- Ripple is nearing a resolution to the SEC lawsuit, indicating a bullish future for XRP and an ETF launch in 2025.

- Whales are buying $84 million worth of XRP, boosting confidence as technical indicators show bullish momentum.

Recent developments, both indoors Ripple and the broader regulatory environment suggest that XRP could be preparing for a significant price increase.

From the progress in Ripple’s legal battle with the SEC to the possibility of launching an XRP ETFThere are several indicators that point to a bullish future for XRP.

Meanwhile, Ripple CEO Brad Garlinghouse shared updates on the ongoing SEC lawsuit in a interview with Bloomberg.

Ripple has spent more than $150 million on lawsuits, trying to resolve the legal dispute over XRP’s classification.

Garlinghouse indicated that a private meeting with the SEC on July 25 could potentially settle the matter. Judge Analisa Torres has ruled that XRP is not a security for sale on the secondary market or through exchange platforms, supporting Ripple’s position.

Garlinghouse emphasized the need for regulatory clarity and held SEC Chairman Gary Gensler accountable for the ongoing uncertainty. Although he could not comment directly on a possible settlement, Garlinghouse suggested:

“We can expect a solution soon.”

This statement has sparked optimism among XRP proponents and may have impacted market sentiment and future price movements.

Outlook of an ETF

In an interview with Fox Business, Garlinghouse hinted about the possibility of an XRP ETF launching in the US by 2025. The CEO’s comments have fueled speculation and excitement within the crypto community.

The prospect of an XRP ETF is seen as a positive development, potentially leading to greater institutional interest and investment.

The approval of Bitcoin ETFs by the SEC earlier this year led to a substantial price increase for Bitcoin. Many believe a similar outcome could occur for XRP if an ETF is launched.

The prospect of an XRP ETF adds another layer of optimism for XRP’s future price performance.

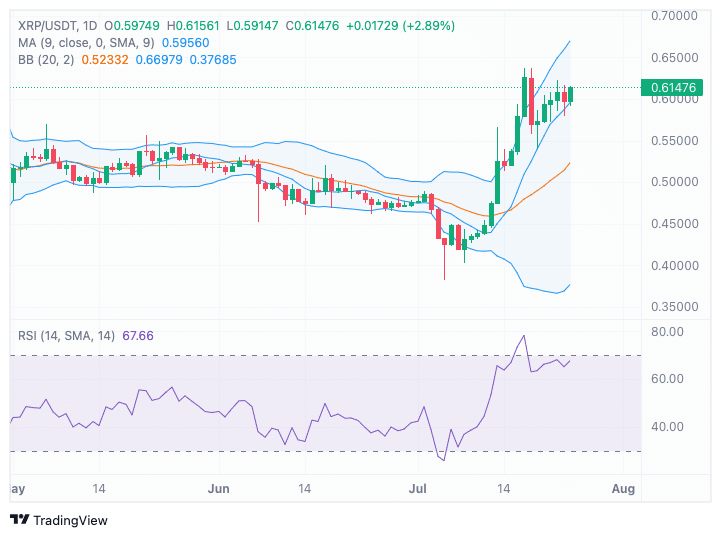

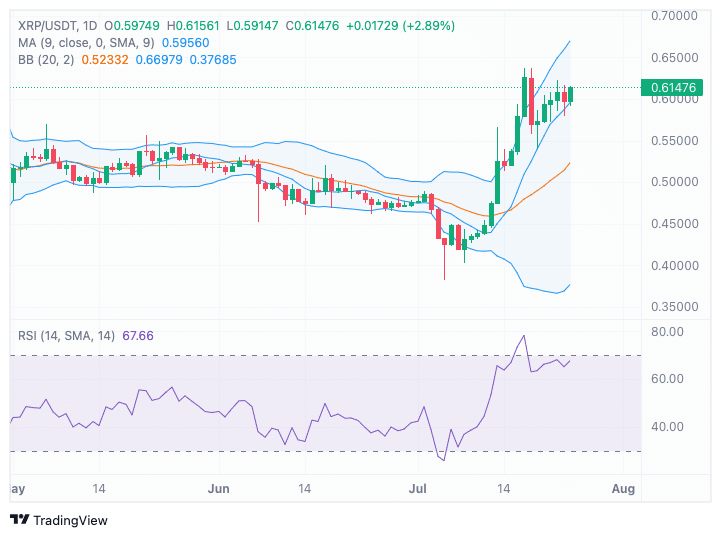

At the time of writing, XRP was trading at $0.6131, with a 24-hour trading volume of $1,812,382,624. This represents an increase of 1.75% in the last 24 hours.

Technical indicators show the 9-day moving average (MA) at 0.59560, indicating continued upward momentum. The Bollinger Bands indicate increased volatility, with the price recently peaking around 0.65 before consolidating around 0.61.

Source: TradingView

The Relative Strength Index stood at 67.66 and was approaching overbought, but not yet at an extreme level. This indicates strong bullish momentum, with room for further upward movement.

Monitoring the RSI and support levels is essential to anticipating possible price corrections or reversals.

Whales Make $84 Million in XRP

Recent data from the crypto community shows significant whale activity, with over 140 million XRP, worth approximately $84 million, purchased in the past week. according to to Ali.

This substantial accumulation by large investors suggests confidence in XRP’s potential for future profits.

Realistic or not, here is the XRP market cap in terms of BTC

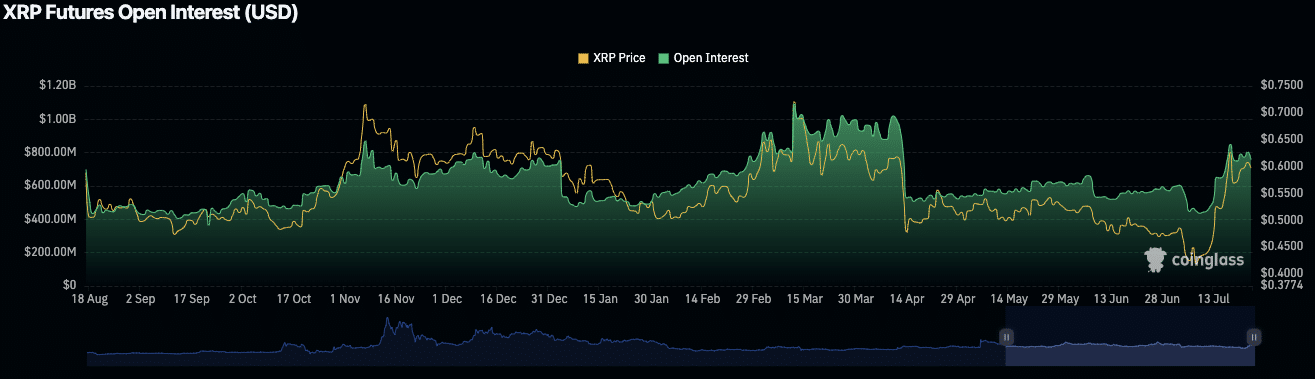

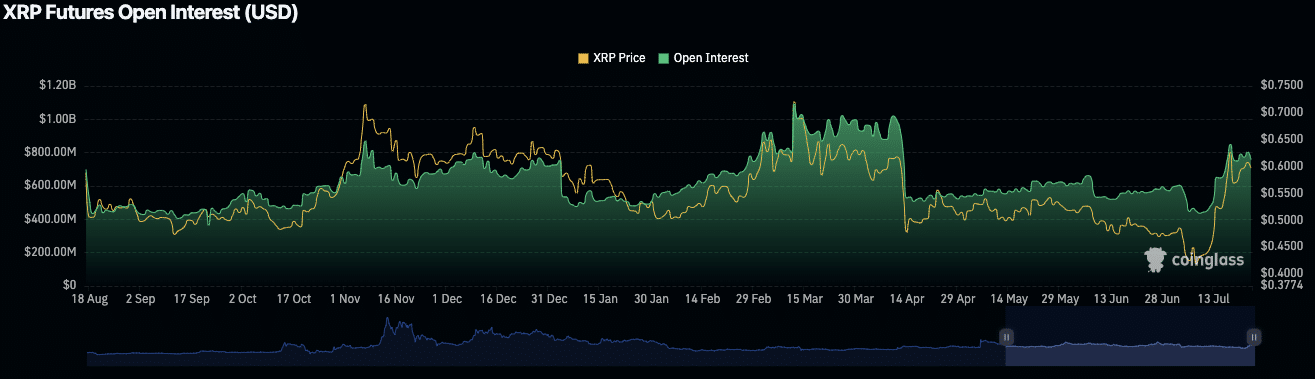

Additionally, open interest on XRP futures currently stands at $793.29 million, down slightly by 0.50%. Options volume stands at $584.98 million, reflecting a decline of 46.56%, indicating reduced trading activity or investor interest.

Source: Coinglass

Historically, open interest has shown notable peaks around mid-November and early April, which have correlated with significant price movements.