Bitcoin price saw a resurgence yesterday, reaching a high of USD 26,843, up 3.7% after the recent USD 29,000 crash. The reasons behind this increase are many.

Why has Bitcoin soared?

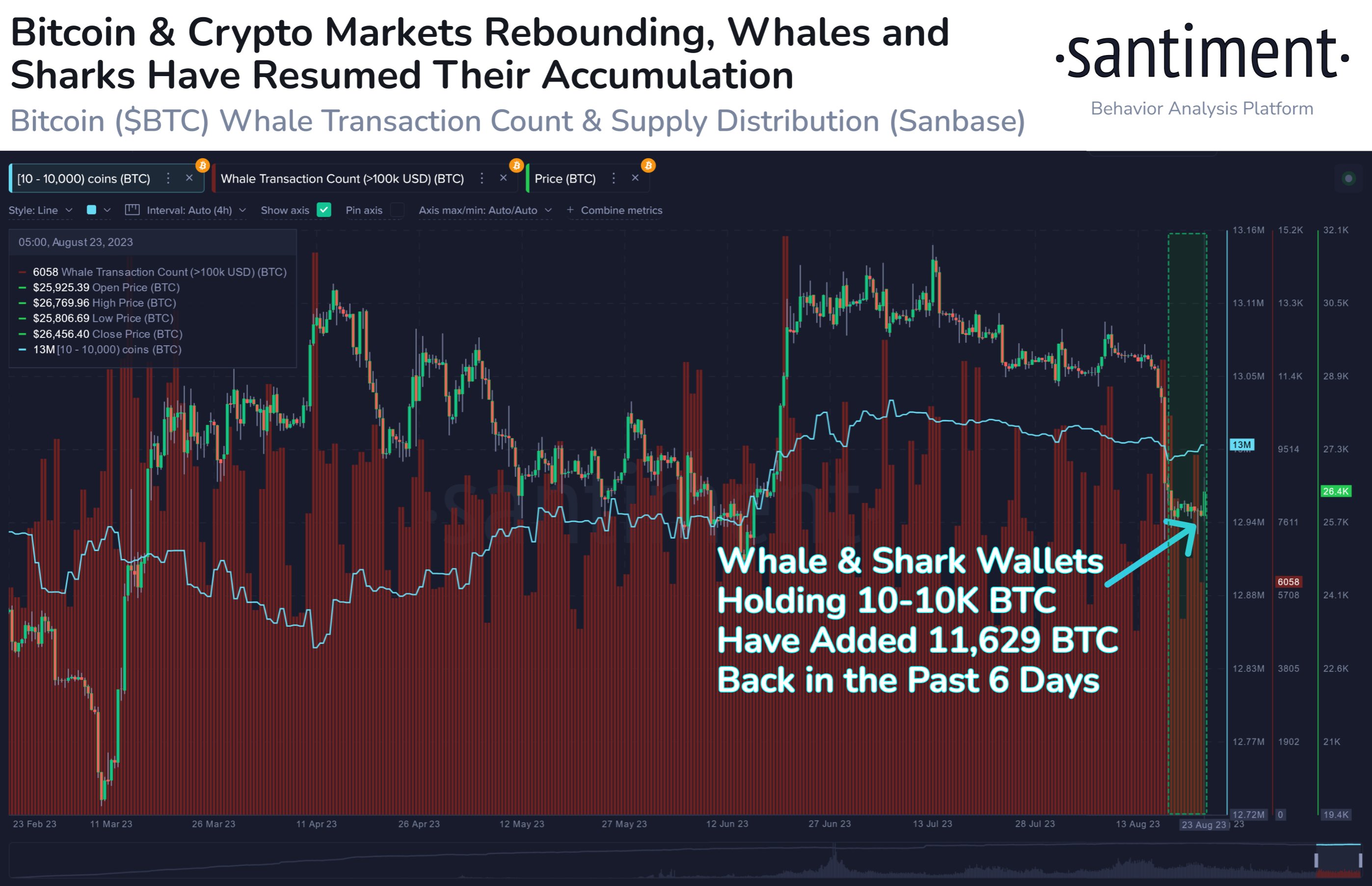

Major Bitcoin holders, often referred to as whales and sharks, have been actively increasing their holdings, according to on-chain analytics company Santiment. Currently, there are 156,660 wallets holding between 10 and 10,000 BTC, with a combined accumulation of $308.6 million since August 17. Whale and shark wallets added 11,629 BTC in the past six days.

Michaël van de Poppe, a renowned crypto analyst, drew attention to the strength of Silver & Gold, especially after yesterday’s disappointing PMI rates. He believes that as returns appear to be peaking, Bitcoin could follow the trajectory of these commodities.

Recent economic indicators from the US private sector provide further context. The S&P Global Composite PMI for early August showed a decline, falling from 52 in July to 50.4. Both the Manufacturing and Services PMI indices also registered declines from 49 to 47 and 52.4 to 51, respectively.

Moreover, the Bitcoin futures market certainly played some role in yesterday’s Bitcoin price movement. Yesterday, $28.06 million in short positions were liquidated in this market. After all, this is the third largest August amount to date, surpassed only by August 17 ($120 million) and August 8 ($37 million).

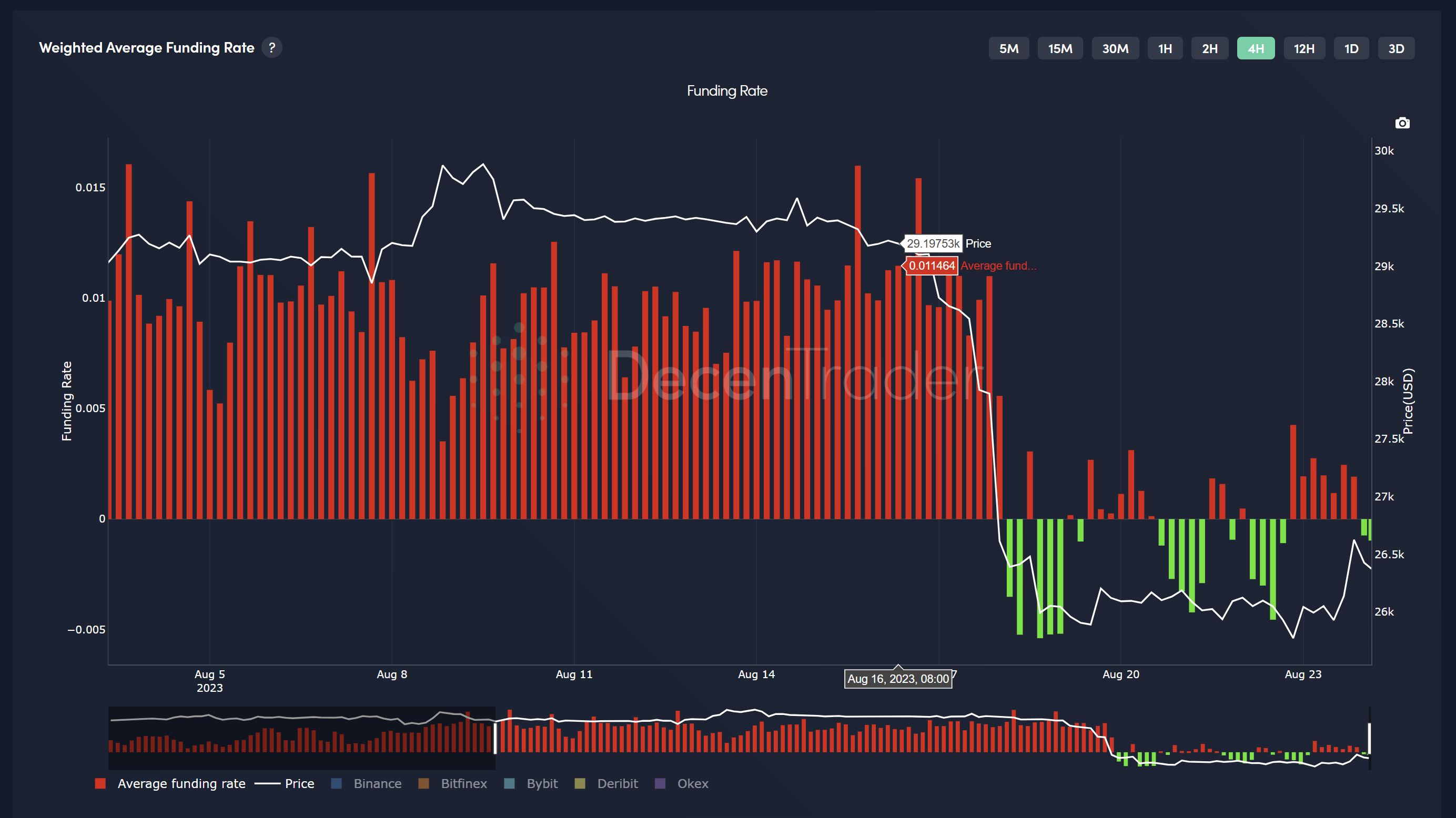

Market intelligence platform Decentrader highlighted the prevailing market sentiment, noting that despite Bitcoin’s price increase, there is still a sense of uncertainty and fear. This sentiment is further underlined by the continued negative fall in the average financing rate. While this means that sentiment is still bad, it opens the possibility for more short squeezes as traders go short.

The Dollar Index (DXY) and its inverse relationship to Bitcoin also played a role. DXY was rejected just below 104 yesterday and fell back to 103.5. The SPX showed a nice rally, with the USD dropping to 103.96.

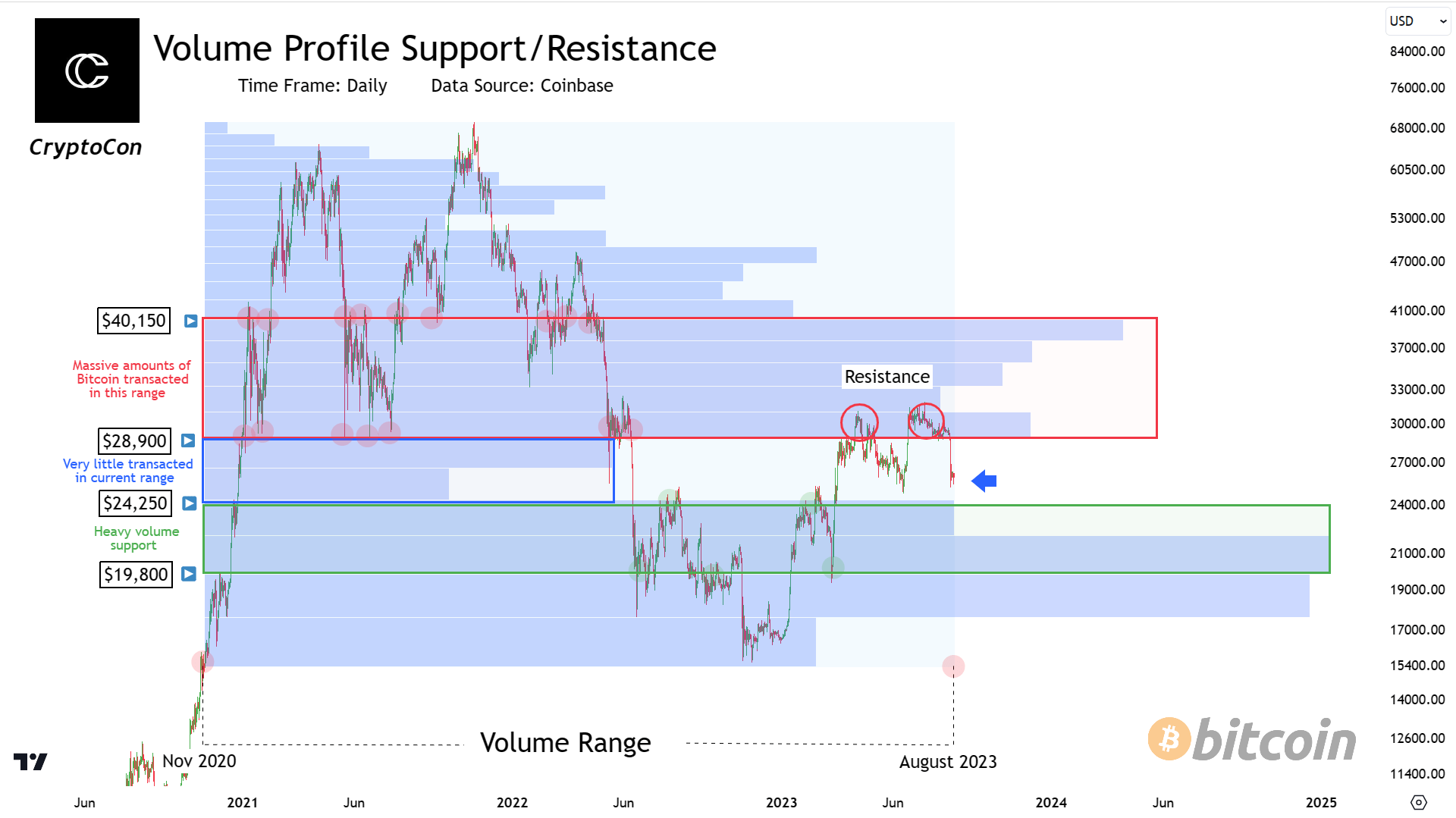

CryptoCon’s volume analysis provides a broader perspective on Bitcoin’s price movement. Since November 2020, the volume of Bitcoin traded reveals why the price stopped at its current position. The volume above $28,900 acts as a major barrier. However, the current 24,000 to 29,000 range for Bitcoin is relatively unknown, suggesting that Bitcoin is looking for new support and preparing for a possible move into the next resistance zone.

What’s next for BTC?

The upcoming Jackson Hole Economic Symposium tomorrow, Friday, where the Federal Reserve will discuss its future strategies, is a pivotal event on the horizon. Keith Alan of Material Indicators recalled the impact of last year’s symposium on Bitcoin, highlighting, “Remember when FED Chairman Powell spoke from Jackson Hole last year and his aggressive tone caused a 29% BTC dump?”

While there are parallels in Bitcoin’s price action leading up to this year’s event, it’s critical to note that market reactions can be unpredictable and depend on several factors. With the Bitcoin market ready for tomorrow’s events, there is a mood of expectation mixed with caution.

At the time of writing, BTC was trading at $26,464.

Featured image from iStock, chart from TradingView.com