- The price of XRP has fallen by almost 10% in the past week.

- It is now trading below the 20-day EMA.

Ripple [XRP] The price has gone down in the past week. Valued at $0.5 at the time of writing, the token’s value has fallen 8% in the last seven days. CoinMarketCaps facts.

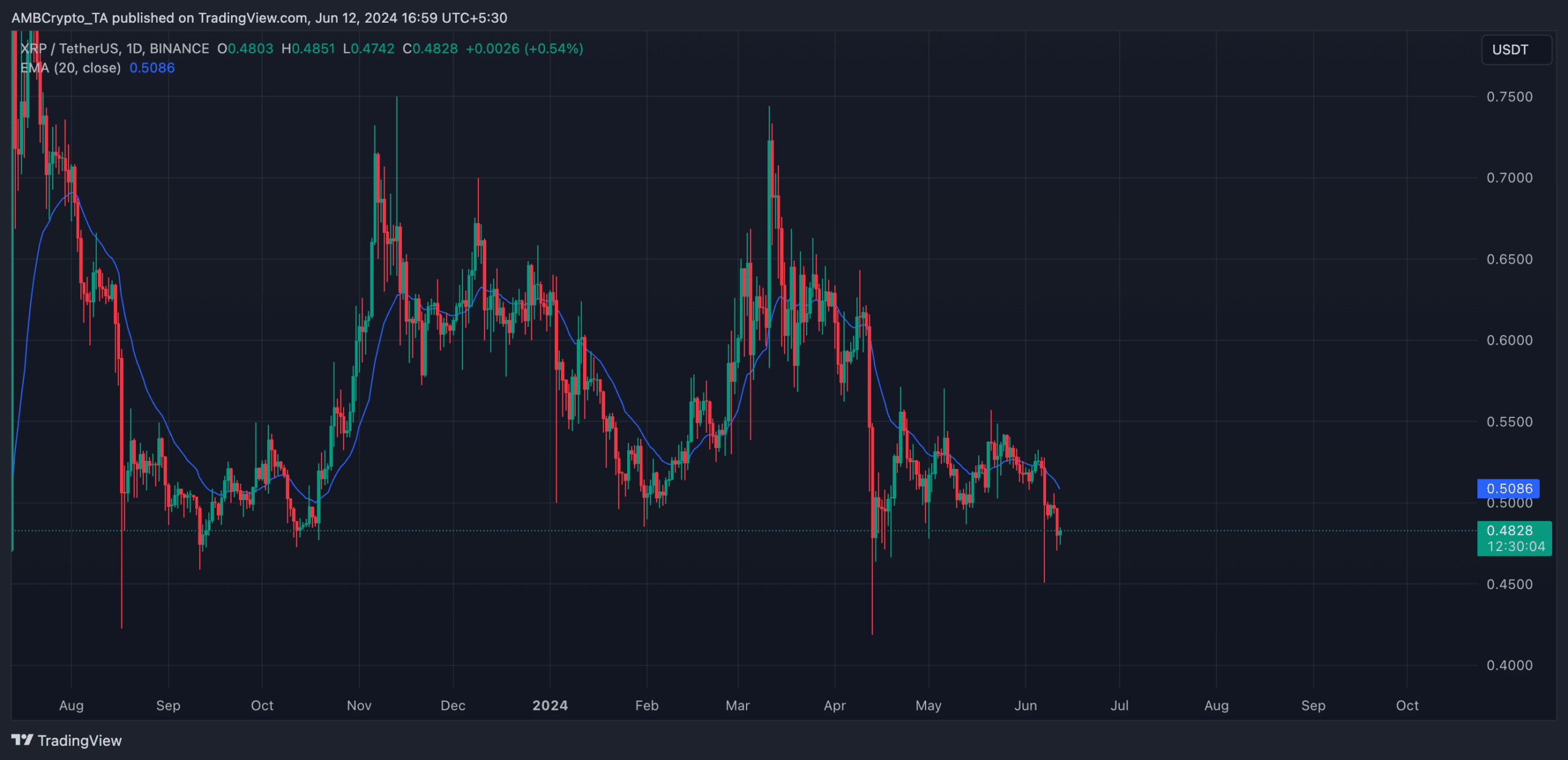

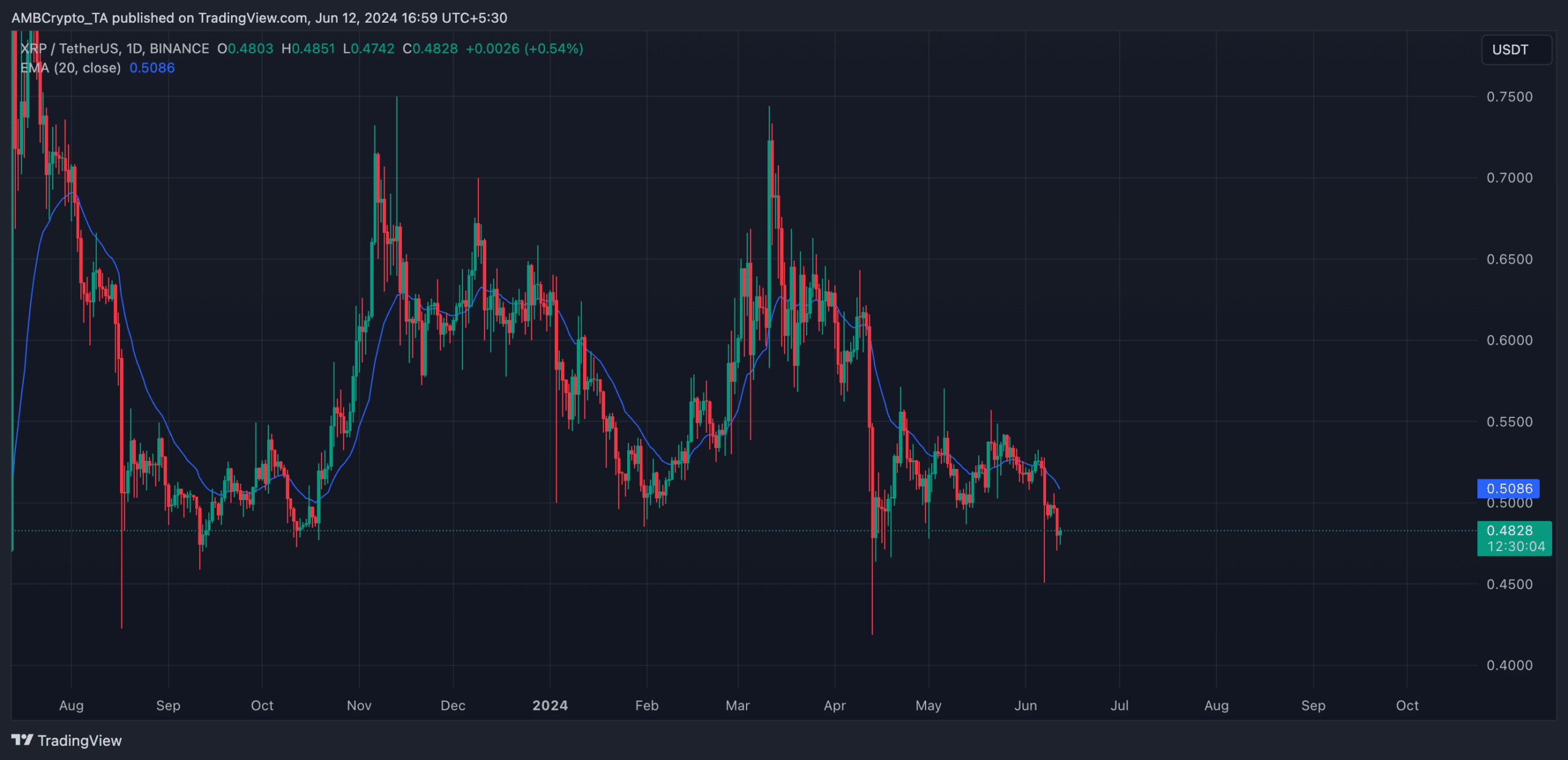

AMBCrypto found that this drop caused the price to fall below the 20-day Exponential Moving Average (EMA) on June 7. This main moving average represents the average price of XRP over the past 20 days.

Source: TradingView

When the price of an asset falls below this level, it will trade at a level lower than the average price of the last 20 days. It indicates a decrease in buying pressure and an increase in the token sell-off. It signals a shift in sentiment from bullish to bearish.

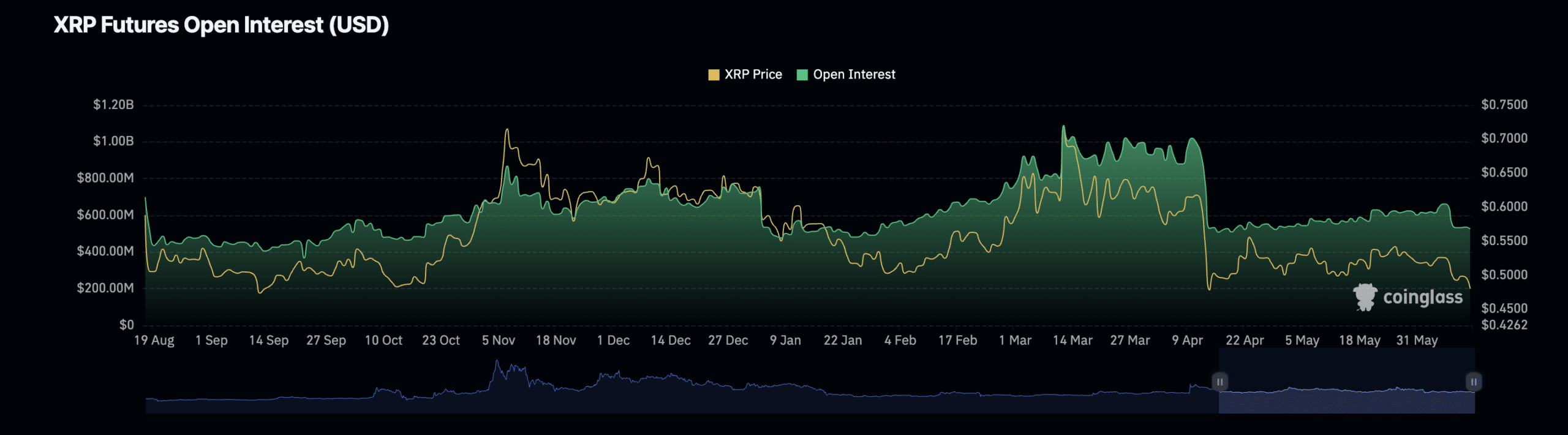

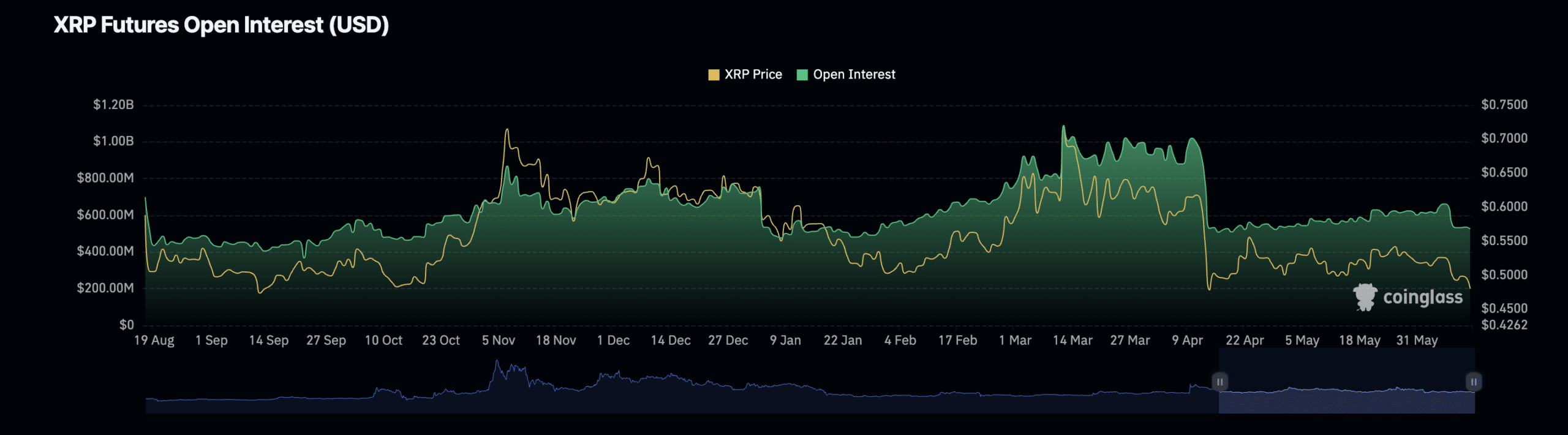

The declining open interest on XRP futures confirms this. At the time of writing, the token’s open interest stood at $525.57 million, down 20% since June 6, according to Mint glass facts.

Source: Coinglass

XRP’s open futures interest tracks outstanding futures contracts or positions that have not yet been closed or settled.

When the price falls in this way, it indicates a spike in the number of market participants leaving the market without opening new positions.

XRP sales momentum is skyrocketing

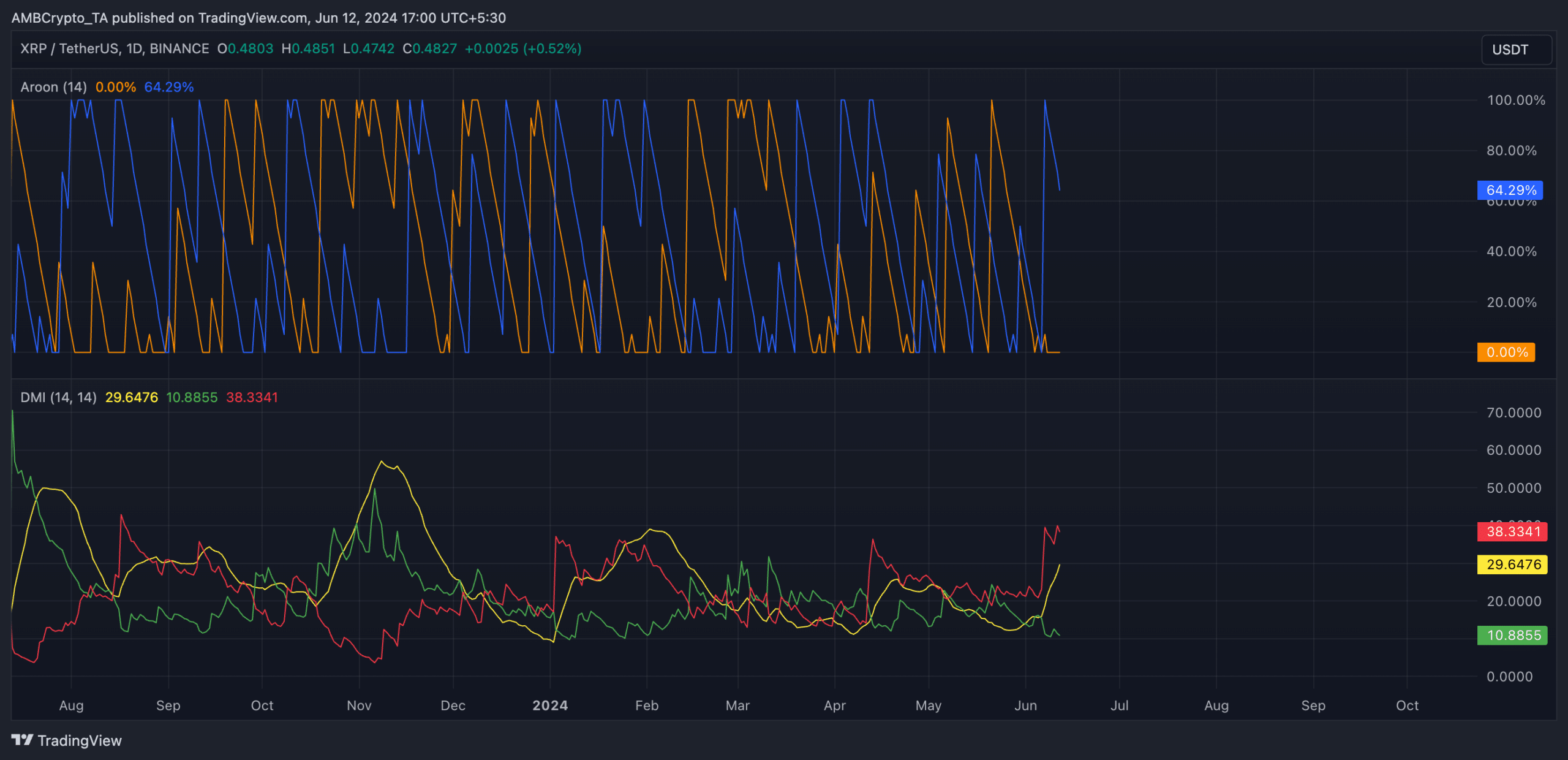

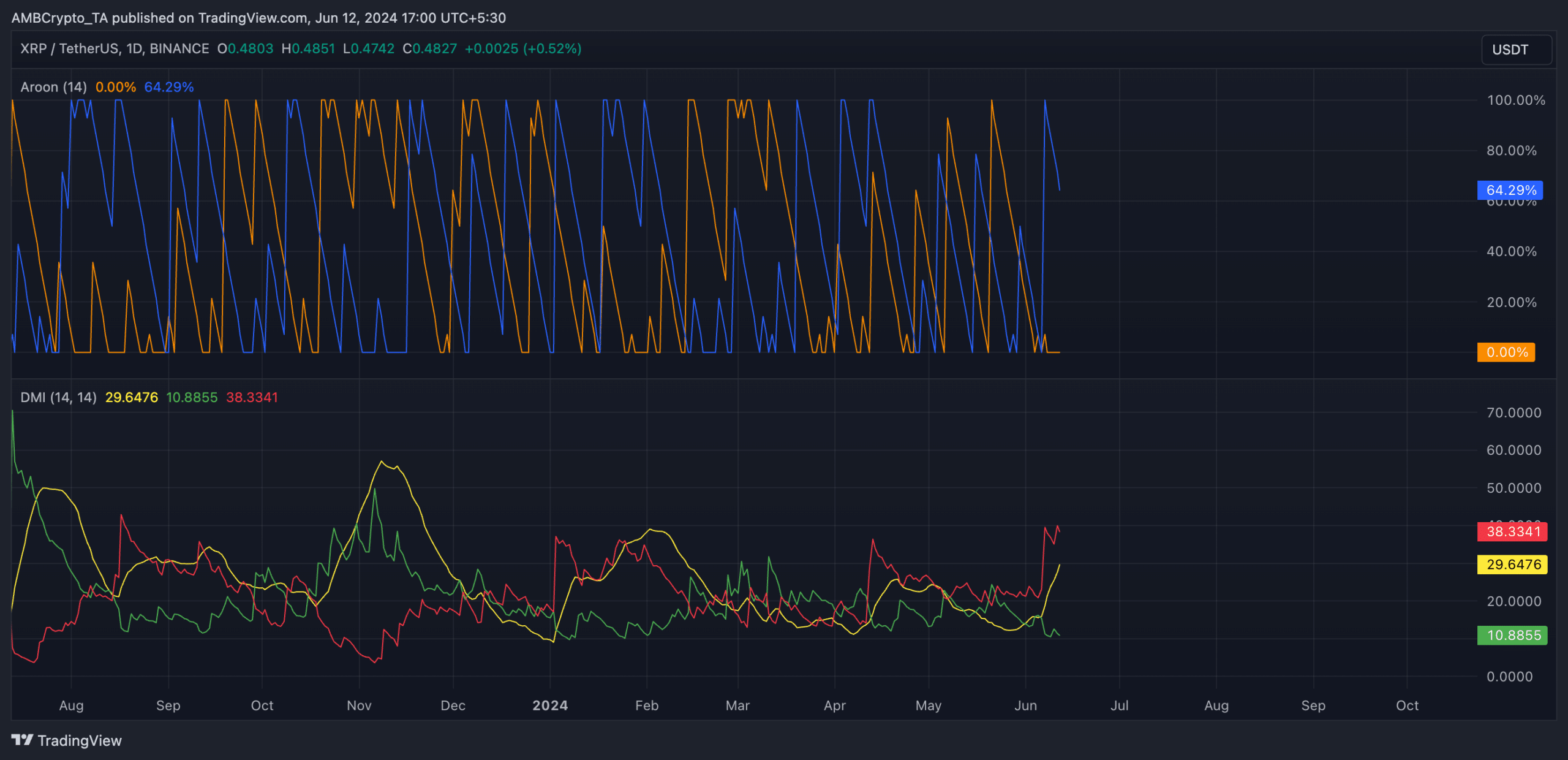

XRP’s Aroon Down Line (blue) was 64% at the time of writing, confirming the strength of the current downtrend.

The indicator identifies an asset’s trend strength and potential price reversal points. When the downline approaches 100%, it indicates that the downtrend is strong and that the most recent low has been reached relatively recently.

Furthermore, XRP’s key momentum indicators rested below their respective neutral lines at the time of writing. The token’s Relative Strength Index (RSI) was 35.12, while the Money Flow Index (MFI) was 37.87.

At these values, the momentum indicators showed that XRP traders favored selling off over accumulating new tokens.

Furthermore, according to XRP’s Directional Index (DMI), the positive directional index (green) was below the negative index (red) at the time of writing.

Realistic or not, here is the market cap of XRP in BTC terms

Source: TradingView

An asset’s DMI measures the strength and direction of a market trend.

When the positive index falls below the negative index, it confirms that the market is in a downtrend, with selling pressure greater than buying pressure.