- MATIC found it difficult to find its position after almost all holders ran out of profits

- The MVRV indicator revealed that the token was in a bear phase and needed a 13% increase to escape

Things go from bad to worse for Polygon [MATIC] after the last market correction. To be very specific, the token’s price plummeted to $0.43 on July 5.

To put this into perspective, the last time MATIC reached this level was in July 2022. At the time, the crypto market was in a full-blown bear phase.

MATIC’s recent decline has been in line with that of the broader market. On one front, however, it all seemed to stand alone.

Now, one would normally expect that most, or at least some, of the top 20 cryptocurrency holders will make some form of profit at some point. Is that really the case with MATIC?

Polygon finally leaves “green land”

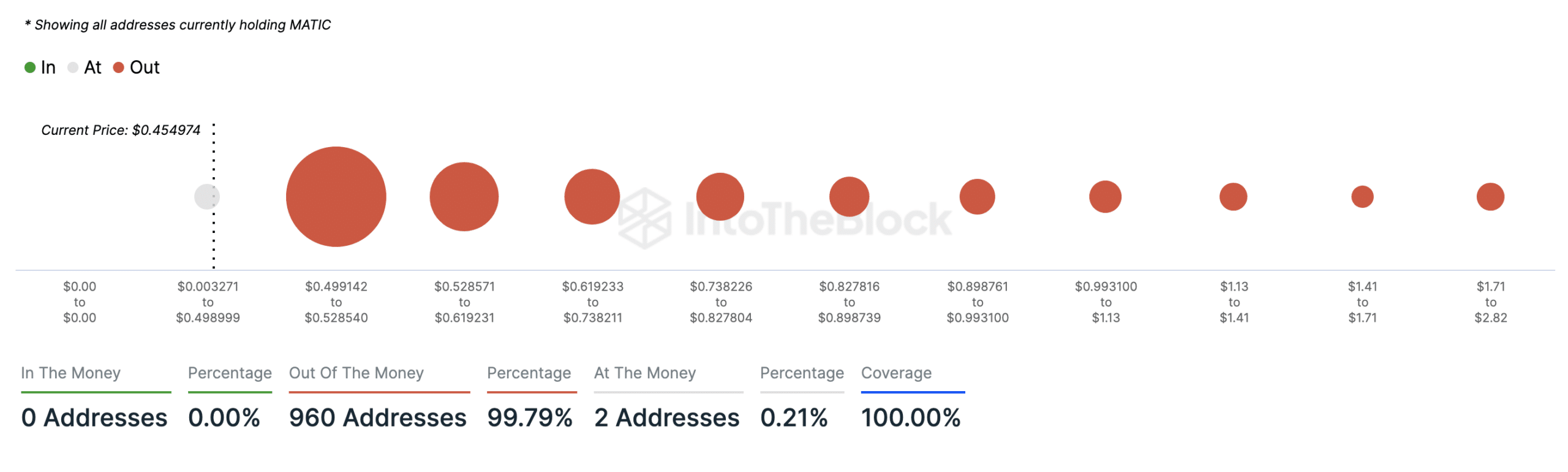

The bad news is that MATIC can’t boast the same. According to InTheBlok, 97% of the project’s active addresses are now out of money. Simply put, this means they are holding the token at a loss.

The remaining 3% do not make a profit, but are at the breakeven point, meaning that no active MATIC holder has unrealized profits.

By March, the price of Polygon’s native token had hit a yearly high of $1.27, sending many holders into the cash. However, everything has gone wrong for the altcoin since then.

At the time of writing, the cryptocurrency was able to find its way back to $0.46. However, there was still a huge wall of sales to face with a minimum price of $0.49.

Source: IntoTheBlock

In this zone, 550 addresses bought 20.47 million MATIC. If the price approaches this level, there is a good chance that investors will be willing to sell.

If this is the case, the value of the token could drop back to $0.43. However, should buying pressure increase, bulls could try to break this wall.

If successful, MATIC could retest $0.51 on the charts. For now, though, that’s an unlikely possibility.

Are the bears here to stay?

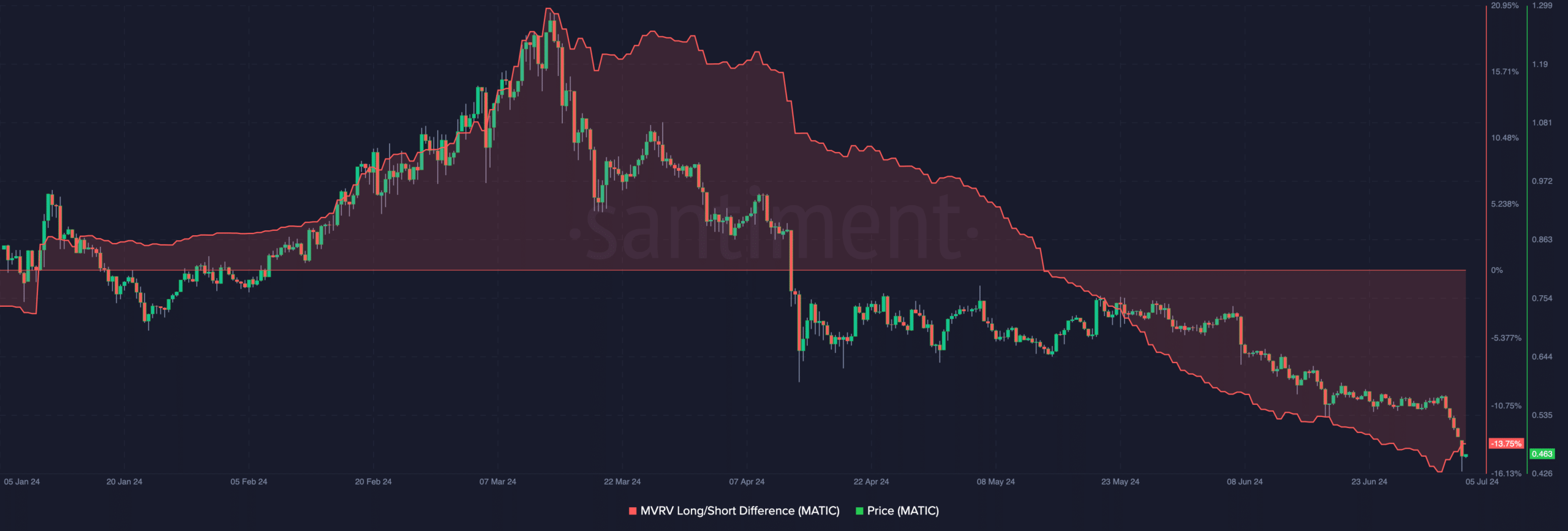

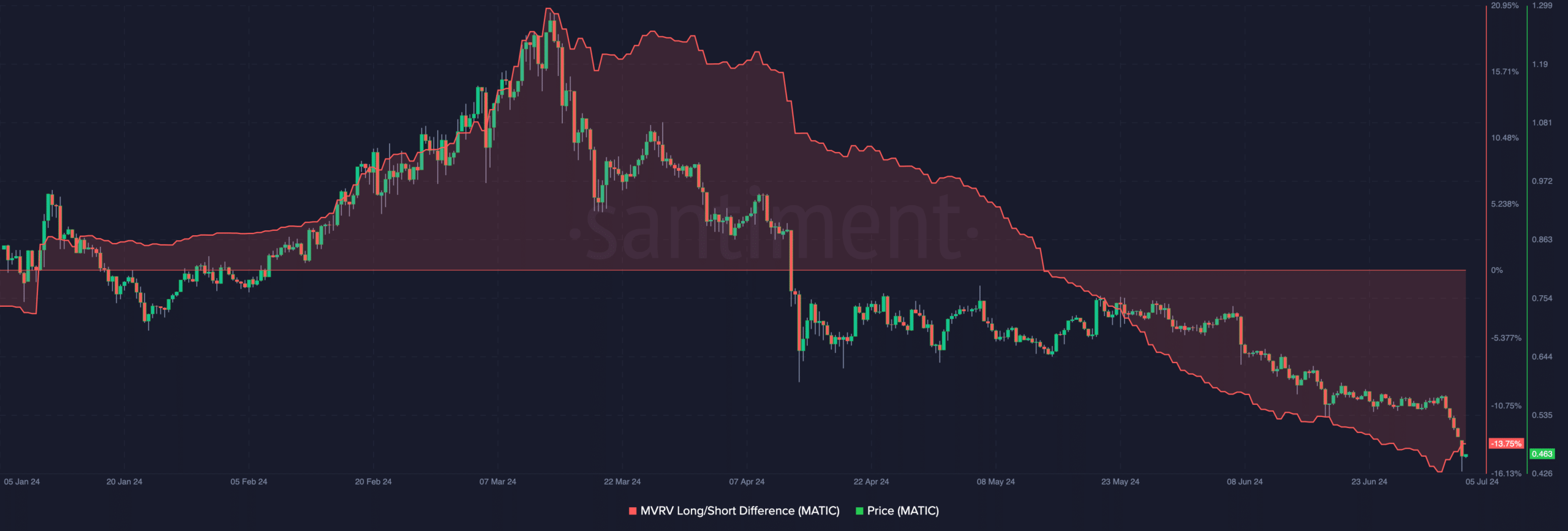

Furthermore, AMBCrypto evaluated whether MATIC had reverted to the bear phase or not. To do this, we checked the long/short difference between market value and realized value (MVRV).

This metric calculates the difference between the MVRV ratio of long-term holders and that of those who are newly collecting a token.

When the metric is positive, it means the token is in a bull phase. However, if the value is negative, it indicates a bear phase.

For the project the MVRV long/short difference was -13.75%, indicating that MATIC was caught in the clutches of the bears. To get out of the zone, the price must rise by 13%.

Source: Santiment

Read Polygon [MATIC] Price forecast 2024-2025

If this happens, the token may attempt to retest previous highs. However, if this is not achieved, the price may fall again.

This time it could drop to $0.40.