- MicroStrategy plans to buy more BTC with a recent convertible bond offering.

- MSTRs remain an irresistible short-term bet against BTC.

On June 13, MicroStrategy [MSTR] announced a plan to add more Bitcoin [BTC] from the proceeds of its $500 million private offering of convertible notes. The senior notes, a kind of debt strategy, mature in 2032. Part of the update read,

“MicroStrategy intends to use the net proceeds from the sale of the notes to acquire additional bitcoin and for general corporate purposes.”

MicroStrategy is using debt to ramp up its Bitcoin strategy.

In April, the company secured another 122 BTC coins worth $7.8 million, bringing the total possessions up to 214,400 BTC worth over $14.5 billion based on current market prices.

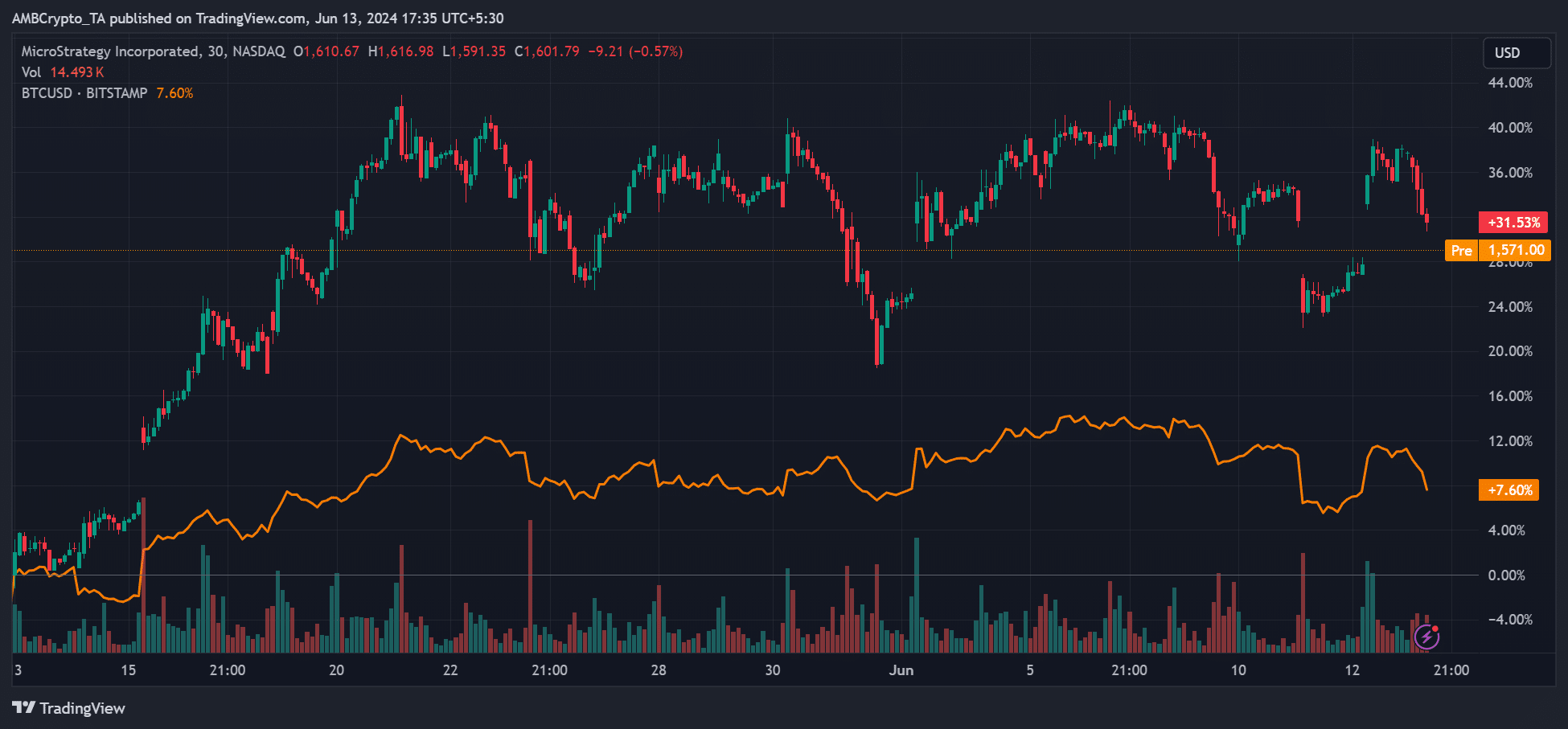

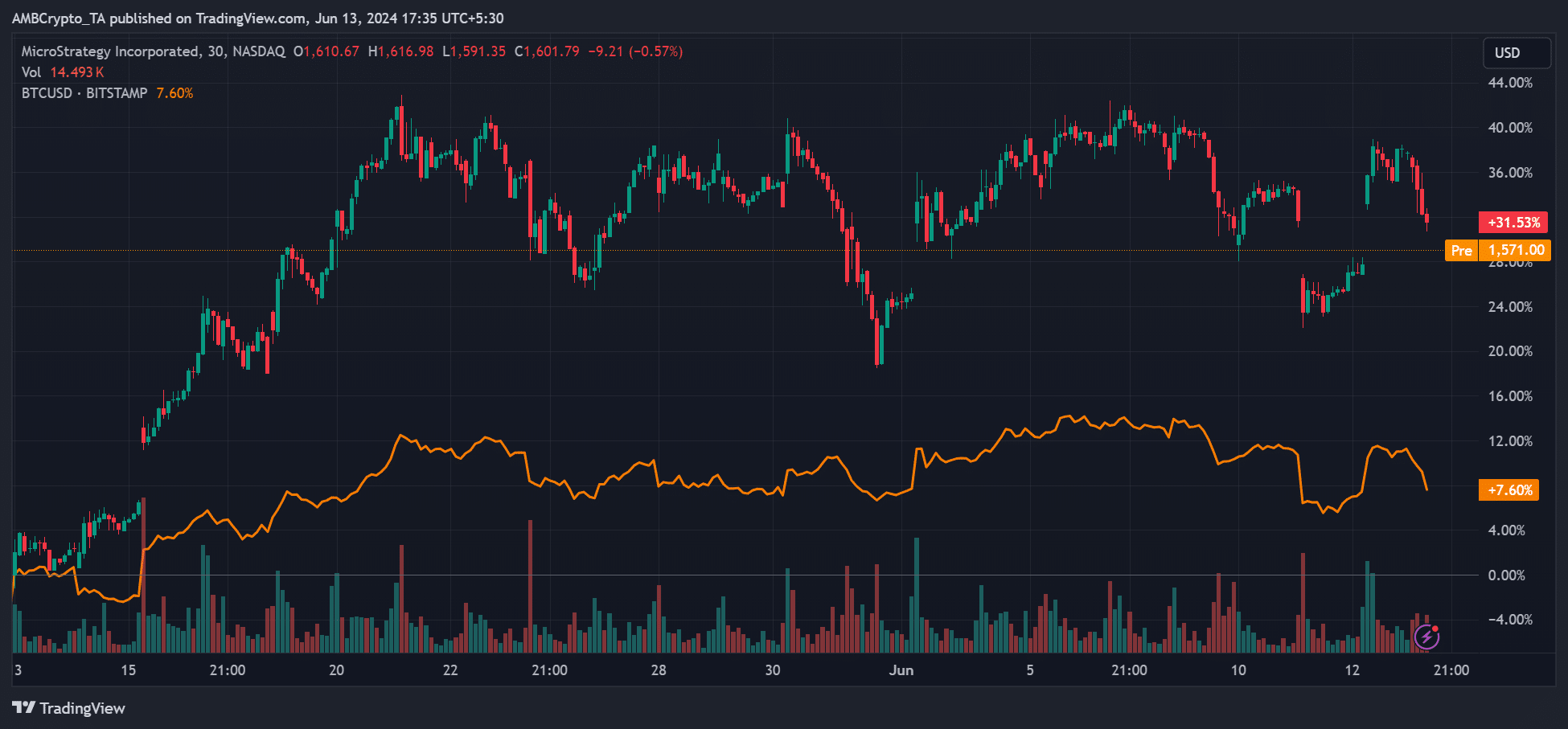

Despite other catalysts such as its addition to the MSCI Index and the upcoming inclusion of the Russell 1000 Index on June 28, MSTR stock has religiously followed BTC’s price action.

However, the stock has emerged as a better short-term strategy than BTC. It has outperformed the King Coin several times.

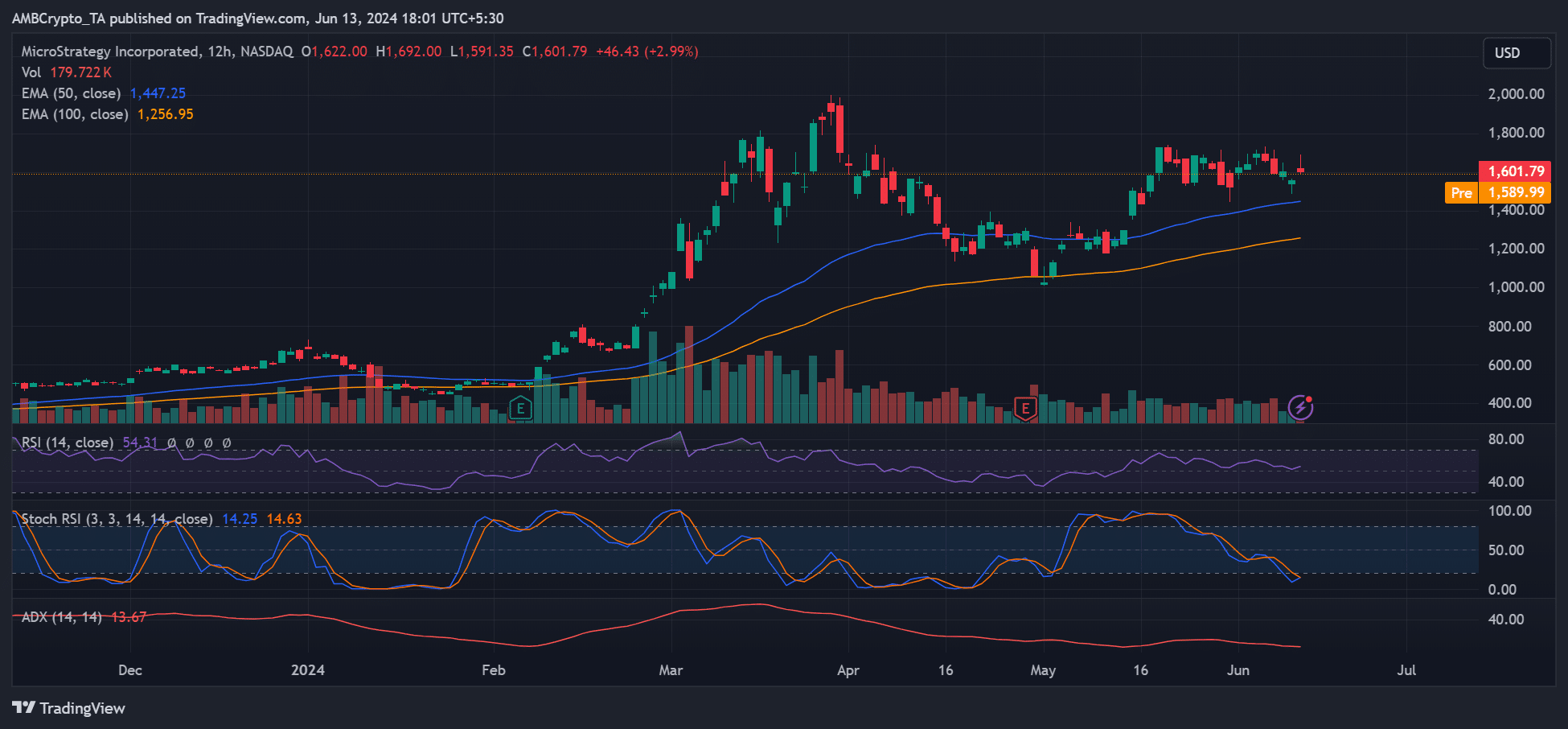

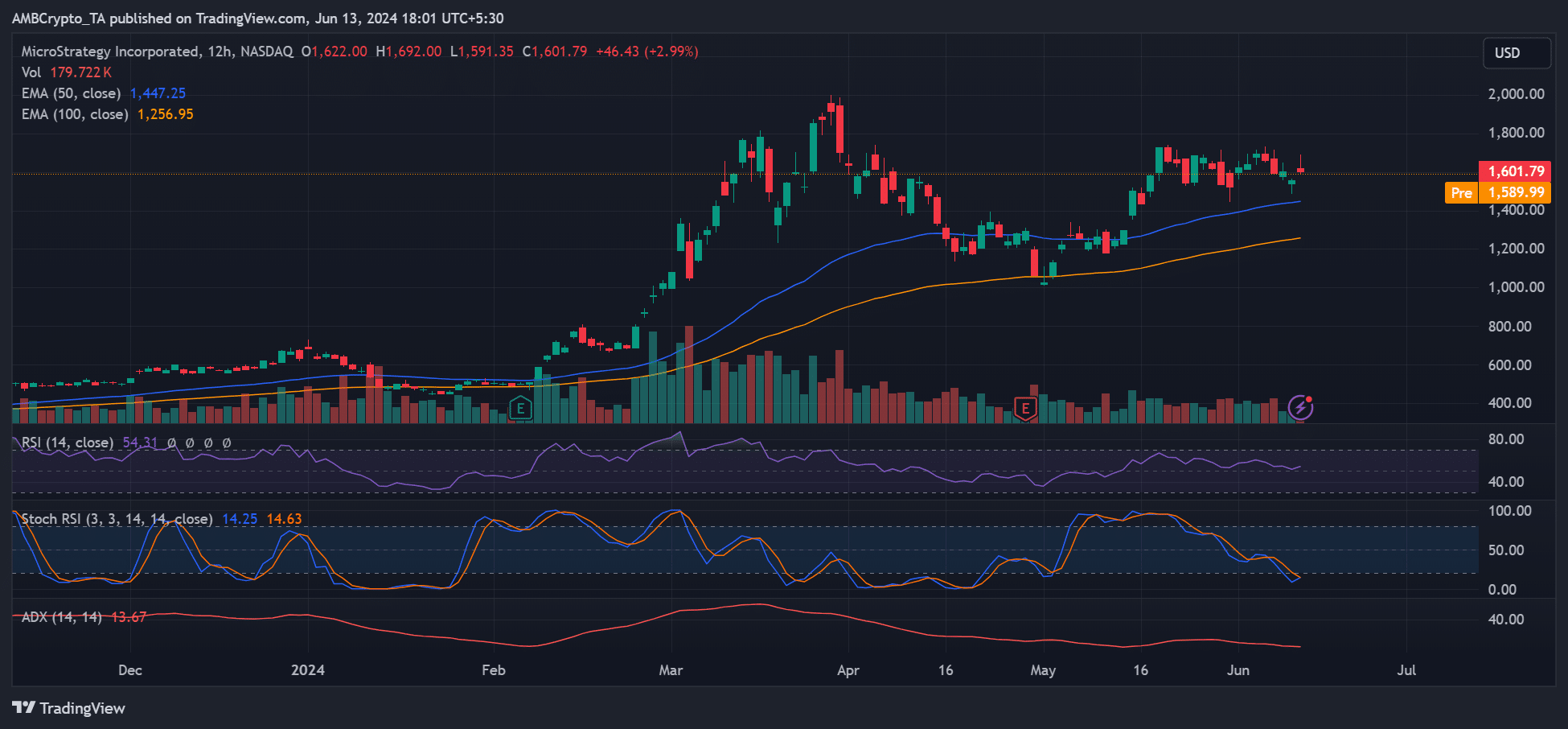

MicroStrategy stock price position

The MSTR market structure was still in a better position despite the current market decline following the Fed’s ‘hawkish’ rate decision.

Source: MSTR Stocks, TradingView

Notably, the price action was above the 100- and 50-day EMAs (Exponential Moving Averages). This showed that MSTR’s short- and long-term price trends had not yet weakened.

Furthermore, the RSI (Relative Strength Index) hovered above the mid-range, reinforcing the moderate but above-average buying pressure. But bulls might be tempted by the stochastic RSI, which flirted with oversold territory and could indicate that a potential bullish reversal was likely.

If so, MSTR could soon bounce off the 50-EMA and target $1800 or $2000.

However, if BTC posts more losses, the stock could be dragged towards the 100-EMA ($1256). The ADX (Average Directional Index) value below 20 indicated a lack of trend and called for caution among traders.

Despite the market disruption and general price consolidation over the past three months, MSTR still presented better returns than BTC.

At the time of writing, MSTR was offering +30% month-over-month gains, versus BTC’s +7% over the same period. This meant that MSTR offered almost 4x more returns than BTC.

Source: MSTR vs BTC Performance