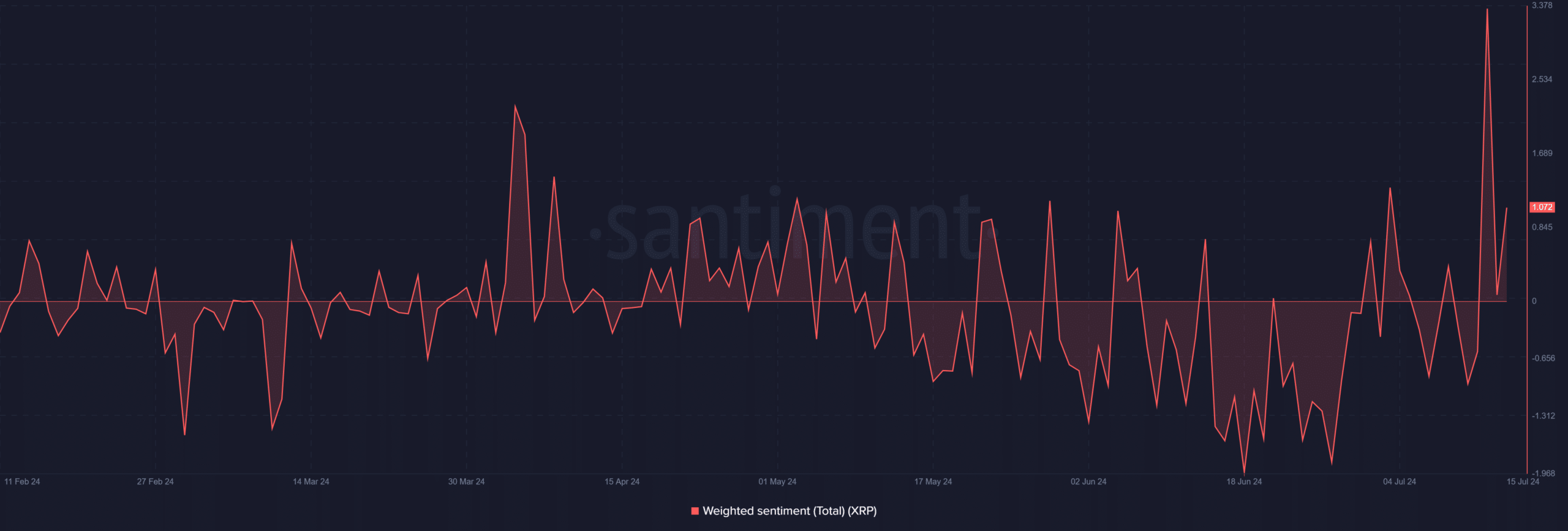

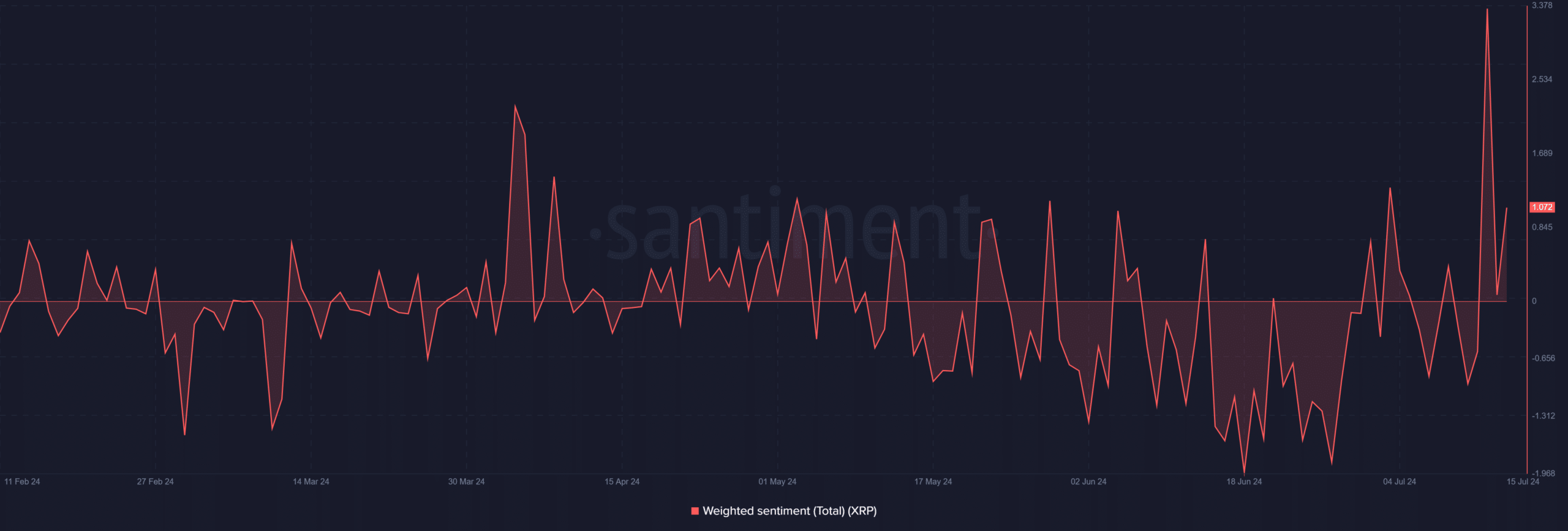

- XRP’s weighted sentiment remained above zero at the time of writing.

- The altcoin has continued its uptrend during the current trading session.

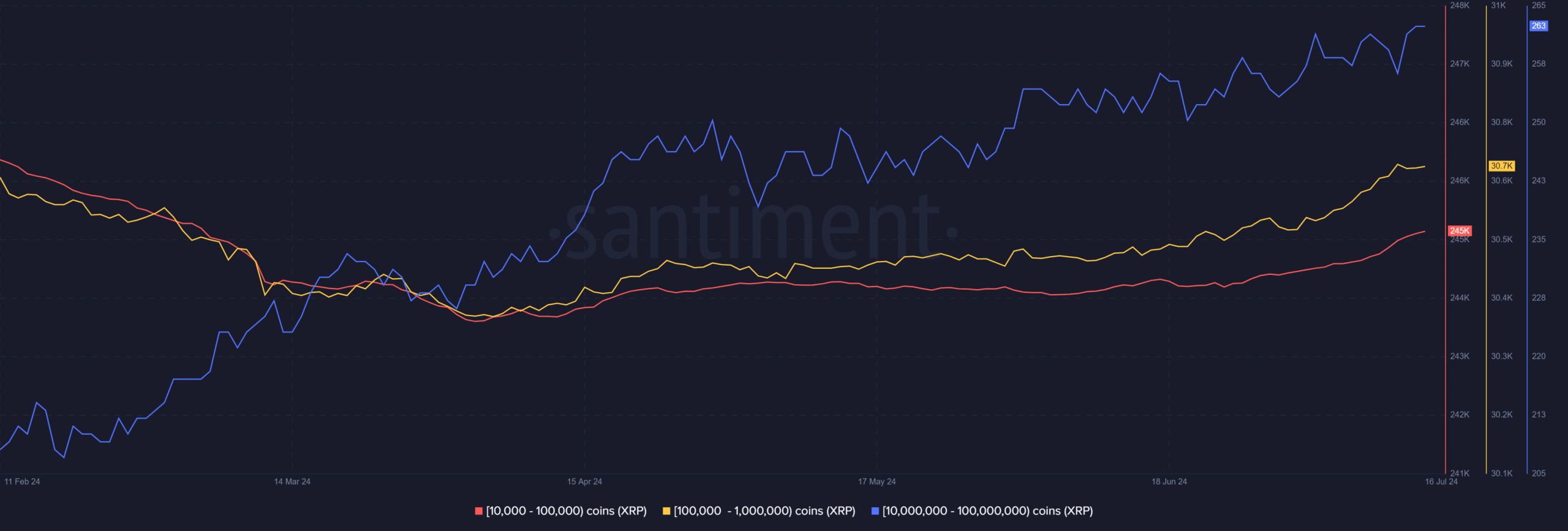

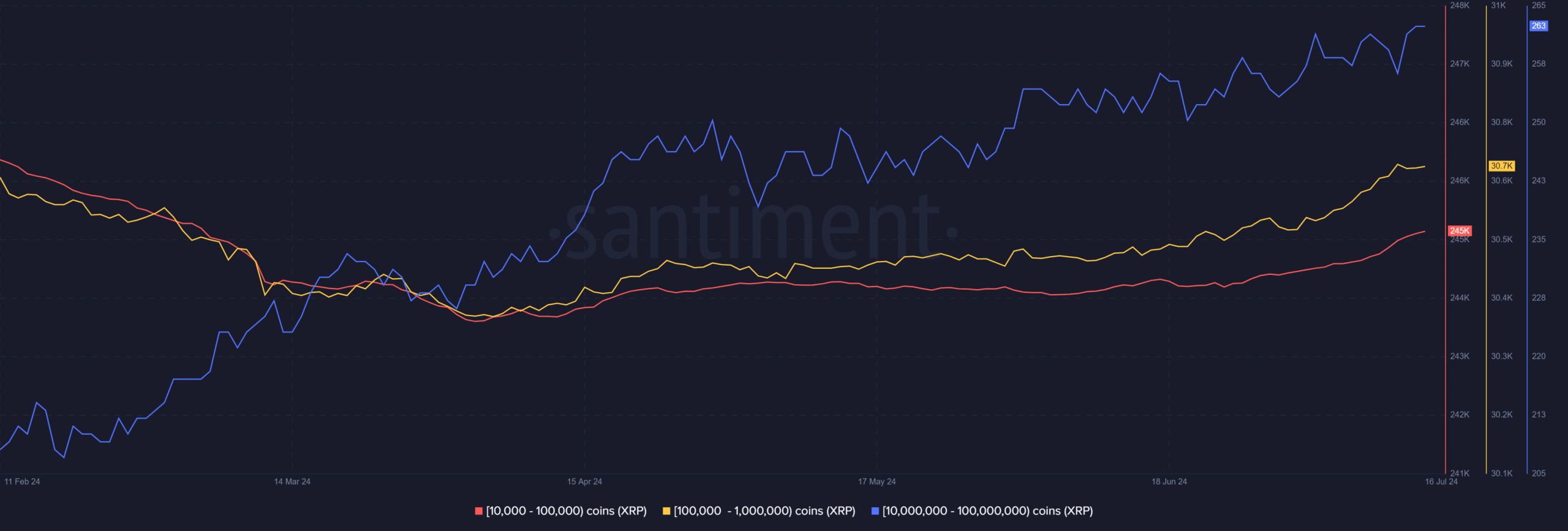

Ripple [XRP] has seen notable whale address accumulation activity in recent weeks, closely aligned with a positive trend in price and general market sentiment.

This correlation between whale activity and price trends is a key indicator of the current bullish sentiment surrounding XRP.

XRP sees whale accumulation

AMBCrypto’s analysis of Ripple’s portfolio activity indicated an increase in whaling activity, especially in recent weeks.

Notably, there has been an increase in the number of portfolios at different holding levels, indicating significant accumulation of XRP.

The number of wallets holding 10,000 to 100,000 XRP has increased slightly from approximately 244,000 to 245,000 at the time of writing.

While this increase seemed modest, it represented the acquisition of millions of XRP tokens, highlighting the significant activity at this level.

There was also an increase in the number of wallets by 100,000 to 1 million XRP, from approximately 30,600 to 30,700. This further indicated continued interest and investment from more substantial stakeholders.

Source: Santiment

The highest tier of holders, wallets holding 10 million to 100 million tokens, also showed growth, with the number of wallets increasing from 260 to 263.

This category, although smaller, represented the most substantial accumulations due to the large volumes of XRP they control.

Sentiment remains on the positive side

AMBcrypto’s look at Ripple’s Weighted Sentiment revealed a notable fluctuation in market sentiment. On July 13, there was a significant spike in weighted sentiment, reaching 3.34%.

This spike suggested a strong increase in positive sentiment towards the token.

However, at the time of writing, there has been a significant decline, with an average weighted sentiment of 1%. This decline indicated that while sentiment remained positive, it had cooled from its peak.

Source: Santiment

The initial spike to over 3% reflected a period when fear of missing out (FOMO) may have dominated market dynamics, causing more investors to buy into Ripple XRP in anticipation of continued gains.

XRP maintains a bull trend

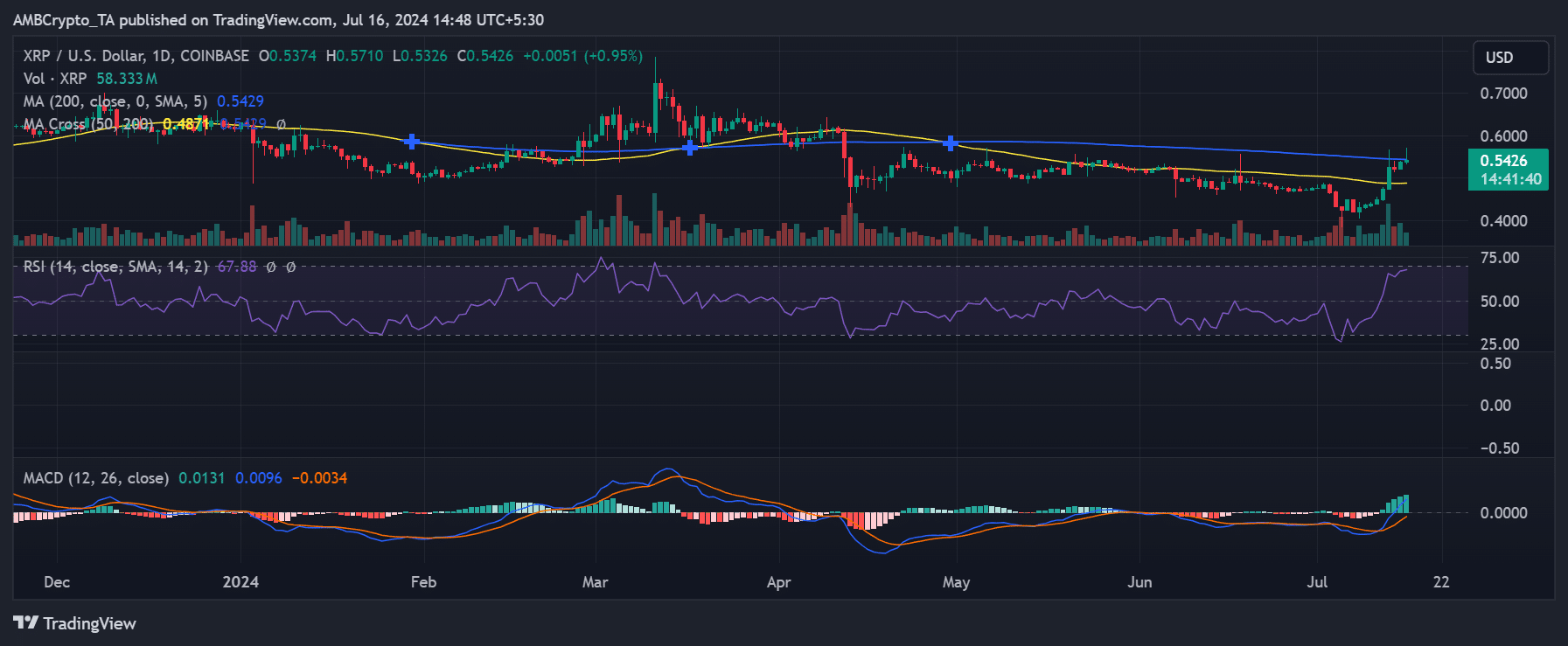

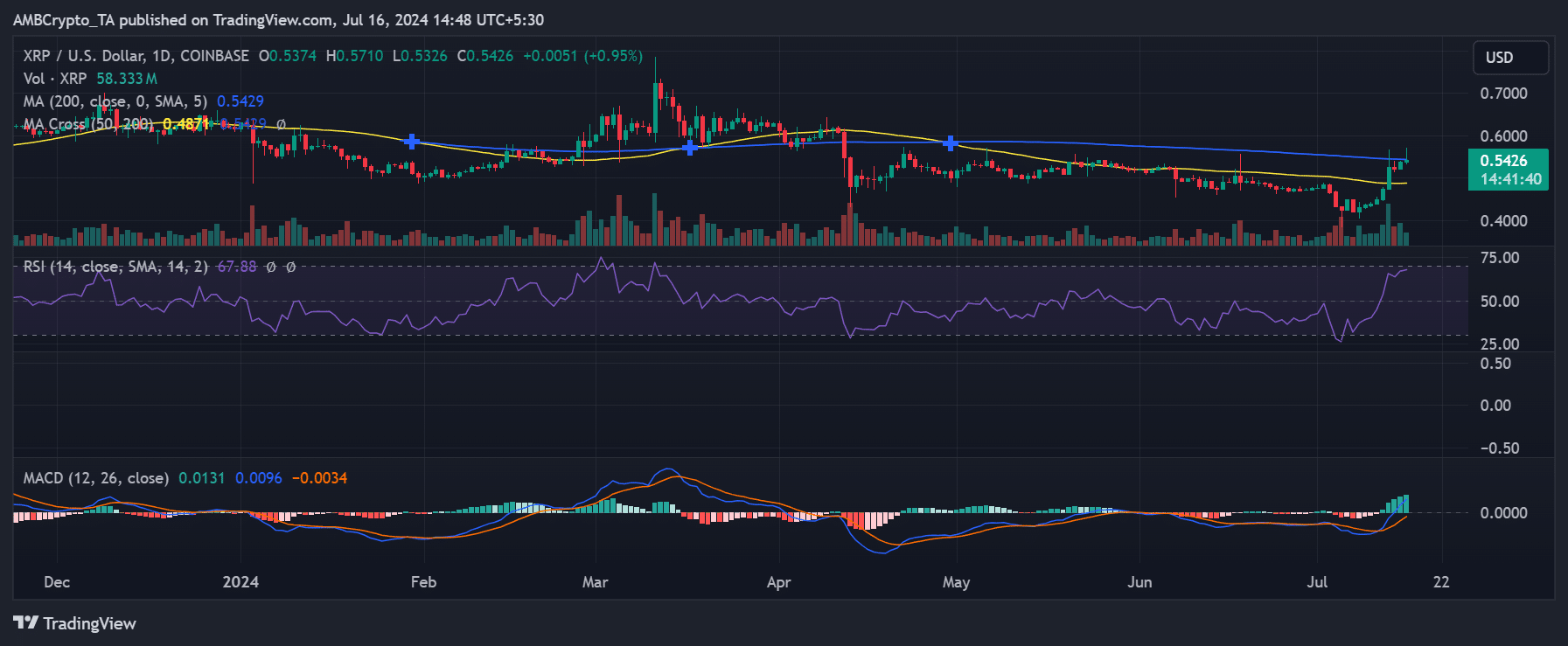

AMBCrypto’s examination of XRP on a daily time frame showed a strong bull trend.

At the end of trading on July 15, XRP ended the day at around $0.53, up over 3.3%. These gains represented a quick recovery from the more than 1% decline in an earlier session.

According to the latest data, it was trading at around $0.54, showing an increase in value of almost 1%.

Source: TradingView

Realistic or not, here is the XRP market cap in terms of BTC

Furthermore, the Relative Strength Index (RSI) for XRP approached 70, indicating that the asset was in a strong bullish trend. This suggested that the asset could be considered oversold.

However, in the context of market momentum and investor sentiment, this level often indicates strong buying activity, which could temporarily extend beyond normal limits before major corrections.