- Bitcoin traders have benefited from significant gains from the recent rally as BTC tested the $64K resistance level.

- Now that the price has fallen, should you buy the dip?

Bitcoin [BTC] hit strong resistance at $64K, giving bears the upper hand. At the time of writing, Bitcoin is down 5.55% over the past 24 hours, trading at $59,532.

Surprisingly, this setback came shortly after economic optimism surged on expectations of interest rate cuts. As a result, AMBCrypto examined whether traders are strategically positioning themselves to profit from the next dip.

BTC traders locked in their gains after the recent rally

After the bearish crash in early August, bulls are eagerly looking for a recovery, aiming to push Bitcoin past the previous resistance at $70,000. However, breaking through $60,000 now seems like a faraway goal.

Driven by this research, AMBCrypto examined historical data and identified a recurring pattern that sheds light on traders’ strategic positioning.

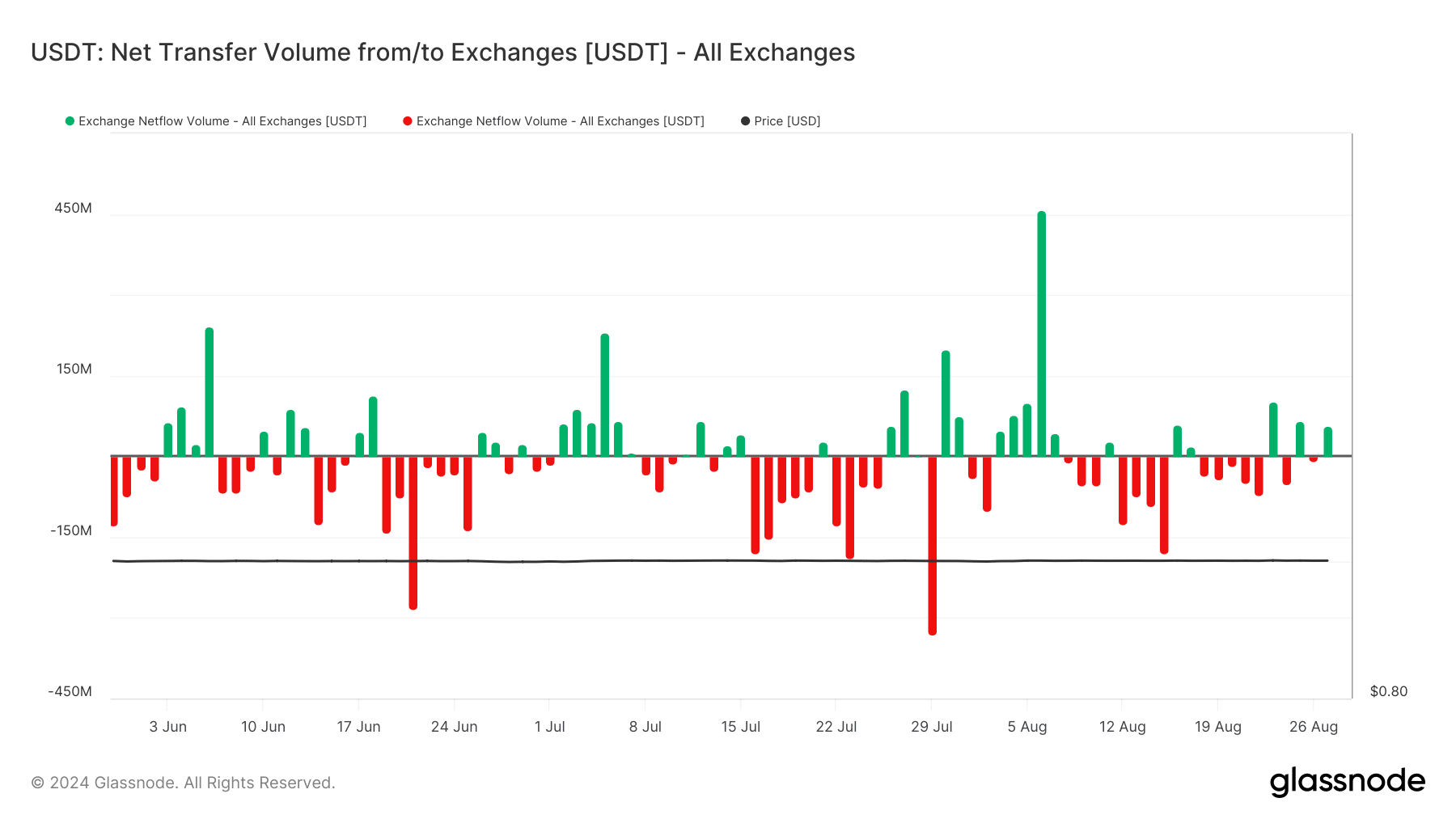

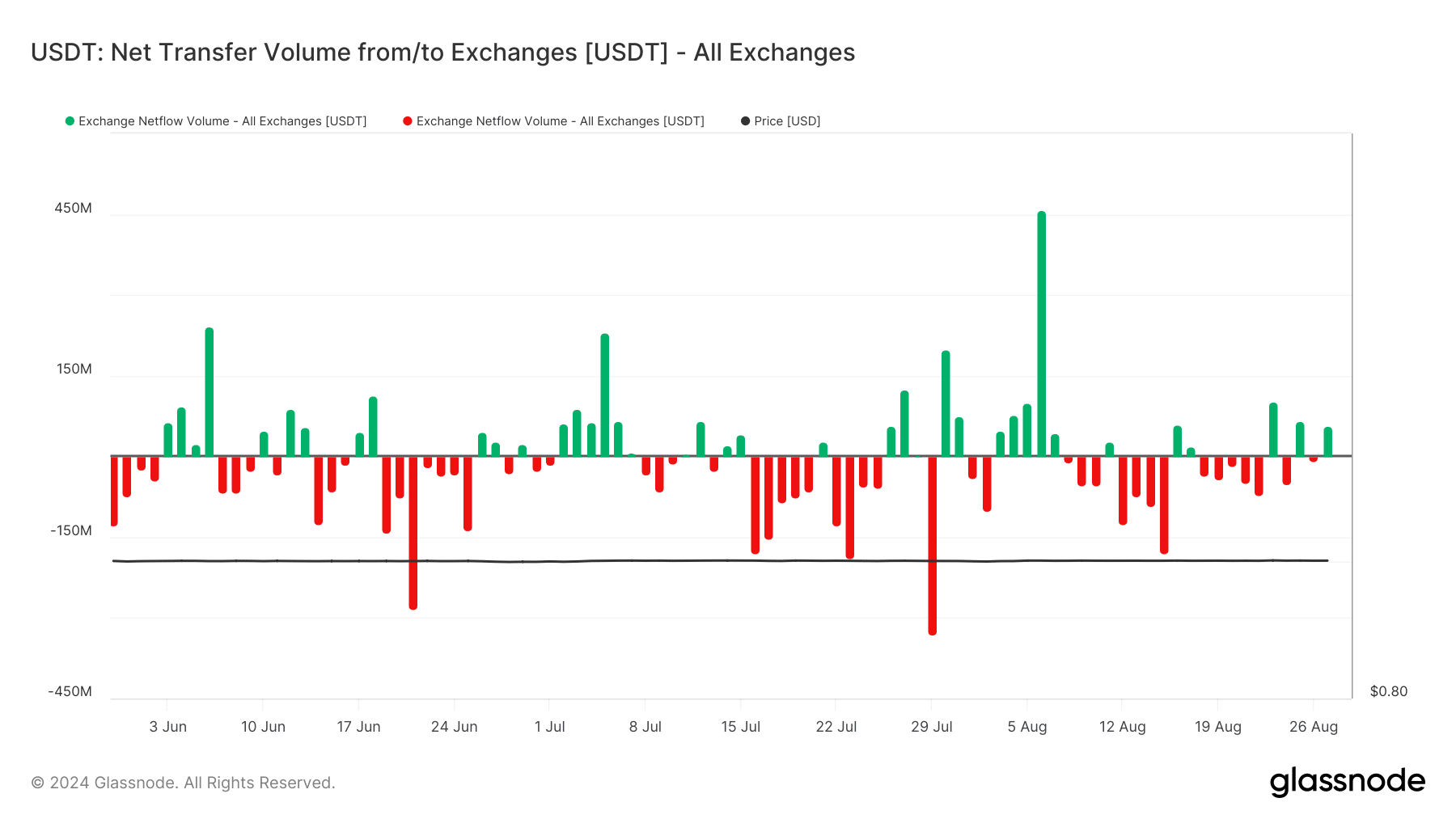

Source: Glassnode

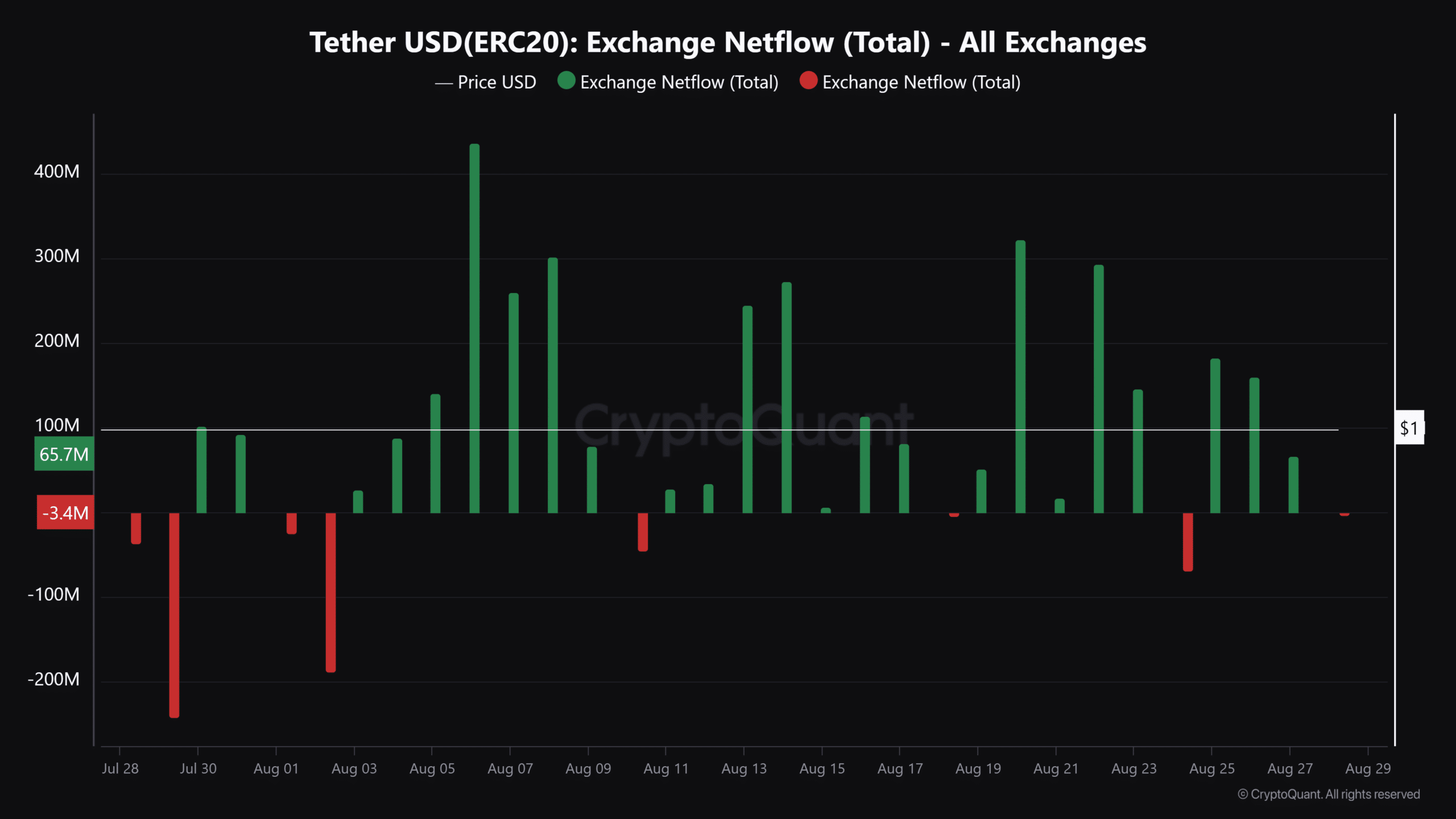

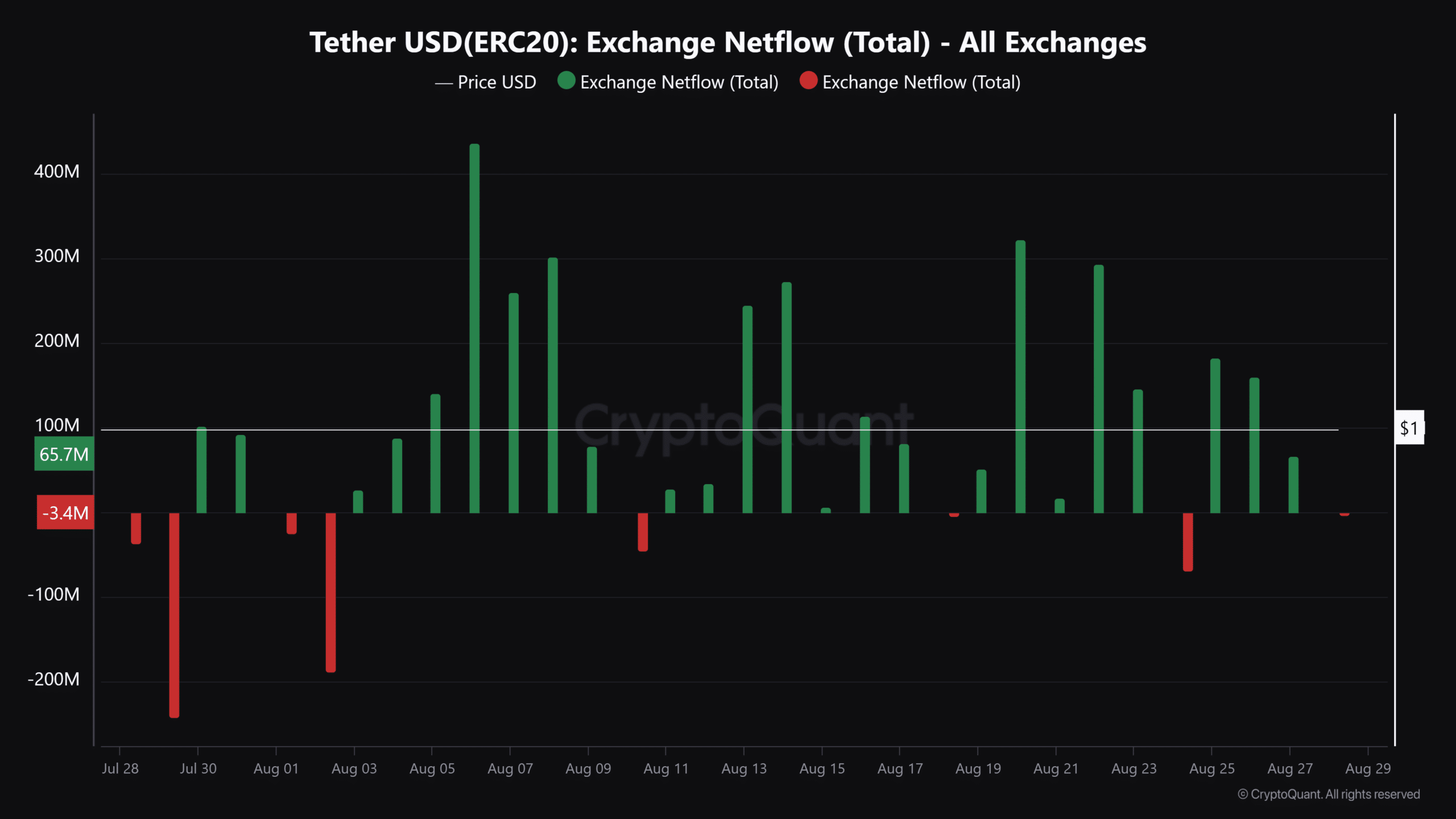

Interestingly, on July 29, after a bullish rally took BTC near $70,000, USDT’s net outflow rose to $330 million, indicating traders were cashing in on previous gains.

These net outflows highlighted a trend of USDT being withdrawn from exchanges and serving as a safe haven or profit keeper.

Similarly, the late August cycle saw traders lock in their two-week gains as BTC bulls managed to break the $62,000 support level, leading to a subsequent price decline.

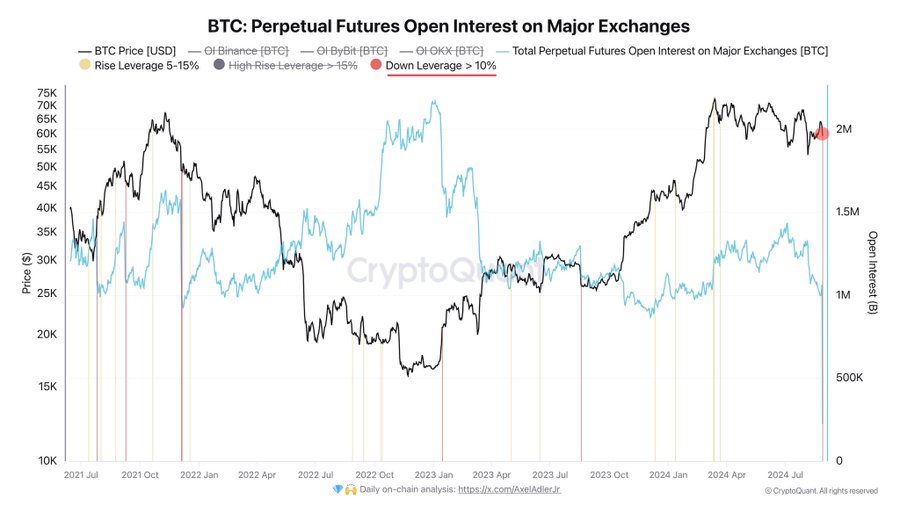

Combining this analysis with data from prospective perpetual market traders would provide a clearer insight.

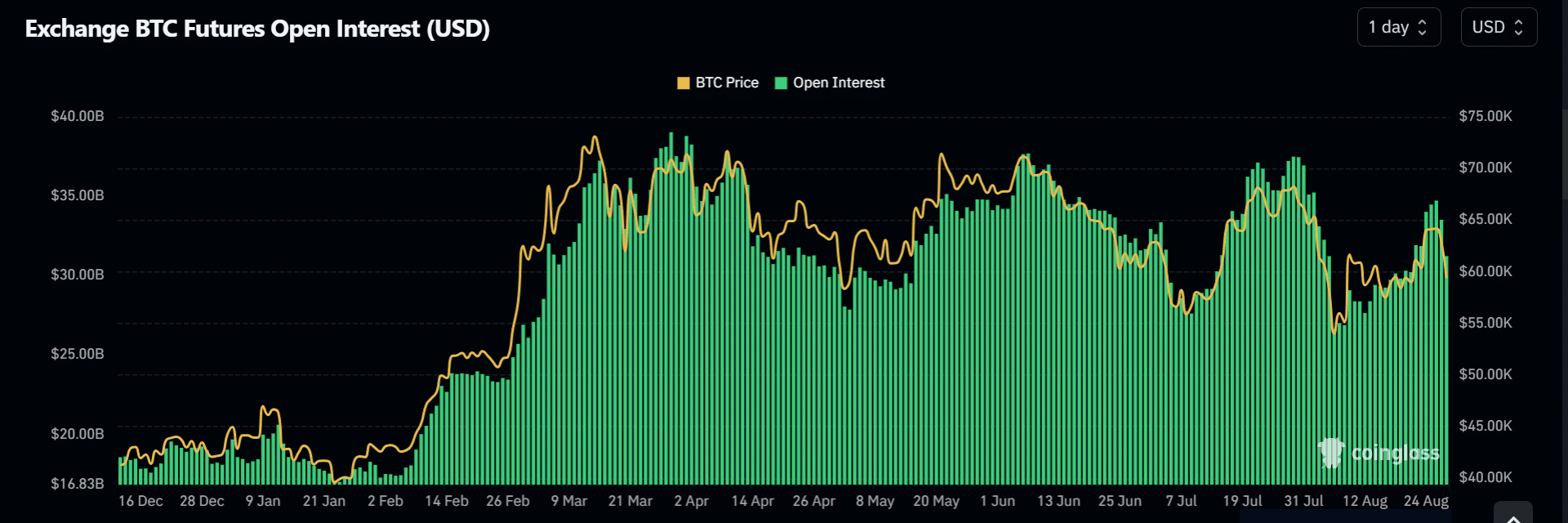

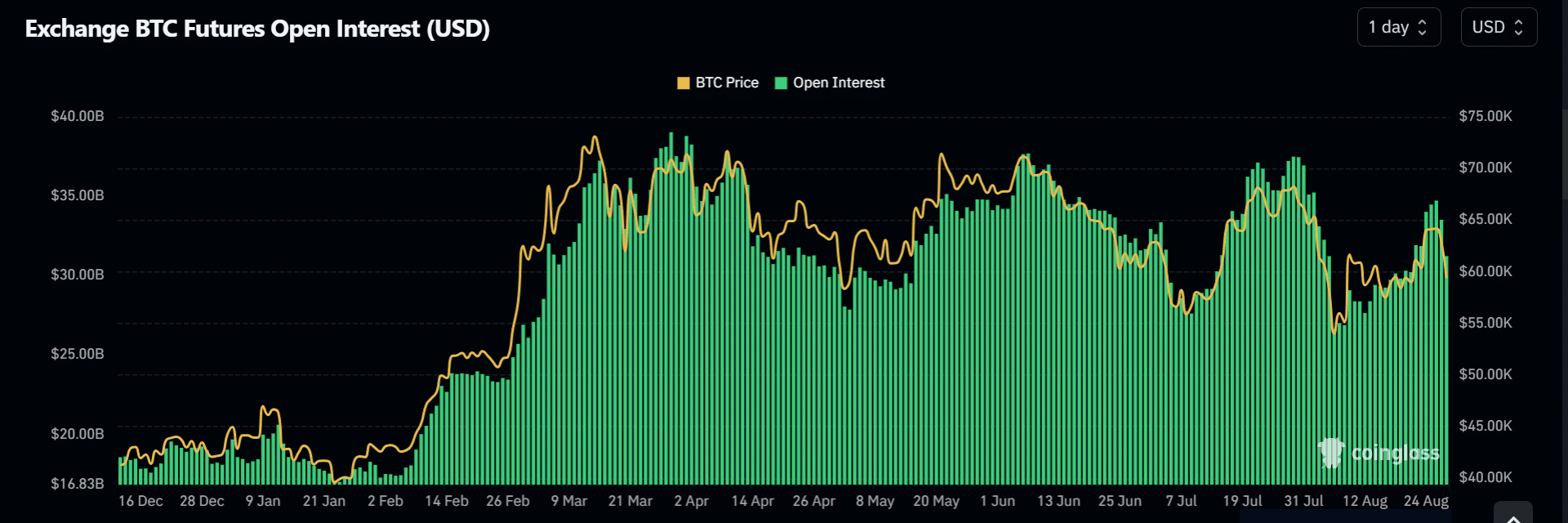

Source: Coinglass

According to AMBCrypto’s analysis of the OI chart, the number of closed positions increases thereafter every time BTC approaches a resistance barrier and experiences a bull rally. This indicates a pattern of profit taking as resistance levels are tested.

A prominent crypto analyst in the past 7 days predicted $64K as the next resistance level for BTC. The price fell when it reached this level, highlighting how willing traders were to lock in their profits.

Should you buy the dip now that the price has dropped significantly after traders made big gains? AMBCrypto investigates.

Signal of high USDT inflows…

As shown in the chart below, on the day BTC last closed above the $64,000 ceiling, on August 24, a staggering $69 million worth of Tether flowed out of exchanges, indicating traders were locking in their gains. Consequently, the price fell below $60,000.

Source: CryptoQuant

However, since then, USDT inflows have regained control. A day after USDT’s massive outflow, exchanges recorded an inflow of $182 million, signaling renewed interest and potential buying pressure.

In one after on

This increase in new wallets, combined with stable BTC and Ethereum wallet numbers, suggests new money is entering the crypto market, indicating more traders are buying the dip.

Source:

Read Bitcoin’s [BTC] Price forecast 2024-25

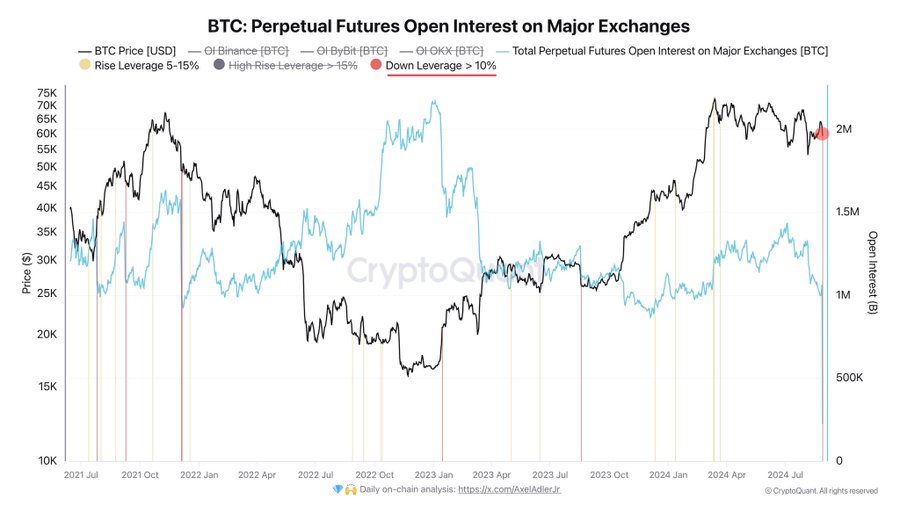

Caution is advised, however, as noted by another prominent analyst. Are Analysis shows open interest has yet to recover, with bulls losing $100 million due to liquidations of long positions.

Therefore, strong whale activity could be the key to curing whale disease wound.