- The Bitcoin rainbow chart showed intense bullishness for BTC over the next 12 to 18 months

- Market sentiment was lukewarm and the public frenzy failed to materialize, even though prices were just below the ATH.

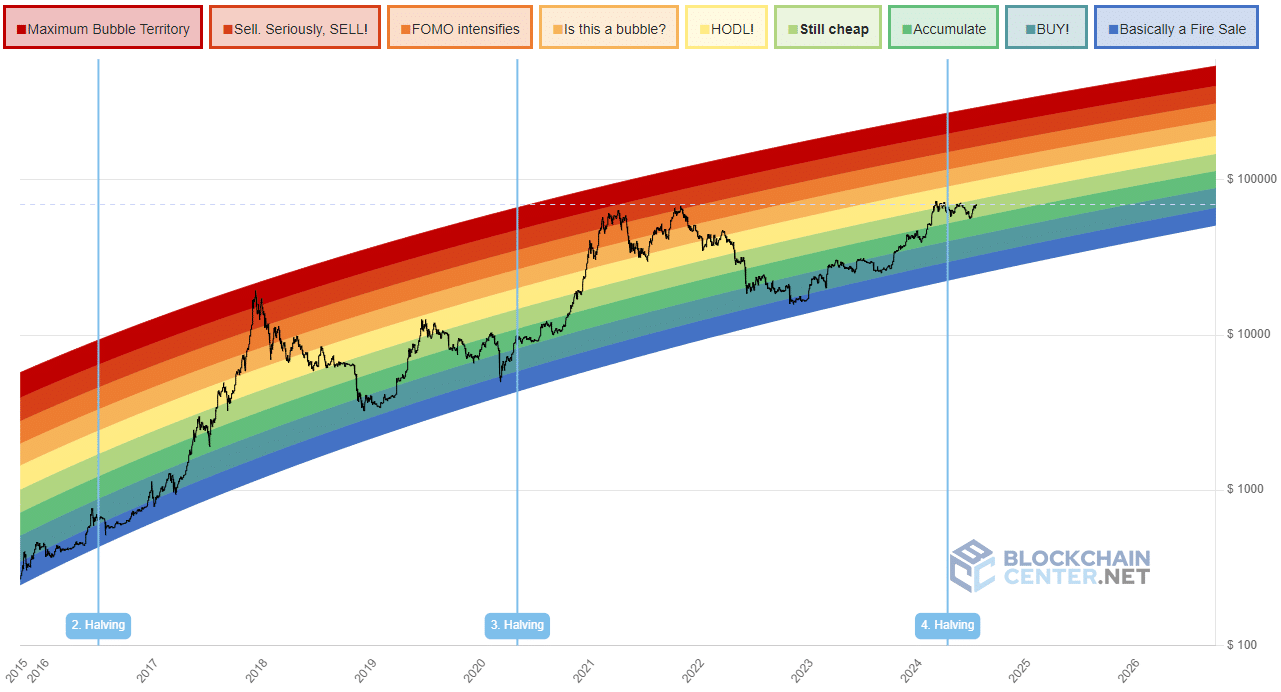

The Bitcoin [BTC] Rainbow Chart is a fun, straightforward way for investors to get an idea of where BTC is in its cycle.

Developed in 2014it takes the past performance of the king of crypto and projects it forward using a logarithmic graph.

This mitigates some of the intense volatility Bitcoin has seen over the past decade, and the different color bands give investors an idea of market sentiment at a glance.

However, this only applies to multi-year holders and not to day traders.

What does Bitcoin do? rainbow chart project for 2024, and when should the holders try to make a profit?

Bitcoin is still cheap!

Looking back at the past two halvings, we can see that it takes a few months for prices to pick up after the halving. This cycle has been different from the others so far.

The price rose rapidly before the halving and reached a new all-time high just a month afterward.

Despite these gains, the price was still within the accumulation zone. This was hugely encouraging for holders and long-term investors.

Like this prominently crypto trader points out that FUD events like Mount Gox, the German government or the US government’s seized BTC sales were all behind us.

Public sentiment is lukewarm and prices are a stone’s throw from ATH. Things could heat up quickly and become more bullish a year later.

In the last cycle, the cycle top came 546 days after the halving. If history repeats itself, Bitcoin could top this cycle in October 2025.

This could push prices into the $144k-$184k window, assuming the “sell, seriously, SELL” zone is not reached.

Insights from statistics in the chain

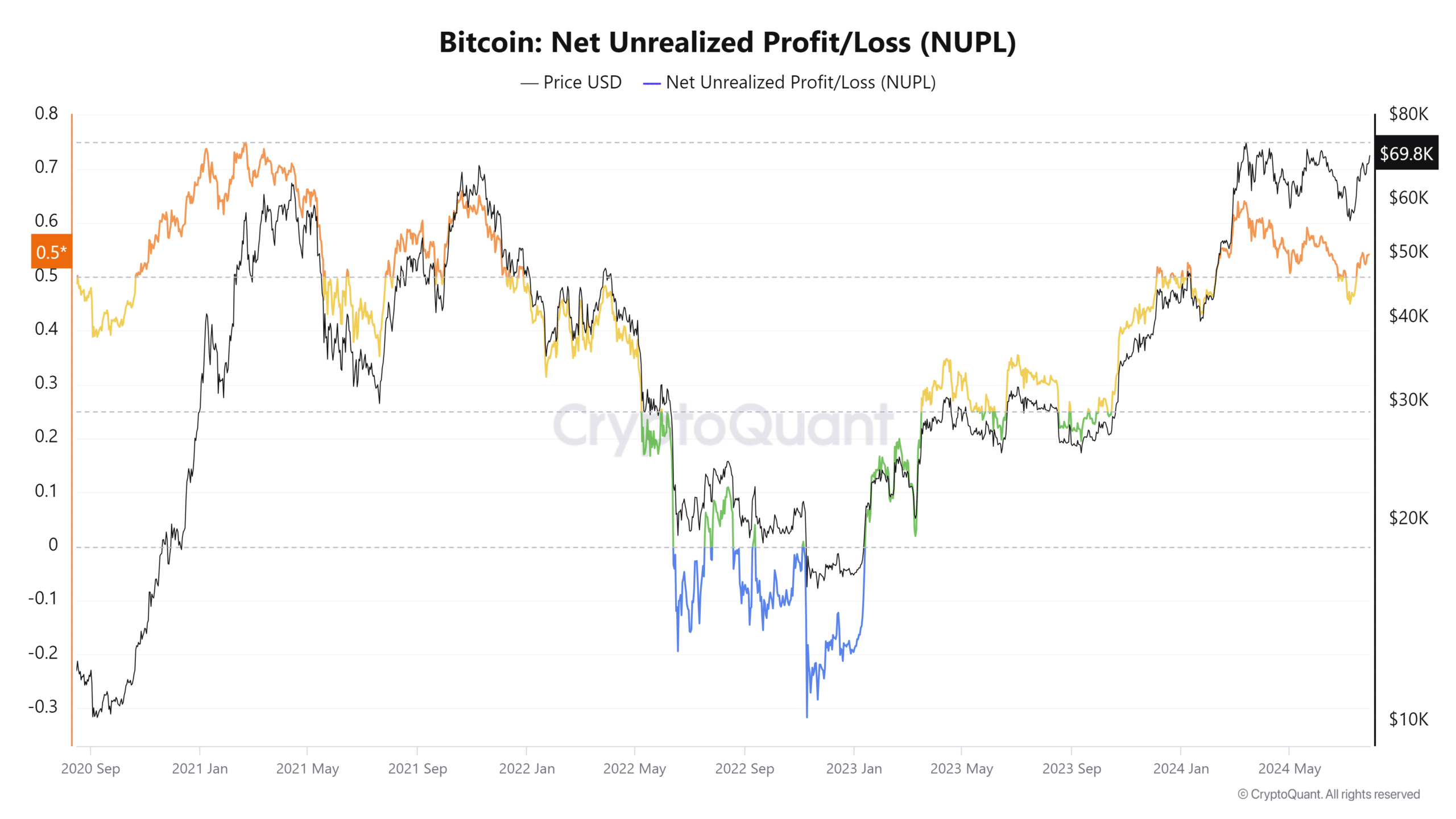

AMBCrypto looked at the net unrealized gain/loss metric. This statistic represents the total amount of profit/loss in all coins, shown as a ratio. Values above 0.7 generally indicate a market top.

In March 2024, the NUPL metric reached 0.62, indicating overheated conditions and increased selling pressure due to profit taking. However, since then the trend has been steadily downward.

This showed that sales decreased.

Is your portfolio green? Check out the BTC profit calculator

So there is more room for price increases. Furthermore, the NUPL can remain in the above 0.5 range for months at a time. The second half of 2020 is a prominent example of this, and the same could repeat itself in 2024.

In general, long-term investors can choose to accumulate more BTC or simply HODL their wallets. It is likely that further price increases will occur, but it may take a few more months.