- The altcoin seasonal index continued to indicate BTC’s dominance.

- ETH’s market indicators looked bearish, but SOL’s indicators turned bullish.

Bitcoin [BTC] has been the center of attention for quite some time, with the king coin reaching its all-time high and plummeting to almost $55,000 shortly afterwards.

In fact, Bitcoin’s dominance has also increased in recent months. However, if the latest data is taken into account, then altcoins love it Ethereum [ETH] And Solana [SOL] might get a chance to shine soon.

Altcoins Will Start Bull Rallies Soon?

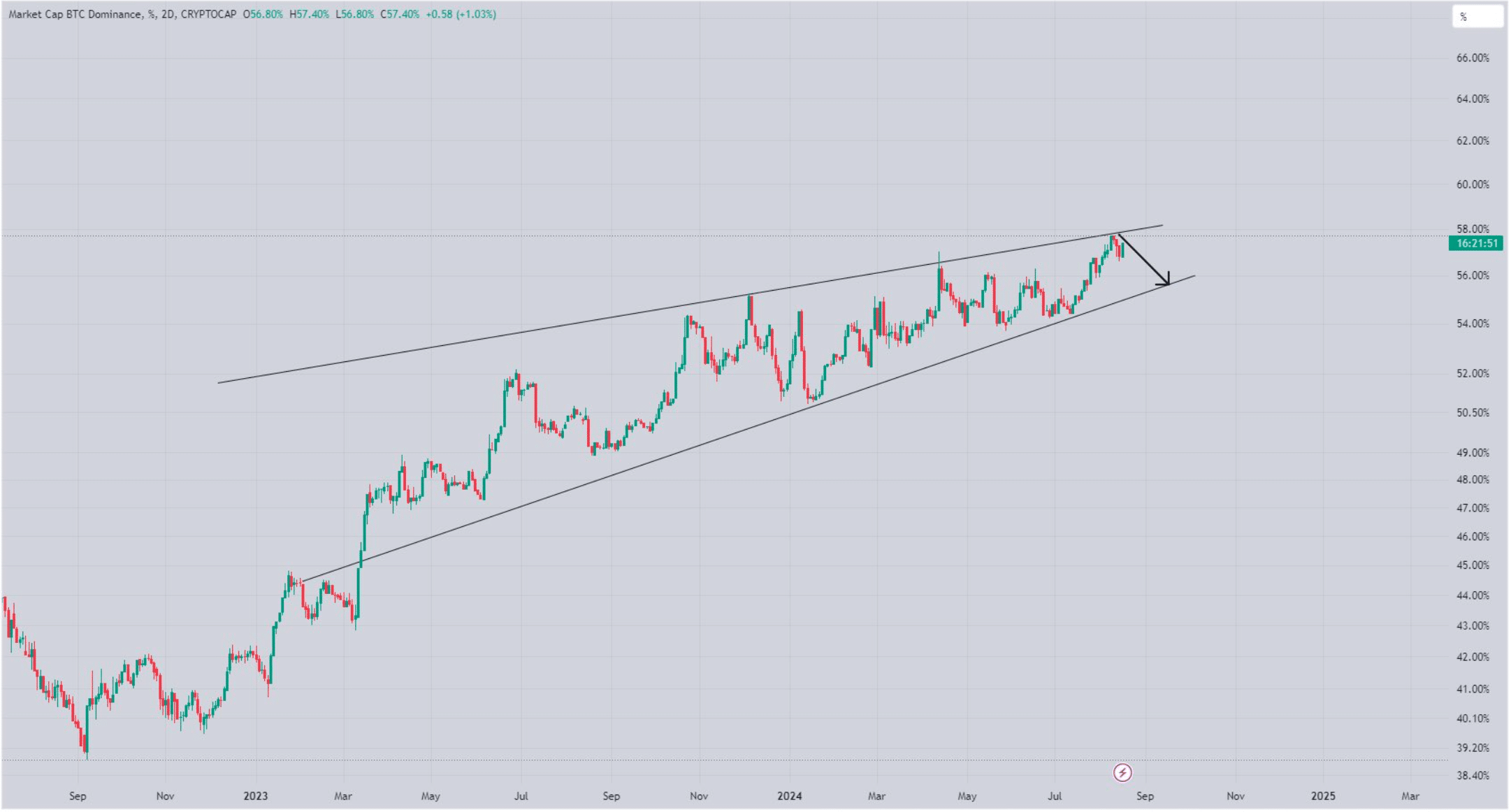

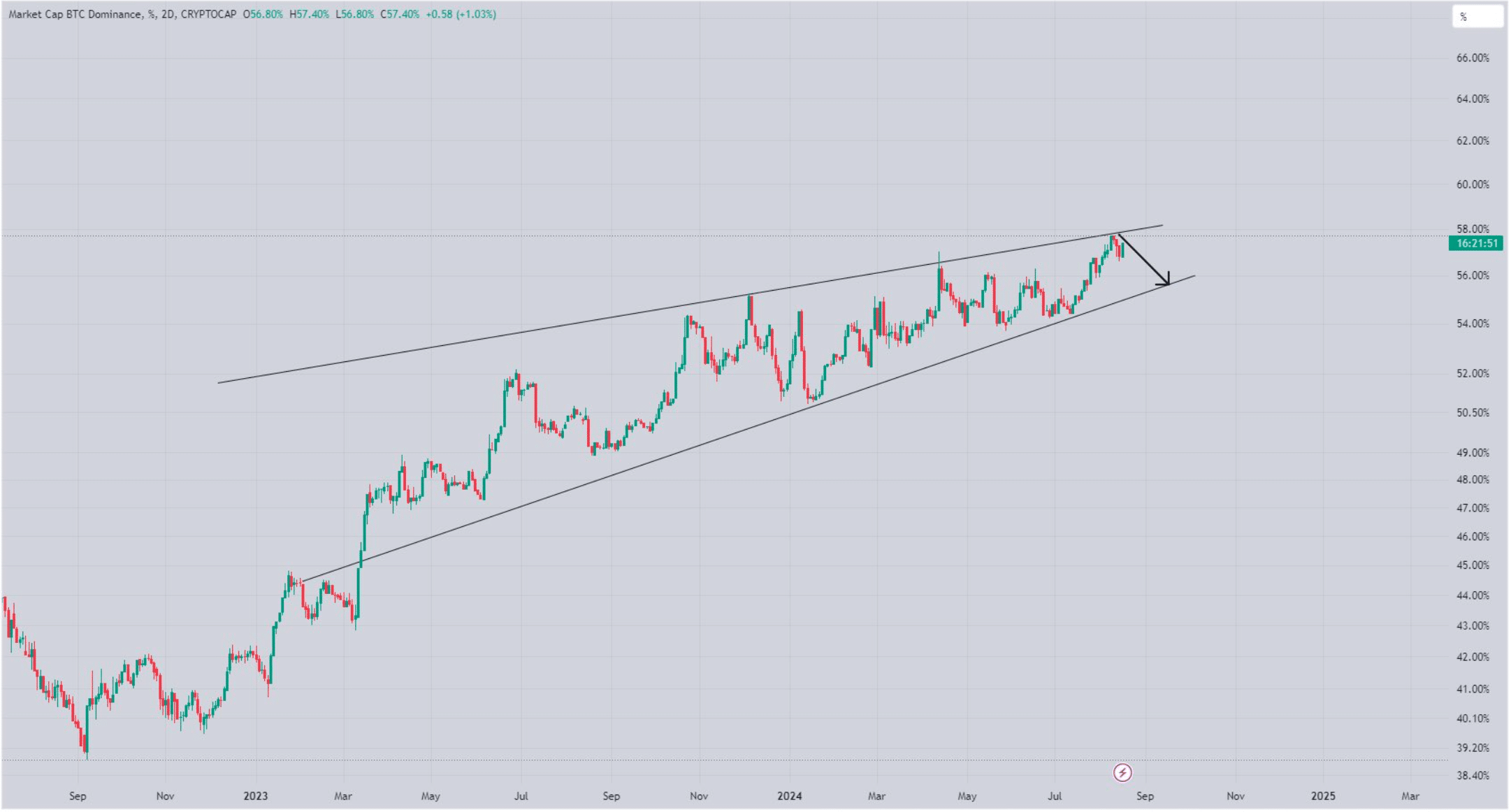

World Of Charts, a popular crypto analyst, recently posted a tweet highlighting a pattern on the Bitcoin dominance chart.

According to the tweet, Bitcoin tested the upper limit of a rising wedge pattern, which indicated a decline in BTC dominance.

A decrease in Bitcoin dominance directly translates into an increase in altcoin prices. However, the tweet also stated that the altcoin’s major recovery would occur after BTC’s dominance disappears under the pattern.

Source: World of charts/X

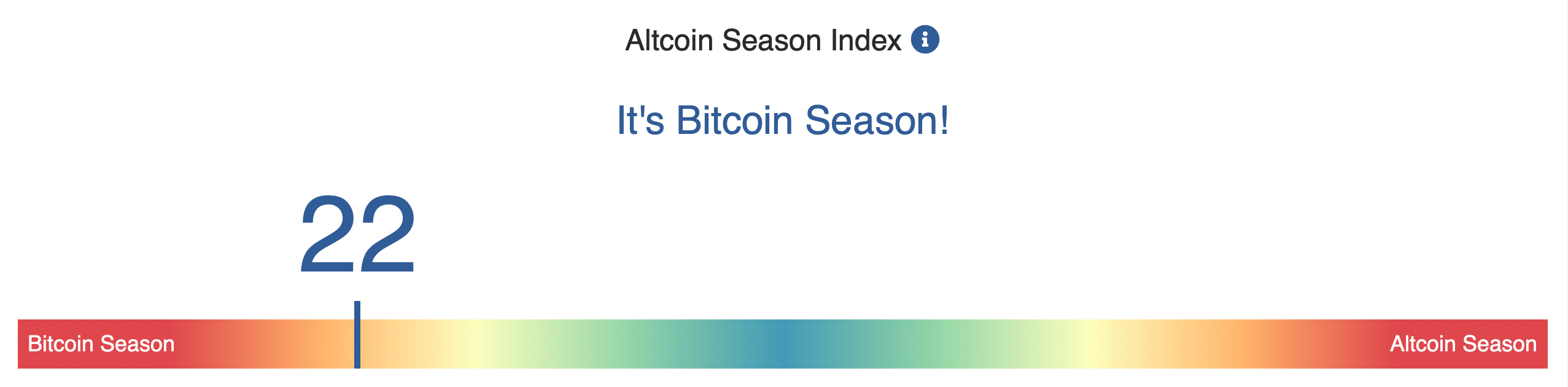

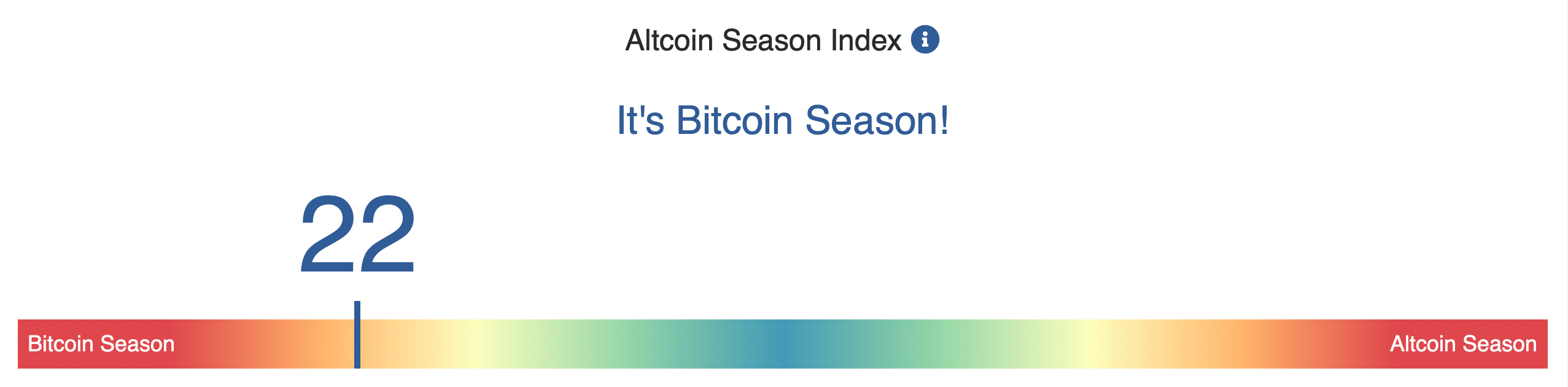

However, not everything seemed to be in favor of altcoins. For example, AMBCrypto’s look at the altcoin seasonal index showed that BTC was still dominant.

The indicator had a value of 22 at the time of writing, indicating that Bitcoin season is still ongoing. For the uninitiated, a number above 75 indicates the start of an altcoin season.

Source: Blockchaincenter

What to expect from Ethereum and Solana

AMBCrypto then planned to take a look at the top altcoins like ETH and the state of SOL to better understand what to expect from them in the near term.

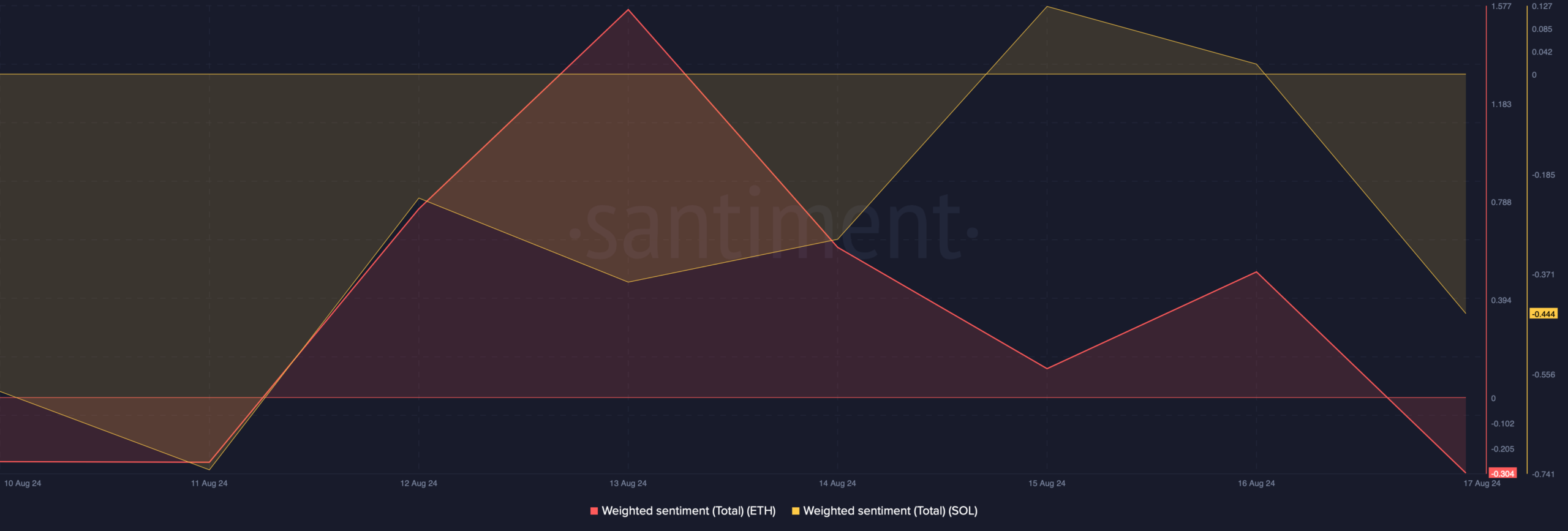

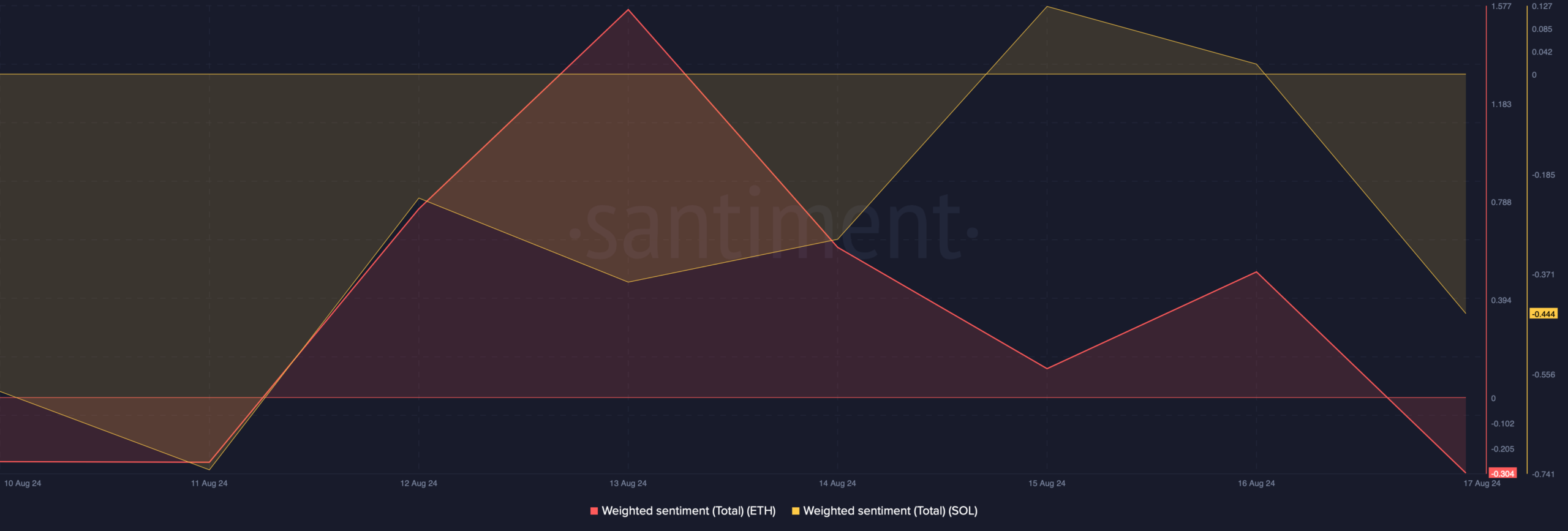

Our analysis of Santiment’s data showed that after remaining in the positive zone, the weighted sentiment of both SOL and ETH moved into the negative zone.

This indicated that bearish sentiment around both tokens increased on August 17.

Source: Santiment

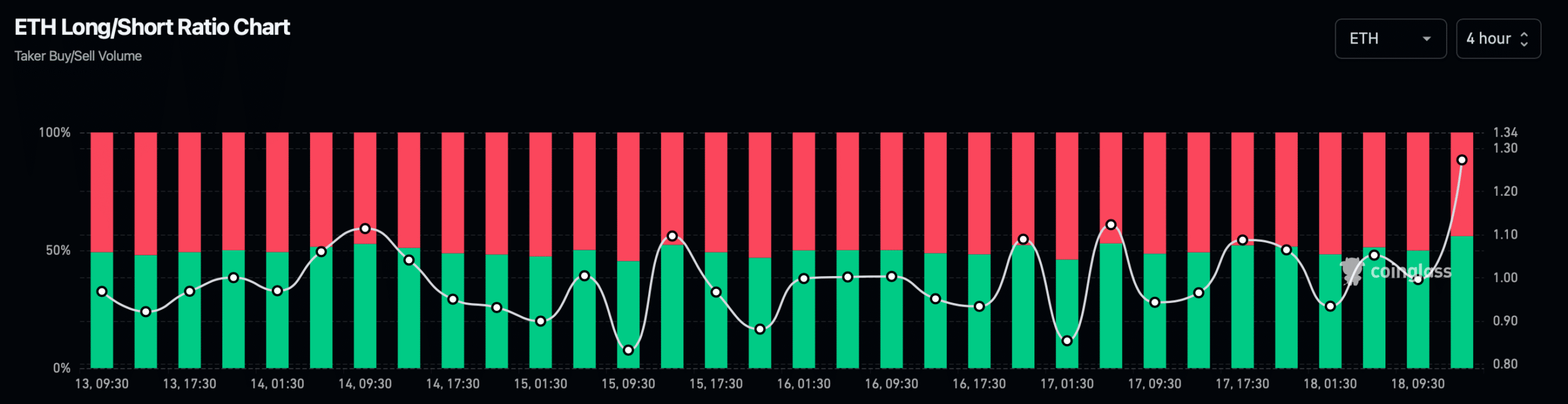

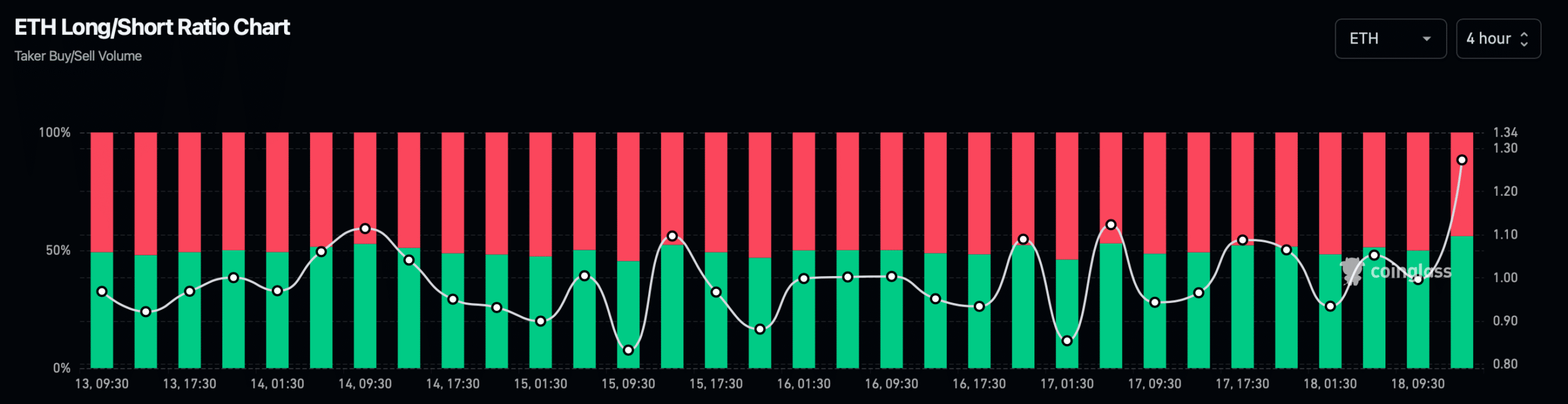

Mint glass’ facts revealed that Solana’s Long/Short Ratio registered a sharp decline. This suggested that there were more short positions in the market than long positions.

However, Ethereum’s Long/Short ratio rose, which looked bullish.

Source: Coinglass

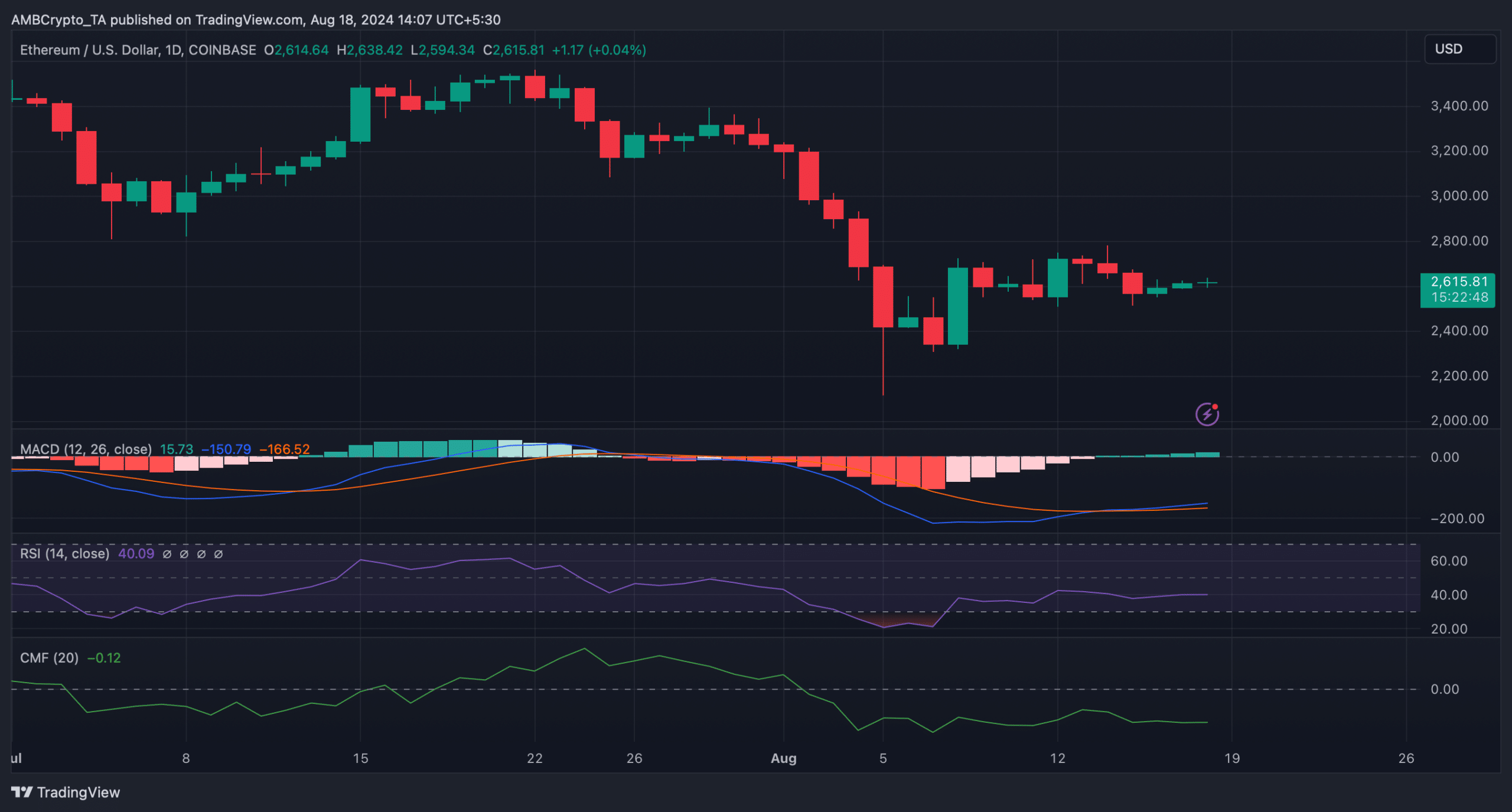

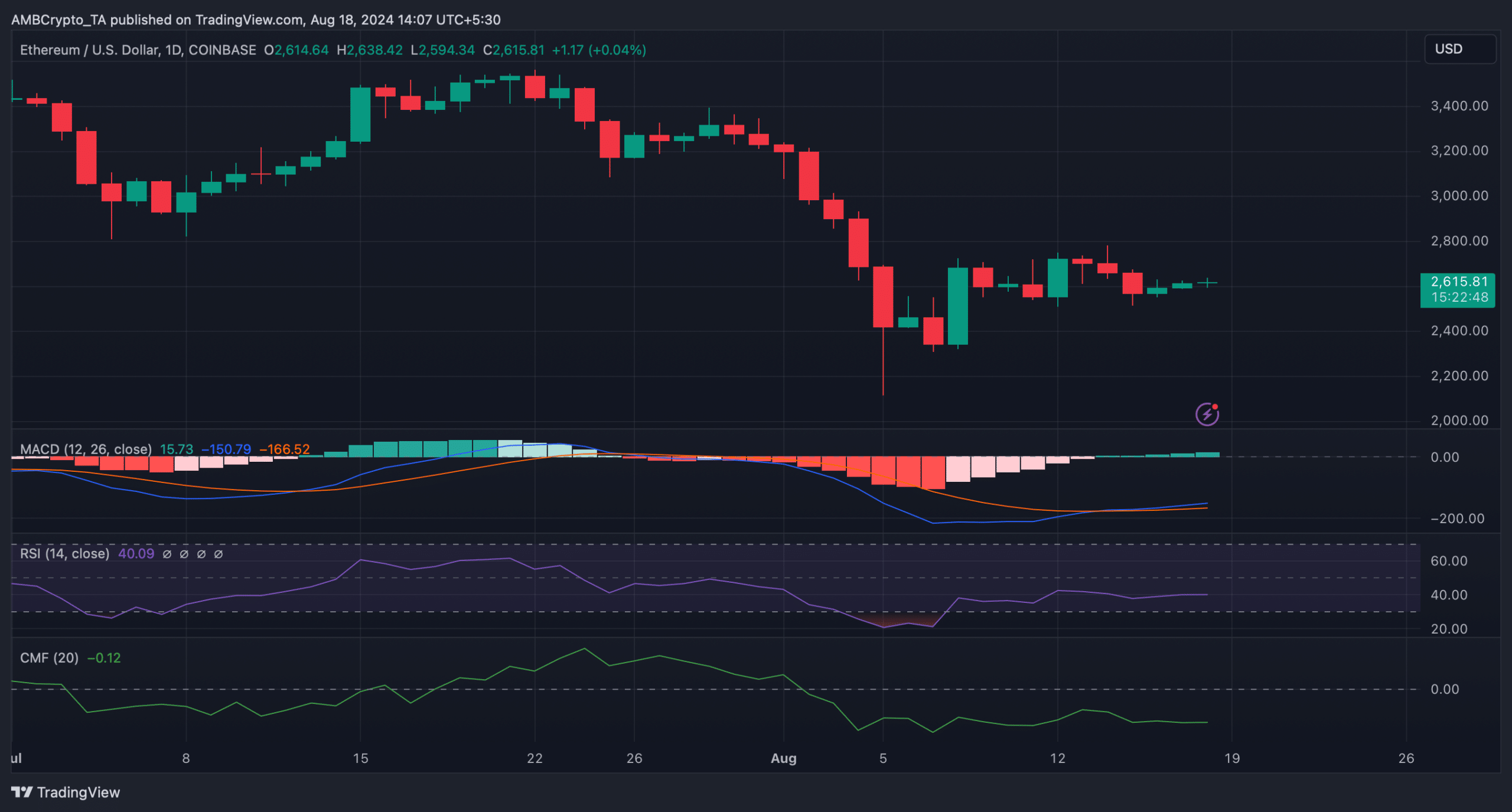

Like the long/short ratio, ETH’s MACD also turned in favor of buyers as it showed a bullish crossover. However, the Relative Strength Index (RSI) followed a sideways path below the neutral line.

The Chaikin Money Flow (CMF) also followed a similar trend, indicating that there are some slow moving days. At the time of writing, ETH was trade at $2,613.42 with a market cap of over $313 billion.

Source: TradingView

Read Ethereums [ETH] Price prediction 2024-25

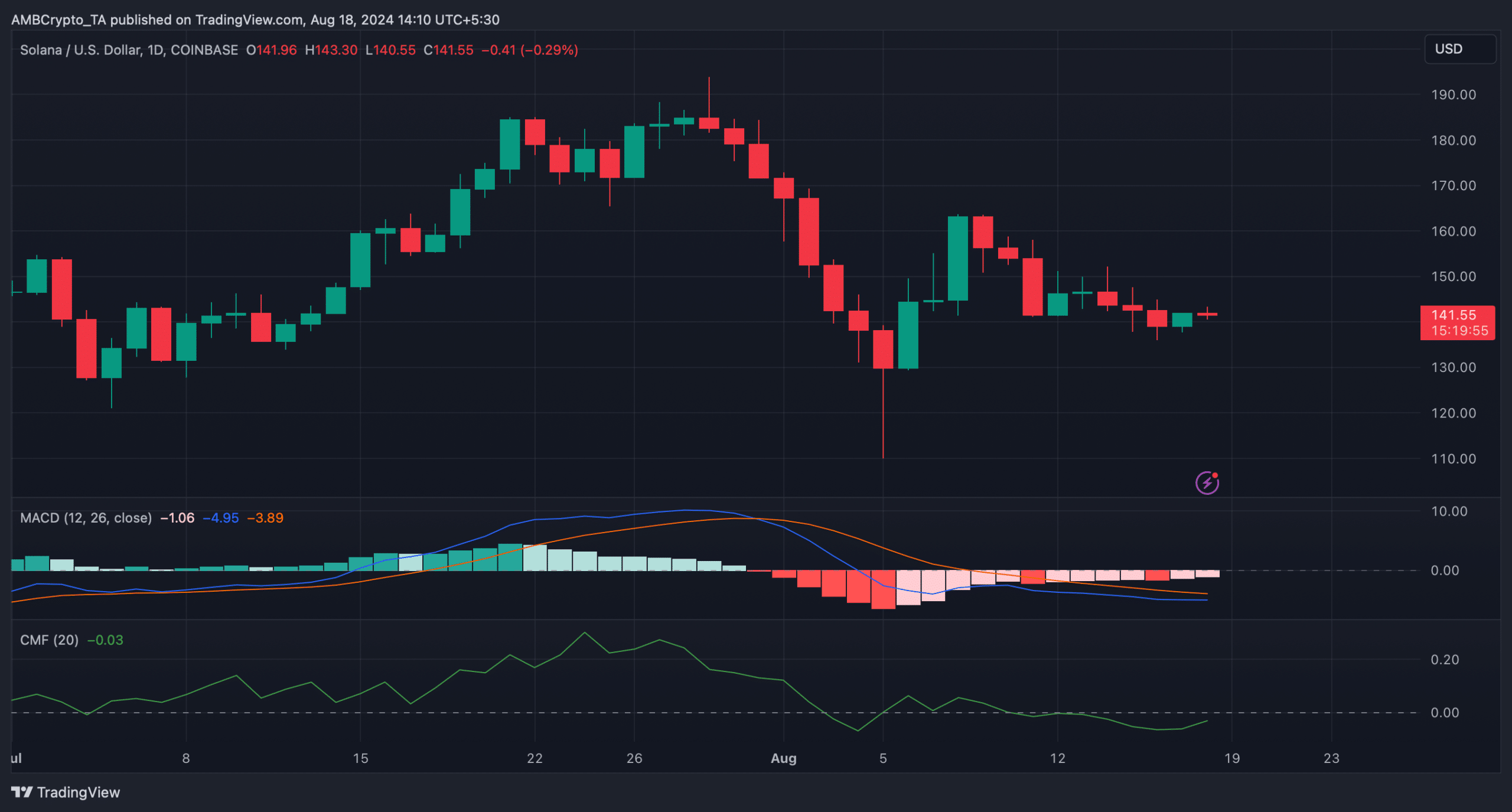

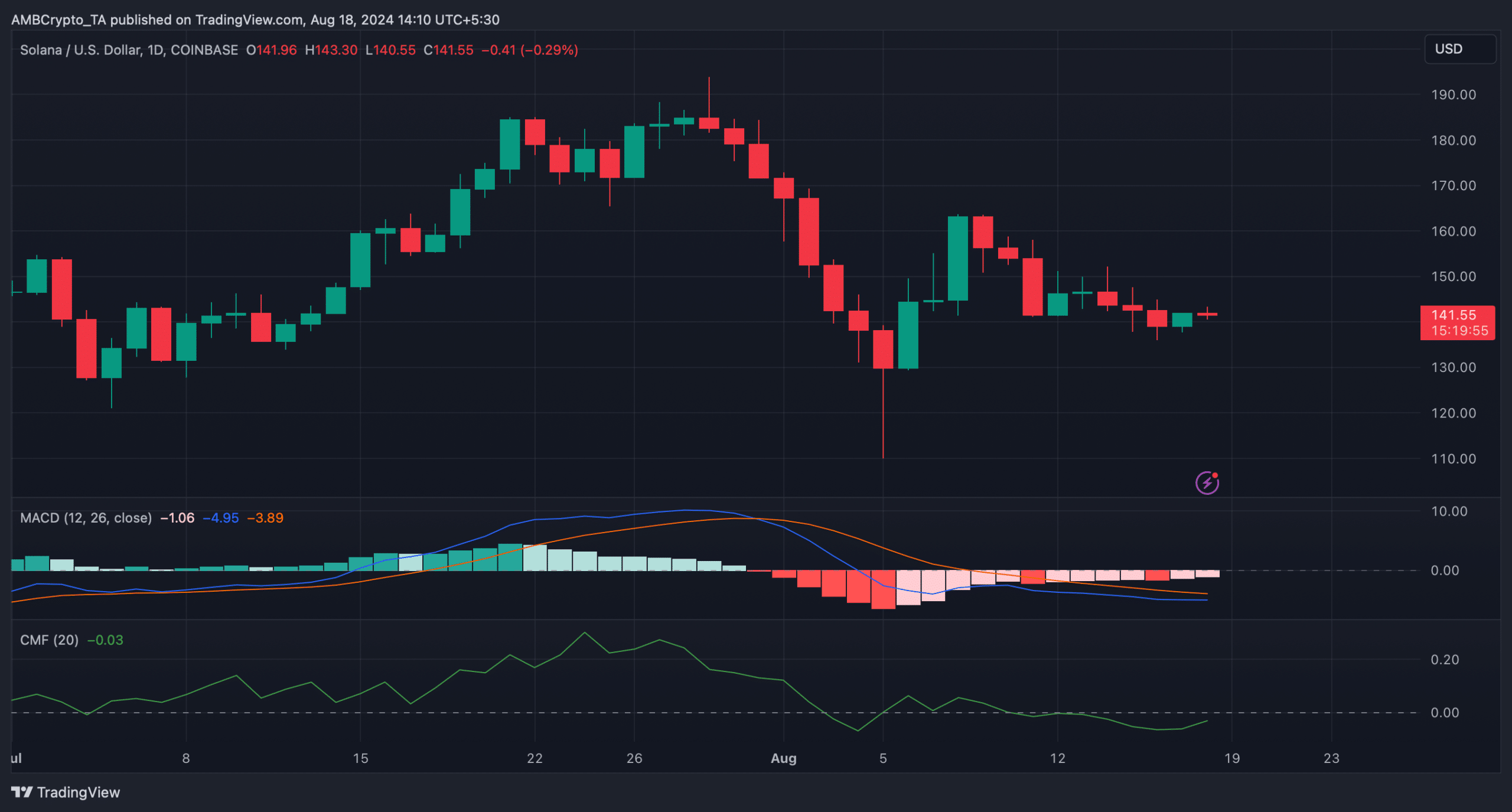

Interestingly, despite the bearish metrics, Solana’s price gained bullish momentum as it rose over 1.5% in the past 24 hours. At the time of writing, it was trading at $141.62 with a market cap of over $66 billion.

SOL’s CMF gained upward momentum. The MACD also showed the possibility of a bullish crossover, indicating continued price appreciation.

Source: TradingView