential for more gains.

The stochastic indicator, currently at 66.63, reinforces this bullish perspective by showing momentum without signaling impending exhaustion. Collectively, these factors suggest that TRX could continue its upward trend in the near future, making it an attractive opportunity for investors.

Increasing enthusiasm for TRON

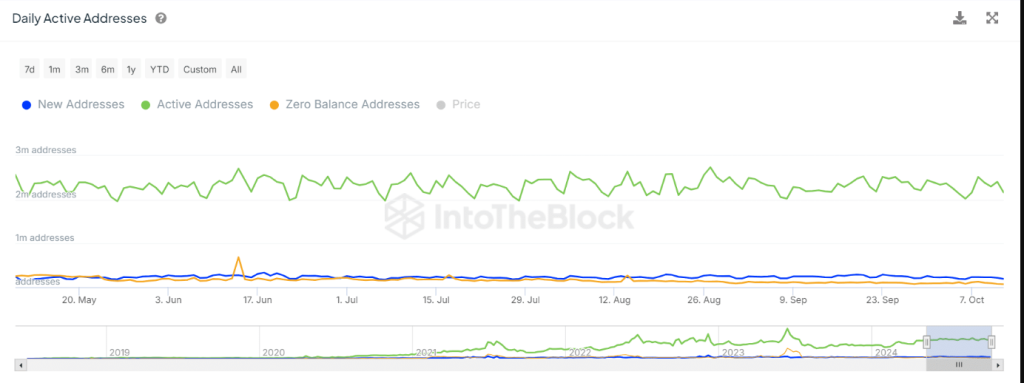

In addition to the token burn, TRON has seen a significant increase in the number of daily active addresses, indicating growing interest from investors, data from IntoTheBlock shows. While the overall trend seems consistent, this small uptick suggests more people are entering the market.

This increasing participation could strengthen the token’s upward trajectory, especially when combined with current deflationary strategies. As TRON tries to reduce its circulating supply, these elements could lay a foundation for higher prices.

Market sentiment and trading behavior

Despite the positive statistics, traders remain extremely cautious. The long/short ratio shows that shorts are slightly larger than longs: 54% shorts and 46% longs. This is a wait-and-see approach by traders in anticipation of possible volatility in TRX price movement.

The TRX OI-weighted funding rate is around 0. This means that the balance between longs and shorts is neutral, and can therefore also have a positive impact on market sentiment, pending the short-term variability of the TRX price.

TRON’s recent token burn and steady increase in active addresses could boost the momentum TRX needs to post solid growth numbers in the coming months.

Technical indicators show a positive trend and solid price projections, showing that TRX will rise substantially in the near term.

Featured image from Pixabay, chart from TradingView