- The growing roster of Optimism’s OP stack can provide a consistent revenue stream for the protocol

- Despite rising revenues, the OP token did not see the green

Over the past year, the Layer 2 landscape has seen a notable increase in competition. At the start of 2023, Arbitrum was at the forefront of the industry, leading many to doubt Optimism’s prospects [OP]’s future success. As Arbitrum’s dominance became apparent, skepticism arose about Optimism’s potential.

Is your wallet green? Check out the Optimism Profit Calculator

OP Stack can have a positive impact

However, Optimism’s OP stack may give the protocol a competitive edge in this industry. In fact, recently facts revealed an impressive list of projects and ventures, including notable names like Coinbase, Binance, Debank, Celo, and Worldcoin, that are actively building their own Layer 2 solutions using Optimism’s OP Stack.

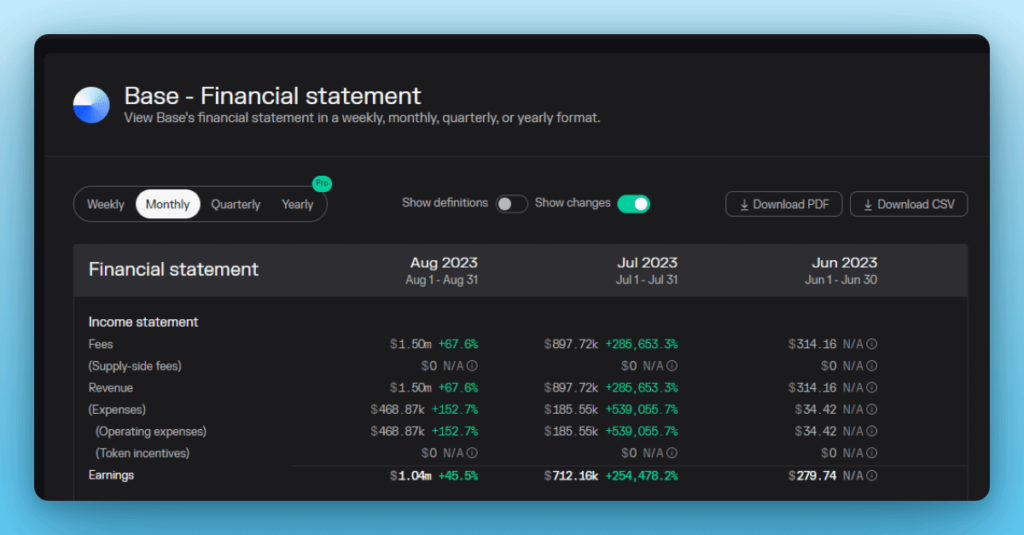

Coinbase’s Base Network has already generated an impressive $1.5 million in revenue within the month. Extrapolating this figure, assuming revenue remains constant, results in an estimated annualized revenue of approximately $45 million, according to data from The Defi Investor.

A significant portion of this revenue, specifically 10% of base revenue, would contribute to Optimism’s coffers, amounting to a substantial $4.5 million. With the potential for Base to continue its growth trajectory, this amount could potentially exceed $20 million during the coming bullish market cycle.

Source: token terminal

This projection represents a remarkable revenue stream of $20 million exclusively attributed to Optimism, courtesy of Base.

In addition, it is important to note that any additional Layer 2 entity that integrates Optimism’s Superchain will also allocate a portion of its revenue to the OP Treasury. This illustrates the wider financial benefits Optimism can achieve as the ecosystem expands and diversifies.

Additionally, according to data from Token Terminal, the cumulative revenue generated by Optimism was $4.8 million. Despite a 1.8% drop in daily active users, the protocol continued to grow in terms of revenue.

Source: token terminal

What about the OP token?

However, OP did not see the same level of growth. Over the past few days, the price of the OP token has dropped significantly, with the same trading at $1,524 at the time of writing. The drop in price was accompanied by declining network growth, implying that new addresses are starting to lose interest in the token.

Realistic or not, here is OP’s market cap in terms of BTC

The lack of interest from new addresses could be one of the reasons behind OP’s recent price correction.

Source: Sentiment