- XRP looks poised to extend its recovery and gain an additional 10%.

- However, there was still general caution in the market as selling pressure persisted.

Ripple [XRP] It appears that some of the recent losses will be reversed, following a recovery of a crucial demand level in the high-time-frame charts above $0.4.

Between the recent low of $0.43 and the press time high of $0.51, XRP rose over 18%. Further market improvement could give bulls impetus to tap an additional 10% after potential resistance turns into support.

The XRP price forecast shows a potential upside of 10%

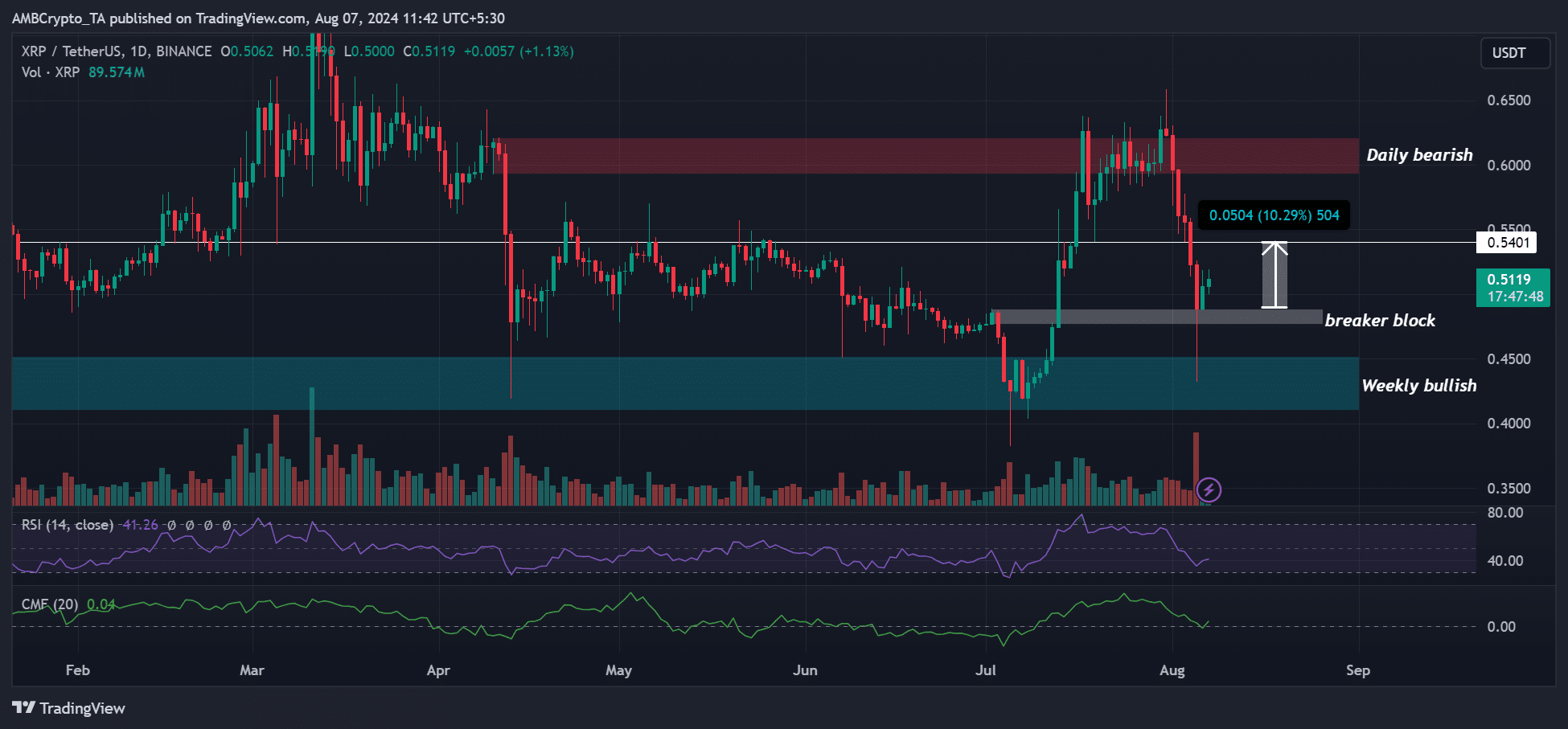

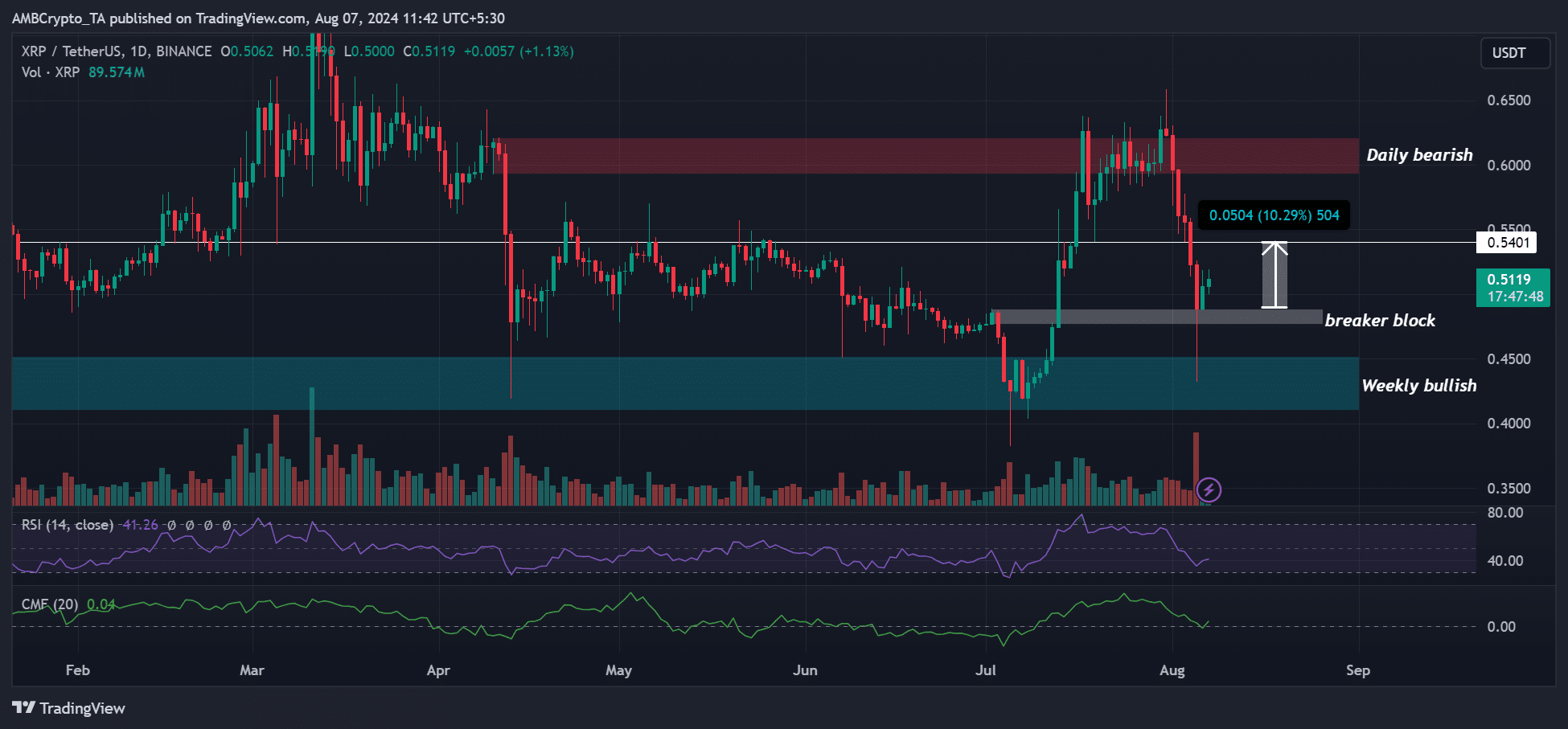

Source: XRP/USDT, TradingView

The recent decline, as evidenced by the long candlestick wick, rebounded from the weekly bullish order block, marked as cyan. This reinforces the $0.4 as a crucial level for bulls as it has been holding XRP dumps since June 2023.

A signal for bulls was the recovery of the breaker block ($0.47 – $0.48), white, which could make a residual test of the immediate target at $0.54 likely. A bounce between the breaker block and the immediate bullish target would lead to a potential recovery gain of 10%, especially if Bitcoin extends the recovery to $60,000.

The RSI (Relative Strength Index) and CMF (Chaikin Money Flow) showed increases, with the latter bouncing above average levels. The revival of the CMF caused capital inflows into the XRP markets to skyrocket.

The RSI rebound also meant that buying interest improved, but it remained below average, giving bulls strong conviction. That said, clearing the $0.54 hurdle could be a challenge without strong buying pressure.

Should XRP weaken again, the price could fall back to the weekly bullish order (OB) above $0.4.

XRP price rise attracts sellers

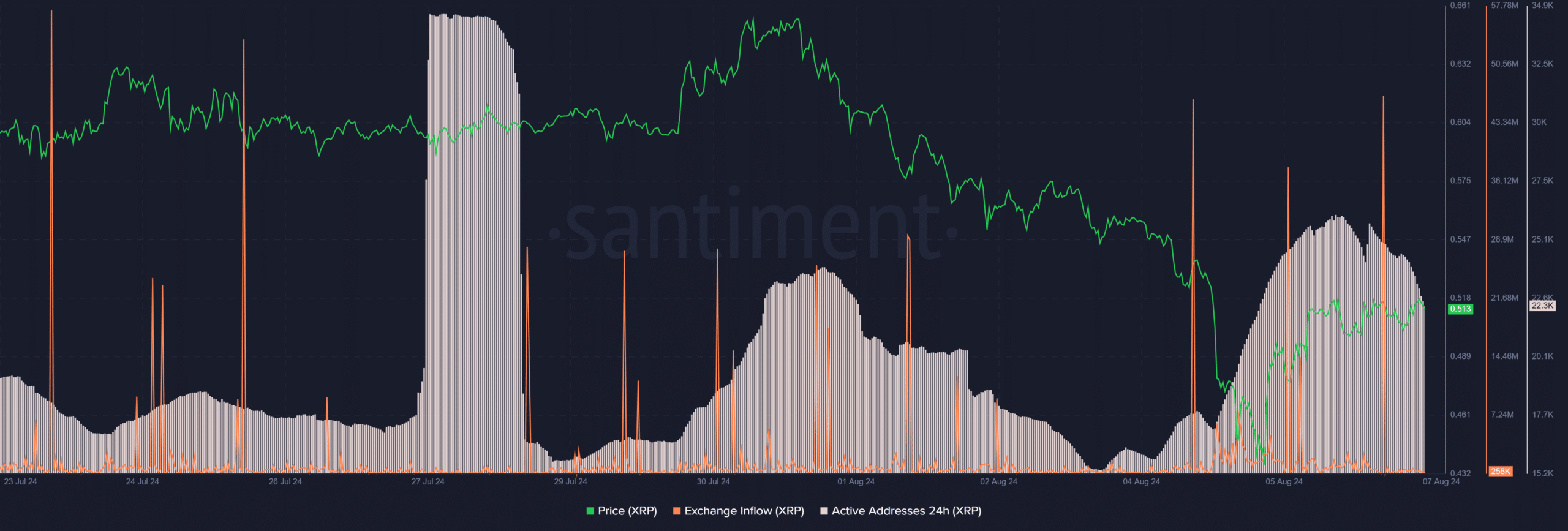

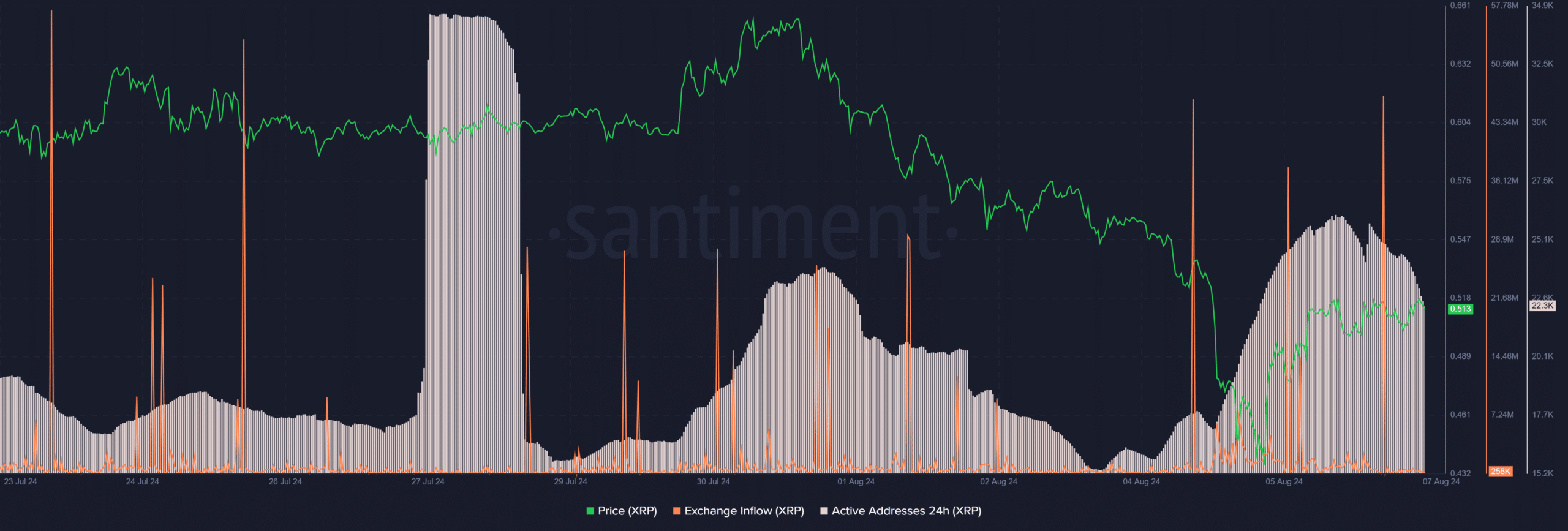

Source: Santiment

The recent slight recovery also led to a sharp increase in selling pressure, as evidenced by spikes in currency inflows. It showed that more XRP tokens were moved to exchanges for sell-offs during the recovery.

Read Ripple [XRP] Price prediction 2024-2025

Furthermore, the increase in network activity, as evidenced by an increase in the number of daily active addresses, also decreased after the light bounce. This meant that interest in the altcoin decreased slightly.

All things considered, the picture painted was one of general market caution still present in the XRP markets despite the recovery prospects.