- XRP’s RSI has been in the overbought zone for the past seven days.

- The price remained above $1.

XRP, Ripple’s native token, is rocketing to new heights, with its price action reflecting strong bullish momentum.

The recent accumulation of whales, coupled with robust technical indicators on the daily chart, indicated continued upward movement.

XRP rockets with wwhole activity

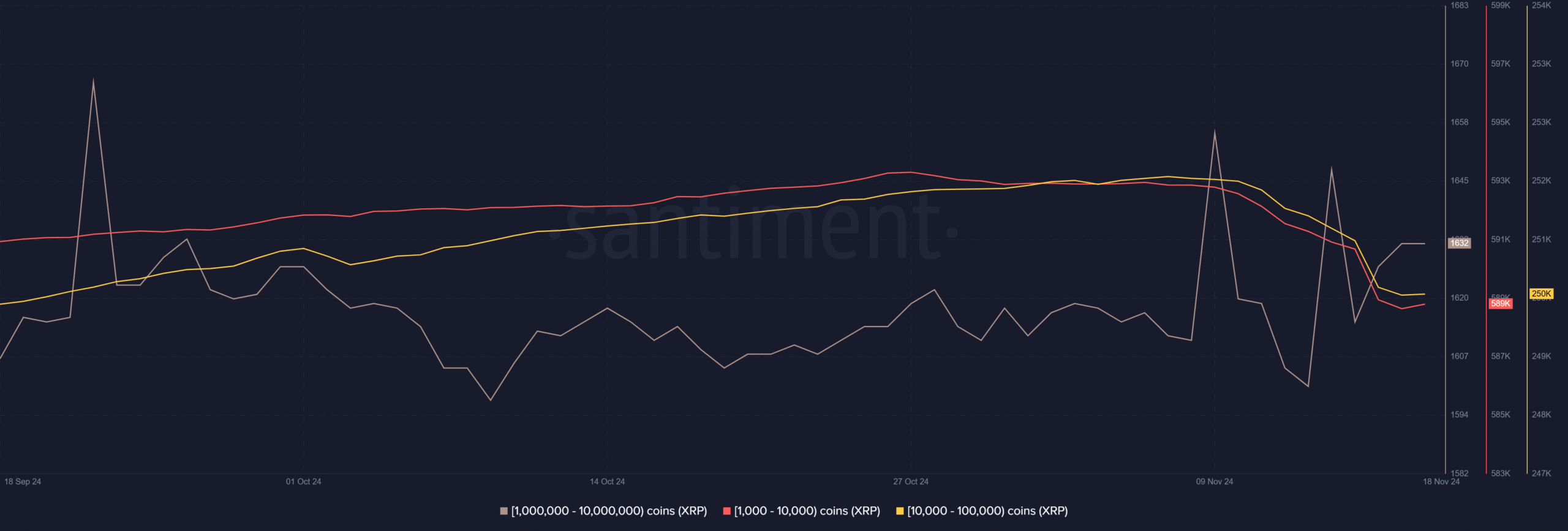

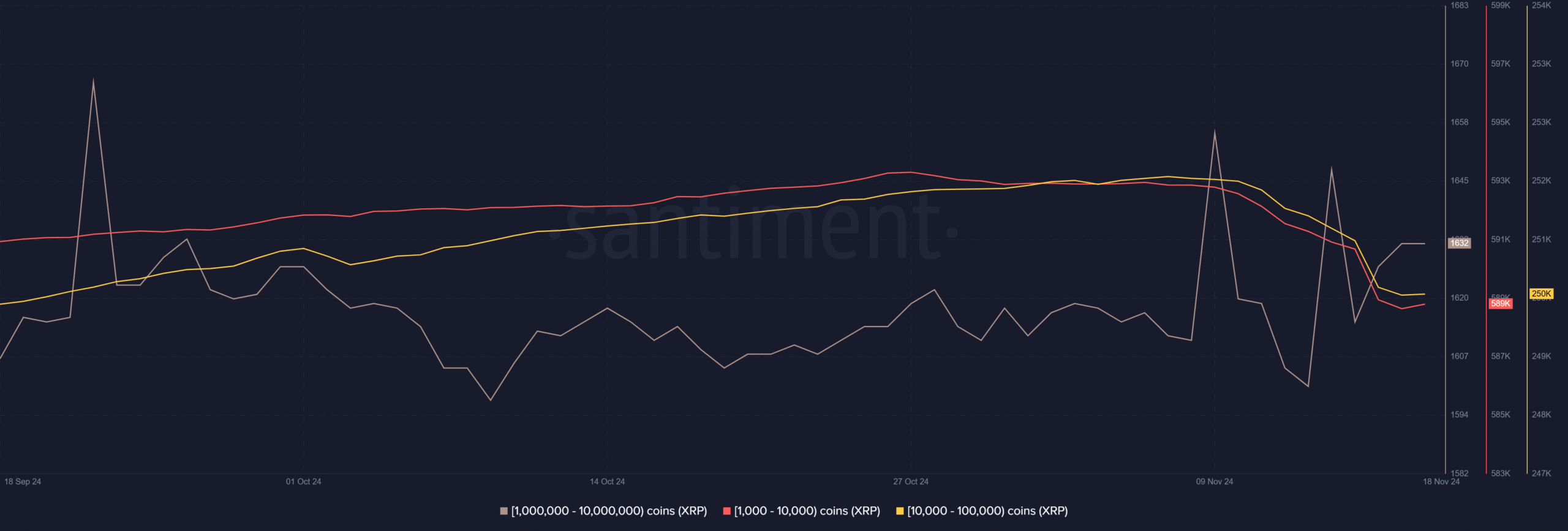

Recent data from Santiment highlighted a significant increase in whale accumulation within the XRP ecosystem.

Large wallets holding between 1,000,000 and 10,000,000 XRPs have steadily increased their holdings, and smaller investors, holding between 10,000 and 100,000, have followed suit.

This synchronized accumulation trend underlined growing market confidence in the long-term potential of coins.

Source: Santiment

The influx of whale activity has directly translated into the price increase of XRP.

The token was trading at $1.15 at the time of writing, up significantly in recent sessions, with increased on-chain activity indicating strong institutional interest.

Such behavior often precedes substantial price increases, further strengthening XRP’s bullish outlook.

There are plenty of bullish signals

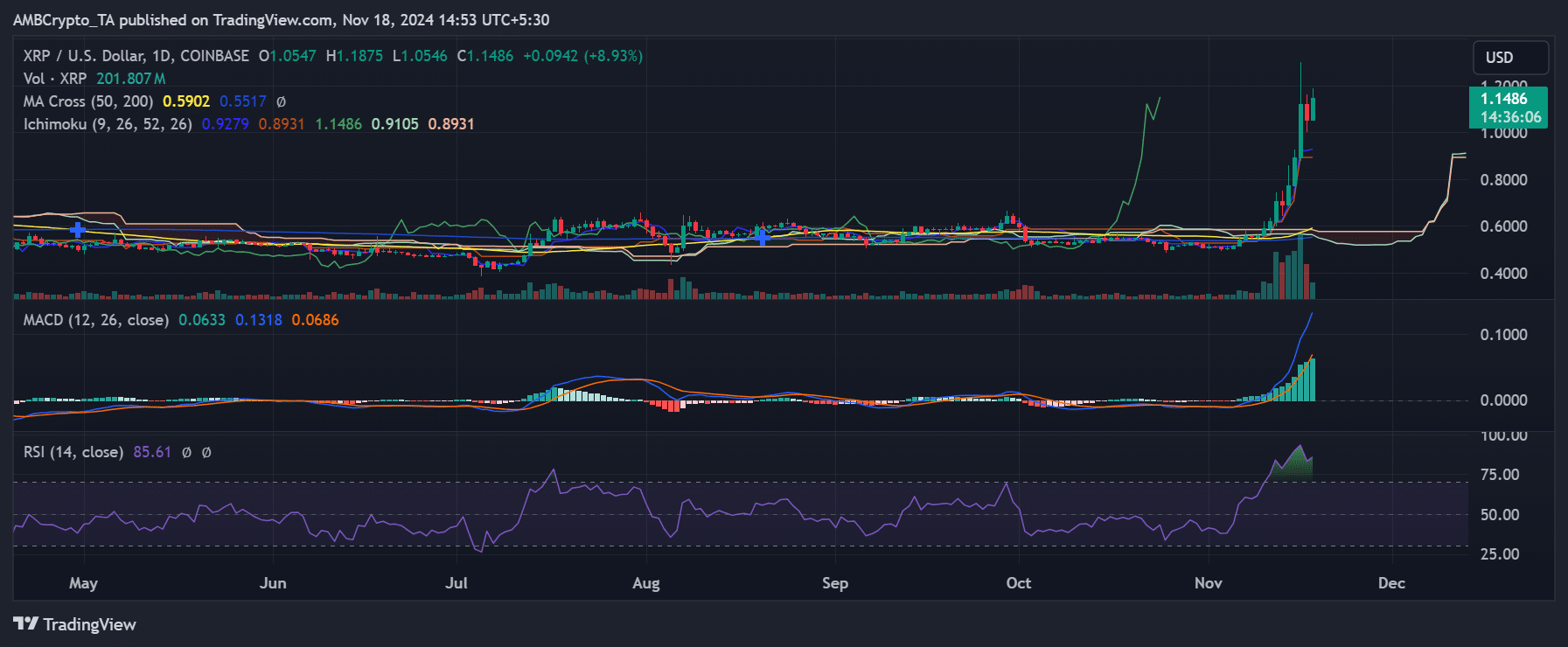

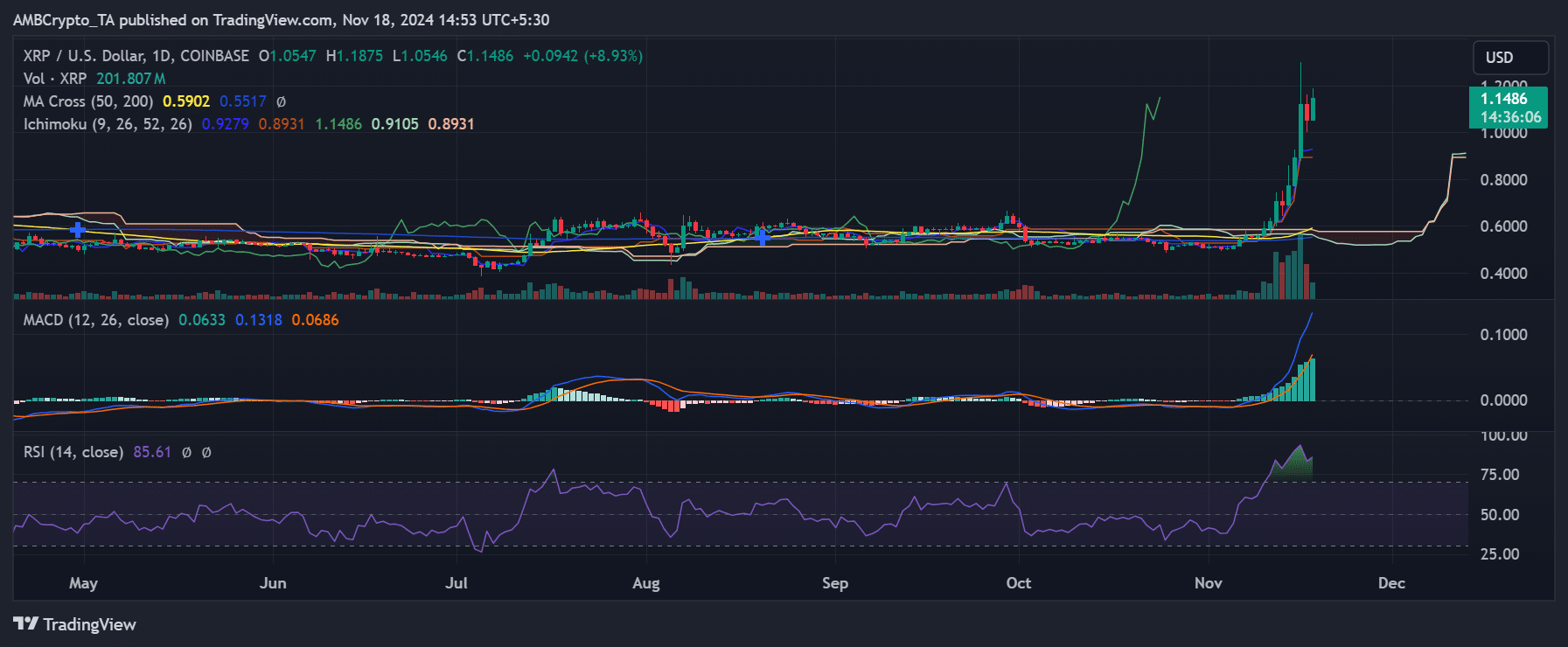

XRP’s daily chart revealed bullish technical indicators supporting its upward trajectory. The price has decisively broken the key resistance levels.

At the time of writing, the price was trading well above the Ichimoku Cloud, a sign of continued bullish momentum. The upward slope of the cloud further amplified the strength of the ongoing rally.

A golden cross between the 50-day and 200-day SMAs was imminent – a historically bullish signal indicating further upside potential.

The MACD indicator on the daily chart continued to grow into positive territory, with the MACD line significantly above the signal line, indicating strong upward momentum.

Source: TradingView

Meanwhile, the RSI stood at 85.61 at the time of writing, firmly in overbought territory.

While this indicates strong buying pressure, caution is also warranted as overbought situations can sometimes precede a short-term pullback. Nevertheless, the broader trend remains decidedly bullish.

Important levels to watch

XRP’s next immediate resistance was at $1.20, a crucial psychological and technical level. Breaking this threshold could pave the way for a rally towards $1.50, where profit-taking could intensify.

On the other hand, $1.00 served as strong support, reinforced by the 50-day moving average.

Moreover, trading volume, which increased significantly, indicated strong market participation.

This increase in volume aligned with the broader market’s positive sentiment, indicating that XRP’s rally was supported by real buying interest rather than speculative hype.

Read Ripple’s [XRP] Price forecast 2024-25

XRP’s rally shows the token’s growing market power, boosted by whale accumulation and compelling technical patterns.

While short-term corrections are possible, given the overbought RSI, the overall trend remains firmly up, showing that the XRP rockets are still firing.