- The 1inch Investment Fund spent $1.75 million to buy 1INCH after the token fell to an all-time low.

- 1INCH has since recovered, with on-chain and technical indicators showing an influx of buyers.

The cryptocurrency market witnessed a bloodbath on Wednesday as liquidations reached nearly $200 million per dollar Mint glass facts. However, 1 inch [1INCH] defied all expectations, as the price rose by 3% in the past 24 hours.

1INCH was trading at $0.241 at the time of writing. The token has recovered after hitting an all-time low of $0.214 as the rest of the market tumbled.

1inch team buys the bottom

The record low price seemed to have piqued interest from whales, particularly the 1inch Investment

Fund. According to SpotOnChainthis team spent $1.75 million in USDC to purchase 7.96 million 1INCH tokens near all-time lows.

Over the past two months, this team has spent $5.5 million to buy back 1INCH tokens at an average price of $0.245. Past trends show that the team tends to buy at the bottom before selling high.

Source:

The behavior of this wallet has fueled interest in the token, and exchange data now shows that fewer investors are interested in selling.

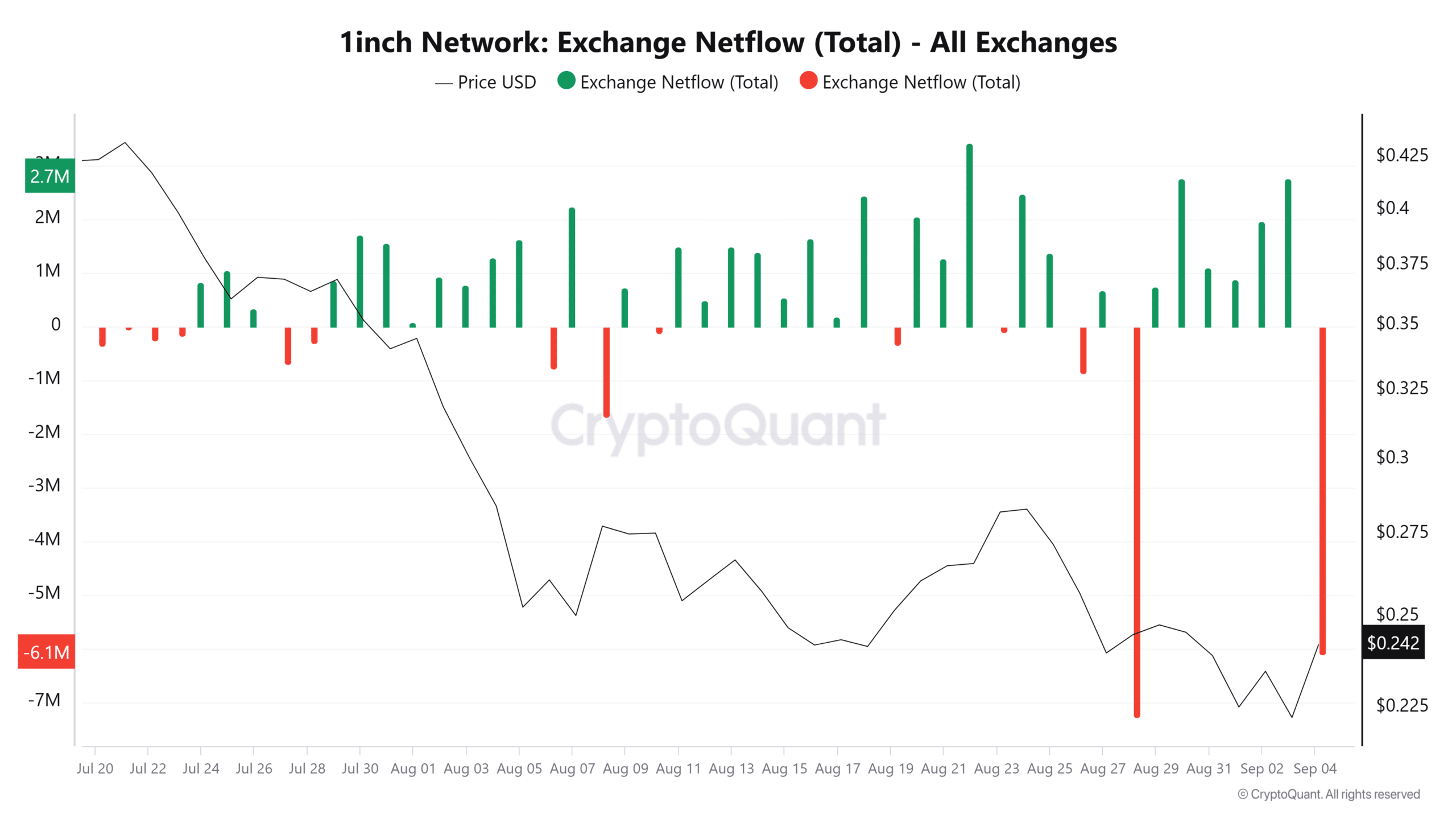

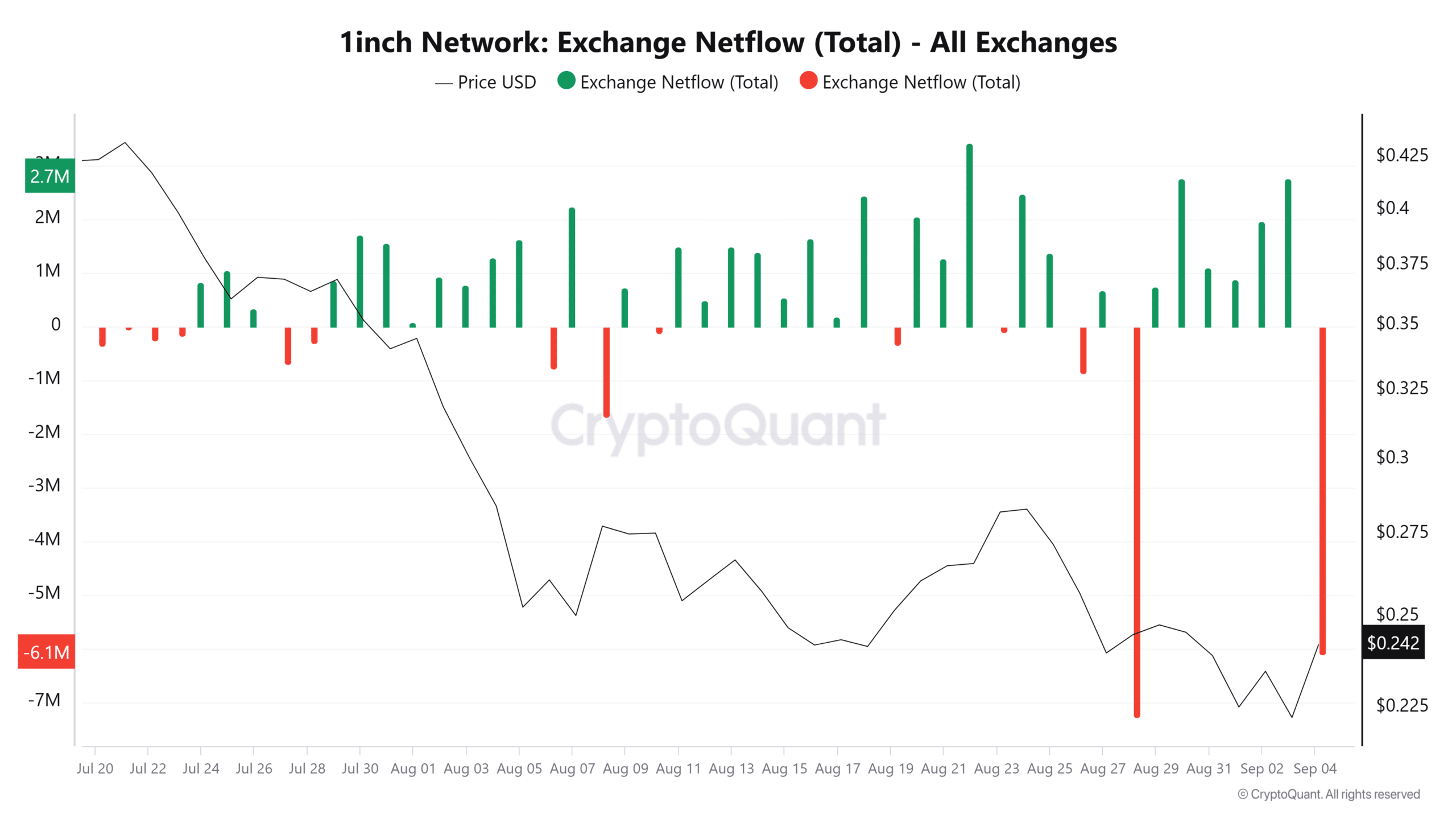

Exchange net flows per CryptoQuant have reached the highest level in a week, indicating that more addresses are withdrawing their tokens from exchanges and may not sell them in the near term.

Source: CryptoQuant

More and more bullish signals are emerging

More bullish signals have emerged, showing 1INCH’s ability to extend its gains.

The Chaikin Money Flow (CMF) indicator showed an increase in buying activity after a sharp move north on the daily chart. It has also shifted from negative to positive, an indication that the bulls were now in control.

The uptrend is further supported by On Balance Volume (OBV), which rose from 815 million to 854 million, an indication that buying pressure is strong and gains could extend.

Source: TradingView

1INCH is also trying to break out above the descending parallel channel. A significant uptrend will be confirmed if this breakout is supported by consecutive green candles.

More buying pressure, supported by the broader market, could also see 1INCH target a critical resistance level at $0.43.

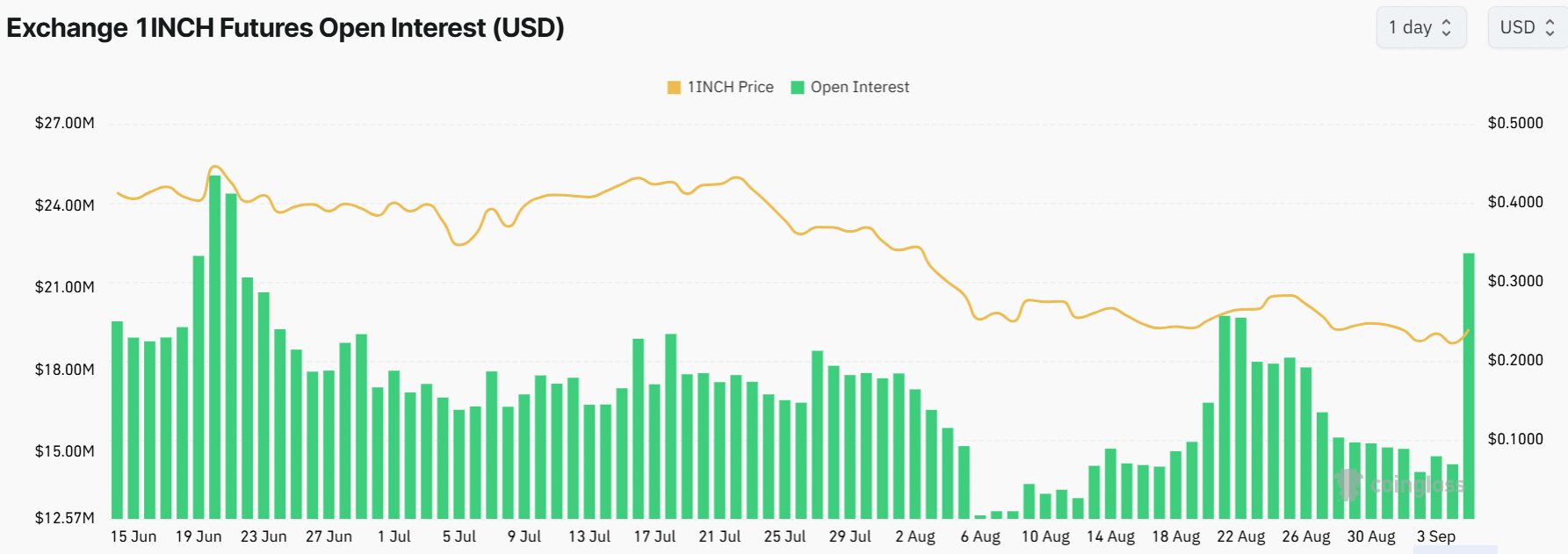

Recent volatility in the 1INCH price has sparked interest in the futures market after liquidations hit a weekly high of $216,000 per Coinglass.

Read 1inch [1INCH]Price forecast 2024–2025

1INCH’s Open Interest also rose 47% in the last 24 hours, from $14 million to $22 million, and was at its highest level since late June.

Source: Coinglass

Funding rates have also turned positive, which also showed bullish sentiment among traders.