- The average Bitcoin mining network efficiency has improved thanks to advances in mining equipment.

- The share of renewable and cleaner sources, such as hydro, solar and wind, has increased significantly.

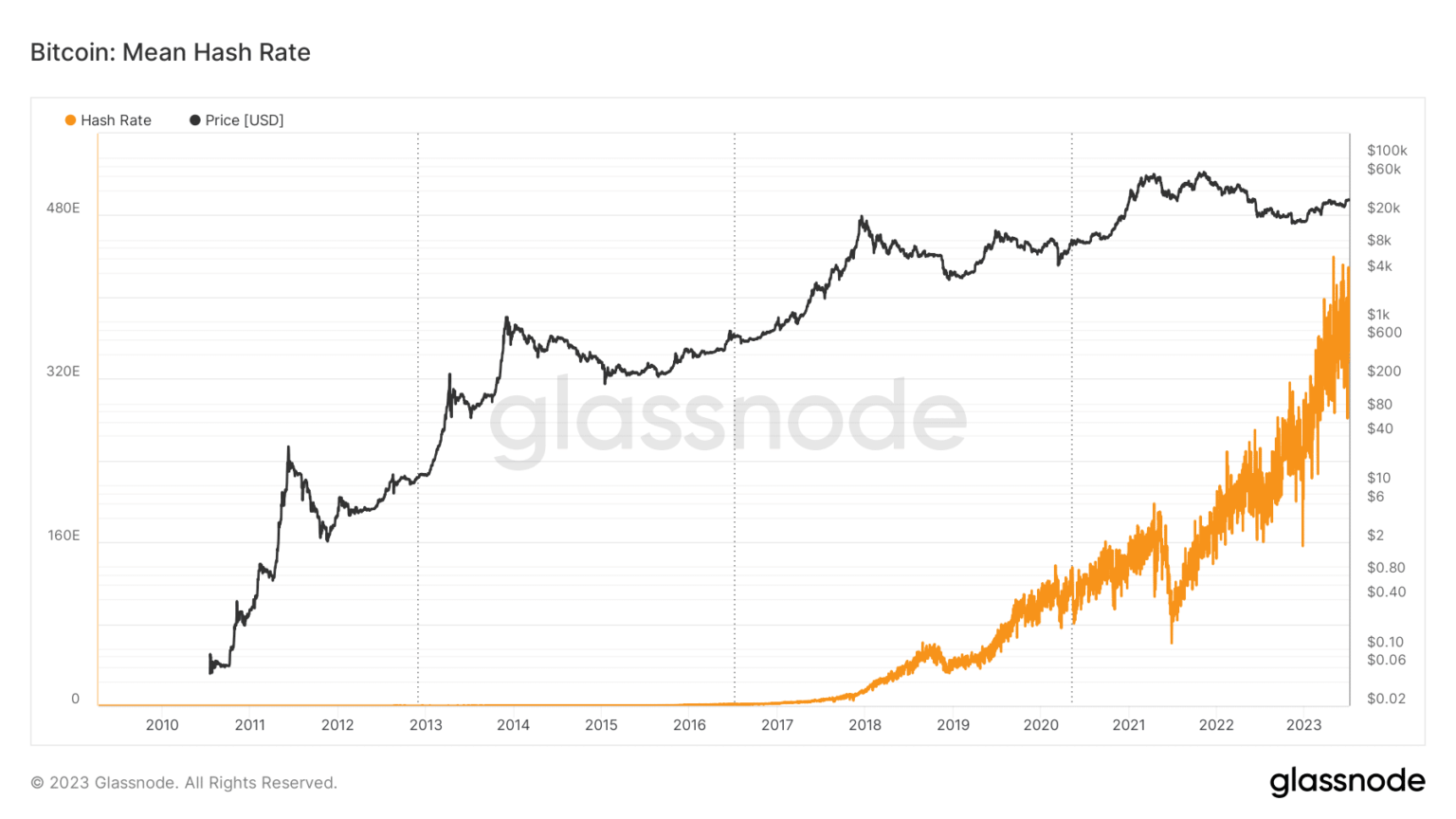

The intense debate around Bitcoin [BTC] mining has merged with the evolution of blockchain technology and cryptocurrencies. According to on-chain analytics company Glassnode, the network’s hashrate has grown astronomically over the past five years, reflecting the surge in BTC’s value.

Source: Glassnode

Read Bitcoin [BTC] Price Forecast 2023-24

What’s the fuss about mining?

The hashrate is a function of growing network traffic. As is clear, the hashrate reached an all-time high of 439 exahashes per second (EH/s) on May 1 after the blockchain was overwhelmed by a record number of transactions.

A growing hashrate indicated that miners needed to invest in more computing power to validate blocks. This, in turn, would lead to increased demand for specialized mining equipment and electricity.

Since the process is a major energy hog, it has been criticized by environmentalists and crypto naysayers for being one of the largest emitters of greenhouse gases. And the criticism is highly meritorious.

Bitcoin is estimated to consume electricity at an annual rate of 129 terawatt hours (TWh), according to the latest data from Cambridge Bitcoin electricity consumption index. This was more than the total annual electricity consumption of countries such as Argentina and the UAE.

Source: Cambridge Bitcoin Electricity Consumption Index

As a result, the network’s total annual emissions rose to 65.59 MtCO2e, greater than the annual greenhouse gas emissions of countries such as Belarus and Papua New Guinea.

Despite these alarming statistics, there has been a noticeable shift in BTC mining dynamics in recent years. This necessitated further investigation.

Mining efficiency improves

This is according to a report from investment company Digital Assets CoinShares, the average Bitcoin mining network efficiency has improved due to the advancement of mining equipment. It is well known that specialized hardware, such as Application-Specific Integrated Circuits (ASICs) are now used to mine cryptocurrencies.

As can be seen in the chart below, the energy used for each tera hash of BTC mining has been steadily declining, a sign that miners were investing in more sophisticated ASIC mining equipment.

Source: CoinShares

But while overall network efficiency has improved, there have been periods when efficiency has dropped dramatically. According to CoinShares’ research, these were largely the periods when BTC prices rose.

Miners compete to solve cryptographic puzzles and validate transactions. As an incentive, they get newly minted Bitcoins and transaction fees. Miners struggle during bear markets as the fall in Bitcoin’s price reduces their income and ability to cover their mining expenses.

Source: Glassnode

Conversely, bull markets make miners profitable. These two contrasting scenarios are shown in the chart above.

With more revenue at their disposal, miners are starting to reintroduce less efficient mining units into the network, which were previously unprofitable. So while miner profitability increases with price increase, overall mining efficiency decreases.

Geographical distribution of Bitcoin mining

Another factor that affects the carbon intensity of BTC mining is the type of energy source used. Over the years, the share of renewable and cleaner sources, such as hydro, solar and wind, has increased significantly.

Even among fossil fuels, natural gas use has skyrocketed over coal. Global warming emissions from the combustion of natural gas are much lower than coal.

According to Coinshares, the increase in natural gas share was due to miners effectively using flared gas, which was previously a useless by-product of the oil extraction process, to power their mining equipment.

Source: CoinShares

The way mining activity has shifted in different regions in recent years has been a major contributor to this noticeable shift. Countries like China were once the epicenter of BTC mining. However, it ceded its position to the US following a blanket ban on cryptocurrency trading and mining in September 2021.

China, along with other Asian countries such as Kazakhstan, are regions where fossil fuels are heavily subsidized. This incentivized miners to exploit these resources, resulting in a larger carbon footprint.

Is your wallet green? Check out the Bitcoin Profit Calculator

But now that mining activity has moved to the US, things have changed. The south-central state of Texas has handed out favorable policies and tax incentives to attract miners to its wind and solar power.

While the increasing carbon footprint caused by BTC mining deserves attention, in reality they represent a minuscule one 0.13% of global emissions. However, it remains to be seen how these numbers hold up as global knowledge and demand for cryptos grows.