In a wire On Focusing on his extensive following, Deutscher elaborated on the impact of the rapid increase in the number of new crypto tokens, a problem he said is at the heart of altcoins’ underperformance in this cycle.

The spread of crypto

Since April 2024, the crypto landscape has witnessed the introduction of over 1 million new crypto tokens, a notable half of which are memecoins created primarily on the Solana network. According to Deutscher, the ease with which these tokens can be staked on-chain contributes to an inflated token count, but highlights a deeper problem of market saturation and dilution.

Deutscher explains: “We now have 5.7 times as many crypto tokens as we did during the 2021 peak boom. This is a key reason why crypto has struggled this year, despite Bitcoin reaching new all-time highs.” He likens the excessive issuance of new tokens to inflation, where “the more tokens launched, the more cumulative supply pressure on the market.”

Related reading

The analyst also sheds light on the dynamics of venture capital (VC) investing in the crypto space, noting that the largest quarter for VC funding peaked at $12 billion in the first quarter of 2022, just as the market started to turn bearish. Deutscher criticizes the timing and strategy of venture capital funds, suggesting that while their capital injection is essential for project development, it often leads to market imbalances.

“VCs, like private investors, are opportunists. Their investment timing is often focused on maximizing returns rather than supporting sustainable project growth, which contributes to cyclical highs and lows in the market,” explains Deutscher. He continues to discuss subsequent market impacts, where projects delay their launch under adverse conditions, only to flood the market when sentiment turns, further exacerbating dilution.

The constant introduction of new tokens not only puts pressure on market liquidity, but also erodes investor confidence, especially among retail investors. Deutscher points out: “The bias toward private markets is one of the biggest and most damaging problems in crypto, especially compared to other markets like stocks and real estate.”

Related reading

This environment creates a barrier to entry for new liquidity and leaves retail investors feeling sidelined, a sentiment exacerbated by high-profile bankruptcies such as LUNA and FTX. Deutscher argues: “If retail investors feel like they can’t win, they won’t play the game. That’s why memes have dominated this year – it’s the only meta where retail feels like they have a fighting chance.”

Looking ahead, Deutscher proposes several strategies to mitigate these problems. Exchanges could enforce better token distribution standards and prioritize larger community allocations. Additionally, adjusting the percentage of tokens unlocked at launch can manage selling pressure more effectively.

“Even if the insiders don’t force change, the market will eventually do so,” Deutscher said. He suggests that exchanges should adopt strict standards for listing new projects and be equally strict in delisting projects that do not meet current criteria, thereby maintaining market integrity and liquidity.

In his closing remarks, Miles Deutscher hopes that his insights will lead to a better understanding and reevaluation of current practices. “Diffusion isn’t the only problem, but it’s certainly a big one – and something that needs to be discussed more openly to promote a healthier crypto ecosystem.”

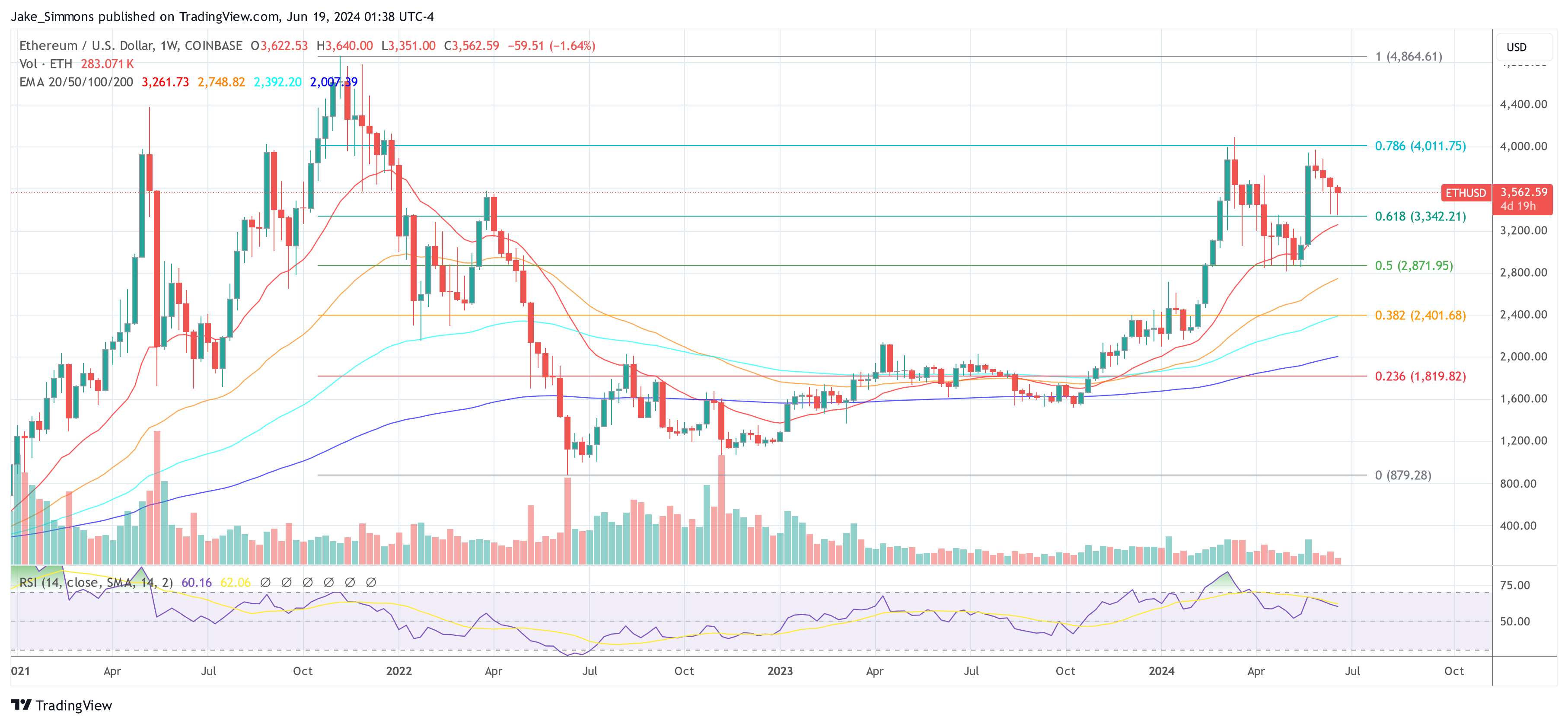

At the time of writing, Ethereum (ETH) was trading at $3,562.

Featured image from Shutterstock, chart from TradingView.com