XRP has been one of the most controversial cryptocurrencies since its creation by Ripple Labs in 2012. Its close ties to traditional finance have alienated parts of the crypto community. However, it retains a loyal following due to its fast and cheap transactions. This XRP price prediction guide examines the coin’s prospects using technical analysis methods.

What is XRP?

XRP is a cryptocurrency created by the Ripple payment network to enable fast cross-border payments. Ripple Labs founders Arthur Britto, David Schwartz, and Chris Larsen designed it to overcome Bitcoin’s scalability issues while enabling seamless transfers between different currencies.

Some key features of XRP include:

Speed

XRP trades take 3-5 seconds to settle, much faster than Bitcoin’s 10+ minutes.

Cheap

XRP transaction fees are a fraction of a cent, making it affordable for micropayments.

Fixed offer

The total supply of 100 billion XRP was created at launch, in contrast to Bitcoin’s limited issuance schedule.

Partnerships with banks

Ripple has partnered with over 300 banks and financial institutions to use XRP for settlement.

Controversies

XRP has been embroiled in controversy over everything from centralization to security classification.

XRP is designed for use by financial institutions, although it is publicly traded on exchanges. The adoption rate will likely depend significantly on the outcome of Ripple’s pending SEC lawsuit.

Factors Affecting the XRP Price

Numerous factors influence XRP prices, leading to high volatility:

Ripple Company Developments and XRP Regulatory Status

Ripple’s partnerships, service offerings and legal issues have significant implications for XRP’s price action. For example, the SEC ruled that XRP prevented the asset from reaching new all-time highs during the crypto bull market in 2020 and 2021. Now that Ripple has won the case against the SEC and a US judge has ruled that XRP is not a security, there could next bullish cycle new all-time highs may come.

Cryptocurrency market trends

Like most altcoins, XRP’s price tends to follow Bitcoin’s price movements in general. When Bitcoin rises or falls sharply, so does XRP. Bitcoin itself has struggled recently as the US Federal Reserve has hiked interest rates.

Regular adoption

If XRP gains transactional adoption from banks and payment providers, it would create a real utility and drive up prices. But it faces fierce competition from private blockchains.

Decentralization Efforts

Reducing Ripple Lab’s control over the XRP supply and ledger through further decentralization could increase XRP’s appeal and value to the crypto community.

Burn speed

Ripple periodically burns XRP stock to manage circulation. Higher burn rates lower the available XRP, which can positively impact prices.

XRP price history

XRP’s price history has been shaped by major announcements, partnerships, and controversies.

2012-2014: the early years

XRP initially traded for a fraction of a cent. Prices remained relatively flat between $0.002 and $0.02 through 2017 as Ripple focused on building partnerships rather than exchanges.

2017: Crypto bubble peak

As the crypto mania peaked in late 2017, XRP saw huge speculative gains, rising from $0.006 in April to an all-time high of $3.84 in January 2018 – an incredible 63,000% return in 9 months!

However, this meteoric rise was fueled by hype rather than fundamental factors. XRP collapsed as Bitcoin collapsed, dropping more than 90% within a year of peaking.

2018-2020: Construction products

Between 2018 and 2020, XRP continued to outperform most altcoins, trading between $0.20 and $0.60, as Ripple doubled its gains in establishing real-world utilities.

Major developments included:

- Ripple launched On-Demand Liquidity (ODL) allowing financial institutions to use XRP for instant cross-border payments.

- More than 300 banks have signed up for RippleNet to connect payment channels worldwide.

- Remittance companies including MoneyGram started using ODL for transferring money.

This suggested that future adoption could be driven by Ripple’s offerings.

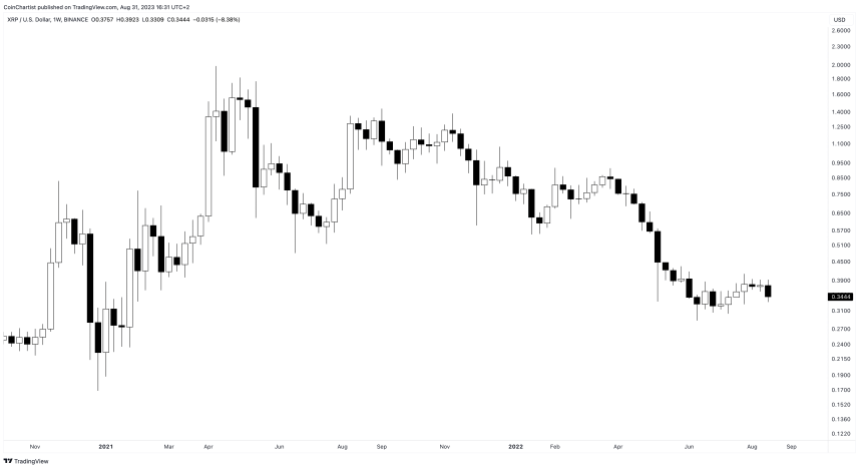

2021 – 2022: Legal troubles and a bear market emerge

After Ripple started 2021 strong as XRP once again surged above $1 thanks to the crypto resurgence, Ripple was hit with an SEC lawsuit in December 2020 alleging that XRP was an unregistered security.

Many exchanges delisted XRP as the price collapsed on the negative sentiment. XRP failed to reach a new all-time high, while Bitcoin, Ethereum, Dogecoin, and several others all failed as a result.

Each of these other cryptocurrencies peaked during this period and entered a bearish market in 2022. This reduced the likelihood of XRP recovering over the course of the year.

Recent XRP price action

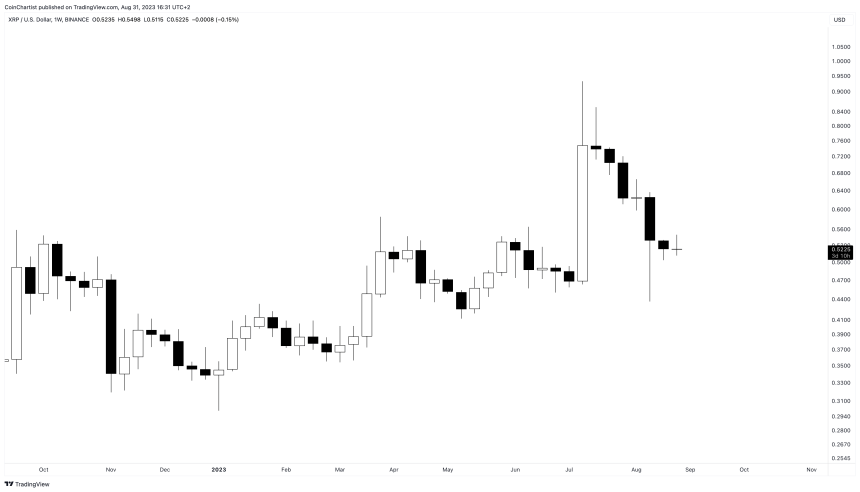

2023 has been a rough year for most cryptocurrencies, which are just beginning to recover from the protracted crypto winter. However, XRP has outperformed most cryptocurrencies this year thanks to Ripple winning the legal battle with the SEC.

A US judge ruled that XRP is not a security when it is sold to private investors. This caused several exchanges to relist the asset, and prices jumped from less than $0.50 to $1 within 48 hours of the decision. The SEC plans to appeal the decision, which led to a full replay of the rally. What’s next for the XRP price?

XRP Short Term Price Prediction for 2023

With XRP fully following the SEC lawsuit ruling, sentiment in the crypto market is fearful again. Combined with other altcoins posting new lows, investors fear the bear market could return.

However, XRP could perform a return test from ascending triangle resistance to support, which is common in the financial markets. If the support continues, the price may eventually break above $1 on the next try.

In the meantime, if the price were to fall back through the bottom of the ascending triangle patternwould indicate a failure and lead to a retest of the bear market lows.

Medium Term XRP Price Prediction for 2024 – 2025

If XRP can continue its bullish market, 2024 and 2025 could see the final step in the first major bull market series.

Elliott Wave Principle believes that bull markets move in a so-called drift wave, an upward series of five waves, where the odd-numbered moves move in the direction of the primary trend, while the even-numbered moves move against the trend.

Corrections are usually labeled ABC unless the correction is a triangle, in which it is labeled ABCD and E. More complex corrections may evolve over time. Triangles represent the consolidation before the last thrust in a series.

Price projections put XRP above $10, between $14 and $17, depending on momentum and the supportive environment.

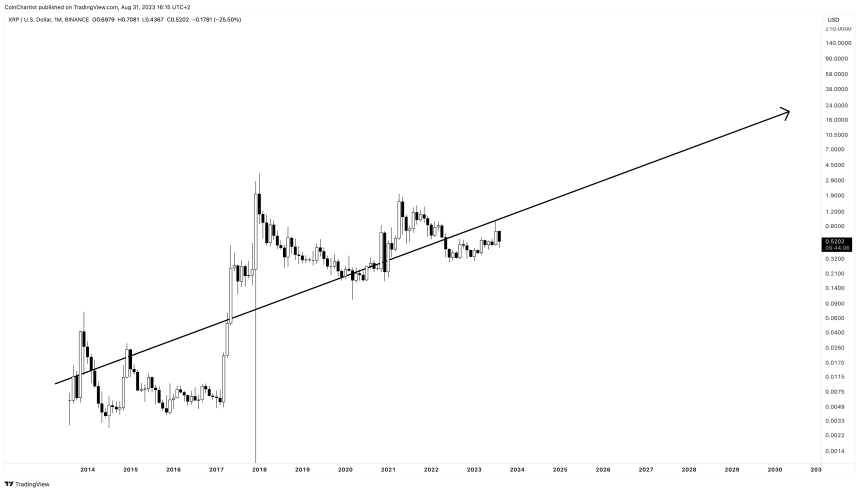

Long term XRP price prediction for 2030

The long-term prediction of XRP is a lot harder to predict using traditional technical analysis techniques. In this case, we chose to pull a price average from years of price action, in an attempt to project a linear trendline.

Peaks and troughs would occur above and below average, providing the opportunity for mean reversion trades. The trajectory will bring XRP above $20 per coin in the future if the average line is correct.

Frequently Asked Questions About XRP Price Predictions

Let’s look at some frequently asked questions about XRP price predictions:

What was the lowest price of XRP?

During the first few years after launch, XRP reached lows between $0.002 and $0.005. The recent low was $0.24 in July 2022.

What was XRP’s highest price?

XRP’s all-time high was $3.84, reached in January 2018 during the crypto bubble. It also briefly surpassed $3.60 in the same time frame.

How high can XRP realistically go?

Based on the fundamentals and adoption risks, a realistic best-case high for XRP over the 2025-2030 period is likely to be between $10 and $20 if it gains widespread utility. Reaching triple digits seems very unlikely.

Can the price of XRP drop to zero?

If Ripple faced an existential threat, XRP could potentially crash below $0.01. But the risks of delisting have eased after a US court ruled XRP not to be a security, making a complete collapse unlikely without a catastrophic event.

Why is the XRP price volatile?

As a cryptocurrency exposed to speculative trading, XRP experiences high volatility due to hype cycles and shifts in investor confidence, amplified by its low liquidity compared to larger cryptos.

When will the price of XRP stabilize?

XRP volatility should stabilize and move closer to currency-like swings once a reliable demand base has been established among commercial users and institutions. But this remains dependent on Ripple’s success.

Investment Disclaimer: The content in this article is for informational and educational purposes only. It should not be considered investment advice. Consult a financial advisor before making any investment decisions. Trading and investing involves significant financial risks. Past performance is not an indication of future results. No content on this site is a recommendation or solicitation to buy or sell securities or cryptocurrencies.