- Massive move of BTC to long-term storage.

- Open interest and technical indicators are bullish on Bitcoin.

Bitcoins [BTC] The upward trajectory continues, with the price recently reaching $64K before a slight retracement to $63.7K. This pullback is temporary as BTC is poised for further gains once the retracement completes.

A major factor driving Bitcoin’s price higher is the withdrawal of 210,000 BTC from the exchanges since the beginning of the year.

This trend indicates that BTC hodlers are increasingly taking their assets off exchanges for long-term storage, easing selling pressure in the market and paving the way for higher prices, likely in the fourth quarter of 2024.

Source: Coinglass

History of Bitcoin’s Falling Wedge Pattern

Bitcoin’s historical price patterns also support the bullish outlook. Since its inception in 2009, Bitcoin has repeatedly formed a bearish wedge pattern, which typically precedes a strong upward move.

This Bitcoin [BTC] The pattern developed between 2021 and 2023 and led to a sharp bullish wave after a period of consolidation.

Source: TradingView

Currently, Bitcoin is in a bearish widening wedge, and a breakout above the $70,000 level could push BTC to $100,000 in the coming months, especially if the Federal Reserve cuts rates in September.

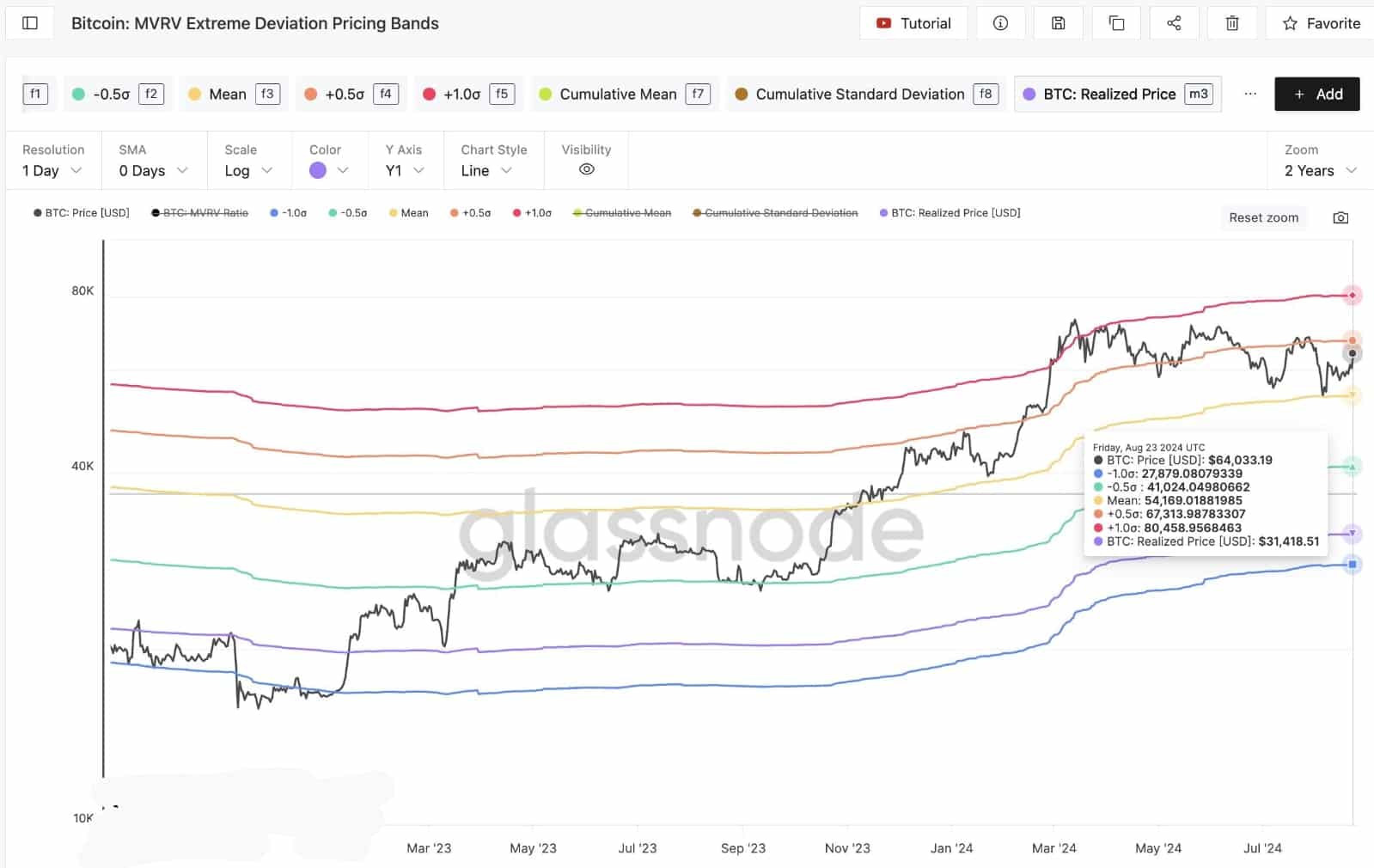

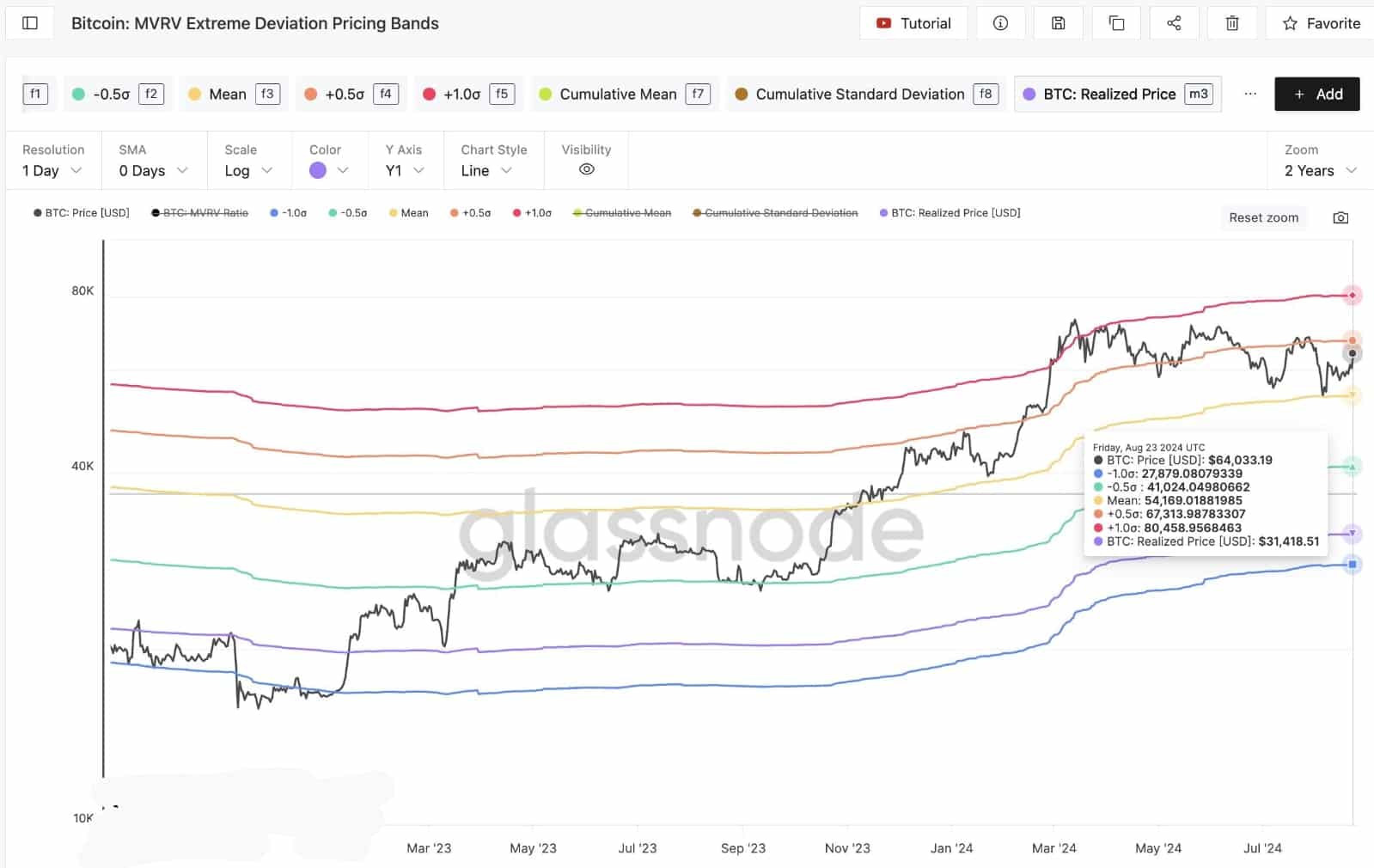

Bitcoin MVRV price bands for extreme deviations

Another key factor affecting Bitcoin’s potential to climb higher is the MVRV (Market Value to Realized Value) price bands.

A significant resistance level at $67,300 is crucial for Bitcoin to clear. If this level is breached, BTC could pave the way to reach $80,500.

Source: Glassnode

With the recent price movements and the decrease in selling pressure in the market due to the long-term storage of 210,000 Bitcoins, it seems increasingly likely that this resistance will be broken, paving the way for higher prices.

Bitcoin’s classic slow move closes the CME gap

Furthermore, Bitcoin’s performance around the CME closing price over the weekend played a crucial role in maintaining market stability.

The lack of a gap at the close of the CME has kept the market stable, providing a solid foundation for the bullish momentum that started last Friday. If Bitcoin continues this trend, it could lead to new purchases and push the price even further.

Source: TradingView

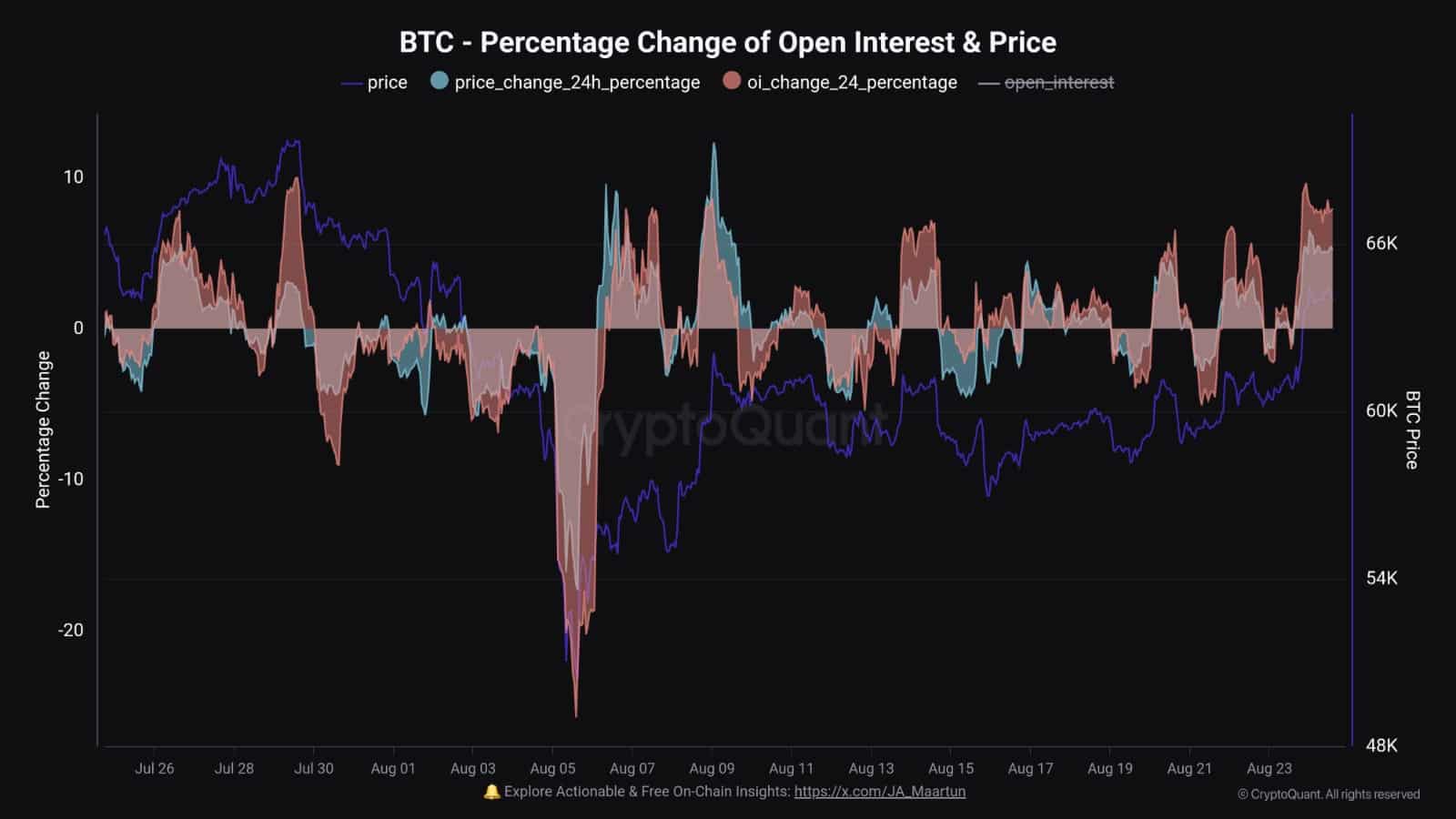

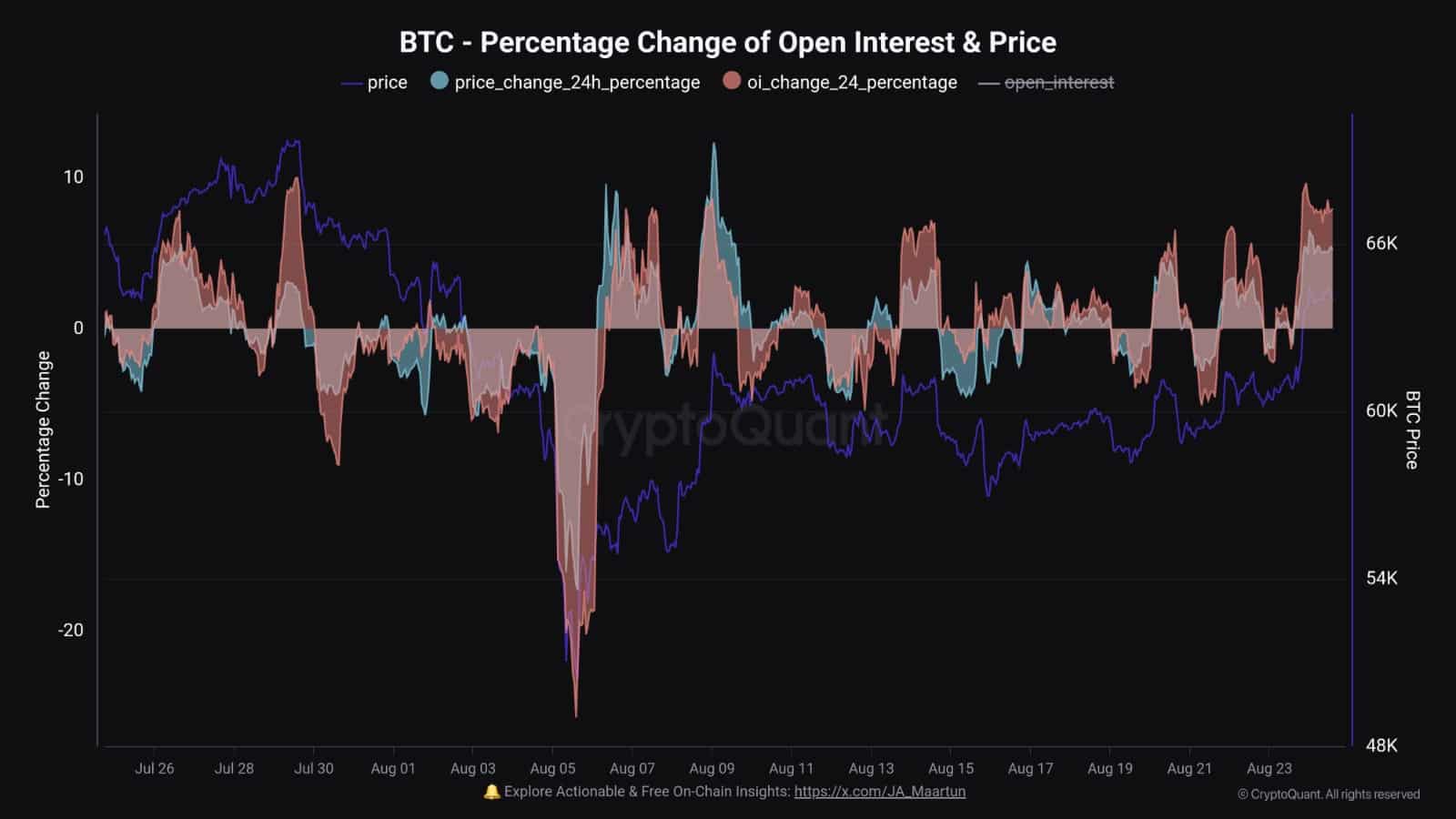

Bitcoin Open Interest Rises

Finally, open interest in Bitcoin has increased dramatically, outpacing the recent price decline. This phenomenon, which we have seen twice before, has historically led to rapid price recoveries and new highs.

Read Bitcoin’s [BTC] Price forecast 2024-25

With this increase in open interest, it is expected that Bitcoin will continue its upward trend, pushing the price higher as the year progresses.

Source: CryptoQuant

Bitcoin is well positioned for strong performance, with multiple factors aligning to push BTC prices higher in the coming months.