- The decoupling became even stronger in the second quarter of 2023 as price trajectories diverged.

- Bitcoin volatility increased after the recent legal action against crypto giants.

Bitcoin [BTC] formed an inverse relationship with technology stocks as sentiment around virtual assets and stocks has diverged lately.

Is your wallet green? Check out the Bitcoin Profit Calculator

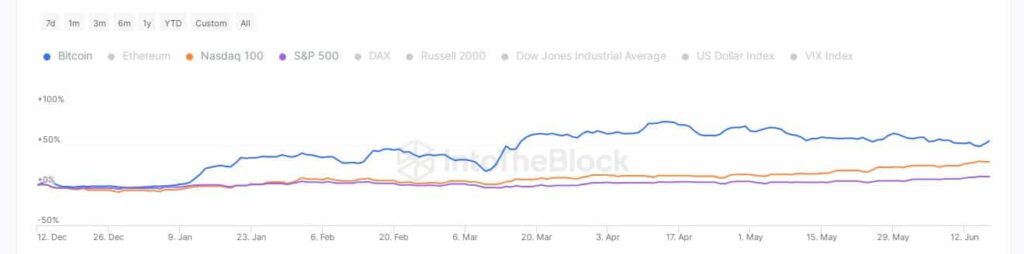

One Twitter user, citing data from on-chain analytics firm IntoTheBlock, said Bitcoin’s 30-day correlation coefficient with popular indices like Nasdaq and S&P 500 turned negative. Essentially, this meant that when the price of BTC rises, the price of the stock will fall and vice versa.

👀 Watch out people, something is changing! Stocks and crypto are now largely negatively correlated, meaning when one booms, the other plummets. Dates from @intotheblock https://t.co/THDanxmnii pic.twitter.com/lXl7eHOhvt

— Elite 💙🧡 (@eliteXBT) June 16, 2023

“Digital Gold” is finally here

Bitcoin proponents have long positioned it as the “safe haven,” or an investment whose value is expected to remain stable or even rise during economic downturns, similar to precious metals like gold.

To be viewed by investors as an inflation hedge, an asset must exhibit significant decoupling from traditional markets. However, with the growing mainstream adoption of cryptocurrencies, Bitcoin and other altcoins have become more and more influenced by the geopolitical and macroeconomic triggers that affect the mainstream market.

But this is starting to change. The spate of banking collapses in March led investors to put their money in the crypto market. After this, the world’s largest crypto by market capitalization, Bitcoin rose 52% until reaching its yearly high in April, according to IntoTheBlock. On the other hand, stock indices have been largely flat until then.

Source: IntoTheBlock

The decoupling became even more pronounced in the second quarter of 2023, as the crypto market in general and Bitcoin in particular entered a consolidation phase. The king coin fell even more as regulators in the United States became increasingly hostile.

However, technology stocks went the other way, resulting in a marked difference in the growth trajectories of the two assets.

It’s not just the stock markets that BTC has begun to isolate itself from. In recent months, “digital gold” has shown increasing decoupling from its real-world counterpart, gold [XAU] also. Bitcoin has grown in value faster than the precious metal since the March banking crisis.

How much are 1,10,100 BTC worth today?

Volatility is starting to increase

BTC changed hands at $26,561.18 at the time of writing. According to Santiment, the coin gained nearly 4% in the past 24 hours. Interestingly, after witnessing an extended period of low volatility, BTC has recently begun to live up to its image of an unpredictable asset. Volatility increased following the recent legal action against crypto giants by regulators.

Source: Sentiment