- BTC has reclaimed the $27,000 price following the court ruling in the Grayscale v. SEC case.

- Prior to the news, some BTC whales had accumulated significant volume of the main coin.

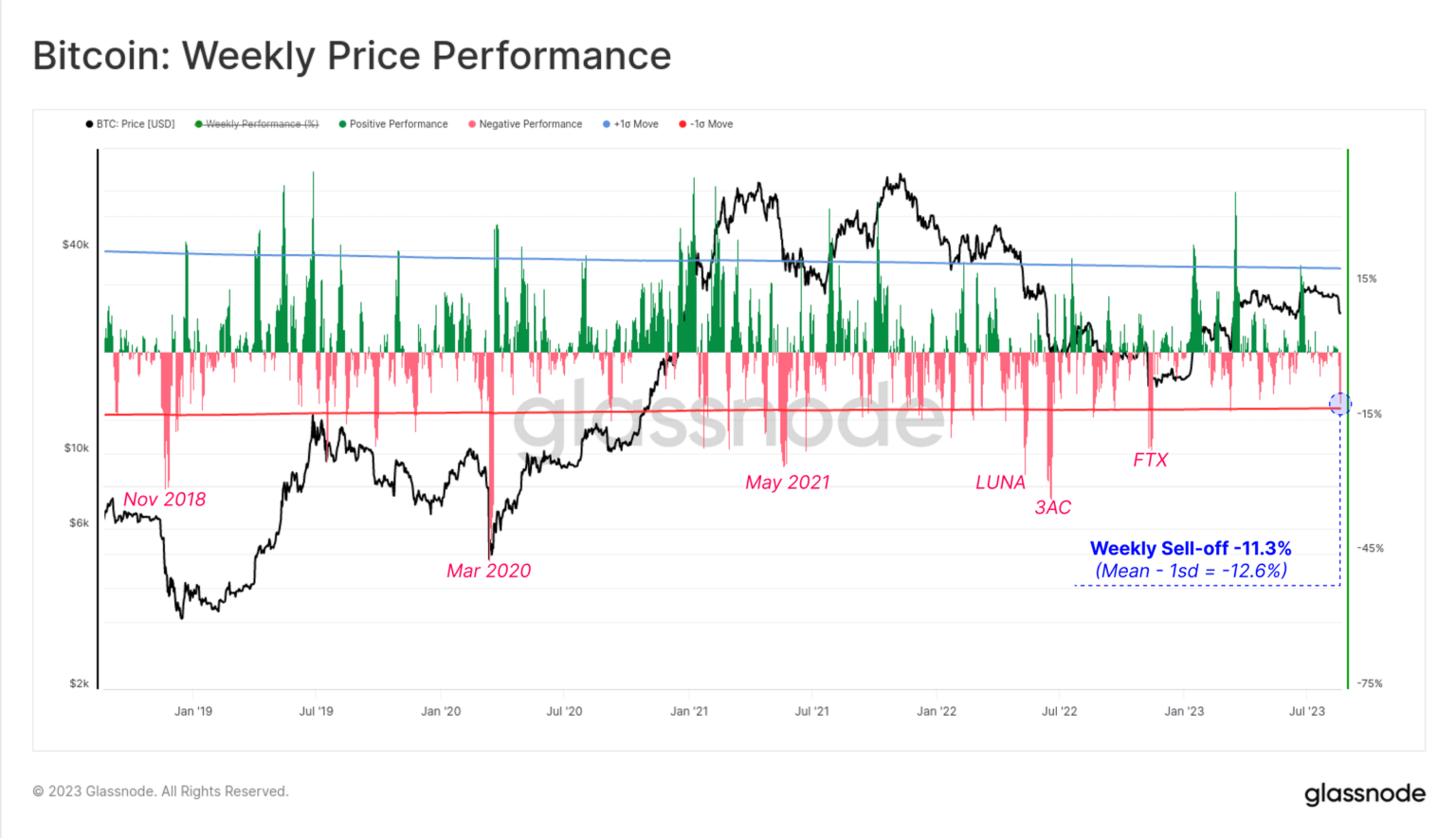

On August 17: unexpected violent sell-off of Bitcoin [BTC] market sent the price of the king coin below $25,000 for the first time since June 20. This deleveraging event resulted in the removal of $2.5 billion in open interest from the futures markets within hours.

Source: Glassnode

Read Bitcoin’s [BTC] Price forecast 2023-2024

As sentiment deteriorated, the price of BTC stagnated in the days that followed at $26,000. On the daily chart, key momentum indicators fell to a two-year low, suggesting that coin accumulation has slowed significantly.

However, during the intraday trading session on August 29, the BTC price surged above $27,000, regaining its pre-August 17 price point. This price increase was due to increased network activity following Grayscale’s victory over the Securities and Exchange Commission [SEC].

BREAKING: There it is, @Grayscale wins their lawsuit against the SEC. DC Circuit Court of Appeals strikes SEC’s denial $GBTC‘s conversion to an ETF. pic.twitter.com/gqFvMpmfnm

— James Seyffart (@JSeyff) August 29, 2023

A trip down memory lane

In October 2021, Grayscale Investments, the world’s largest digital currency asset manager, archived with the SEC to convert Grayscale Bitcoin Trust (GBTC) into a Bitcoin spot ETF. The company decided to do so after the regulator gave the green light to similar filings from ProShares, Valkyrie, and VanEck in the same year.

In June 2022, the SEC refused Grayscale’s request, alleging that the company’s application did not meet anti-fraud requirements or investor protection standards.

On the same day, Grayscale archived an appeal to the Federal Court of Appeals for the District of Columbia, seeking a review of the agency’s decision. In an opening letter filed in October 2022, the digital currency asset manager argued that by denying its own application, the SEC had acted “arbitrarily and erratically.”

This was because it had previously approved “materially similar” Bitcoin futures ETFs, applications filed by Teucrium And Valkyrie.

We filed the opening letter in our lawsuit against the SEC, contesting their decision to deny our conversion application $GBTC to a spot Bitcoin ETF.

A “short” thread:

— Grayscale (@Grayscale) October 12, 2022

In December of the same year, the SEC filed its 73-page defendant’s letter. The regulator argued that the ETF applications it approved contained only futures contracts traded on the Chicago Mercantile Exchange (CME).

Grayscale has not provided any arguments in its petition to support the fact that the CME’s oversight of futures trading:

“Sufficiently detect and deter fraud and manipulation targeting the Bitcoin spot market.”

Grayscale responded immediately answer briefly on January 13, 2023, in which it doubled down on its stance that the agency failed to justify its different treatment of Bitcoin futures and spot Bitcoin ETFs. The company added that its denial order was discriminatory and harmful to investors.

The short argued:

“There is a 99.9% correlation between prices in the Bitcoin futures market and the spot Bitcoin market.”

Grayscale also argued that the SEC had exceeded its regulatory powers:

“The Commission is not allowed to decide for investors whether certain investments have value – and yet the Commission has done just that, to the detriment of the investors and potential investors it is supposed to protect.”

How much is 1.10.100 BTC worth today?

Victory at last for Grayscale?

In a pronunciation Out on August 29, the DC Circuit Court of Appeals agreed with Grayscale and asked the SEC to review its decision.

At court opinion, filed by D.C. Court of Appeals Judge Neomi Rao, stated:

“The Commission’s inexplicable discounting of the obvious financial and mathematical relationship between the spot and futures markets falls short of the standard for reasoned decision-making.”

Bitcoin holders are the biggest winners

After news of the court ruling broke, BTC’s social activity boomed. According to Santiment, the coin’s social volume immediately surged by 7% as discussion around the leading cryptocurrency soared.

📊 After the news of #Grayscale‘s victory over the #SEC quickly lifted #crypto markets, has turned out to be the biggest notable beneficiary #BitcoinCash, due to the increased exposure. This phenomenon was similar to what we saw in mid-June when the #ETF news came first pic.twitter.com/HzEEEqZqIt

— Santiment (@santimentfeed) August 29, 2023

A corresponding rise often follows the growth of an asset’s social activity in its price. This has been the case for BTC. The value of the coin, which stood at $27,488 at the time of writing, is up 6% in the past 24 hours.

On-chain data provider Santiment also stated that BTC whales may have been aware of the court’s decision before it was made public. As far as, BTC whale wallets showed that addresses with between 10 and 10,000 BTCs had been cumulatively buying coins worth $388.3 million per day before the news went public.

🐳 Whales and sharks may have known a thing or two about the outcome of the #Grayscale And #SEC lawsuit, with 10-10K $BTC wallets that together bring in an amount of $388.3 million $BTC the day before the news. They were richly rewarded with a price increase of +6%. https://t.co/j28CwVYKS6 pic.twitter.com/cx5rRuS6IV

— Santiment (@santimentfeed) August 30, 2023

When the news broke and the price of BTC rose, these investors quickly posted their profits.