- ETH’s selling pressure was stronger than buying pressure.

- Market sentiment shifted from neutral to greedy, indicating a potential increase in buying in the coming days.

Ethereum [ETH] continued to pull back over the weekend, falling to $2,407, according to this write-up CoinMarketCap.

The largest altcoin fell 2.64% in the past 24 hours, with weekly losses of more than 4%.

Assessing ETH’s next steps

Taking stock of developments, popular technical analyst Ali Martinez noted that ETH was in a crucial zone. The rebound from support at $2,388 could potentially push ETH higher.

That said, he also had a word of caution for market traders, noting:

“If ETH If we cannot maintain this level, we may see a pullback to the next major support area around $2,000.”

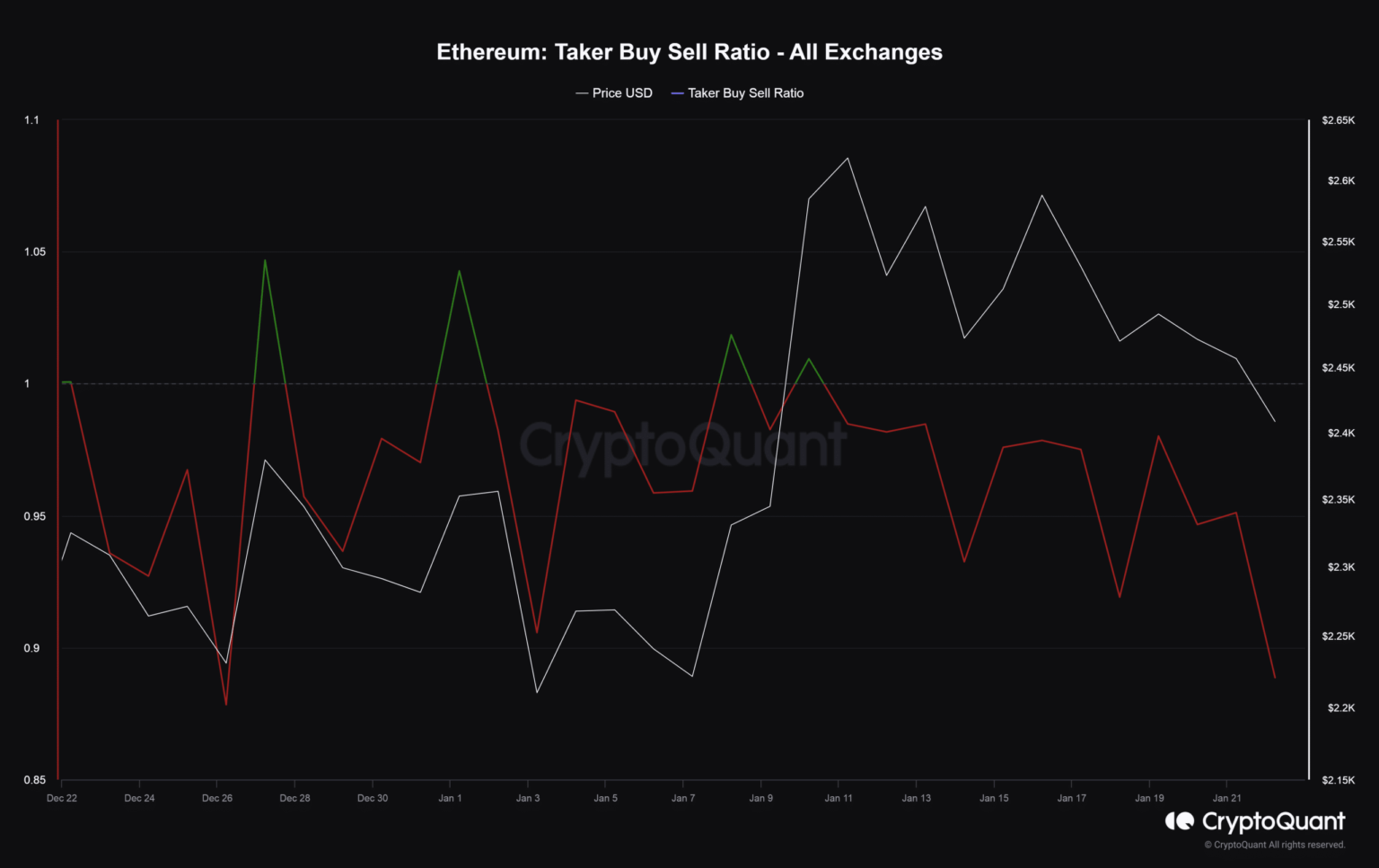

Well, the mood in the market wasn’t exactly bullish. According to AMBCrypto’s analysis of CryptoQuant data, the ratio of ETH buying volume to taker selling volume has been less than 1 over the past 10 days.

This meant that more sellers were willing to sell at a lower price, which in turn indicates that selling pressure was stronger than buying pressure at the time of writing.

Source: CryptoQuant

Whales become silent

Another notable aspect that attracted attention was the activity of whale investors. Using Santiment’s data, AMBCrypto has noticed a dramatic drop in the number of large ETH transactions over the past ten days.

Note how the increase in transactions in the period between January 7 and 10 caused a spike in the price of ETH, indicating that the whales were accumulating.

However, the ascent was halted when the whales retreated. Since then, ETH has been range-bound.

Source: Santiment

ETH reserves on exchanges have also fallen over the past week. This was a sign that whales were in a HODLing mood.

Derivatives traders are bearish on ETH, but…

A look at ETH’s derivatives market made it clear that bearish leveraged traders were dominant at the time of writing.

According to Coinglass, ETH’s Longs/Shorts ratio has been below 1 since January 12, implying that positions betting on price declines were larger than those betting on price increases.

Source: Coinglass

Read Ethereum’s [ETH] Price forecast 2023-24

Interestingly, market sentiment shifted from neutral to greedy, as shown by AMBCrypto’s examination of Hyblock data.

This could give way to an increase in ETH purchases in the coming days, bringing the price back to life.

Source: Hyblock Capital