- Starknet’s price forecast promised a move towards $0.51 and $0.62.

- Profit-taking activity increased as STRK approached the $0.5 resistance.

Starknet [STRK] is up 29.74% over the past three days and has seen a small decline of 2.5% in the two hours before press time. The technical indicators showed a strong bullish outlook.

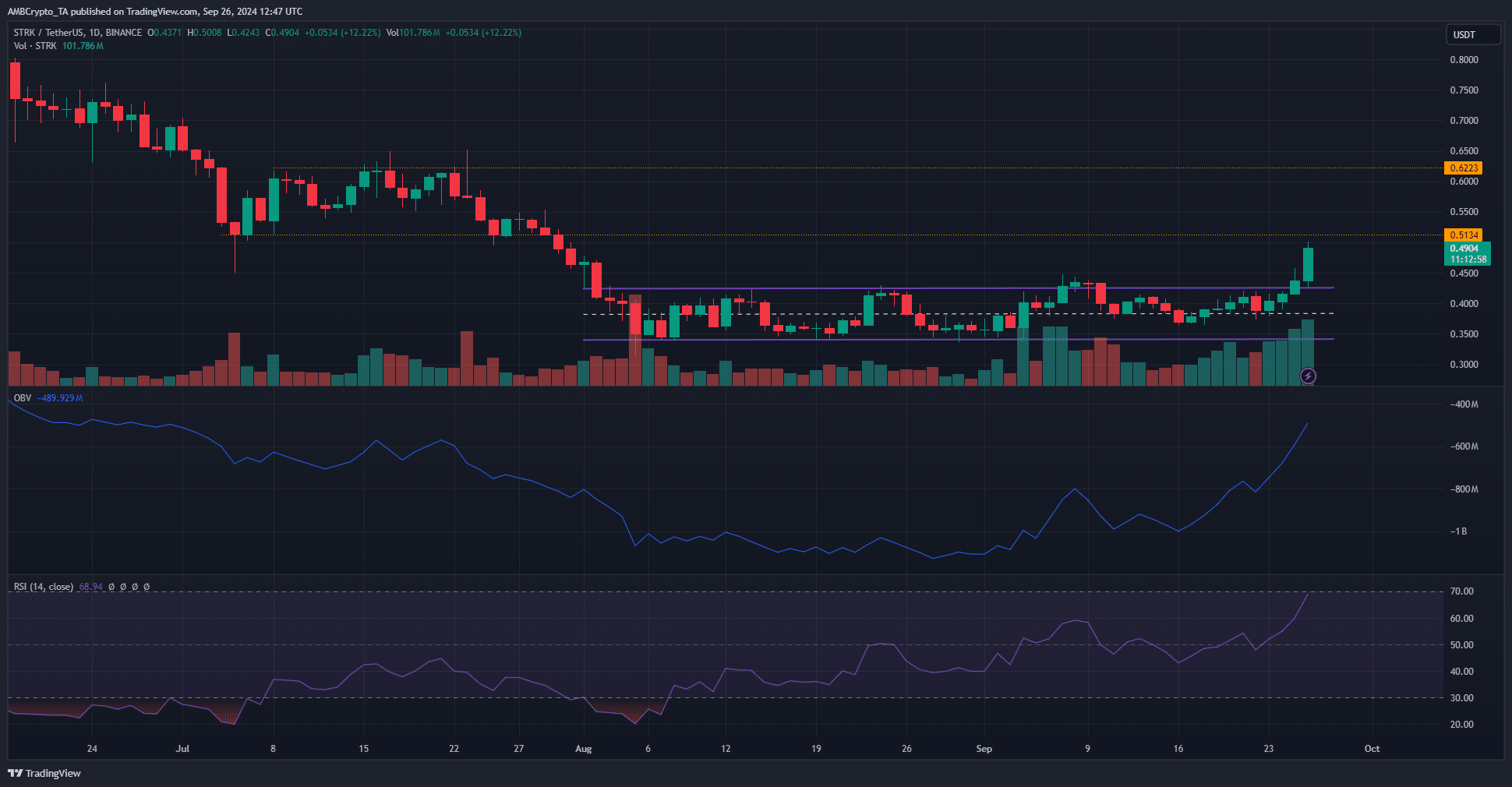

The token has been in a downward trend since April. From April 8 to September 23, the coin had lost 81.8% of its value.

The recent gains are encouraging, but it’s also possible that long-term investors will want to exit at break-even.

Starknet Price Prediction

Source: STRK/USDT on TradingView

On the upside, the long-term downward trend was followed by a range formation from August to almost the end of September.

This three-month consolidation and breakout provided an ideal accumulation opportunity, and the breakout occurred on high volume.

The OBV easily overcame the local highs and signaled strong demand over the past two weeks. The daily RSI also underlined the strong momentum.

The former support level of $0.51 and the July resistance of $0.62 are the next targets for STRK. Investors who joined after August may want to consider taking profits, but previous holders may have other ideas.

Do they choose to hold on to a currency that needs to rise 300%-400% to reach April levels?

Or do they try to get as close to breakeven from STRK and try their luck with another coin that they think holds more promise?

Only investors who did their research and kept their faith in the token would have held on. These are the ones who would be willing to wait for $2+ prices, but they are likely in the minority.

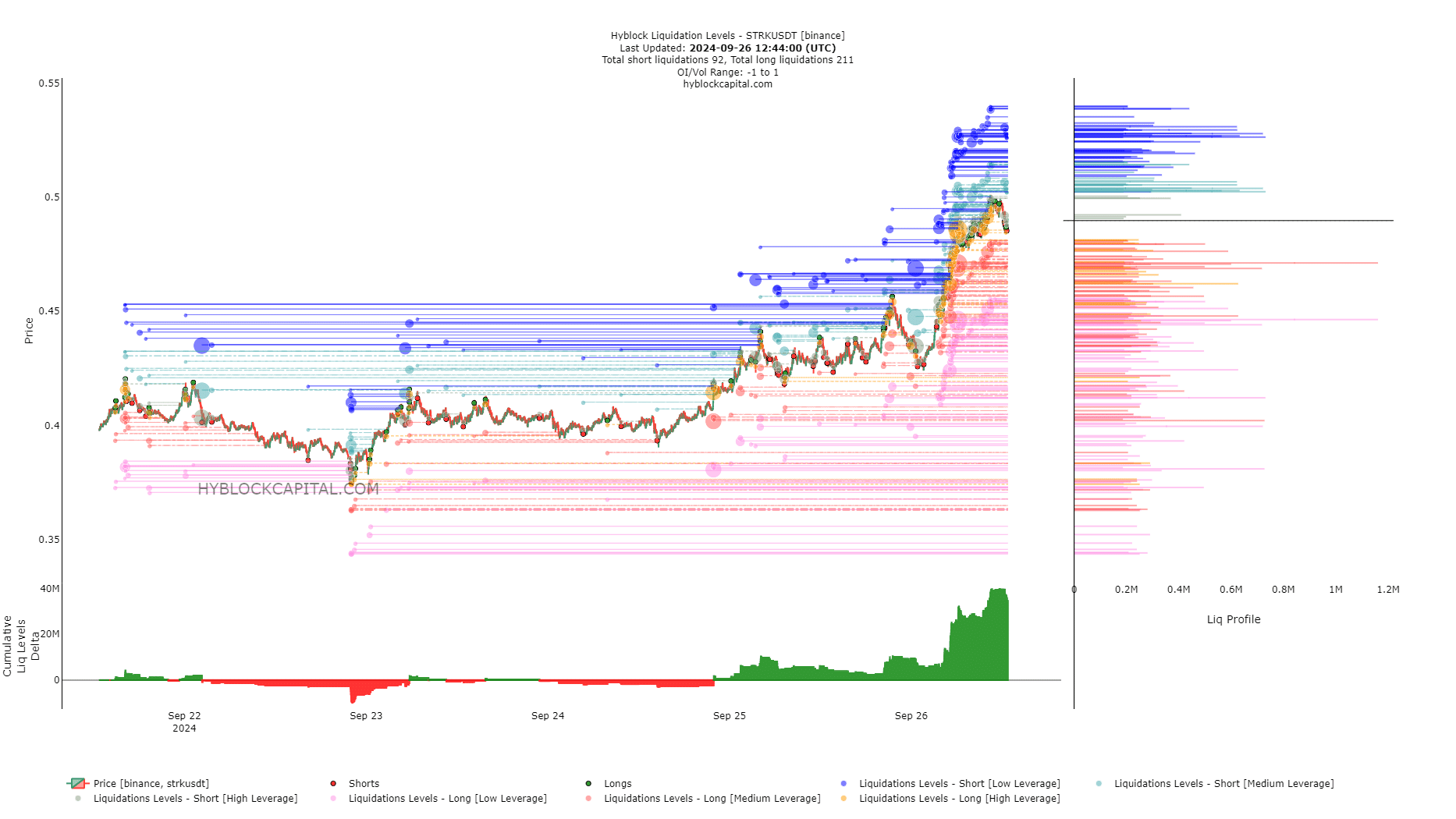

Futures data shows future price volatility

There was a high positive cumulative delta of LIQ levels, indicating that long positions could come under pressure. A price drop to $0.47 and $0.44 in the next 24 to 48 hours was possible.

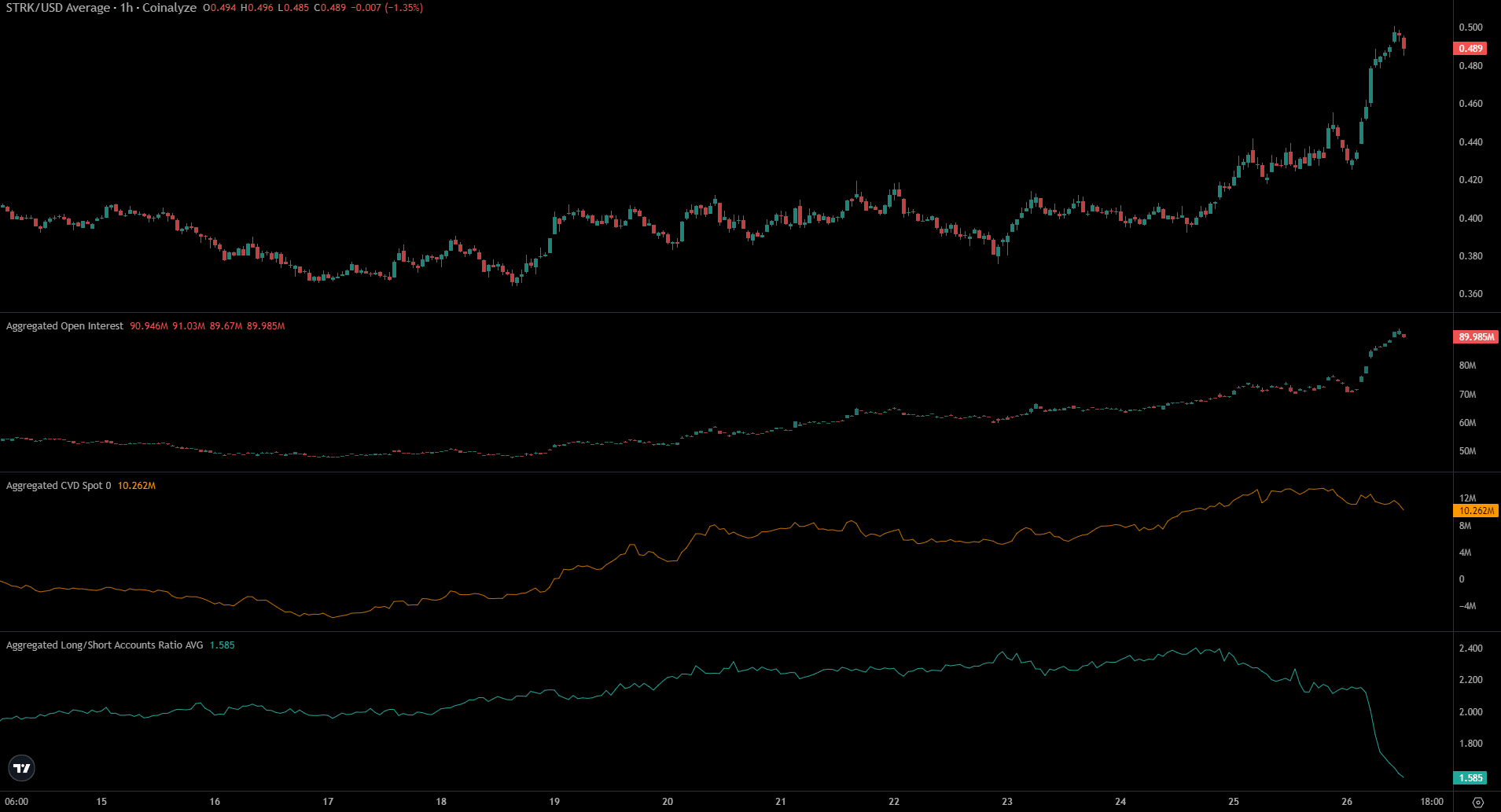

Such a dip could provide a buying opportunity, provided spot CVD does not fall too sharply. The Open Interest continued to exhibit a bullish speculative market.

Realistic or not, here is STRK’s market cap in BTC terms

Yet the ratio of long to short accounts has fallen dramatically over the past two days. The price was still in favor of the bulls, but the steep decline indicated that many long positions were closed as the price rose.

The market may need time and a small retracement before it can move higher.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer