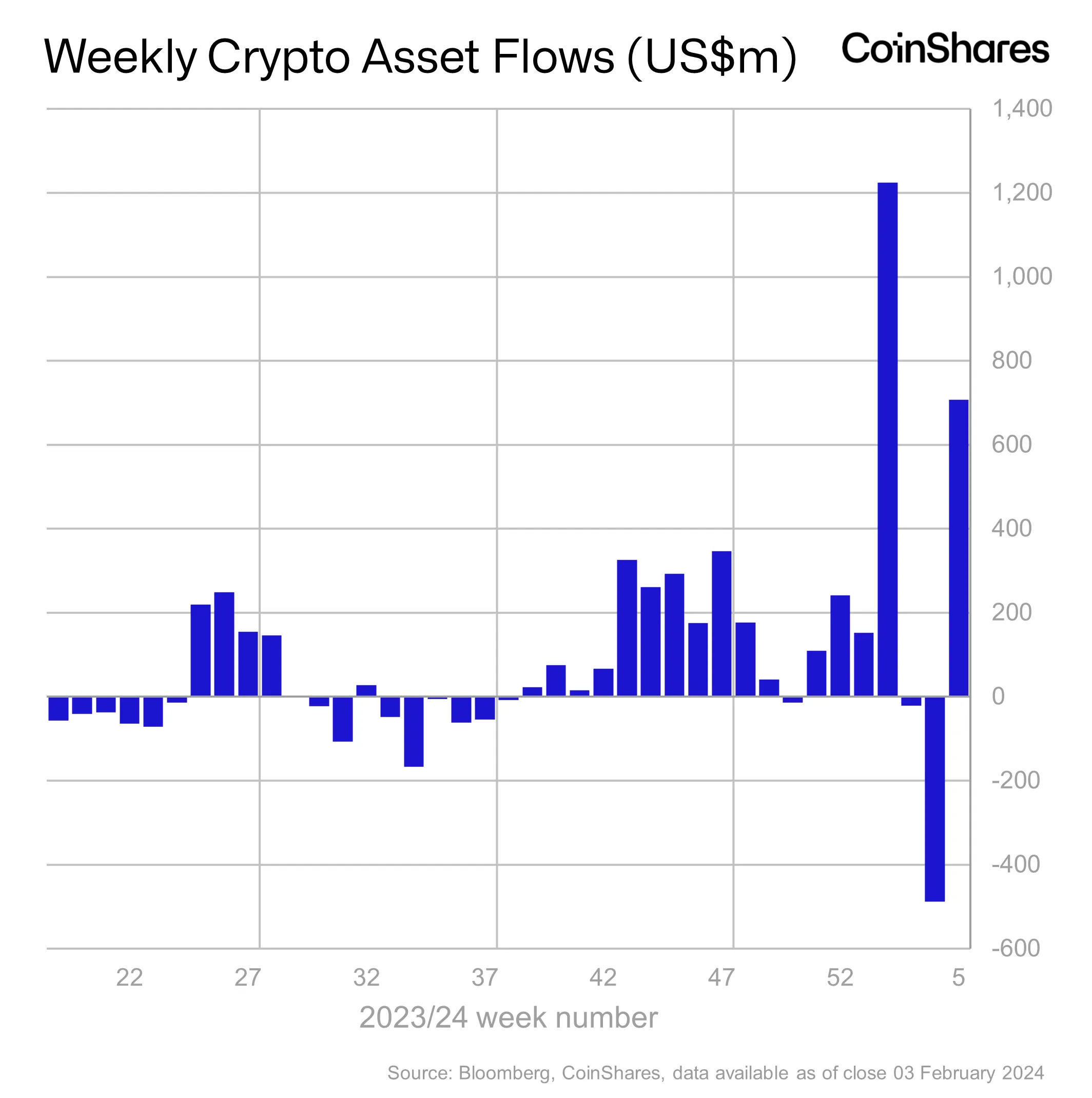

Digital assets manager CoinShares says institutions are putting money into crypto exchange-traded products (ETPs) to the tune of $708 million, weeks after the U.S. Securities and Exchange Commission (SEC) approved spot BTC exchange-traded funds (ETFs).

In his latest Digital Asset Fund Flows reportCoinShares notes that crypto investment products saw huge inflows last week, as grayscale outflows slowed somewhat.

“Digital asset investment products saw large inflows totaling $708 million last week, bringing this year’s inflows to $1.6 billion and total global assets under management to $53 billion.

Trading volumes in ETPs fell to $8.2 billion, compared to a total of $10.6 billion in the previous week, although they remain well above the weekly average of $1.5 billion in 2023.”

Recently issued US-based ETFs have seen $1.9 billion in inflows over the past four weeks, according to the data. Such ETFs have seen inflows of nearly $7.7 billion since their approval by the SEC last month.

“This was offset by outflows from established issuers, which totaled $6 billion, but data suggests a significant decline in the momentum of these outflows in recent weeks.”

BTC products saw the overwhelming majority of the $703 million inflows, while Ethereum (ETH) products suffered $6.4 million in losses. ETH rival Avalance (AVAX) lost $1.3 million in outflows, while Solana (SOL) products saw $13 million in inflows.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Owlie Productions/Natalia Siiatovskaia