- Bitcoin’s price continued to fall in the hour immediately following the pivotal event.

- The gap between Bitcoin supply and demand is expected to widen further

After a long wait, Bitcoin finally completed its fourth halving in the early hours of April 20 GMT. As a result of the halving, mining rewards have now dropped from 6.25 BTC to 3.12 BTC. The event that happens once every four years, Bitcoin [BTC] underwent its halving when the 840,000th block was mined and added to Bitcoin’s blockchain.

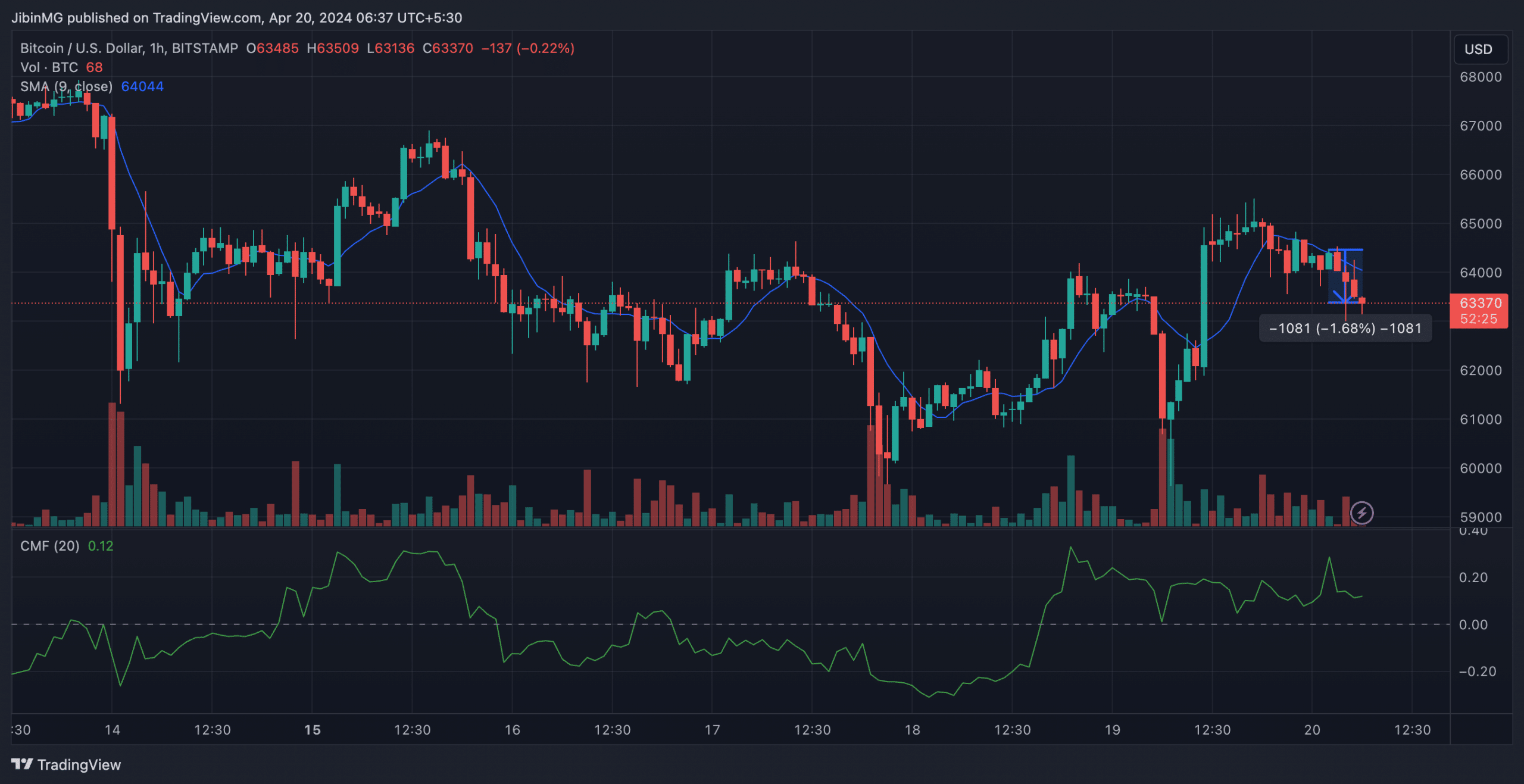

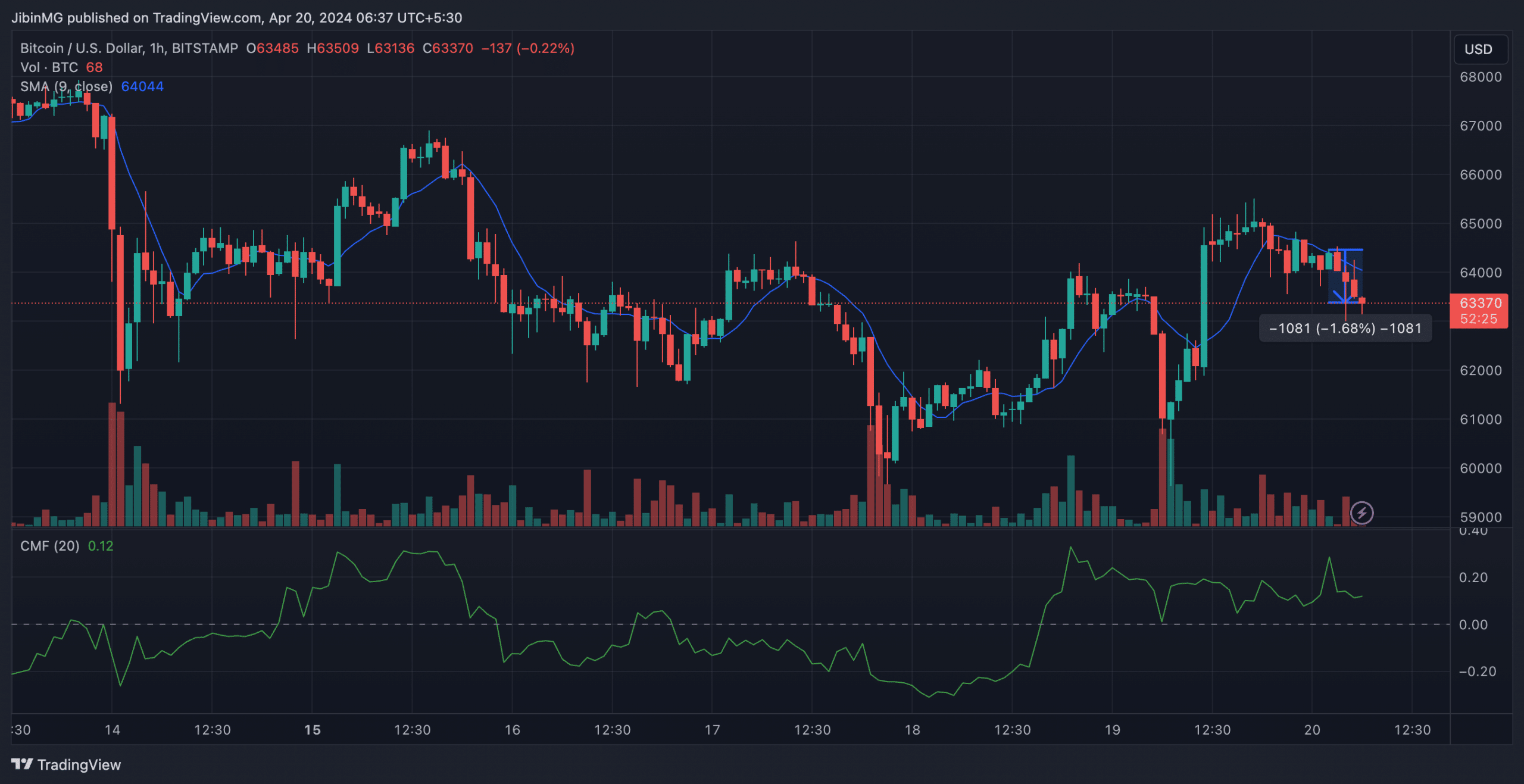

As expected, a lot of volatility has been the norm on Bitcoin price charts in recent weeks in light of the halving. At the time of writing, BTC was valued at $63,370, having fallen nearly 2% in the past six hours alone. Indicators pointed to bearish tendencies as the moving average was well above the price candles. On the other hand, the CMF was well above zero – a sign of positive capital inflows.

Source: BTC/USD, TradingView

Bitcoin is becoming scarcer

Bitcoin was seen as a deflationary currency. Simply put, the supply would gradually decrease with each halving until it reaches the hard limit of 21 million. Such a supply contraction, combined with growing demand, could boost its prospects as a store of value, similar to how gold is viewed in the mainstream.

Will the king’s coin gather?

Market participants view halving as a bullish event as the king coin has historically risen in value afterward.

The July 2016 halving was followed by a threefold increase in the value of BTC over the next twelve months. Similarly, the last halving in May 2020 saw the king coin explode by 500% the following year, according to AMBCrypto’s analysis.

Source: CoinMarketCap

A lot depends on the demand for ETFs

The latest halving is important because it takes place during what still appears to be a bull market phase.

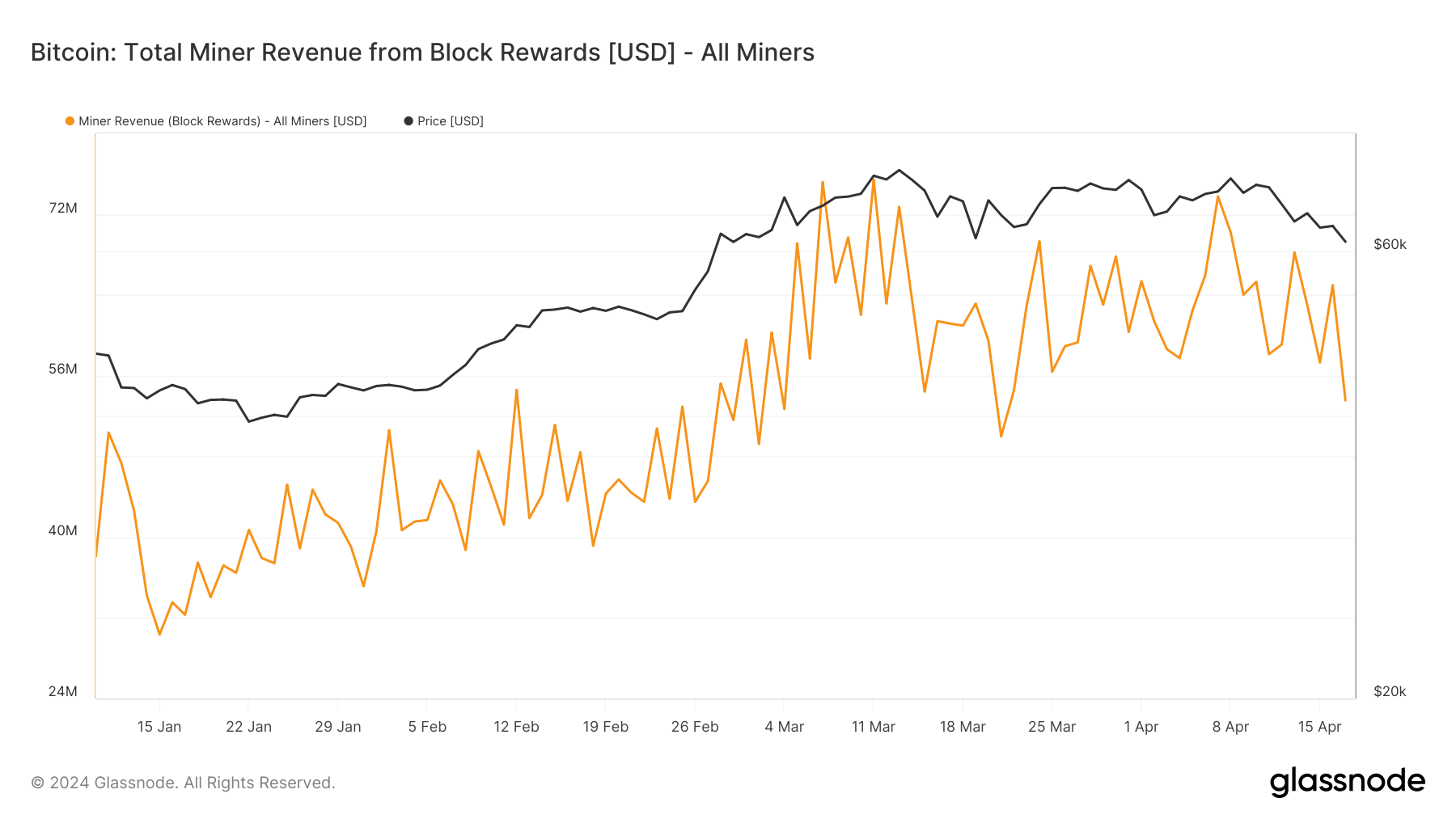

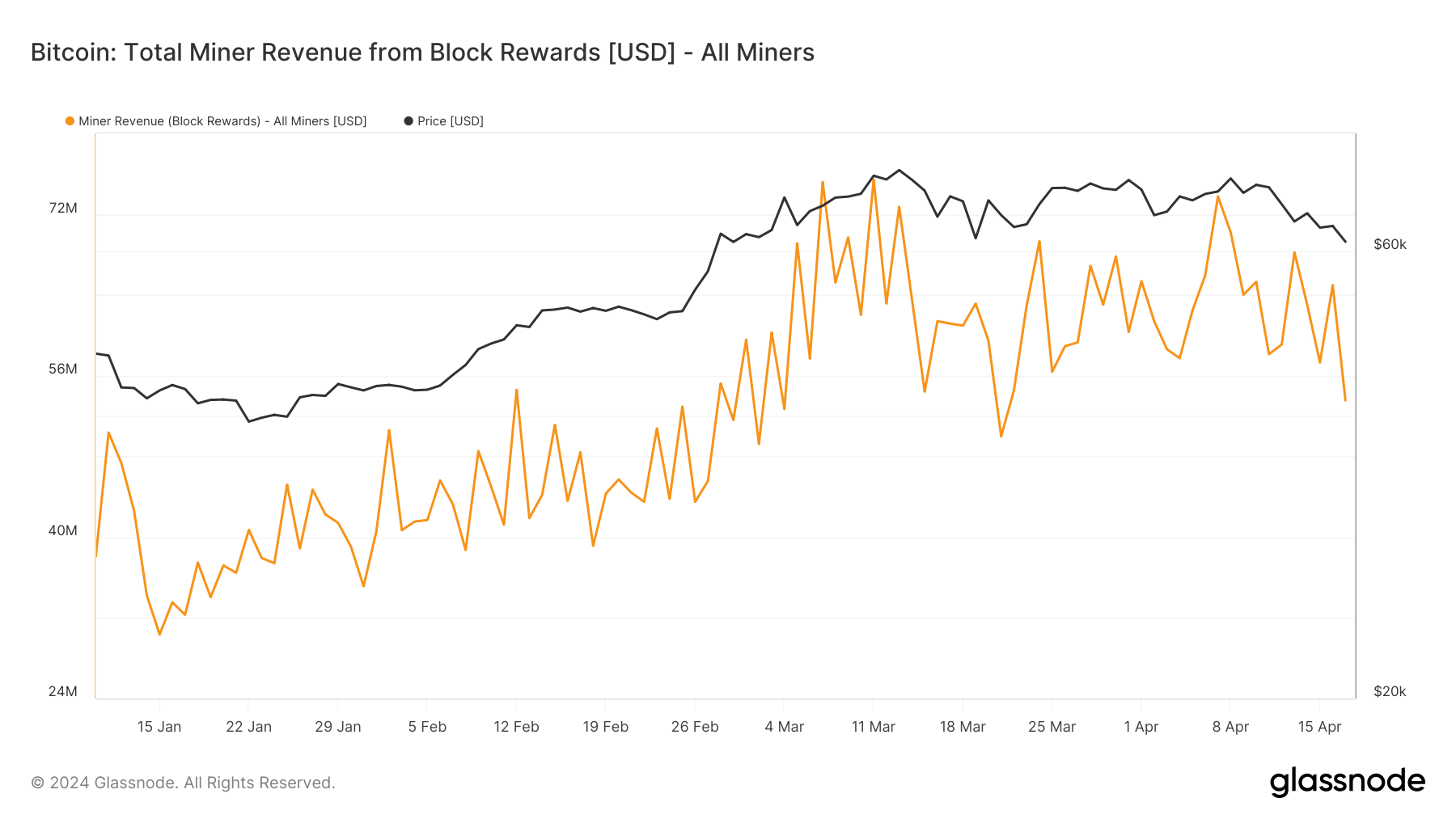

Demand for Bitcoins has soared following the listing of spot exchange-traded funds (ETFs) in the US earlier this year. The new investment opportunities have a Cumulative total net inflow of more than $12.23 billion since their listing. This means that an average of almost $120 million worth of Bitcoin flows into these funds every day.

Is your portfolio green? Check out the BTC profit calculator

On the other hand, the number of new Bitcoins mined daily averaged $50 million, AMBCrypto found based on Glassnode’s data.

At the time of writing, demand exceeded supply by a factor of more than twice. With supply set to drop further, the gap can be expected to widen further, causing Bitcoin to recover.

Source: Glassnode