- BTC and the S&P 500 have been seeing a high correlation lately

- Cryptocurrency continues to trade above $65,000 on the price charts

Bitcoin [BTC] recently broke through a significant resistance level and continued its positive uptrend on the charts. Interestingly, the cryptocurrency’s correlation with US stocks has also risen to a two-year high. This means that Bitcoin is increasingly moving in tandem with traditional financial markets.

Bitcoin’s correlation with US stocks reaches two-year high

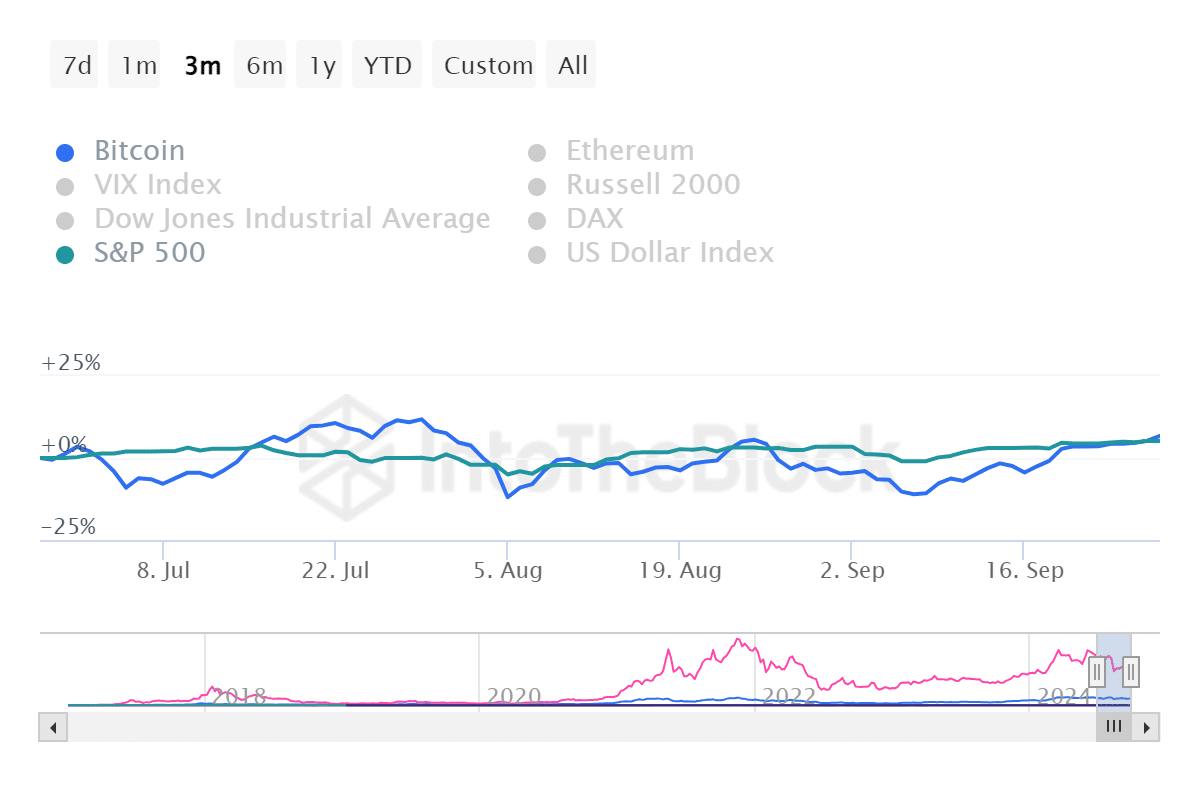

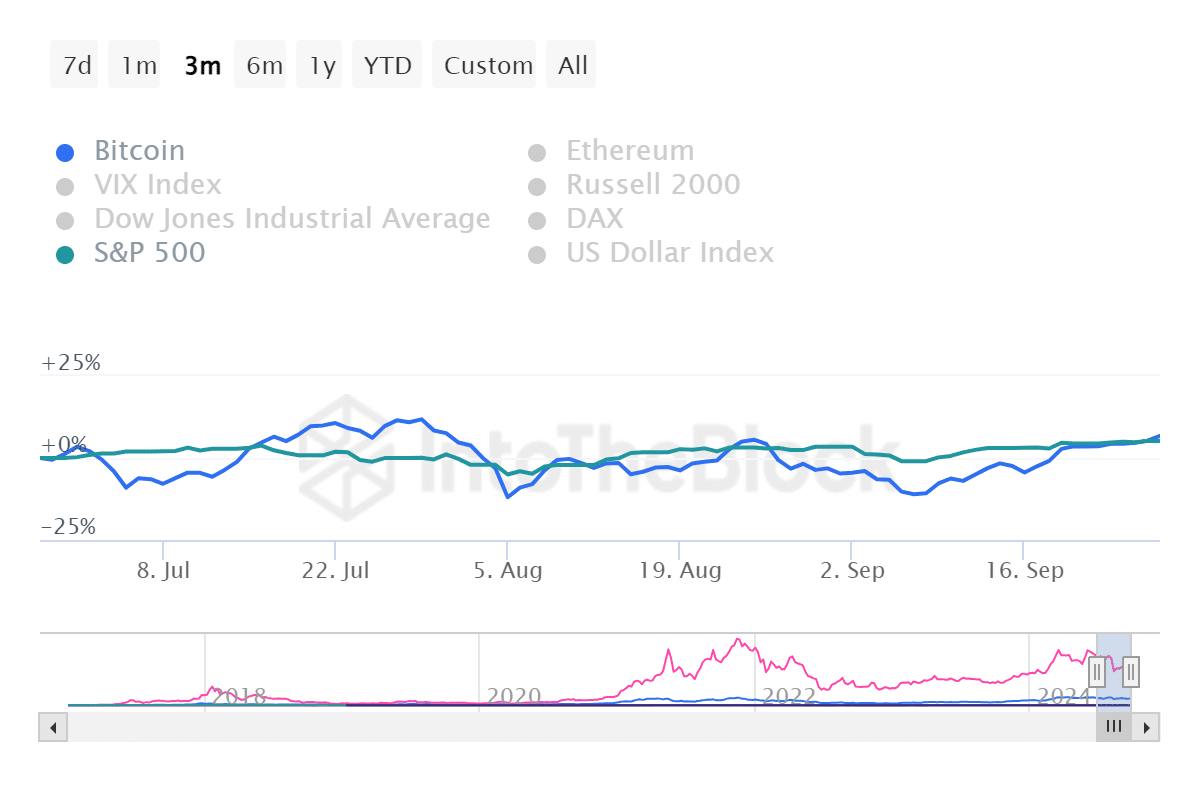

Recent data from InHetBlok revealed that Bitcoin’s correlation with US stocks has reached a two-year peak. Over the past three months, Bitcoin has seen moderate volatility with periods of slight increases and decreases, maintaining a range close to its starting value.

Overall, BTC price movement has been relatively stable, with a subtle positive trend towards the end of September.

Source: IntoTheBlock

On the contrary, the S&P 500 has shown stable performance with less pronounced volatility compared to Bitcoin. However, both assets have developed relatively in sync, reflecting similar market sentiment.

Although BTC’s inherent volatility results in slightly more pronounced movements, the parallel trends indicate that it is currently behaving like a risk asset. One that closely monitors macroeconomic trends and investor sentiment.

Implications for Bitcoin Investors

Bitcoin’s price trend indicates a ‘risk-on’ environment, with investors maintaining or slightly increasing their exposure to traditional stocks and cryptocurrencies. BTC could benefit from the positive sentiment if the S&P 500 continues or improves on its steady performance. However, any negative shocks to the stock market could also hit BTC due to their correlated movements during this period.

As the correlation continues, Bitcoin’s price movements may increasingly mirror those of traditional stocks. During times of rising stock markets, this could be bullish for BTC, as risky sentiment drives more inflows into BTC and other crypto assets.

Bitcoin continues its upward momentum

An analysis of Bitcoin’s daily chart showed that it closed with a gain of less than 1% during the last trading session.

However, the price briefly reached the $66,000 level before settling around $65,789. At the time of writing, BTC was trading at around $65,660, after a slight decline of less than 1% on the charts.

Source: TradingView

Additionally, an analysis of the Average True Range (ATR) revealed a value of approximately 2,099.44. This meant that Bitcoin’s price range (from high to low) over the past 14 periods has averaged around $2,099. The ATR has been declining since mid-August, indicating that volatility has decreased over time.

This could mean that the market has seen less intense price movements compared to previous months.

– Read Bitcoin (BTC) price prediction 2024-25

When the ATR is low, it may indicate that the asset is preparing for a breakout in either direction.