- Hedge fund predicts Bitcoin miners’ shares will go to zero.

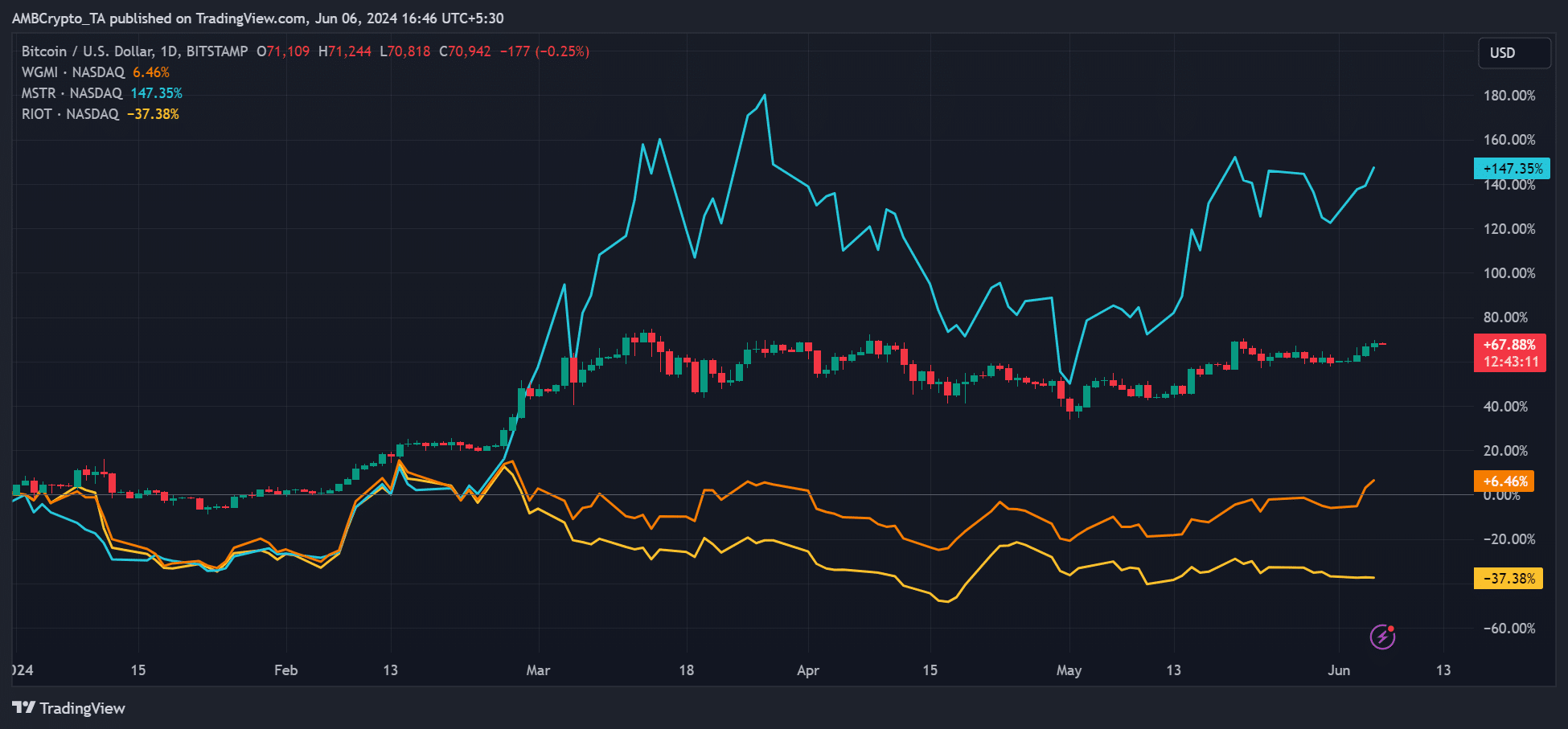

- BTC and MSTR have outperformed the overall BTC mining stocks on a YTD basis.

After shorting MicroStrategy’s MSTR shares in March, TradFi hedge fund Kerrisdale Capital is back with a new short strategy, this time focused on Bitcoin the RIOT share of miner Riot Platform.

So, what’s the deal with RIOT? Sahm Andrangi, the CIO of Kerrisdale Capital told Yahoo Finance that,

“Our investment thesis is that this sector will no longer exist in five years,”

On X (formerly Twitter), the hedge fund further slammed Riot, calling it a ‘dysfunctional hamster‘ and ill-equipped to deliver better rewards to shareholders.

“Like other US publicly traded miners, $RIOT’s biz model is a dysfunctional hamster wheel of cash burn, which is why it plunders private shareholders with non-stop ATM withdrawals to fund operations. Even with $BTC near record highs, $RIOT’s mining operations are unprofitable after the halving.”

Interestingly, Andrangi was against the entire Bitcoin mining sector, calling it the “dumbest business model” and predicting that it would “eventually go to zero.”

Bitcoin as a hedge against BTC miners

In such a bearish scenario, the hedge fund claimed that BTC would always outperform BTC mining stocks. So it would be used as a hedge against BTC miner stocks – long BTC, short BTC miners.

However, since Kerrisdale Capital’s last short strategy against MSTR in March, the stock has risen 37%.

This tipped some market observers to take a contrarian approach and ‘thanks‘ the fund calling BTC miner stocks ‘floor’ for the remainder of 2024.

Another X user outright wondered how imperfect was the fund’s strategy.

“This genius is shorting #Bitcoin miners and $MSTR heading into the biggest crypto bull market in history.”

However, the fund was right when BTC outperformed mining stocks. On a YTD (year-to-date) basis, MSTR was up 147% and BTC was up 67% at the time of writing.

However, RIOT fell 37%, while the overall BTC mining stock tracker, based on Valkryie Bitcoin Miner ETFs (WGMI), rose modestly by only 6% over the same period.

Source: Performance of BTC vs. BTC Miners, TradingView

That said, the WGMI is trending upward as BTC rises. But it remains to be seen whether the hedge fund’s ‘BTC miners going to zero’ projection will come true.