- Willy Woo predicted that Bitcoin could reach a minimum of $700,000 based on a conservative asset allocation.

- He dismissed the $24 million mark as unrealistic, requiring total global investment in Bitcoin.

Bitcoin [BTC] has been on a bearish ride since peaking above $73,000 in March.

At the time of writing, the asset was trading at a price of $64,020, which is 13.2% from the all-time high in March (ATH) and about 4.4% over the past week.

Despite this bearish trend, Willy Woo, a leading analyst in the crypto space, recently shared his insights on BTC’s potential future valuation.

Expectations and market dynamics

Woo stated that the minimum potential valuation for Bitcoin could be around $700,000, while the maximum could be as high as $24 million per BTC.

However, he clarified that reaching the upper estimate would require an unlikely scenario in which all global wealth – amounting to approximately $500 trillion – is invested in Bitcoin.

This scenario, he noted, is highly unlikely, stating that a $24 million valuation per Bitcoin “will never happen.”

Continuing his analysis, Woo discussed realistic expectations for institutional investor involvement in Bitcoin.

He was referring to Fidelity’s recommendation that portfolios include 1-3% in Bitcoin, which contrasts with BlackRock’s much higher investment of 85% in some cases.

Woo leaned toward a 3% allocation as a more sensible figure, which could still push Bitcoin’s price toward the $700,000 mark if it were widely adopted.

Woo expanded on his predictions and discussed the adoption S-curve, noticing that global Bitcoin adoption was 4.7% at the time of writing.

He predicted that as adoption increases to between 16% and 50%, Bitcoin’s price could escalate to the levels he outlined, driven by increasing mainstream adoption and investment.

Bitcoin current market attitude

However, the current market tells a different story.

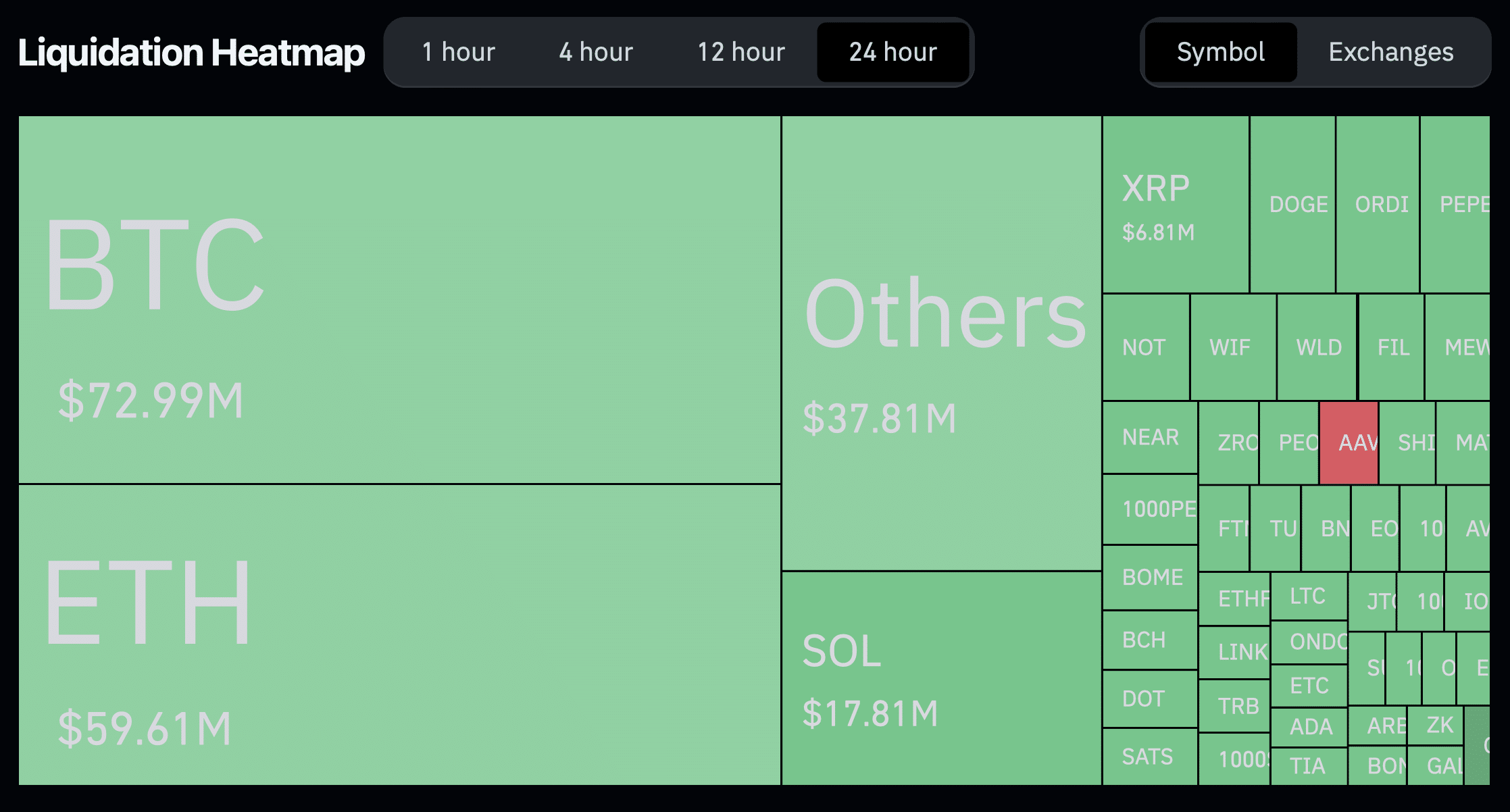

Recent fluctuations have led to a significant number of trader liquidations, with Bitcoin accounting for approximately $72.99 million of the total $255.67 million in liquidations in the past 24 hours, according to Coinglass. facts.

The majority of these were long positions, signaling a tumultuous period for investors betting on immediate profits.

Source: Coinglass

Crypto analyst RektCapital weighed in on the recent market dip, suggesting the current setback could be shorter than the previous one. He explained,

“The first return within the pattern lasted five weeks until the bottom. The next one lasted 4 weeks. It will only take two to three weeks for this current bottom to be reached.”

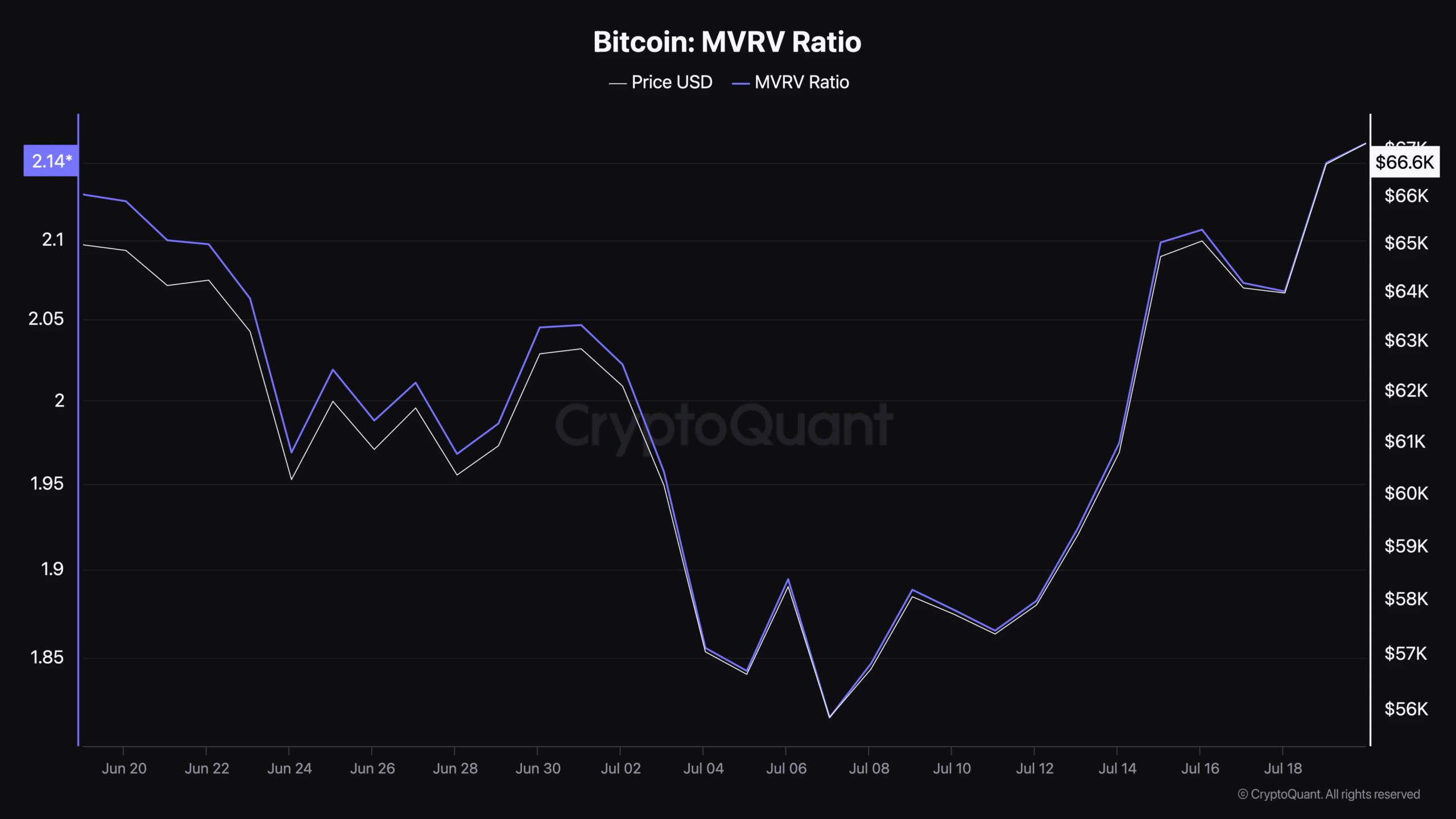

Adding to the discussion, data from CryptoQuant showed that Bitcoin’s market value to realized value ratio (MVRV) – used to assess profit or loss by comparing market value to realized value – 2.1 at press time.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024-25

An MVRV ratio greater than 1 suggested that Bitcoin was overvalued compared to its realized price, indicating that investors are holding coins at a profit, which could influence their selling decisions and affect market stability.

Complementing this outlook, AMBcrypto recently highlighted in a report that BTC is exerting pressure mounts.