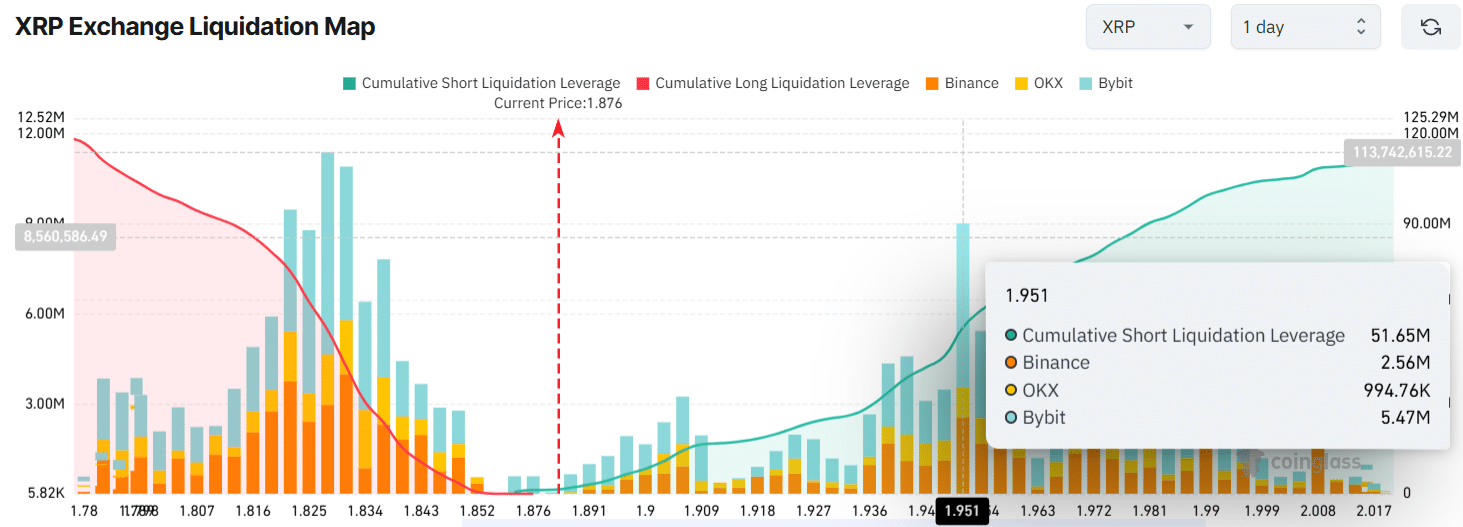

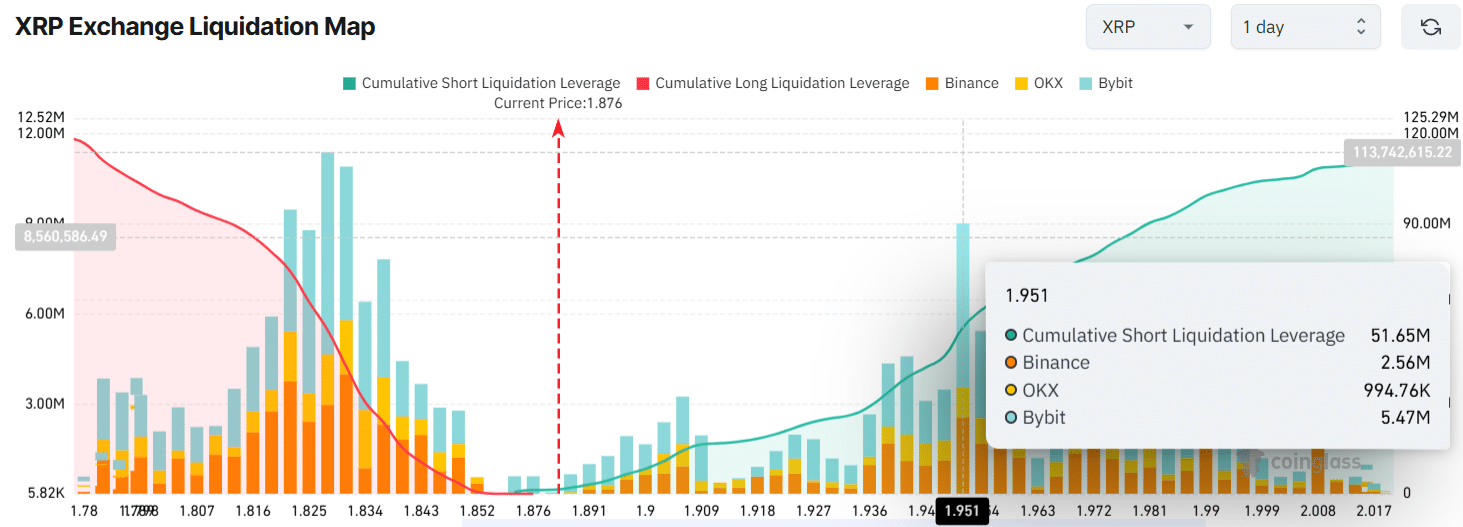

- Traders are excess at $ 1,828 at the bottom (support) and $ 1,951 at the top (resistance).

- Short positions worth $ 51.65 million were built at the level of $ 1,951 in the hope that the price will not be above this resistance.

XRP, Ripple’s native token, seems ready to continue his downward momentum in the coming days.

The current market sentiment is strong Bearish, and the current tariff wars, which do not show any signs of finish, push the market further down.

Current price momentum

At the time of the press, XRP traded nearly $ 1.85 and had registered a price die of 6.50% in the last 24 hours.

In the same period, the trade volume of the active fell by 10%, which indicates lower participation of traders and investors compared to previous days.

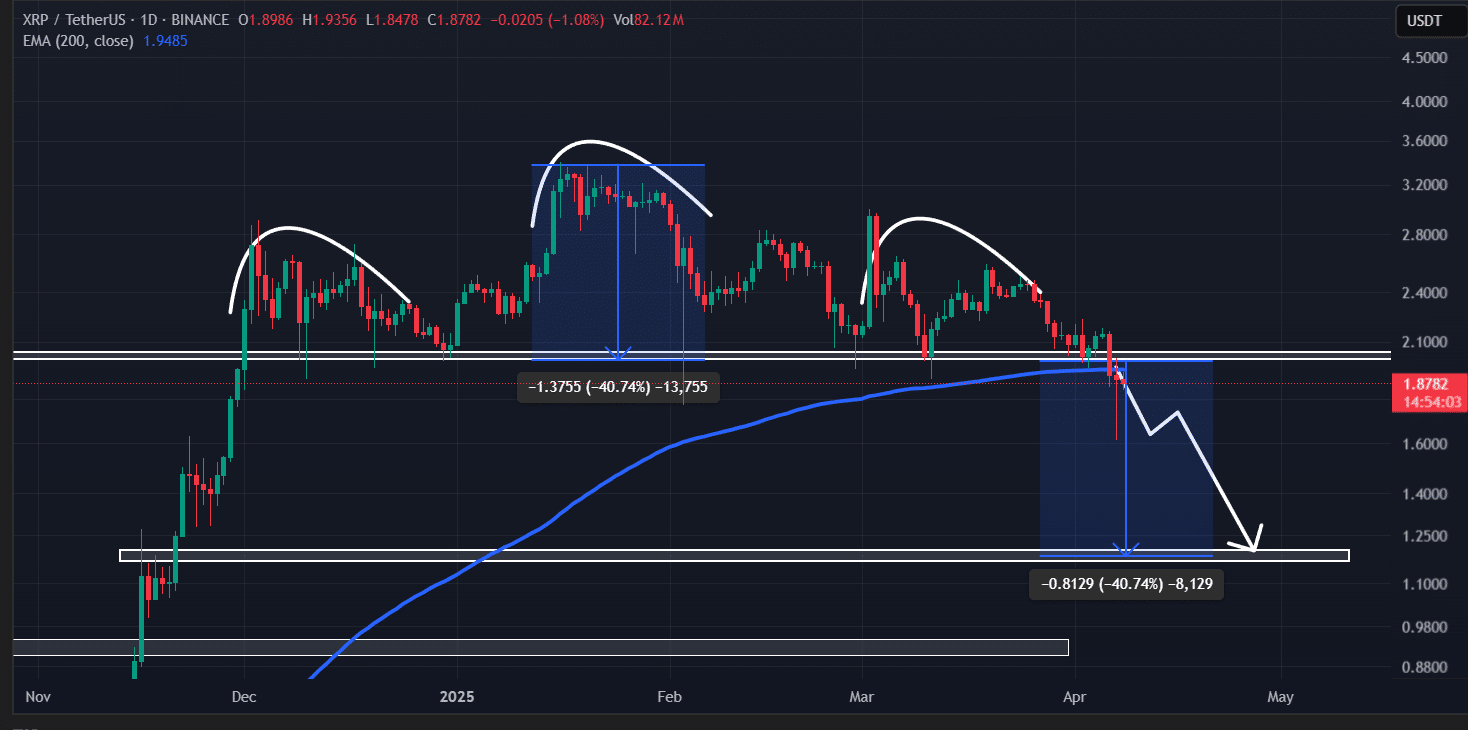

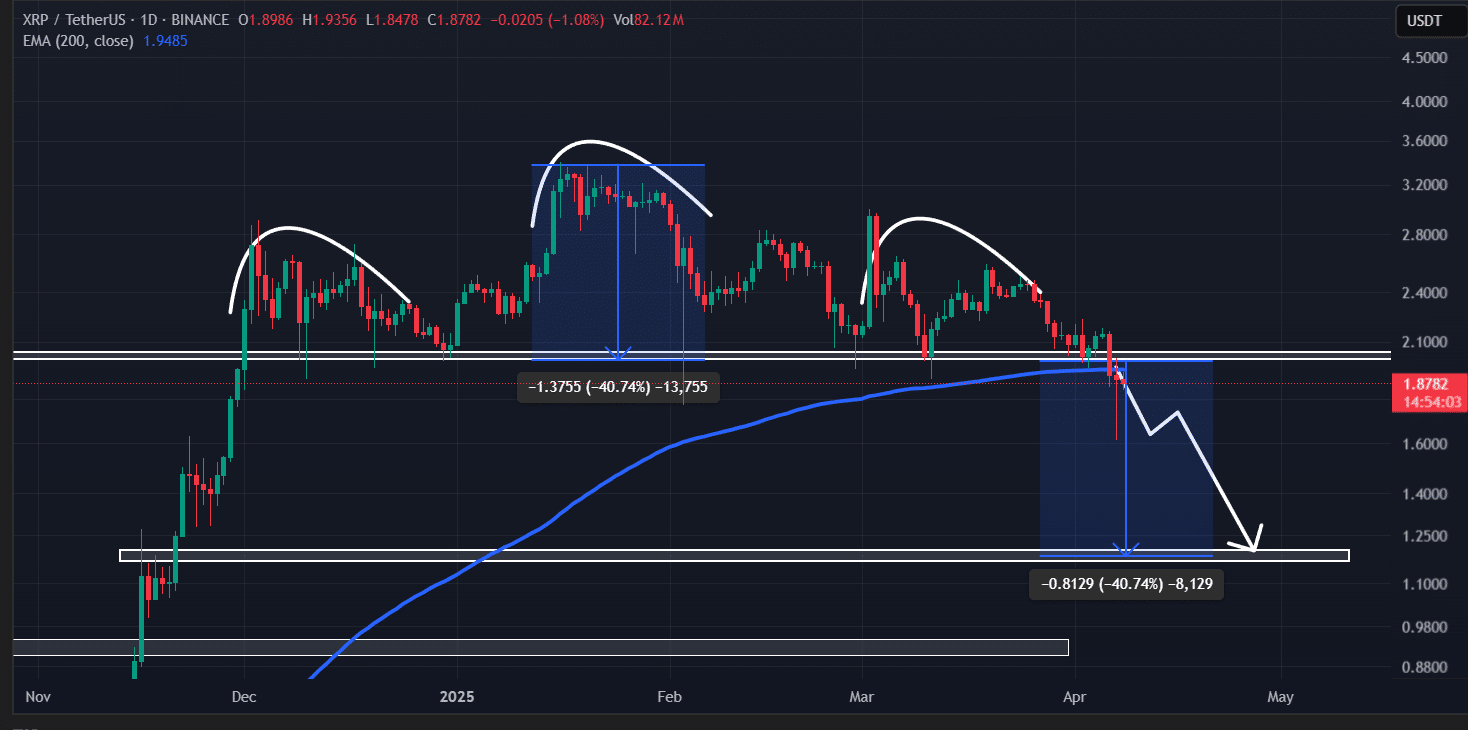

Despite this upward momentum, XRP Beerarish seemed. According to the technical analysis of Ambcrypto, it was actively recently broke out of a bearish main and shoulder pattern on the daily period.

In addition, XRP closed its daily candle under the neckline at $ 1.95, which partly confirmed a further price decrease in the coming days.

Source: TradingView

Can a crash of 35% take place?

This neckline was also an important horizontal support that XRP respected since November 2024.

Earlier, when the price of the active level has reached this level, it consistently experienced an upward momentum or a price distance. This time, however, it is finally broken under it.

Based on the recent price promotion and historical patterns, the interruption of this key level has opened the path for a potential price crash of 35%, with XRP possibly falling to the $ 1.20 level in the near future.

In the meantime, with the recent price decrease, XRP has not been brought to the daily period of time with the recent price decrease.

Trade under 200 EMA indicates a strong bearish sentiment and also suggests that sellers are currently in control.

During such events, traders and investors usually search for short opportunities as soon as the price shows some signs of upward momentum.

Beerarish on-chain statistics

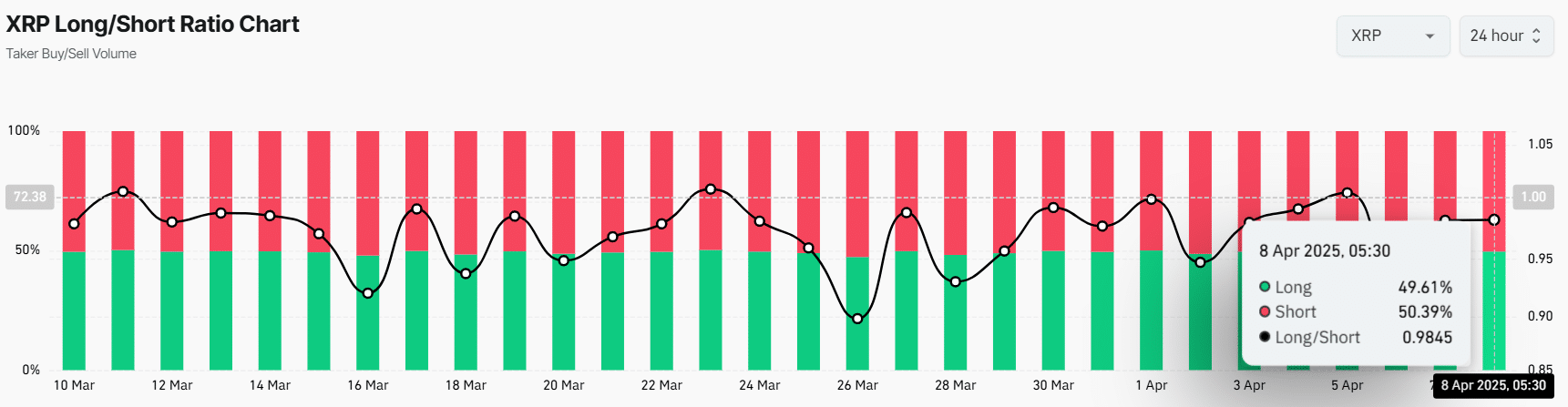

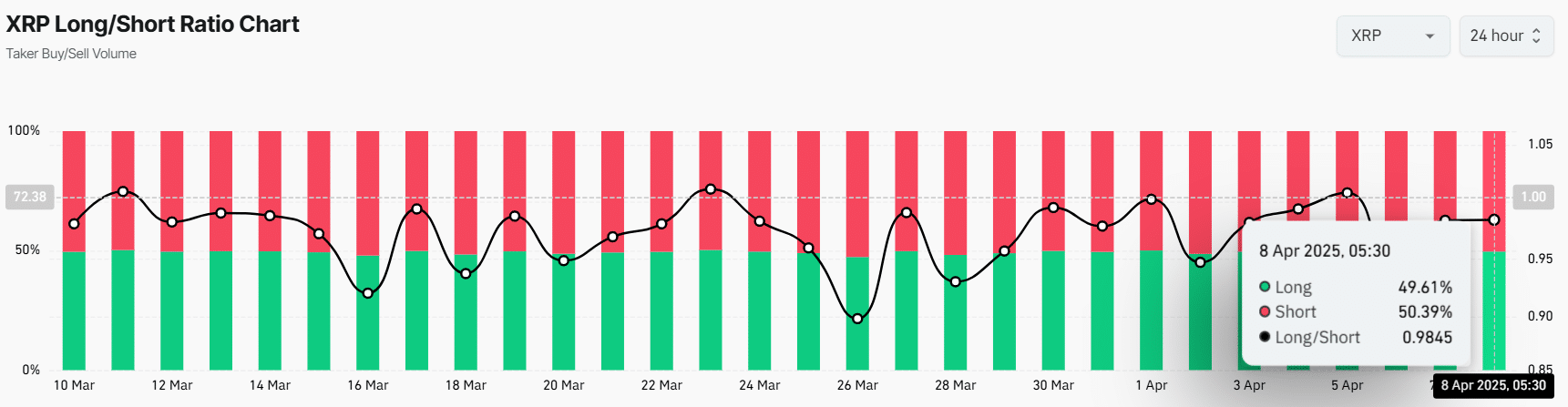

Looking at the Bearish Outlook, traders seem to follow the same sentiment if they bet strongly on the bearish side, according to the on-chain analysis company Coinglass.

The long/short ratio of XRP in particular was 0.98 at the time of the press, which indicates a bearish bias among traders. Moreover, there were more short positions than long positions on the market.

Source: Coinglass

$ 51.65 million in Bearish bets

Coinglass data has also shown that traders were used too much at $ 1,828 at the bottom (support) and $ 1,951 on the top (resistance), with $ 22.50 million and $ 51.65 million in long and short positions respectively.

These liquidation levels and trading positions clearly reflect the current market sentiment.

Source: Coinglass

These liquidation levels and trading positions are probably activated if the XRP price moves in both directions.