- $1.84 billion worth of short positions in Bitcoin are at risk if it reaches $70,000.

- Recent bullish signals indicate potential upside despite ongoing market corrections.

Amid the turbulence in the crypto markets, Bitcoin’s [BTC] Its resilience is being tested as it battles to reclaim the $70,000 threshold, a price rife with potential liquidations.

Short sellers, loaded with bearish bets, keep a close eye on every price in the market, with significant financial interests at stake.

Bitcoin is approaching major thresholds

Bitcoin was trading at $65,802 at the time of writing, reflecting a slight increase of 0.7% in the past 24 hours, but still registering a decline of almost 7% in the past week.

The current state of the crypto market shows a robust battle between hope and caution.

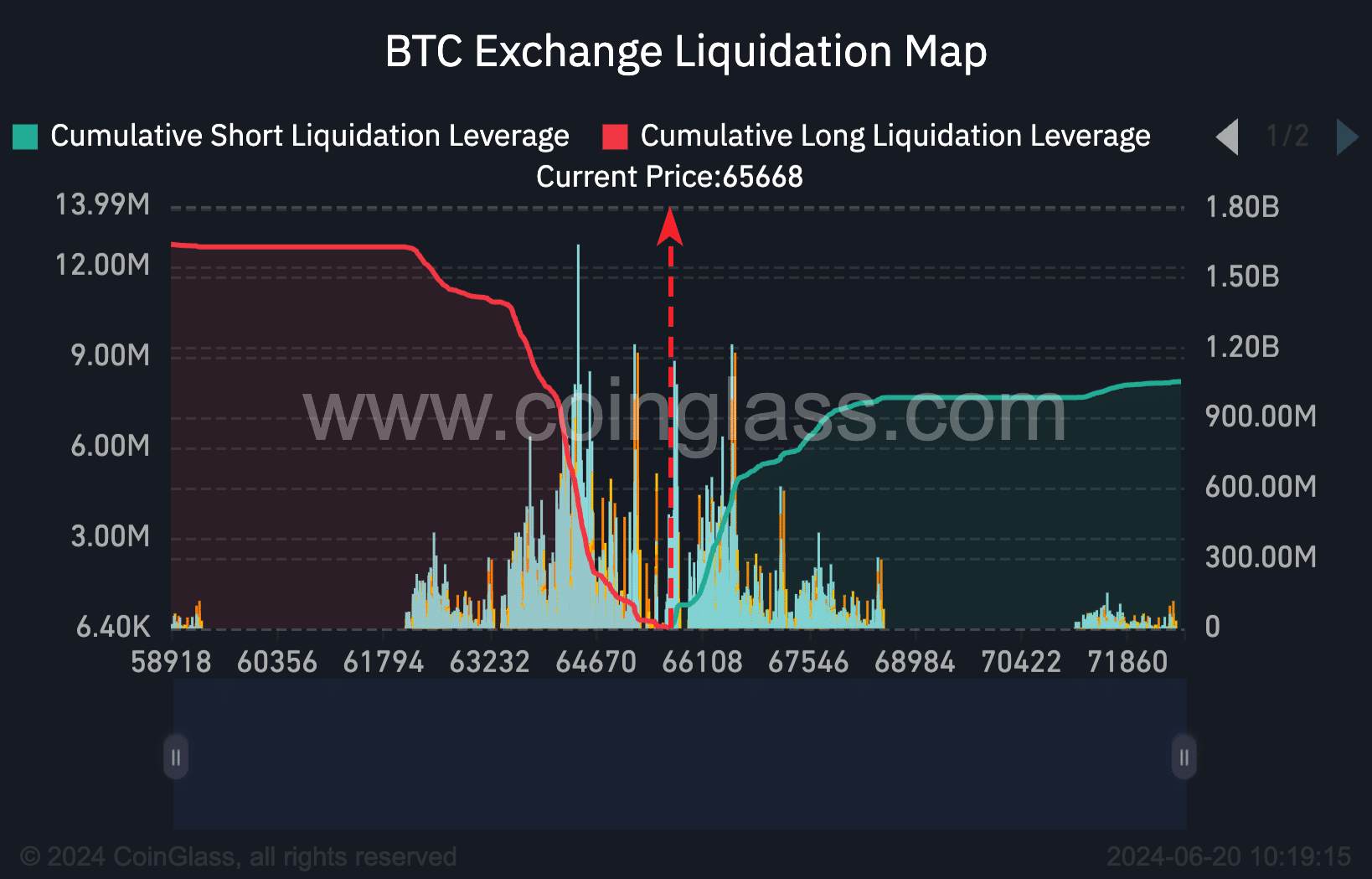

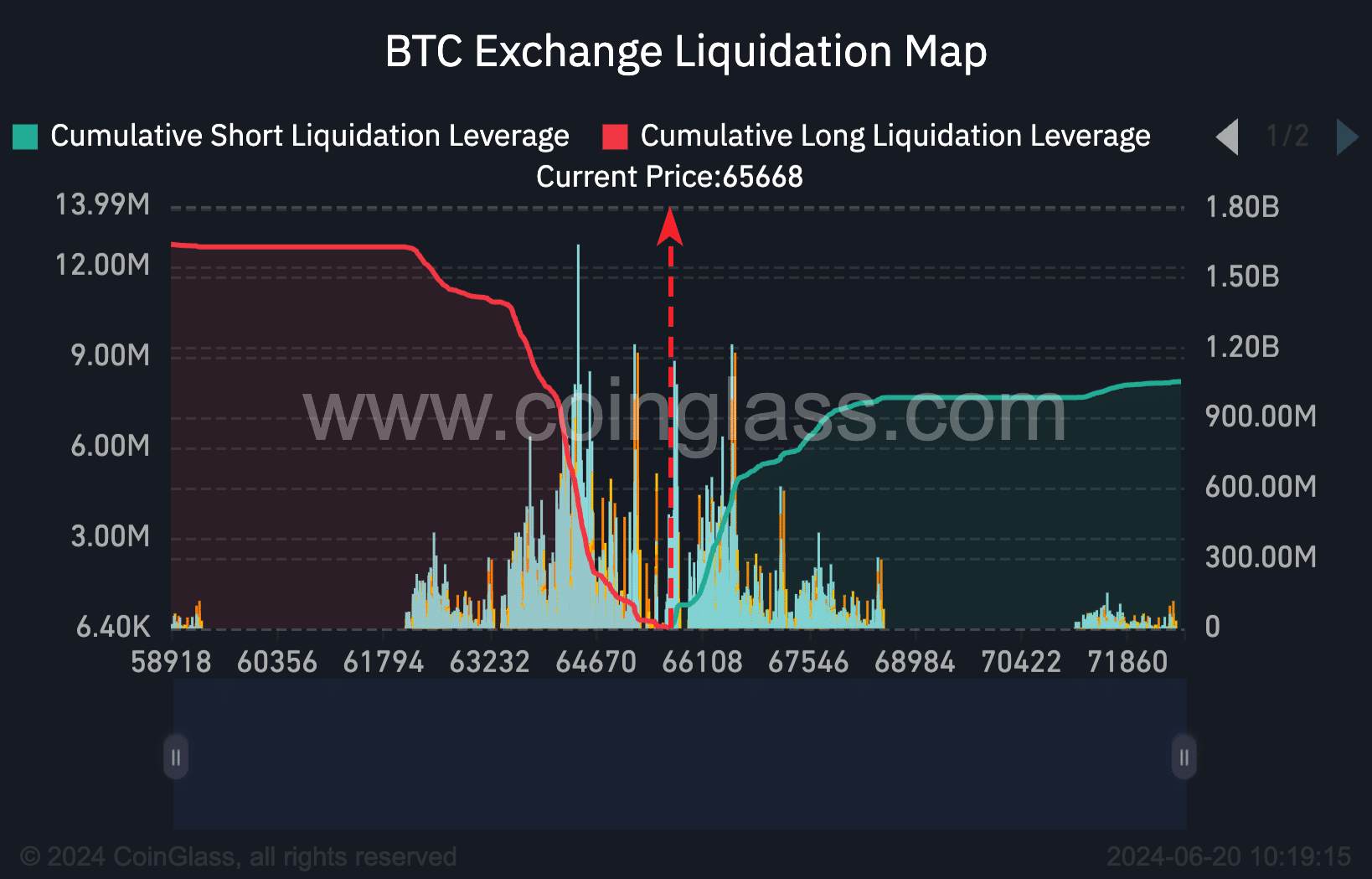

This sentiment is mainly fueled by the large number of short positions totaling $1.84 billion, which, according to US authorities, face the threat of liquidation. facts from Coinglass, Bitcoin should rise back to $70,000 – a level not seen since early June.

Source: Coinglass

The possibility of Bitcoin reaching this crucial price has been a topic of much debate.

Joshua Jake, CEO of Discover Crypto, shared his insights on X (formerly Twitter), stating:

“The markets are incredibly bullish right now. Bitcoin and ETH liquidations are stacked. There is a threat of bouncing.”

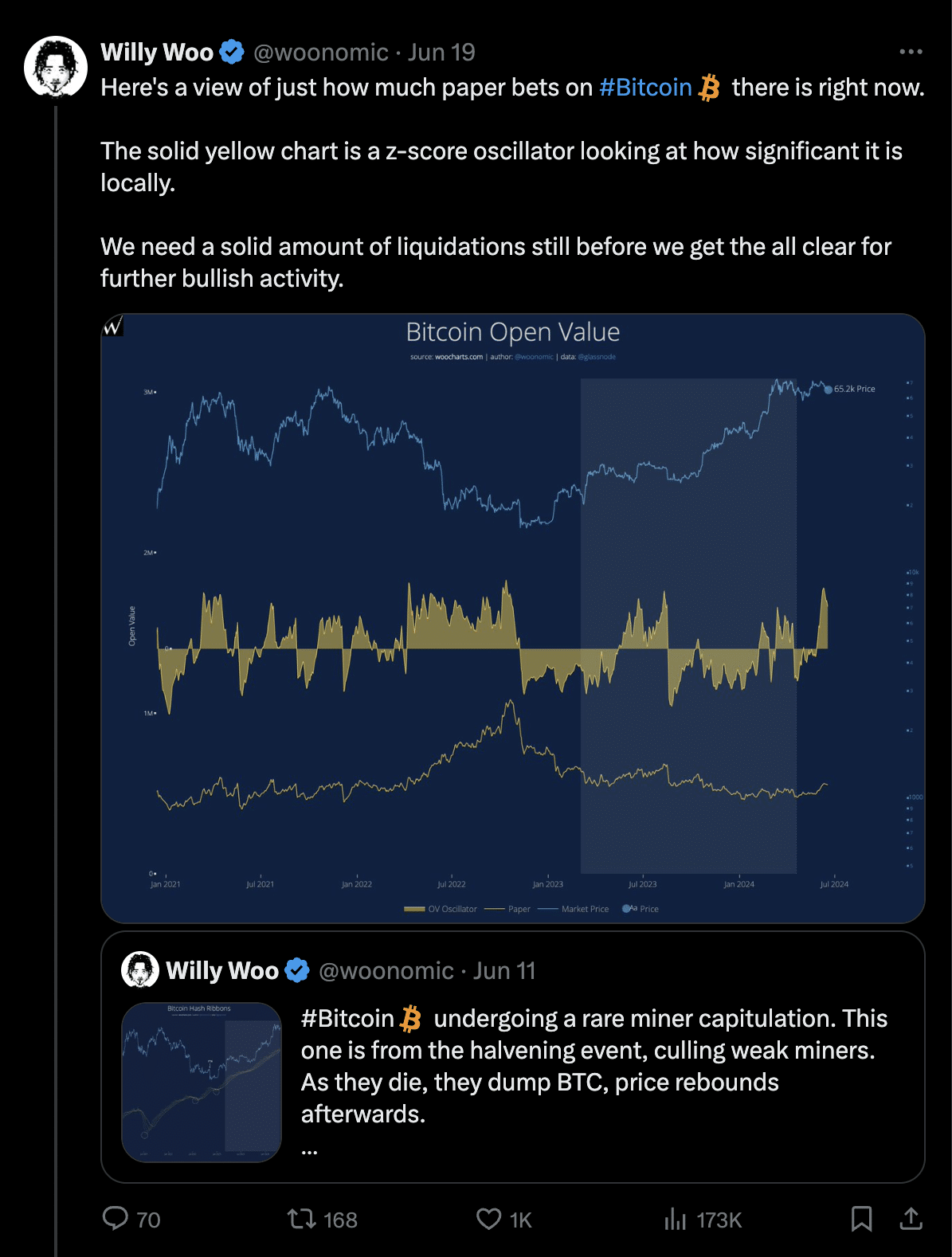

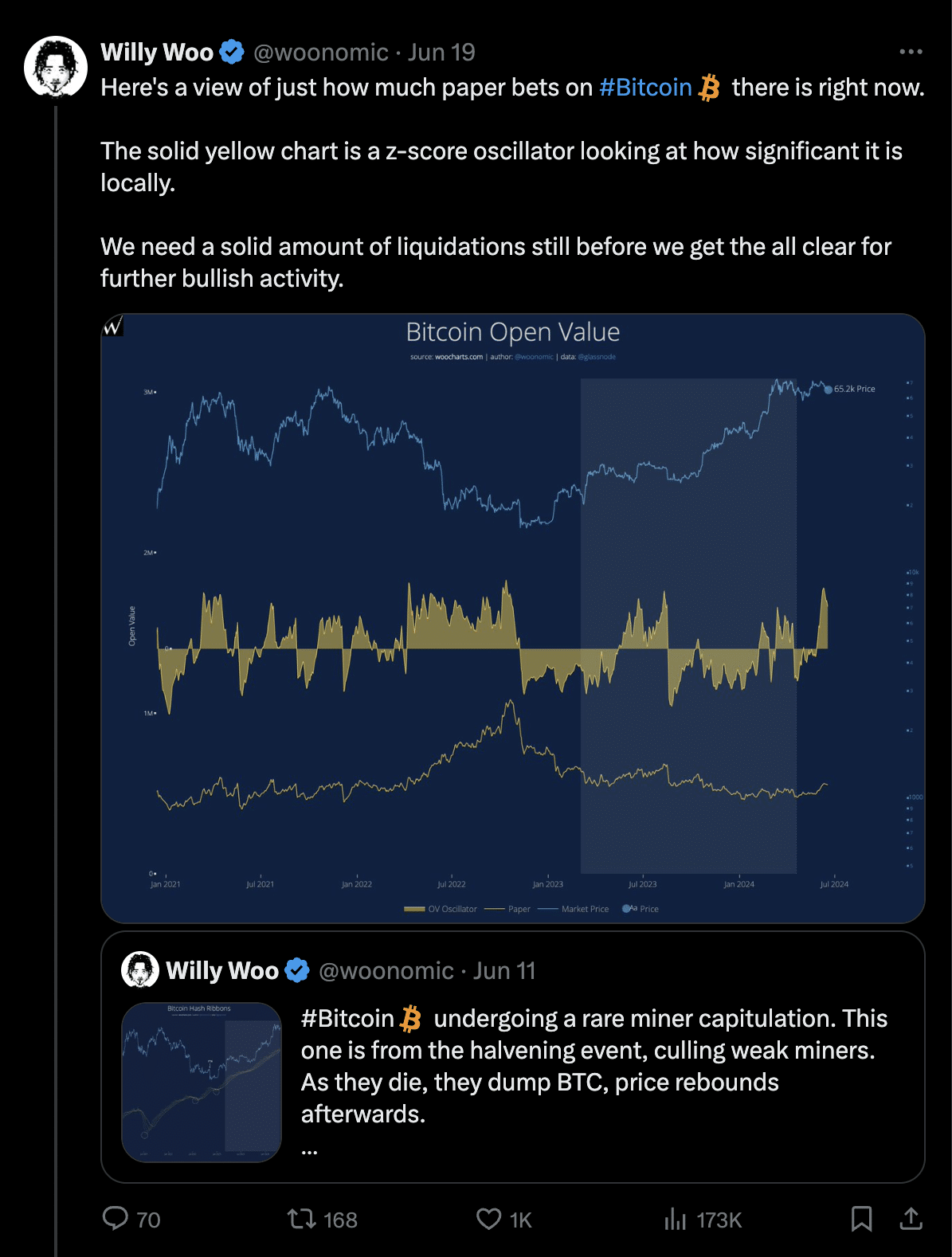

This feeling was echoed by prominent crypto analyst Willy Woo, who suggested on the same platform that a substantial wave of liquidations could be necessary to pave the way for a bullish revival.

Source: Willy Woo on X

Analysis of the fundamentals of BTC

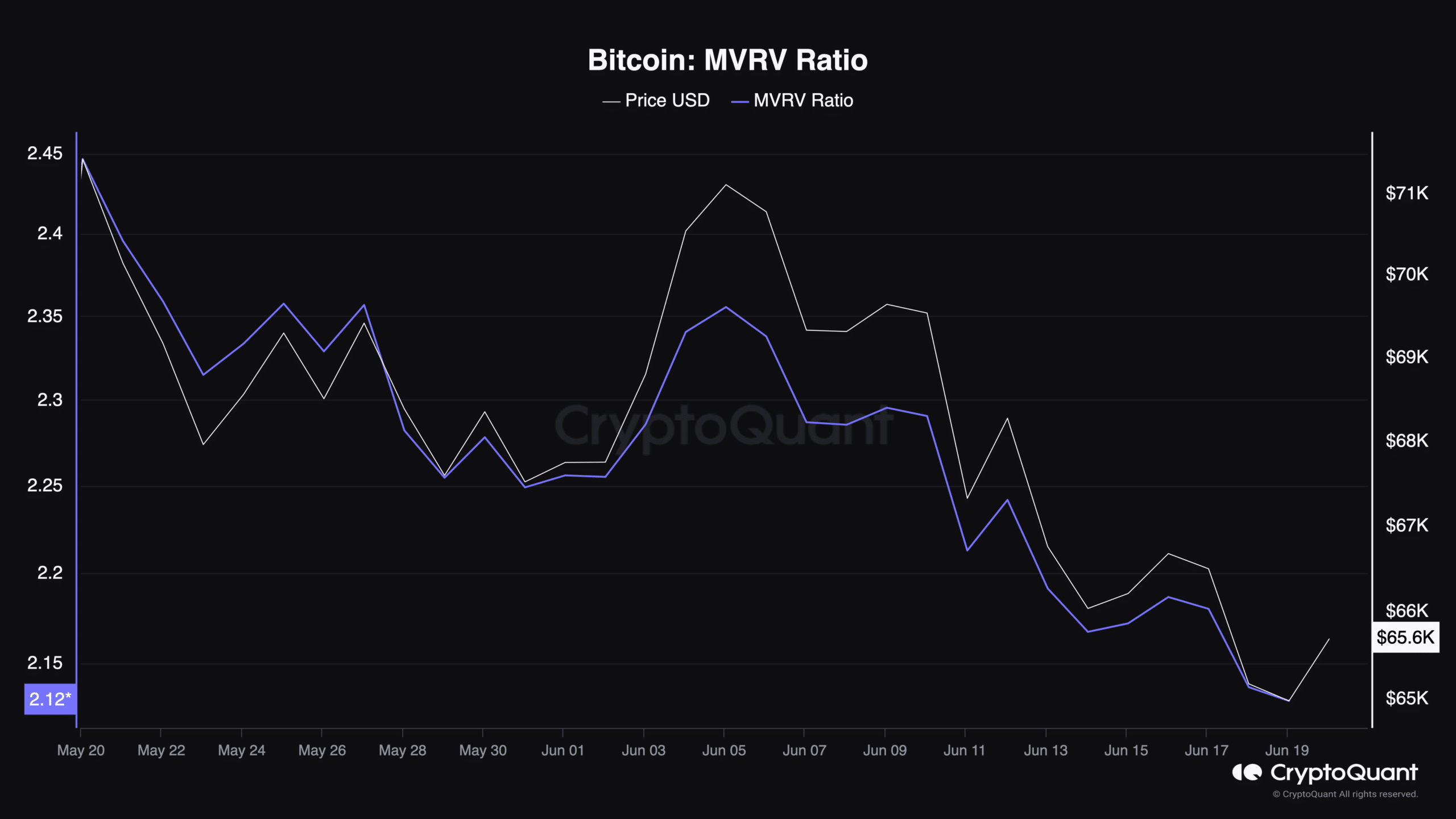

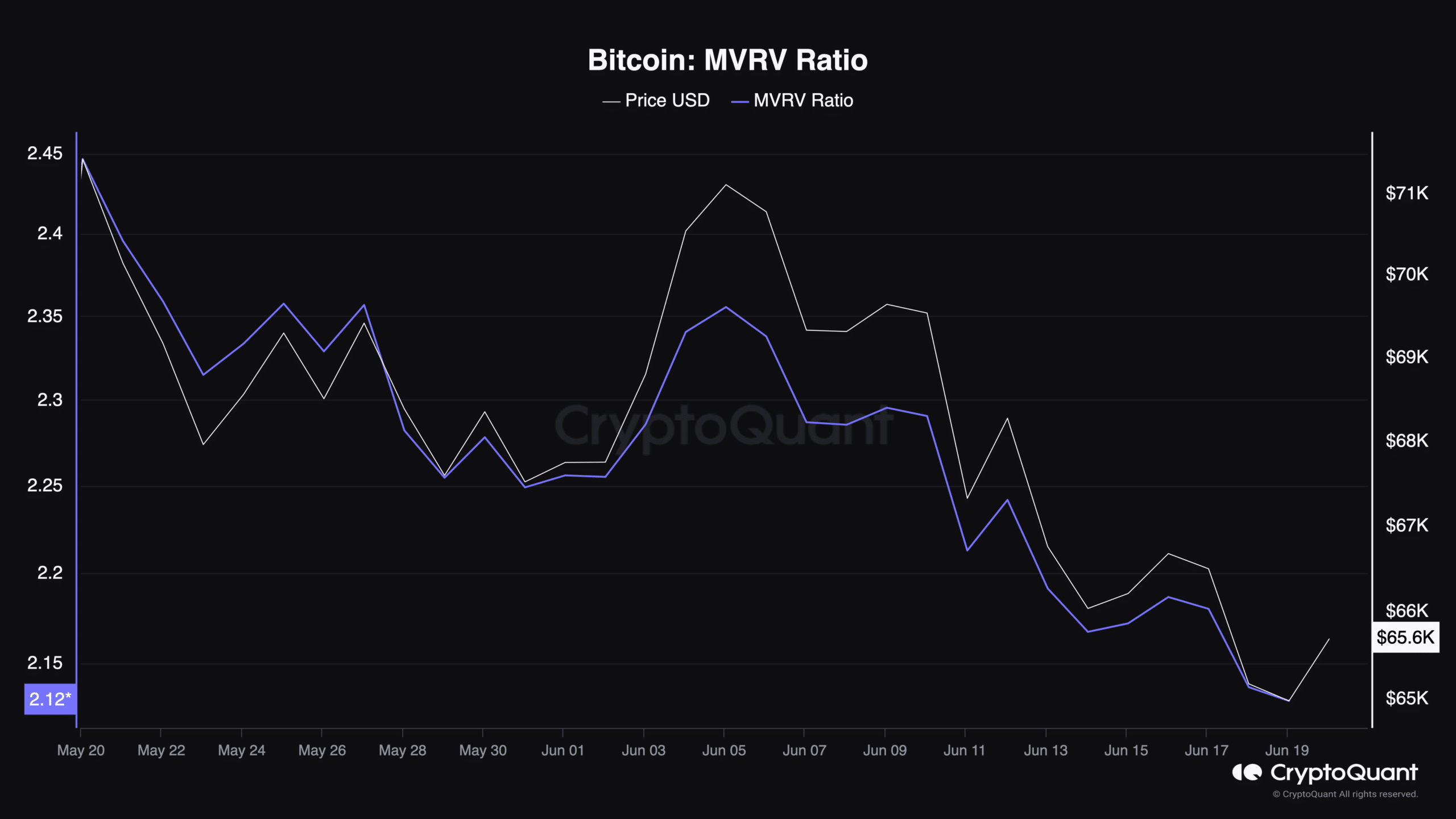

Delving into the fundamentals of Bitcoin, the MVRV ratio – a measure that compares market value to realized value – has recently fallen along with the price and currently stands at 2.12, according to facts from CryptoQuant.

This figure suggests that Bitcoin may still be undervalued, offering a potentially lucrative entry point for investors who believe in the coin’s long-term viability.

Source: CryptoQuant

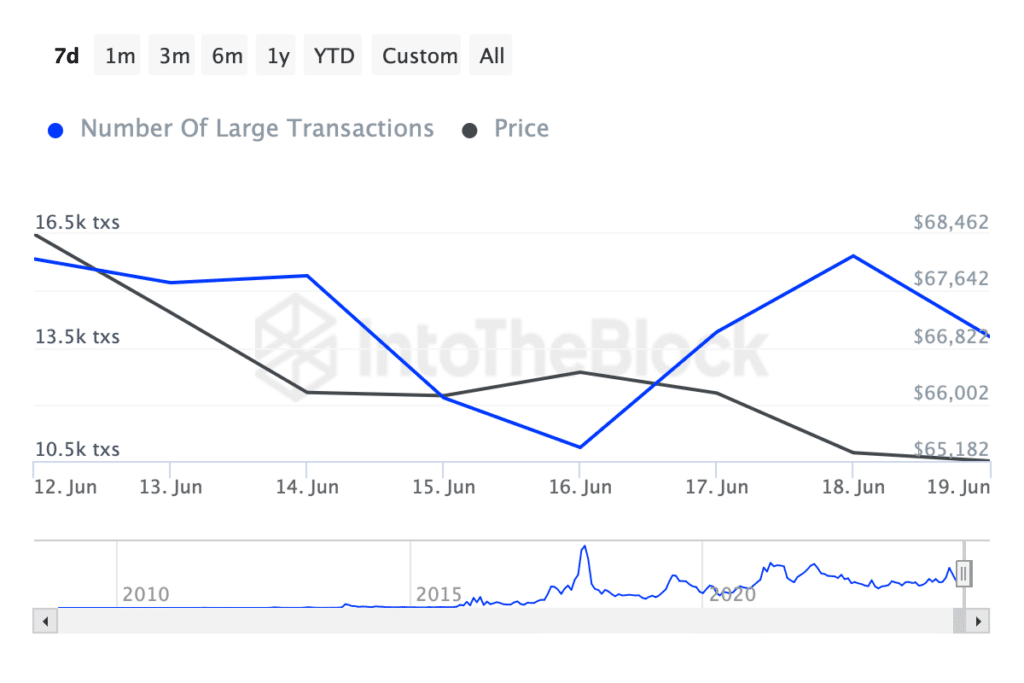

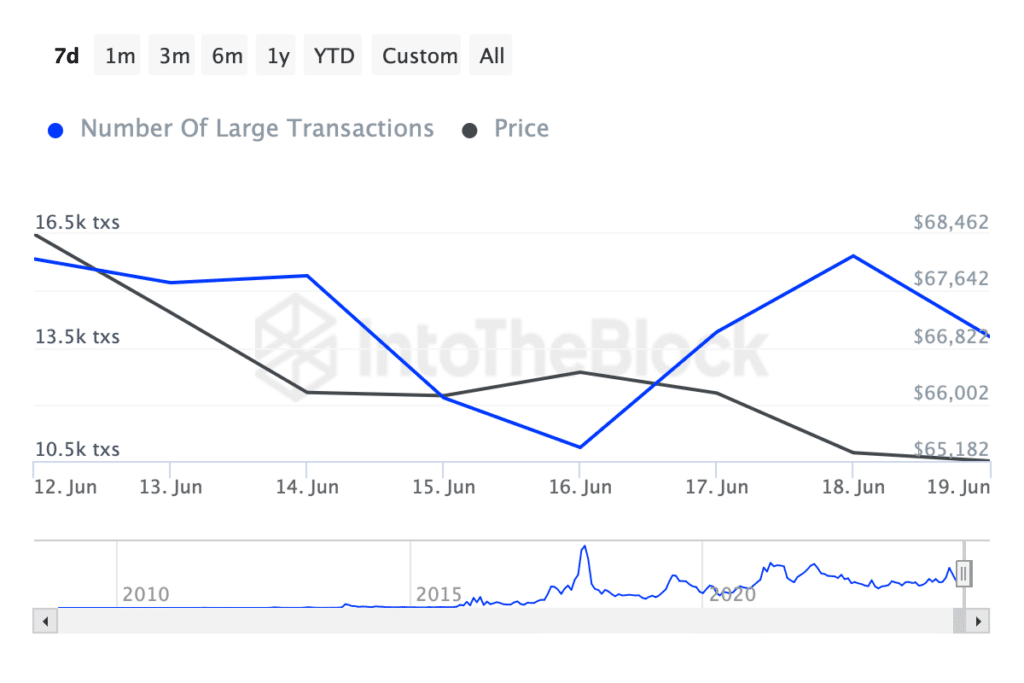

Additionally, there has been a notable increase in Bitcoin transactions over $100,000 rose from less than 10,000 to 13,000 transactions in the past week.

This increase in the number of large transactions is often seen as a sign of increased activity and interest from major investors or institutions.

Source: IntoTheBlock

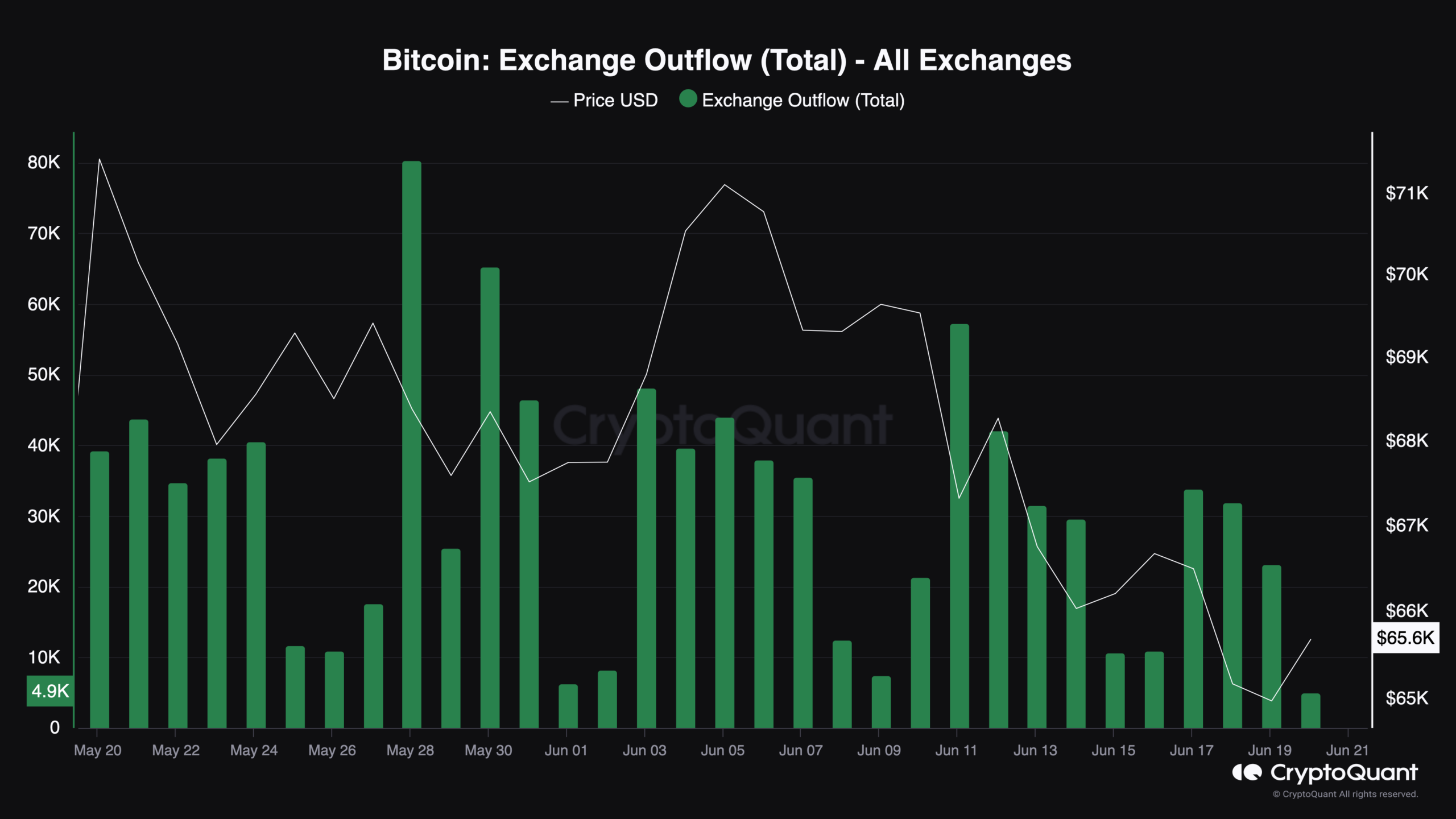

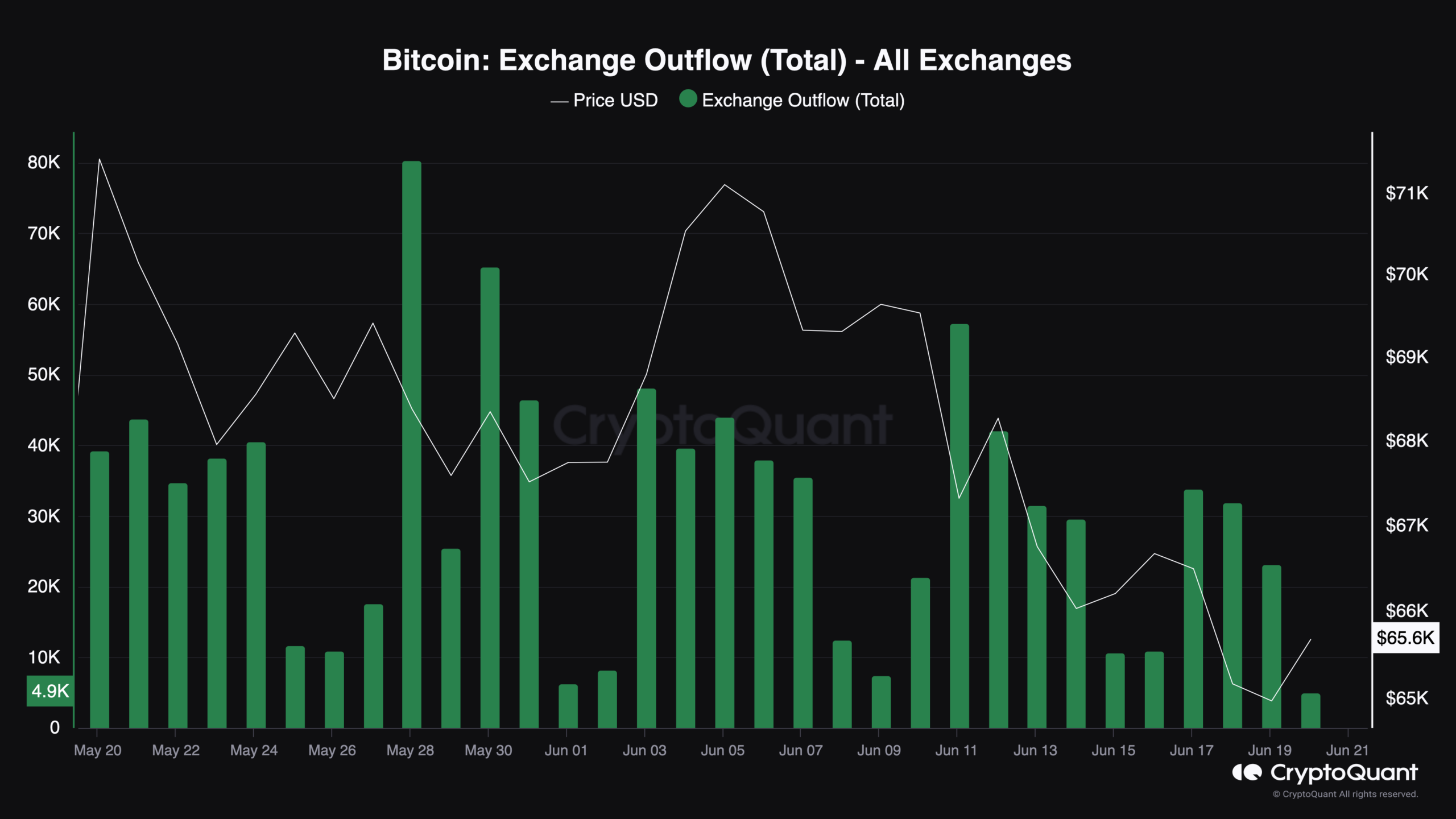

In addition to the transaction data, outflow statistics from CryptoQuant are also available indicated increased activity.

Specifically, Bitcoin outflows from the exchanges rose to over 33,000 BTC on June 17, a significant increase from the figures recorded just days before.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price forecast 2024-25

Such outflows can often indicate accumulating behavior by investors, indicating possible preparation for a price rise as coins move from exchanges to private portfolios for long-term investment.

Despite these potentially bullish indicators, a note of caution remains from AMBCrypto, which reported a key Bitcoin measure signaling a potential further correction that could push prices as low as $54,000.