- BTC recently hit another ATH.

- There has been more competition to get hold of BTC, which has increased demand.

Bitcoin has soared to a new all-time high of $106,000, driven by an unprecedented surge in institutional demand and tighter supply through OTC agencies.

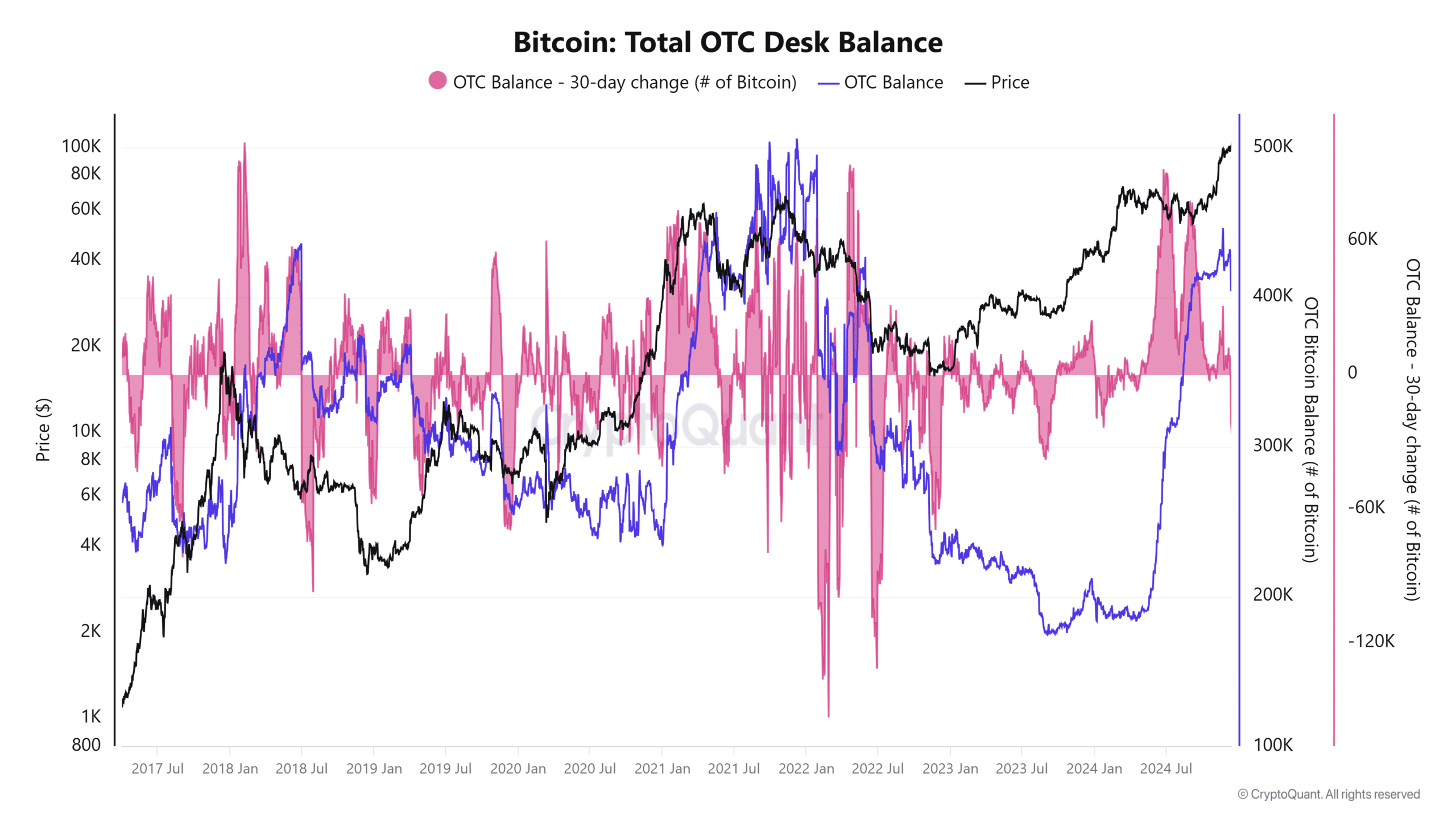

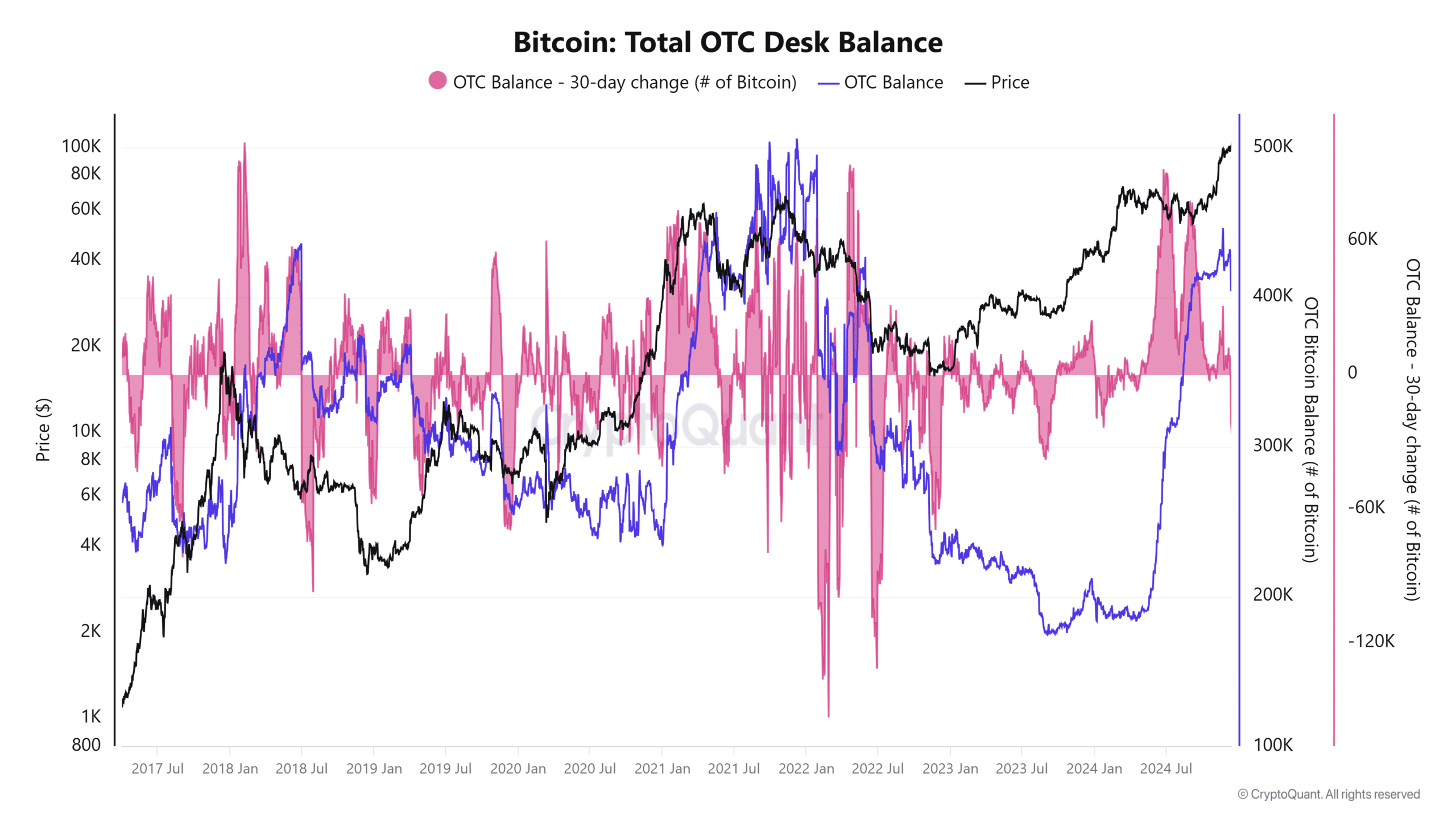

On-chain data shows a significant decline in OTC desk balances as apparent demand continued to outpace supply over the past month. This combination has led to a supply squeeze that has fueled Bitcoin’s sharp price momentum.

Bitcoin’s institutional accumulation is growing

Analysis of the Bitcoin OTC Desk Balance Chart, per CryptoQuantreveals a sharp decline in OTC balances, marking the steepest decline this year. In the last 30 days alone, OTC desk balances have dropped by 25,000 BTC, while a total of 40,000 BTC have left these desks since November 20.

Source: CryptoQuant

Institutional investors and high net worth individuals typically use OTC desks to purchase large amounts of Bitcoin without impacting spot market prices. This depletion indicates that institutions are accumulating aggressively, reducing the supply available to broader market participants.

The dwindling OTC reserves coincide with Bitcoin’s rally to new highs, illustrating how institutional demand has fueled upward momentum while creating a supply shortage in the market.

Demand exceeds supply, driving price momentum

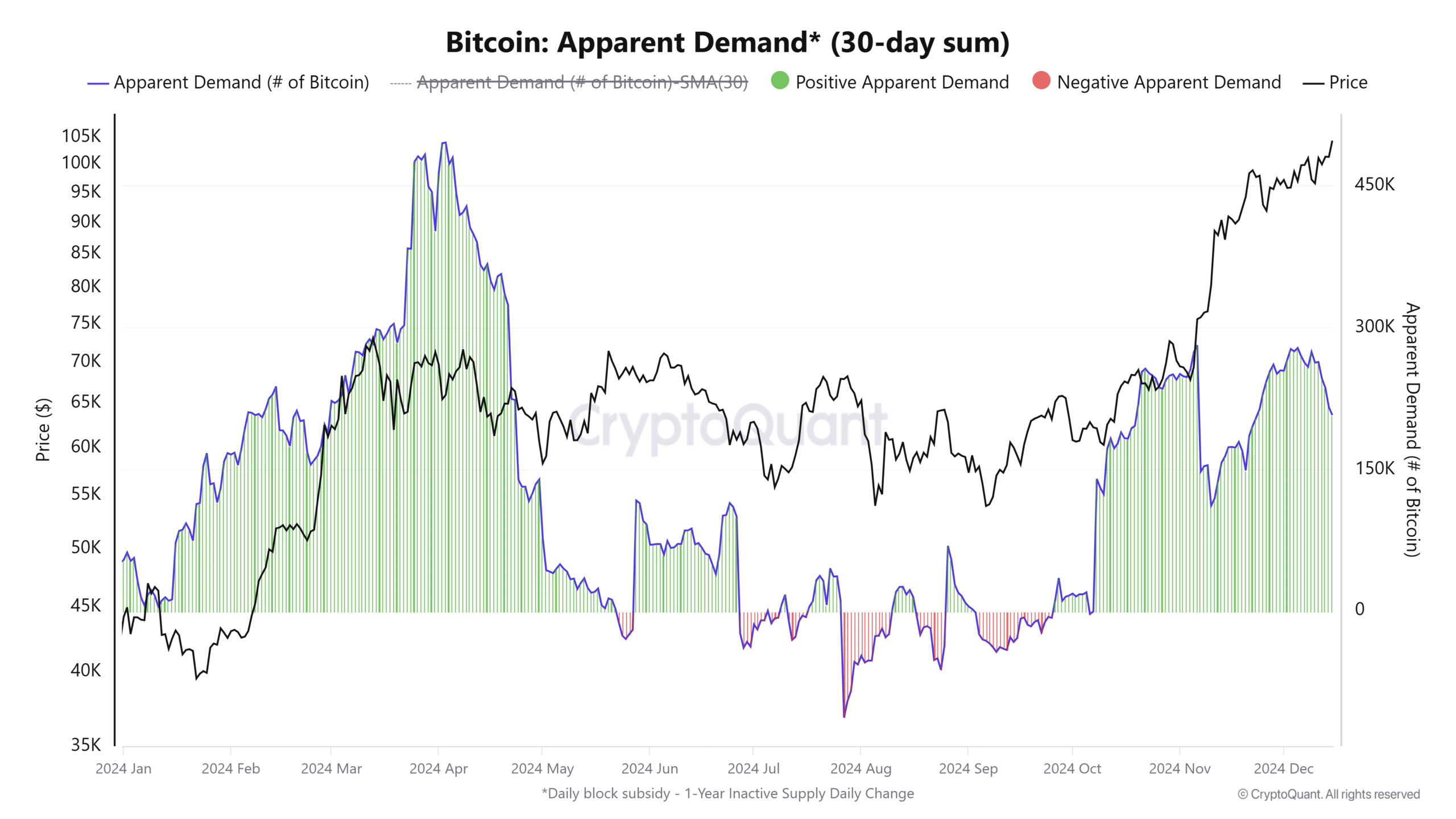

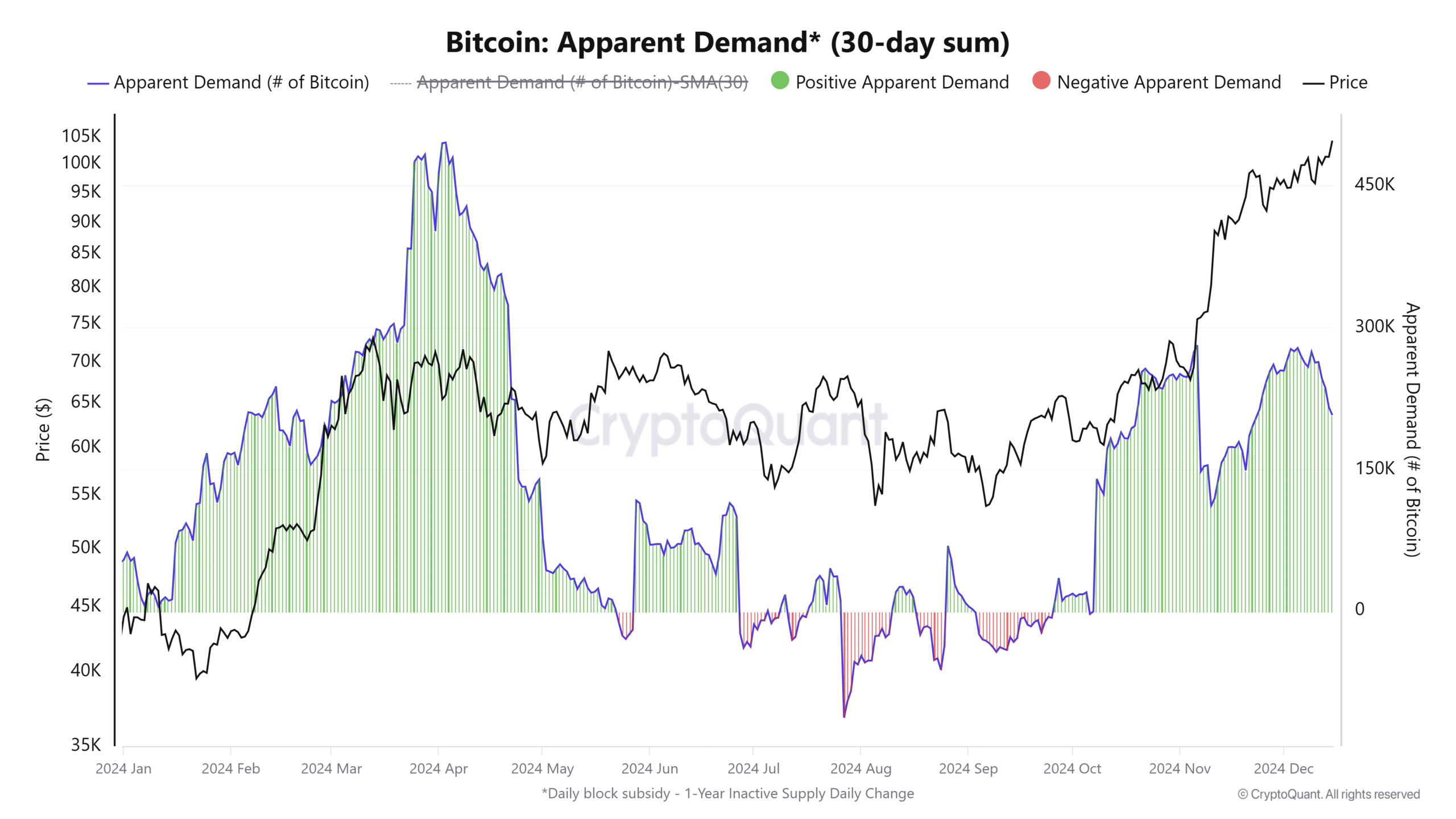

Analysis of the Bitcoin Apparent Demand chart reinforces the story of increasing demand. Apparent demand, which tracks net Bitcoin absorption, has soared since November, showing consistent growth as the market rally gained momentum.

Positive apparent demand has dominated, reflecting a market environment where BTC inflows significantly exceed outflows.

Source: CryptoQuant

As demand rose, Bitcoin broke through critical resistance levels and reached the current high of $106,000.

The decline in OTC balances, combined with this increase in demand, caused a supply squeeze, creating the perfect environment for BTC’s record performance.

Bitcoin price action confirms strong bullish sentiment

The price chart confirms Bitcoin’s bullish momentum. The price has formed a clear uptrend, characterized by higher highs and higher lows, indicating market strength. Bitcoin remains comfortably above its 50- and 200-day moving averages, indicating continued support for the rally.

Source: TradingView

Furthermore, trading volumes have increased during key upward moves, indicating that price gains are supported by strong participation from both institutional and retail investors.

The Relative Strength Index (RSI) is currently around 70, reflecting strong momentum. However, it also suggests the possibility of near-term consolidation as the market absorbs recent gains.

Institutional demand and supply squeeze are driving BTC higher

Bitcoin’s rise to $106,000 is a direct result of increasing institutional demand and tightening supply. The depletion of OTC desk balances indicates aggressive accumulation by large investors as apparent demand continues to exceed available supply.

These factors have created the conditions for a significant supply squeeze, pushing Bitcoin to new all-time highs.

– Read Bitcoin (BTC) price prediction 2024-25

While consolidation may occur in the short term, the long-term outlook remains firmly optimistic as institutional confidence and demand for Bitcoin show no signs of slowing down.