Over the weekend, the Bitcoin price fell below $60,000 amid rapid selling by major holders such as the German and US governments. This led to one of the biggest drops for the pioneer cryptocurrency in the past two years, costing the market billions of dollars. Despite this, Bitcoin holders are still seeing big gains, with the vast majority of investors currently making profits despite the market crash.

Bitcoin holders enjoy huge profits

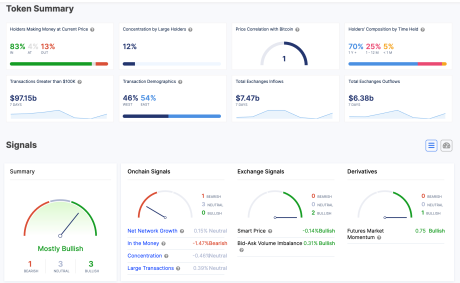

According to facts from the on-chain tracker IntoTheBlock, there are approximately 53.57 million Bitcoin holders worldwide. Of these investors, a total of 83% still see profits despite the BTC price drop below $60,000, as it is currently just above $56,000.

Related reading

This figure only leaves about 17% of total BTC holders who are currently not seeing any profits. Of this figure, 13% lose money, meaning they bought their BTC coins when the price was higher than the current value, leaving 4% of holders at breakeven. This means that these 4% bought their coins around the current value so they are not making or losing money at the current price.

With these percentages, this means that approximately 44.61 million Bitcoin investors are still making profits on their positions. 6.8 million BTC holders are now suffering losses, and approximately 2.16 million investors are currently at breakeven.

Interestingly, the majority of these investors making a profit have their entry prices under $50,000, meaning that even with another 10% crash from here, the vast majority of Bitcoin investors would still see a profit from their holdings.

Long-term BTC holders are at risk of losses

While the data shows that the vast majority of Bitcoin investors are still seeing gains, there is a growing trend that is mainly affecting long-term holders. According to a Sentiment reportthe average return of Bitcoin’s long-term holders is in danger of falling into losses for the first time in more than a year.

Related reading

This isn’t a negative for the price, however, given how BTC has reacted in the past when average long-term holder returns fell into the red. As Santiment notes, this is usually a good time to buy, especially when “Bitcoin’s 30- and 365-day MVRV are in negative territory.” The tracker further added: “This is when there is mathematical validation that you are buying relative to the pain of other traders.”

To explain how good a buying opportunity this is: “If you had bought the last time both lines were in negative territory, your return on BTC would be +132%,” Santiment notes. To put it simply, these types of developments can often be a good indication of where the bottom is and when you should start buying.

Featured image created with Dall.E, chart from Tradingview.com