- Bitcoin Millionaires Up 111% in 2024, Driven by New ETFs and Bitcoin Highs

- Top crypto hubs such as Singapore and Hong Kong benefited from favorable tax policies

Despite the recent dip in the cryptocurrency market, a dip was accelerated by Bitcoin [BTC] traps under $60,000 on August 28, there remains a silver lining. This is thanks to Bitcoin’s stellar performance through most of 2024.

Crypto Wealth Report Analyzed

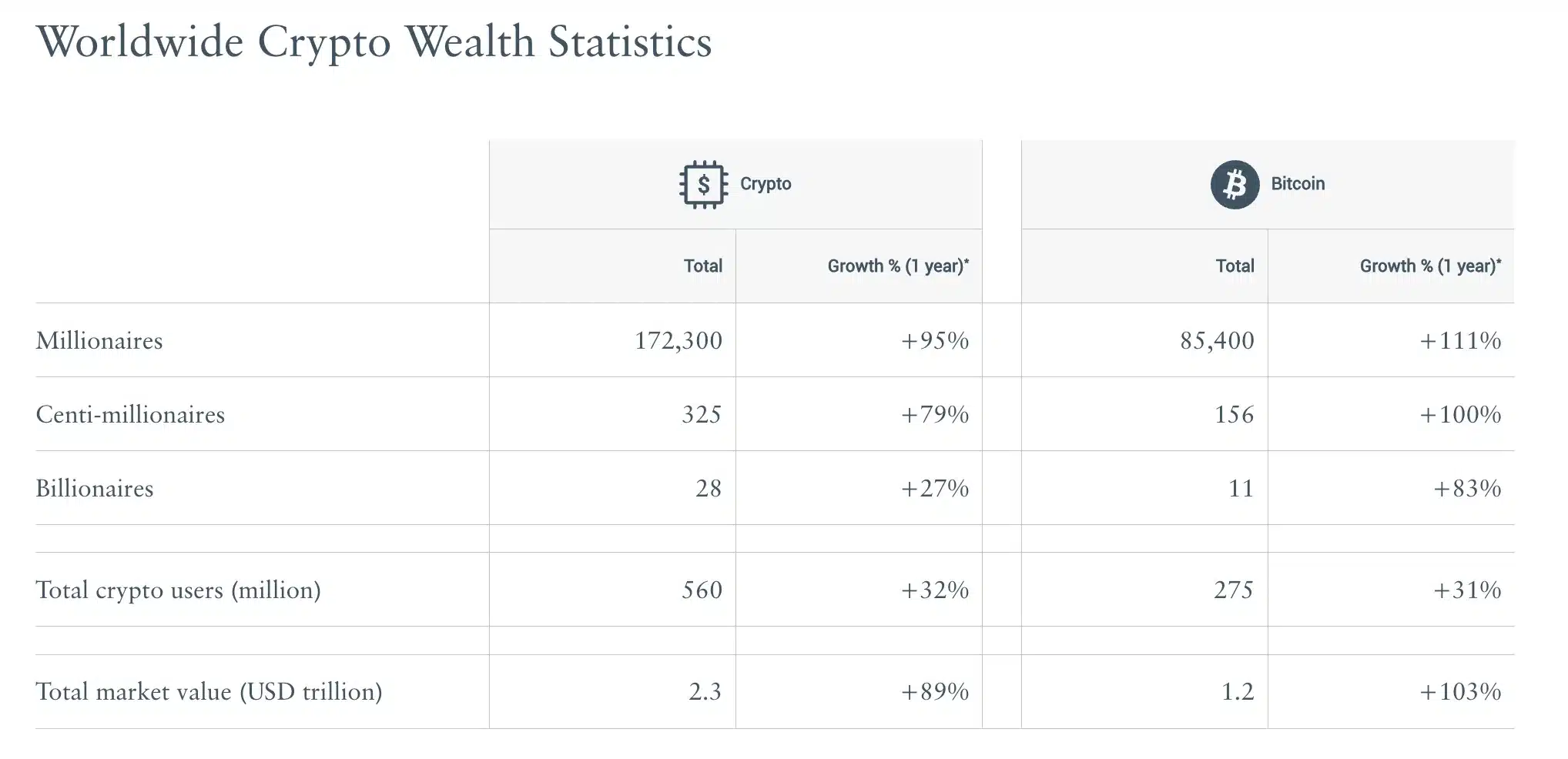

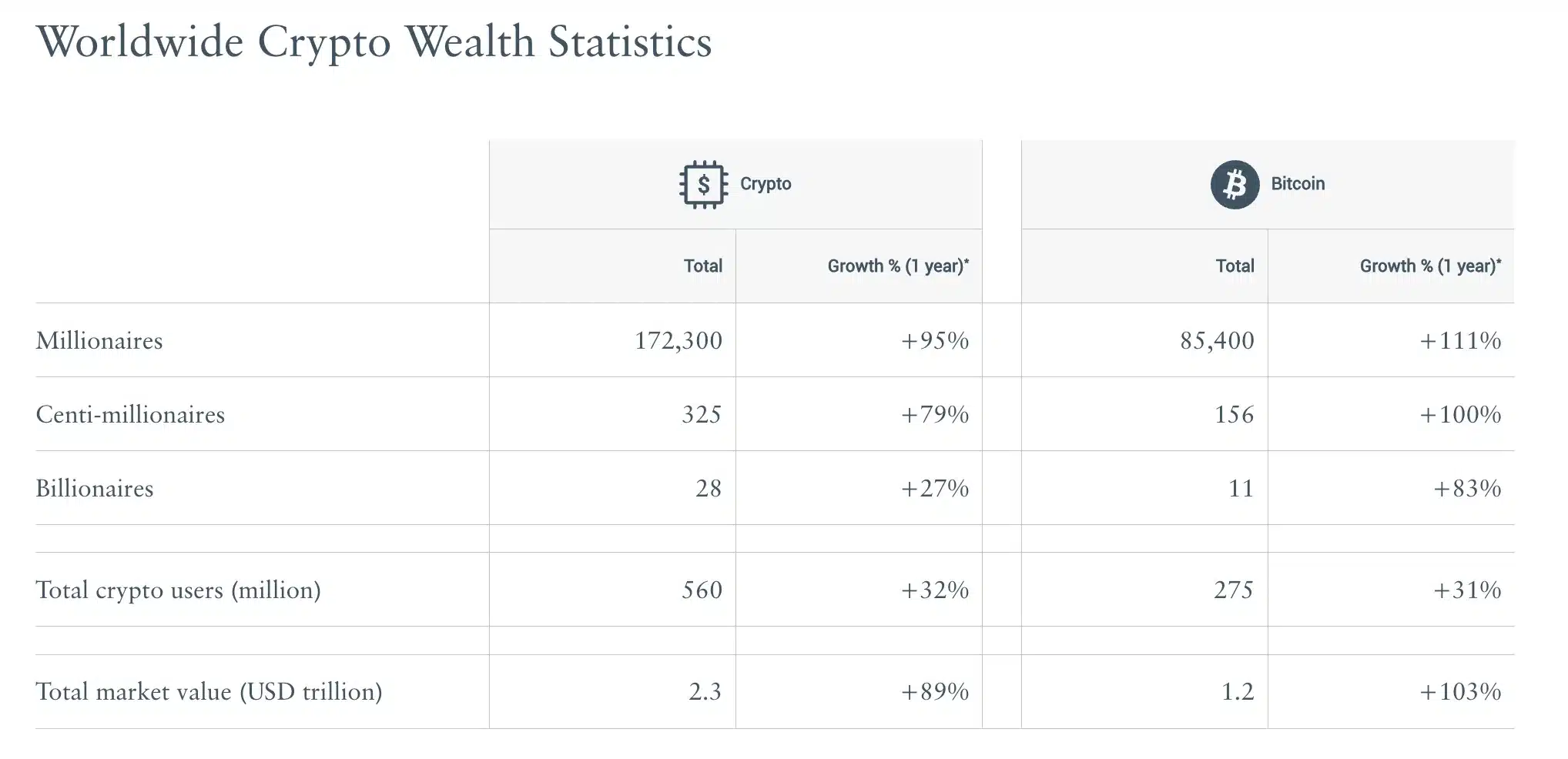

According to “The Crypto Wealth Report 2024” by New World Wealth and Henley & Partners, the number of BTC millionaires has increased by 111% in the past year. In fact, the figures for this are now as high as 85,400.

Source: www.henleyglobal.com

At the same time, the total number of crypto millionaires has also seen a significant increase, from 88,200 last year to 172,300.

The rise in the number of crypto millionaires can be attributed to the introduction of newly approved spot ETFs in the US, which propelled Bitcoin to new heights in 2024.

After reaching an all-time high of over $73,000 in March, Bitcoin quickly settled around $64,000 – marking a 45% increase despite some retracement. However, BTC would later drop even further in the charts.

Over the past twelve months, the value of BTC has increased by 138%. The launch of these ETFs has had a particular impact, amassing more than $50 billion in assets since January, after a protracted battle for approval from the Securities and Exchange Commission.

Managers weigh in…

Making the same comment on this, Dominic VolekGroup Head of Private Clients at Henley & Partners said:

“The cryptocurrency landscape of 2024 bears little resemblance to its predecessors. Bitcoin’s rise to over $73,000 in March set a new record, while the long-awaited approval of spot Bitcoin and Ethereum ETFs in the US unleashed a flood of institutional capital. Anticipation is now growing for potential Solana ETFs to join the Wall Street party.”

He added:

“These milestones have ushered in a new era of crypto adoption, one where digital assets increasingly cross-pollinate with traditional finance and global mobility.”

António Henriques, CEO of Bison Bank and Chairman of Bison Digital Assets, also pointed out:

“In the rapidly evolving financial world, cryptocurrencies are challenging the dominance of traditional fiat currencies. As these two financial domains intersect, we are witnessing the dawn of a new era in global finance, where the innovative potential of digital assets meets the stability of traditional money.”

What this means is that despite short-term fluctuations, many still strongly believe in the potential of Bitcoin and other crypto assets.

If Michael Saylorformer CEO of MicroStrategy, put it succinctly:

“#Bitcoin is rules without rulers.”

Nation states are stepping up their crypto game

Finally, the report also revealed that Singapore tops the global cryptocurrency hub index with a score of 45.7 out of 60, followed by Hong Kong and the UAE.

All three stand out for their favorable tax policies, especially their capital gains tax exemption. This benefits crypto investors and wealthy individuals.

However, that’s not all. Recently, El Salvador’s Bitcoin reserves grew to 5,851 BTC, worth approximately $356.4 million.

Meanwhile, Russia has shared plans that it will begin trials for crypto exchanges and cross-border transactions from September 1, 2024.

This is a sign of the continued belief in Bitcoin’s potential despite short-term market fluctuations.