- ETH funds recorded positive growth, confirming the return of institutional demand.

- Ethereum continued to experience net demand, delaying a potential retracement.

In recent weeks we have seen confidence in Ethereum return [ETH], just as has been the case with many top cryptocurrencies. This confidence boost has led to a certain FOMO situation and, more importantly, the return of institutional demand.

Is your portfolio green? Check out the ETH profit calculator

ETH funds offer investors the opportunity to gain exposure to the cryptocurrency. Such private funds are attractive to institutions and therefore often emphasize what the institutional class of investors is doing.

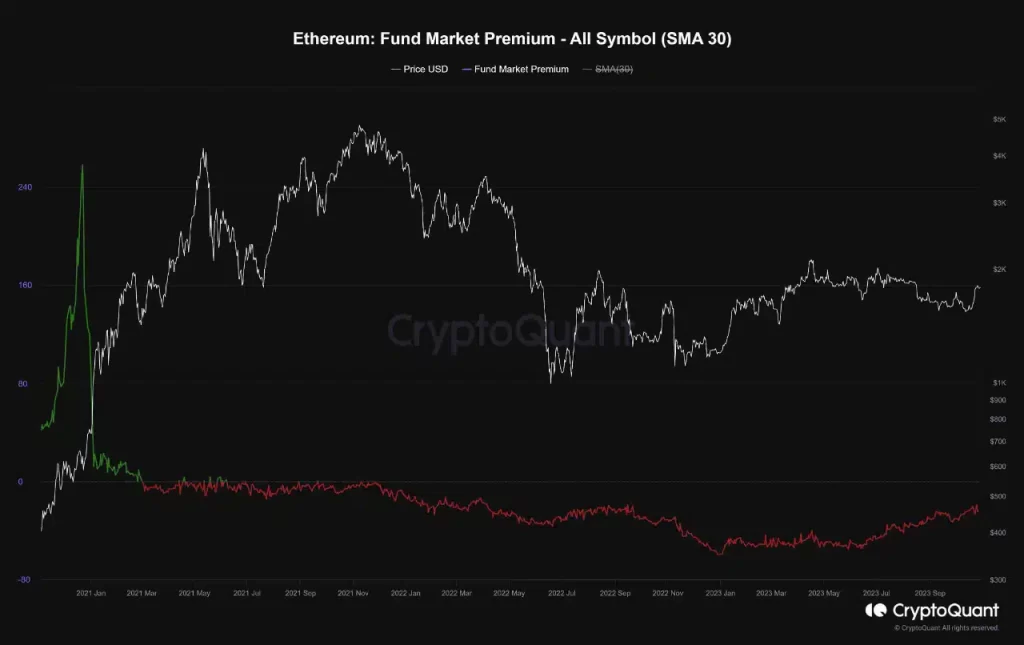

A recent one CryptoQuant Analysis confirmed that ETH funds were on an upward trajectory at the time of writing, as indicated by the Fund Market Premium. The analysis showed that ETH funds have been recovering since January 2023 and have followed the same trajectory to date.

This was an important observation as it confirmed a recovery in demand for ETH.

Source: CryptoQuant

The same analysis noted that an upward trend in Ethereum funds would narrow the gap between the market value of Ethereum contracts and the market price. This upward trajectory was in line with growing confidence in the cryptocurrency in the derivatives market.

It reflected the positive growth seen in ETH funding rates over the past two months.

Source: CryptoQuant

The past few days have been particularly fruitful for ETH’s Open Interest Profile, based on a 30-day assessment. We also looked at the buy and sell profile and found that the sell positions have declined in recent days.

The number of sales peaked in the last two weeks of October at more than 105,000. On the other hand, purchases peaked at just above 57,000.

Source: Hyblock

ETH is struggling to regain control

You might expect a pullback for ETH in the coming days, given that ETH was recently overbought after a robust rally. However, the bears are struggling to keep the price under control.

One possible reason could be that many ETH holders are choosing to HODL instead of taking short-term profits. Notably, analysis of currency flows showed that prevailing demand at press time was higher than selling pressure.

Source: CryptoQuant

Read Ethereum’s [ETH] Price forecast 2023-24

It is also worth noting that ETH exchanges have cooled down significantly compared to the previously observed mid-month surge. ETH was exchanging hands at $1,785 at the time of writing.

Although the bulls showed resilience and demand prevails, traders should still be cautious as the market could still look for a correction.