- ETH tried to recover, but a rally could be muted due to low demand.

- Assessment of the impact of rising foreign exchange reserves and the state of currency flows.

Ethereum [ETH] finally managed to recover somewhat from last week’s massive wave of selling pressure.

Although there has been a slight recovery over the weekend, there are some signs that a smooth recovery may not occur this week.

After closing September on a bearish leg, ETH’s selling pressure finally eased on Thursday following a 15% retracement.

This was followed by some bullish momentum over the weekend, leading to a 7% recovery from last week’s low.

ETH was exchanging hands at $2477 at the time of writing. Notably, the price action respected a short-term rising trendline highlighted in yellow. So far, the slight upward trend indicates that some accumulation has occurred.

Source: TradingView

At first glance, the weekend rally may seem like a healthy rally and a possible indication of more upside in the coming days.

However, ETH’s money flow indicator has been trending downward over the past 24 hours, suggesting that liquidity could be flowing out of ETH.

Source: TradingVIew

The MFI suggests that the latest rally may be characterized by weak demand. This also means that the potential upside of ETH may be limited.

However, this is subject to changes in supply and demand dynamics throughout the week.

Will low excitement on ETH hinder the uptrend?

The above findings are consistent with the declining interest in Ethereum cryptocurrency. It could be a sign that ETH may not be the best option for those looking for maximum profits in the short term.

Moreover, on-chain data also showed a sharp increase in ETH exchange reserves in the coming days. Such an outcome could be consistent with expectations of increased selling pressure.

Source: CryptoQuant

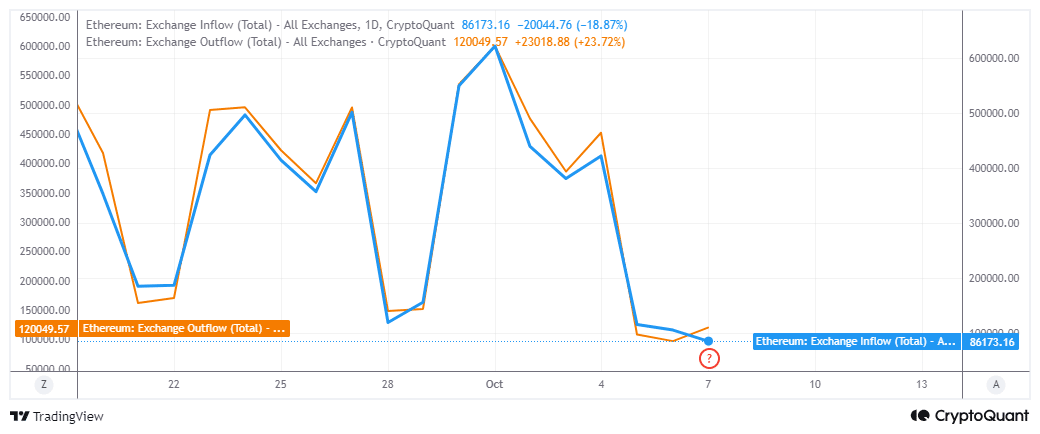

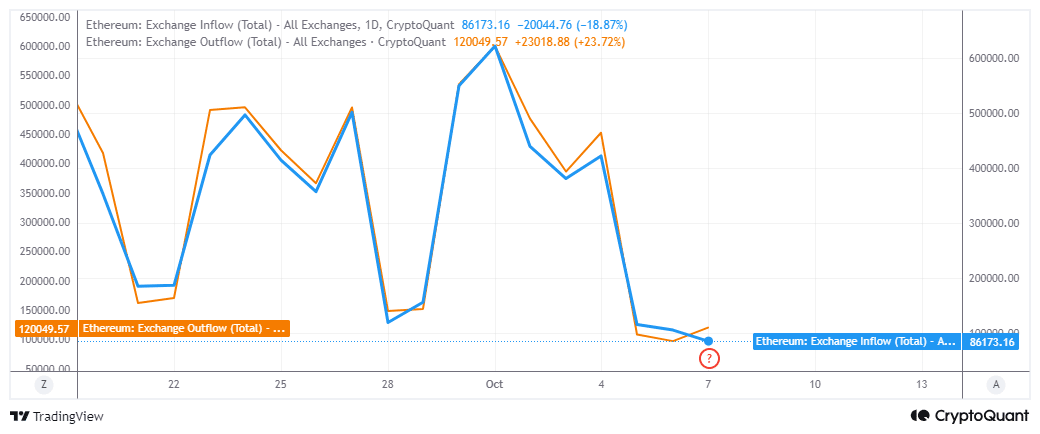

But what do the exchange flows reveal about the current situation? According to CryptoQuant, ETH exchange flows slowed at the beginning of the month, leading to slower volumes.

For example, foreign exchange inflows peaked at 621,000 ETH in early October, while currency outflows were slightly lower at $599,778 ETH.

Fast forward to the present, and the currency inflows amounted to 86,173 ETH. Currency outflows were higher, at just over 120,000 ETH.

This means that there was a net demand of 33,827 ETH, equivalent to a demand worth $83.5 million.

Source: CryptoQuant

Read Ethereum’s [ETH] Price forecast 2024–2025

Based on the data above, we can conclude that ETH is experiencing some demand, but in relatively small quantities.

In other words, there was little excitement in the cryptocurrency and thus the likelihood of a subdued outcome.