- Blur’s weekly average trading price has remained higher than Opensea’s since launch.

- The token fell over 31% last month and the stats were bearish.

Since its launch Fade [BLUR] has become extremely popular in the NFT space, even outperforming market leader Opensea on a number of fronts. While the market’s performance continued to be relatively good, the original token had little to write home about.

Read Fade [BLUR] Price Prediction 2023-24

Blur before Opensea

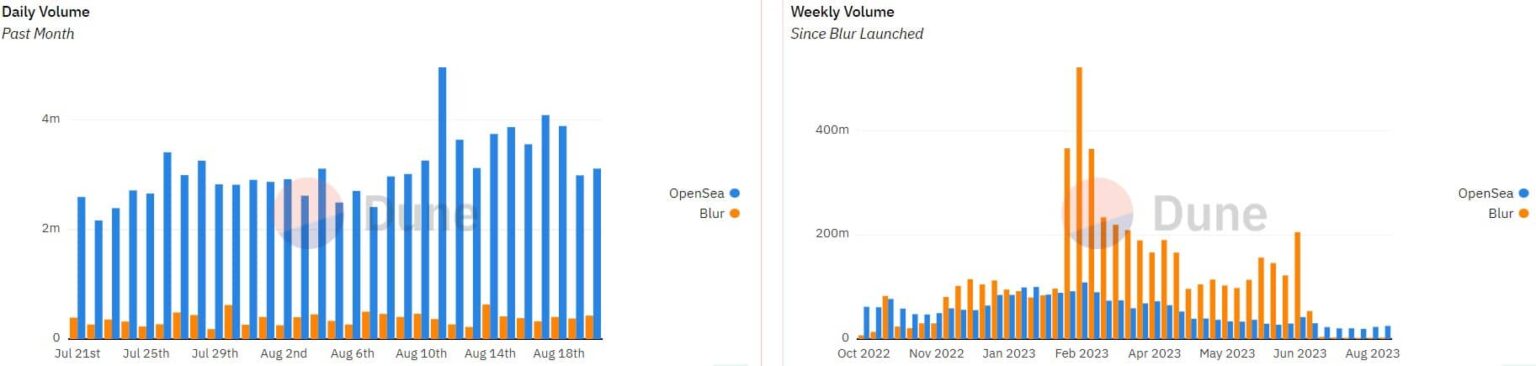

A check of the statistics of both NFT marketplaces showed that Blur outperformed Opensea on several fronts. Notably, Blur witnessed a surge in weekly volume when it surpassed Opensea by a huge margin in February 2023.

However, Opensea’s daily volume remained higher over the past month.

Source: Dune

A similar trend was also noted on the chart, highlighting the weekly average transaction prices of both marketplaces, where Blur surpassed Opensea. But things took a turn over the past month as Opensea’s chart remained closely tied to Blur.

Source: Dune

Blur has great growth potential

While the market’s performance has been remarkable, the stats have recorded a drop in recent months alongside the price of the original token. However, an NFT researcher at Delphi Digital mentioned a few potential new business lines that Blur could explore that could benefit both the market and the token.

Of $ fade‘s token is down about 96% from its all-time high (ATH), one might wonder if there’s still hope. However, let’s take a quick look at some potential new lines of business that Blur could explore and analyze what BLUR holders are currently doing in the chain. One 🧵

/15 pic.twitter.com/s3ClgBNh8u

— yh.ΞTH🦇🔊 | Delphi Digital (@yh_0x) August 25, 2023

According to the tweet, Blur could be investigating NFT derivatives. NFT offenders could provide flexibility and hedging to NFT traders, just like the token markets. Another possible direction was the NFT Trading Bot.

FadeThe market bot could direct users to its marketplace aggregator, reducing barriers to entry and encouraging more frequent trading, increasing overall trading volume.

The tweet also mentioned that Blur’s market leadership positions it as an attractive launch pad for NFT projects. The marketplace can differentiate itself from competitors by generating revenue from maker fees or mints.

The original token bleeds

Not only did the market stats register a decline, but BLUR’s performance on the price front was also concerning. The token fell about 96% from its all-time high (ATH).

Over the past month, the token is down more than 31%, and at the time of writing, it was trade at $0.2041 with a market cap of $178 million. A look at the token’s current stats yielded a bearish idea.

How many Worth 1,10,100 BLURs today?

For example, the trading volume fell, which means that investors are not willing to trade the token. The token’s inflows spiked, indicating it was under selling pressure.

On top of that, Fade will too unlock more than 2 million tokens in February next year, which could further lead to a price drop. Interestingly, the top 100 wallets have not traded the token in the past month, reflecting the whales’ confidence in BLUR.

Source: Sentiment