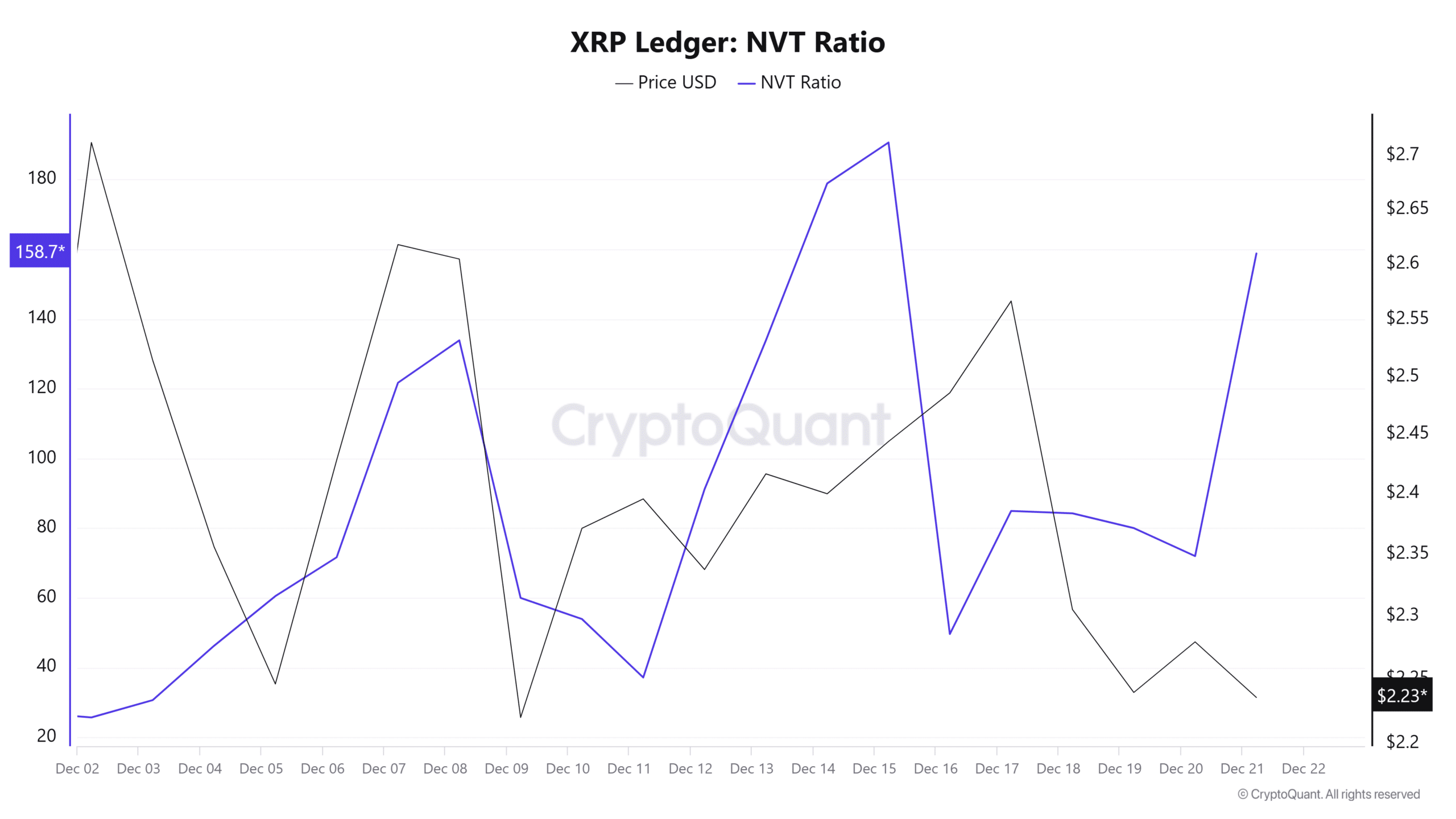

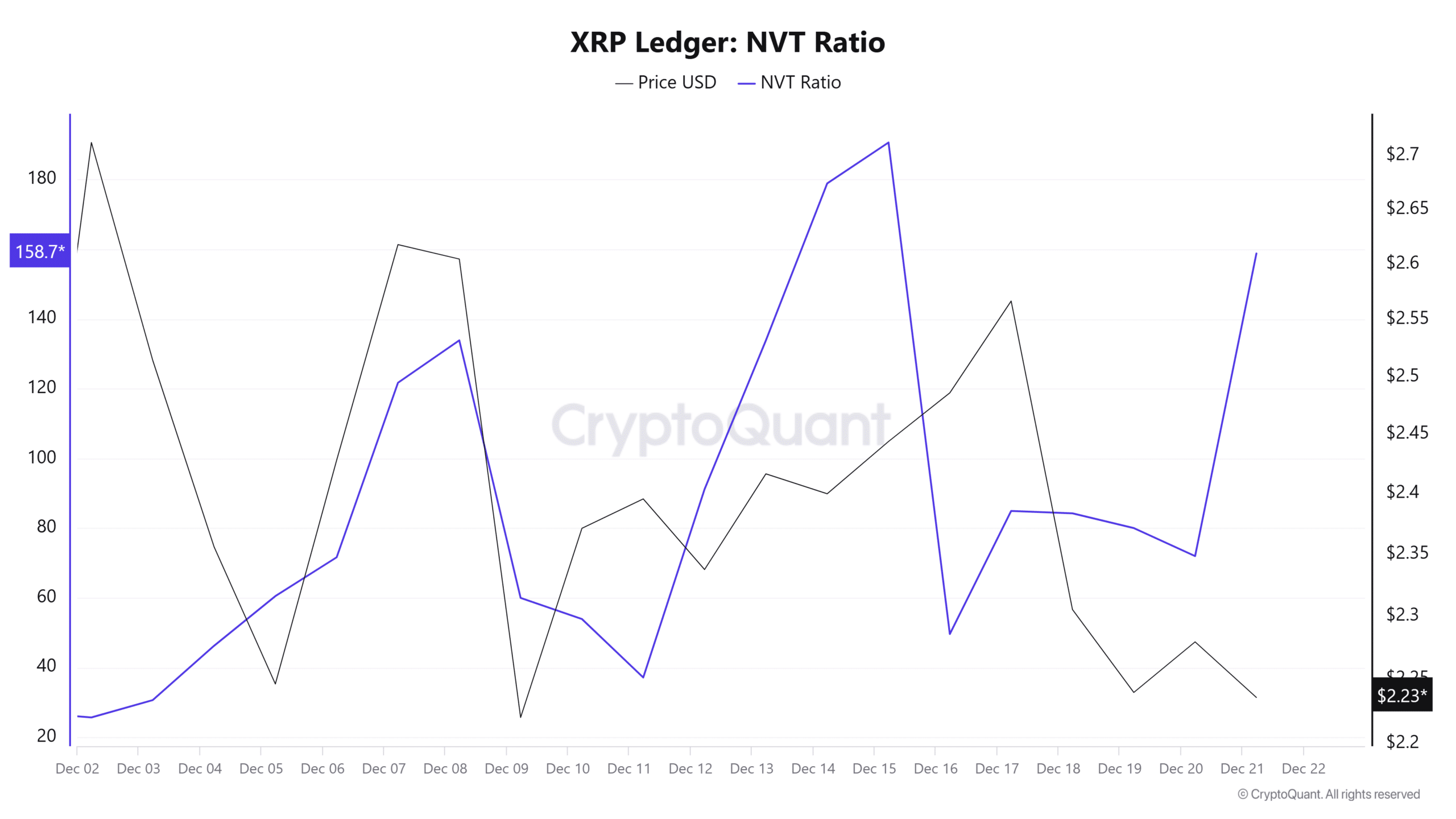

XRP’s NVT ratio indicates overvaluation

The Network Value to Transaction (NVT) ratio for XRP highlights a potential risk of overvaluation despite the recent rally. The metric compares the asset’s market capitalization to transaction volume and provides insight into whether the price is sustainable.

Source: Cryptoquant

XRP’s NVT ratio fluctuated widely in December, indicating instability. The current spike in the ratio reflects a discrepancy between the price of XRP and the underlying transaction activity on the network.

Although the price is $2.23, the high NVT ratio indicates that market capitalization growth is faster than that of network companies, which is a bearish sign. Unless transaction volumes catch up, XRP could face greater correction risks, testing the bullish momentum of recent weeks.

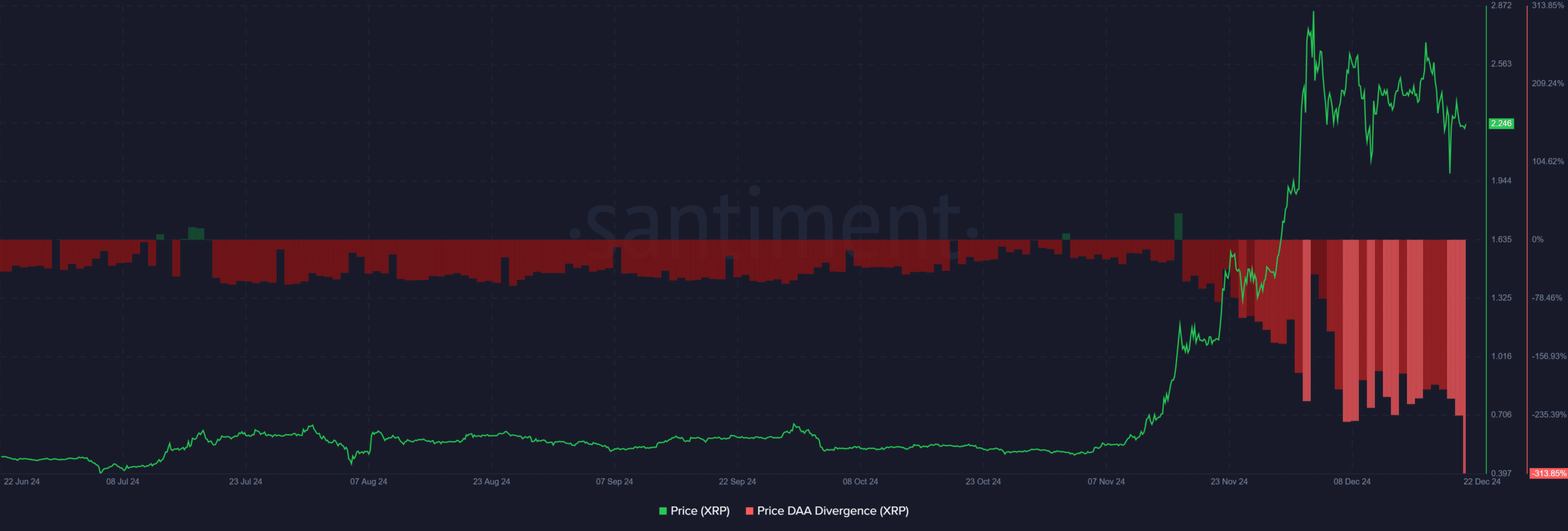

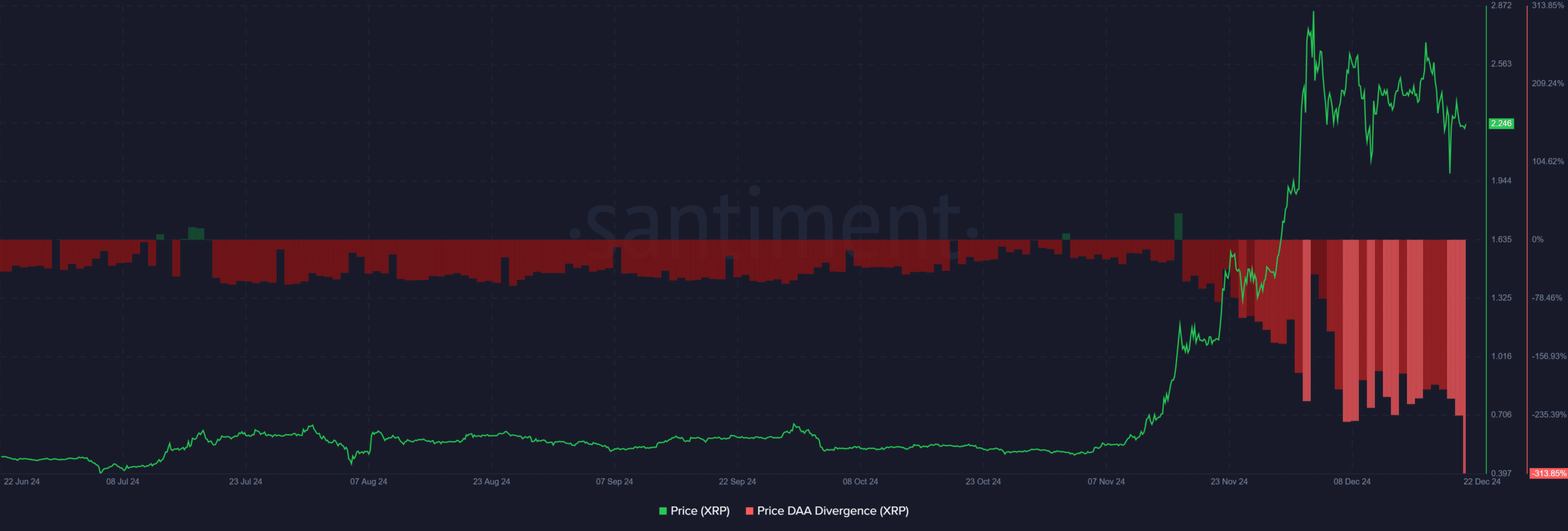

XRP: Reduced Network Activity?

The difference in Price-Daily Active Addresses (DAA) reveals a worrying trend for XRP’s rally. This metric assesses whether price movements align with users’ engagement on the network.

While the price of XRP rose to $2.23, the DAA divergence has plummeted by 326.13%. This sharp decline indicates a decline in the number of active XRP wallets interacting with the token.

Source: Santiment

Such a sharp difference suggests that the recent price spike is not supported by robust on-chain activity.

If user engagement remains low, it could undermine XRP’s bullish momentum and increase the risk of a significant price correction, putting pressure on the current rally.

Read XRP’s 2024-2025 Price Prediction