- Dell Technologies did not add BTC to its holdings in the second quarter

- On the other hand, AI was the biggest driver of the company’s revenue

Michael Dell, CEO of technology hardware giant Dell Technologies, left the Bitcoin The community was disappointed after it was announced that the company had not adopted a BTC strategy in the second quarter. The crypto community expected a statement of BTC holdings during the Q2 earnings report on August 29. This is because the CEO has publicly supported the world’s largest cryptocurrency via X (formerly Twitter).

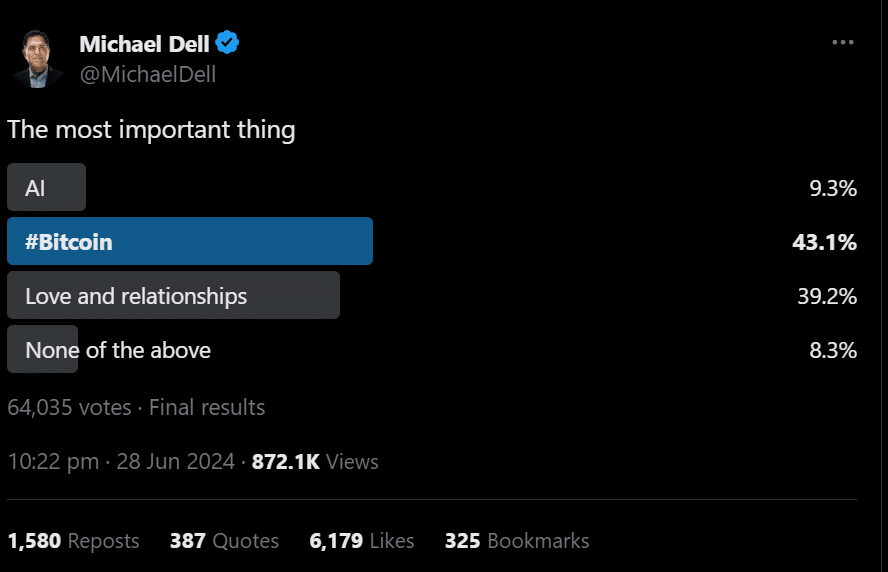

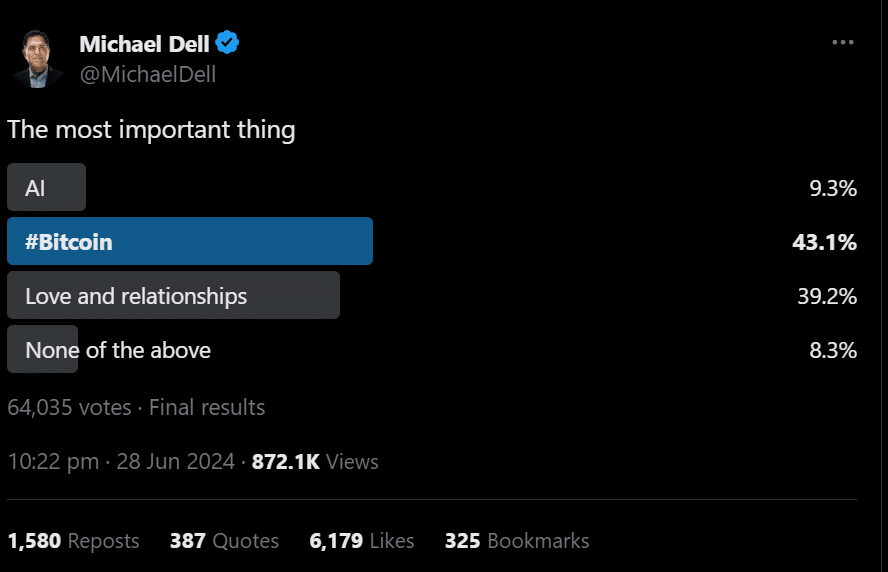

Dell’s ‘public support’ for BTC

In June, Dell carried out an X-poll to determine ‘the most important’ between AI, BTC and love/relationships. The survey results ranked BTC higher than the rest of the entries and attracted positive responses from some of the top BTC bulls like Michael Saylor.

Source:

A week before the aforementioned poll was taken, the chief of Dell Technologies posted a cryptic message: ‘Scarcity creates value,‘which is typically associated with BTC due to its limited supply of 21 million coins.

These messages gave the impression that the executive was leaning towards the crypto asset. By extension, many also believed that Dell would adopt the famous BTC strategy that Michael Saylor and MicroStrategy had developed.

However, BTC was not mentioned in the company’s second quarter earnings reports report. Most market watchers couldn’t hide their opinions disappointment after their BTC hopes were dashed.

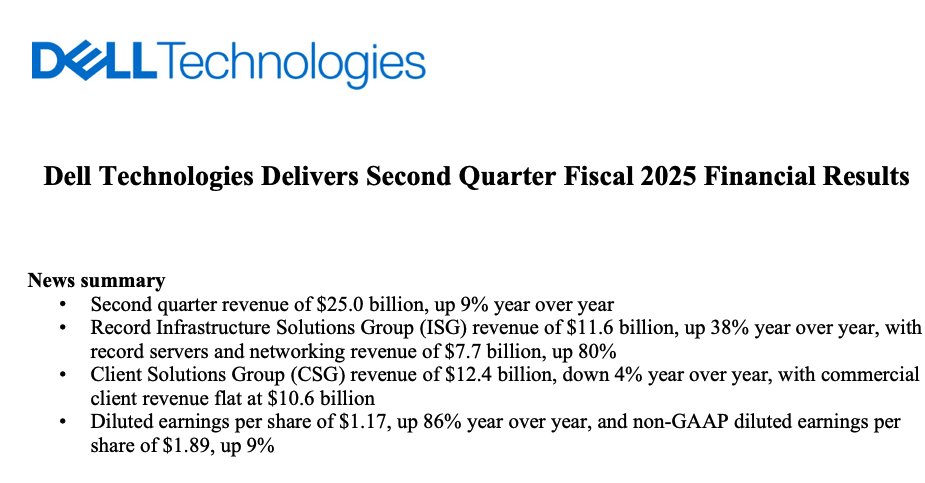

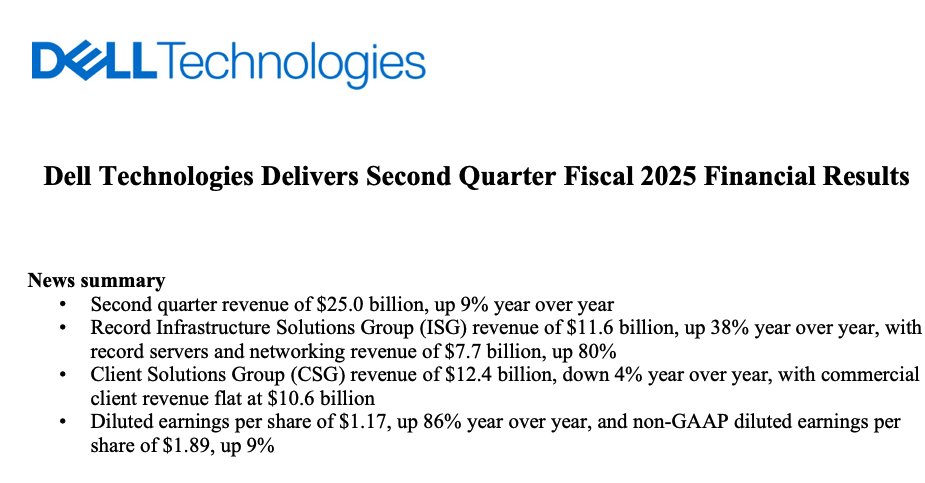

Source: Dell Technologies

Interestingly, despite Bitcoin ranking higher than AI in the poll at Commenting on the company’s second quarter performance, Dell Technologies Vice Chairman Jeff Clarke said:

“Our AI momentum accelerated in the second quarter and we have seen an increase in the number of enterprise customers purchasing AI solutions each quarter.”

Here it is worth noting that MicroStrategy’s Bitcoin strategy, which involves BTC being part of the treasury, has been adopted by the likes of Semler Scientific and Metaplanet.

MicroStrategy, at time of going to press, held 226.5K BTC, worth over $13 billion. The main goal of the strategy is to increase the value of the underlying stocks, especially in light of increasing institutional adoption through BTC ETFs. This was recently noted by Eric Semler, president of Semler Scientific. He said,

“We are encouraged by the growing institutional adoption of bitcoin. It was recently reported that institutions own more than 20% of bitcoin ETF assets under management for the first time. We believe this increasing industrialization will create value for both Bitcoin prices and our shareholders.”