- XRP investors are cashing out, making the $3 level crucial.

- Now that the Trump pump is losing its magic, will the whales step in to save the day?

Ripple[XRP] doubled in value, with 72% of the recent move trending upward, increasing its market capitalization by 33%. Yet it is still down 8% from the peak of $194 billion as investors cash out.

With BTC missing a ‘Trump rally’ and caution high, where does XRP stand in the bigger picture?

XRP is at a crossroads

Just yesterday, Bitcoin[BTC] reached $109,000, an all-time high, as billions poured in. The crypto market cap rose to $3.71 trillion. Fast forward 24 hours – $502.51 million of longs have been wiped out and the market is down 6.2%. The optimism has quickly faded.

Altcoins were not spared, with high-caps losing key levels. But XRP remained strong at $3, down just 1.22% – significantly better than its value peers.

Lately, XRP has been overheating, with billions of tokens snapped up by whales since the post-election surge.

In fact, another $100 million was injected just before Donald Trump was sworn in. These major players hoped to recreate the historic wave when XRP broke through two major resistance levels.

But now the market is shifting. XRP is down 11% from its yearly high of $3.40. Big players face a difficult task: cash out or wait, risking the next big opportunity? All eyes are on them.

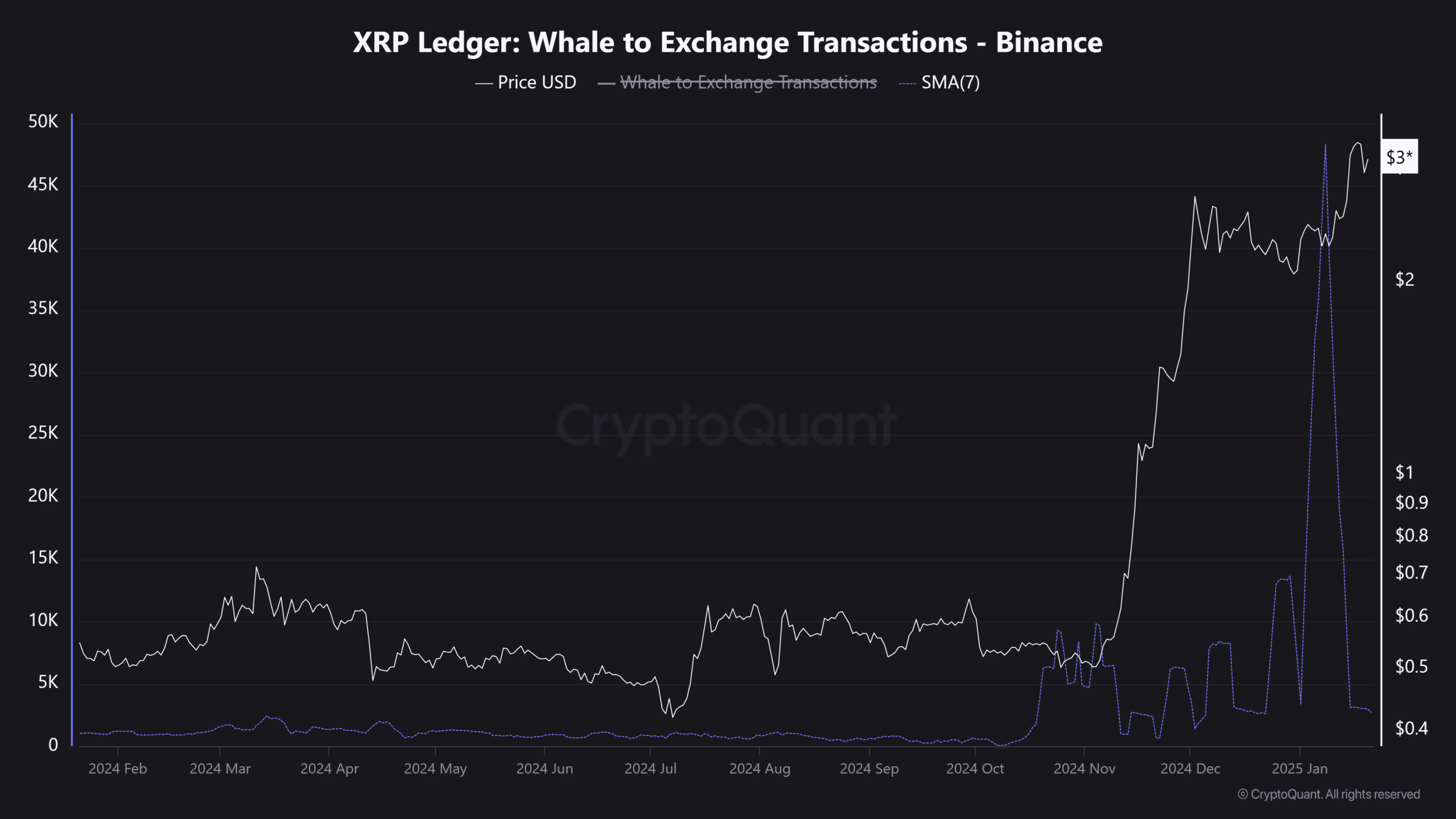

Source: CryptoQuant

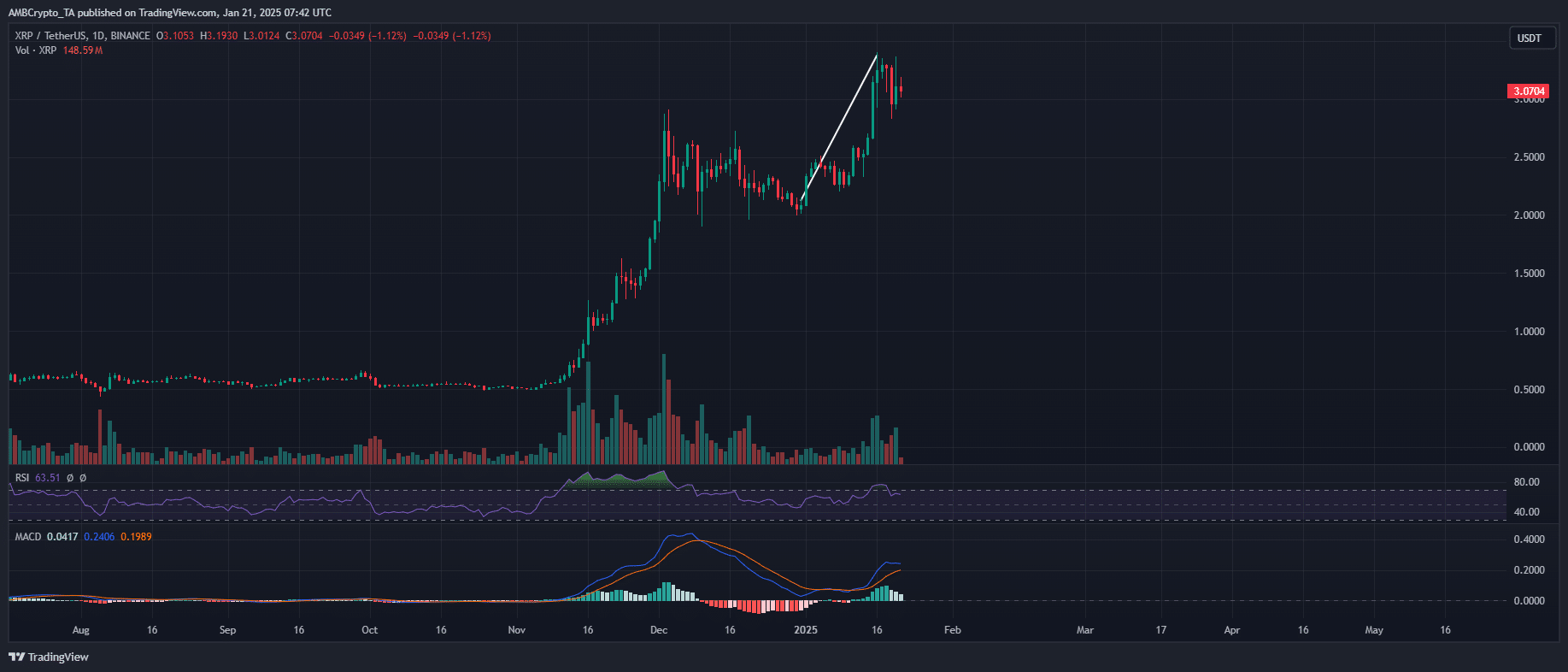

So far there hasn’t been a massive sell-off, but if XRP falls below $3, the risk of holding it could prompt investors to protect their margins. And it doesn’t get any better: the XRP/BTC pair is falling, while the MACD is about to turn around bearish.

Instead of waiting for a ‘dip’, investors act quickly: Binance has seen 270 million XRP flow in.

Now there are two options for a turnaround: either the broader market rebounds and restores confidence, or major players swoop in with their classic buy-the-dip move.

High risk, high reward gamble

Remember the second Fed clash? As the New Year’s buzz injected new capital, Bitcoin and altcoins rose.

After the collision, BTC fell from $102,000 to $91,000 in just three days. Meanwhile, XRP recovered with a rise of 6.53%.

Source: TradingView

As Bitcoin’s high-risk, high-reward appeal cools, XRP could be poised for a repeat rally or strong near-term consolidation. Whales may be watching the market, ready to trigger a buying frenzy in the coming days.

Realistic or not, here is the XRP market cap in terms of BTC

Meanwhile, Open Interest (OI) on the futures market has done just that decreased more than 4%.

It is clear that longs are either anticipating a correction or have been forced to close their positions. This pressure could be a way for the market to clear the air for new capital inflows.

The big question now is: will the market see a massive accumulation? If this happens, XRP could rise towards $3.50. With history on its side, this is a real possibility, but the coming days will be critical in shaping this move.