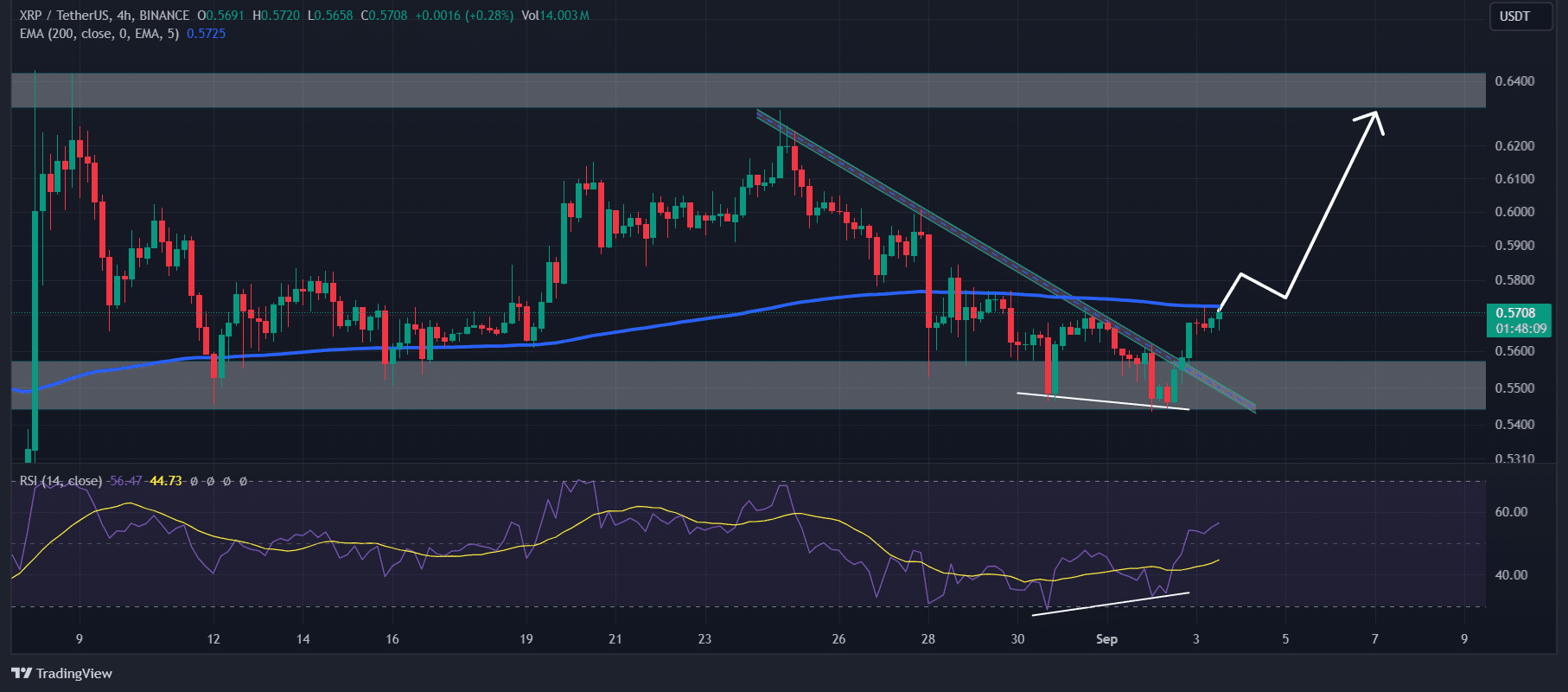

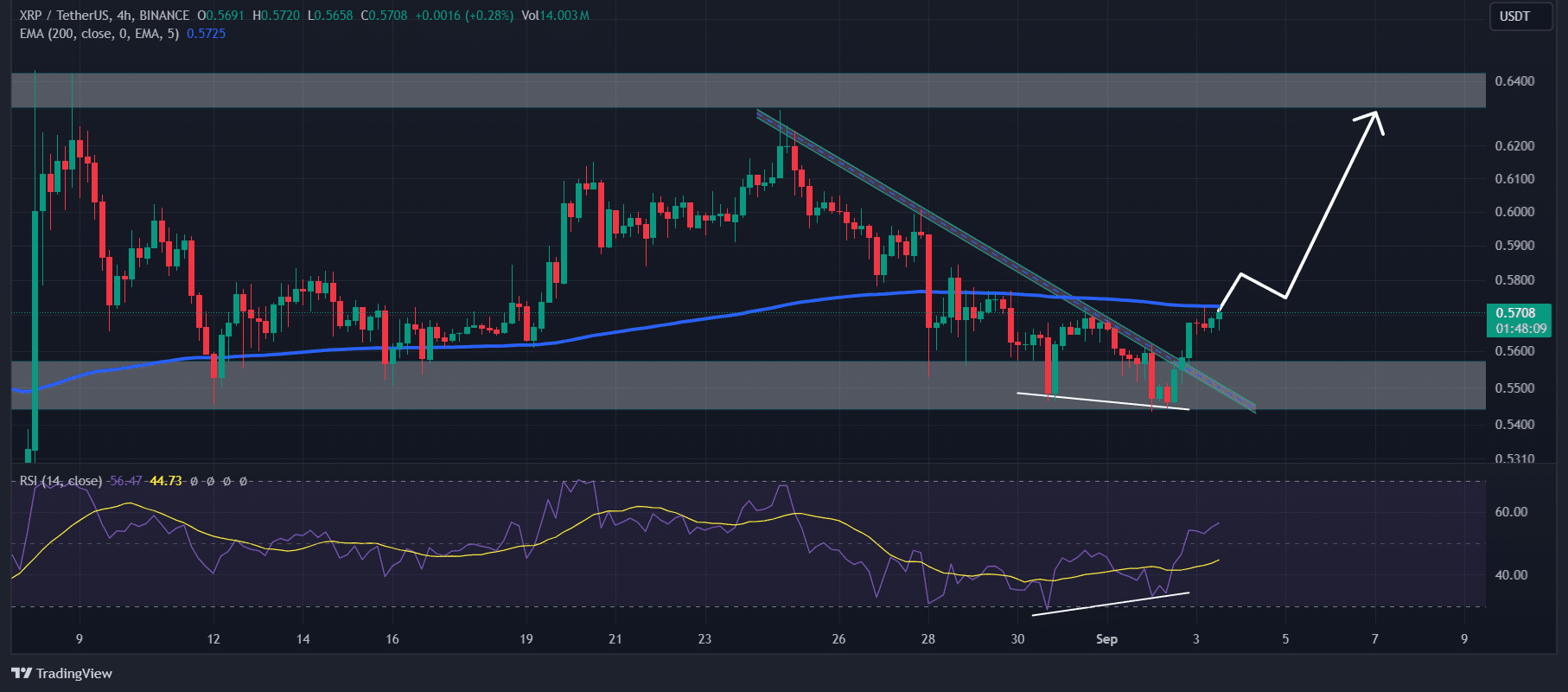

- XRP’s Relative Strength Index (RSI) formed a bullish divergence, signaling a bullish trend.

- After breaking the descending trend line, there is a good chance that XRP can rise by 15%.

In this bearish market sentiment, Ripple [XRP] looked bullish as the on-chain metrics indicated that the price was about to skyrocket.

Since August 2024, XRP, along with other major cryptocurrencies, experienced a massive price drop, possibly due to the significant drop in the value of Bitcoin. [BTC] price.

XRP could rise 15%

Looking at XRP’s key on-chain metrics, a recent trendline breakout and bullish divergence on the chart have created a bullish outlook for the token.

However, there is a good chance that the price will rise by 15% in the coming days.

According to AMBCrypto’s analysis, XRP has recently gained support from the crucial $0.55 level and the 200 Exponential Moving Average (EMA) on a daily time frame.

Since July 2024, XRP has revisited this support level several times, and each time it has experienced a price increase of almost 14%.

This time, there is a good chance that history will repeat itself and XRP could reach the level of $0.65 or even more.

Source: TradingView

Meanwhile, XRP recently broke out of the trendline within a four-hour time frame. Furthermore, the Relative Strength Index (RSI) formed a bullish divergence, signaling a bullish trend.

During the recent market decline, the price of XRP formed a lower low while the RSI made higher lows, resulting in this bullish divergence. Traders and investors see this as a potential buy signal.

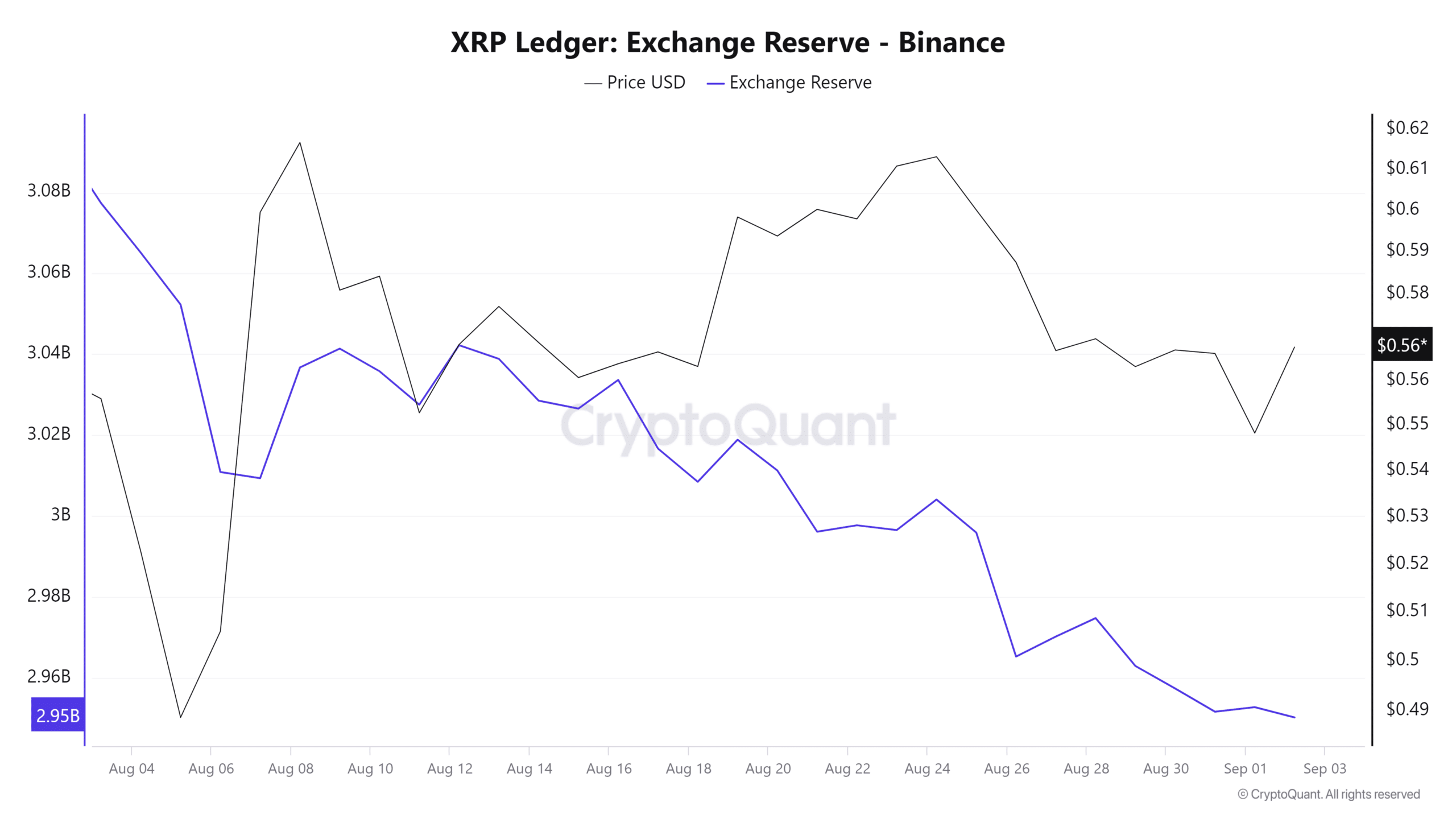

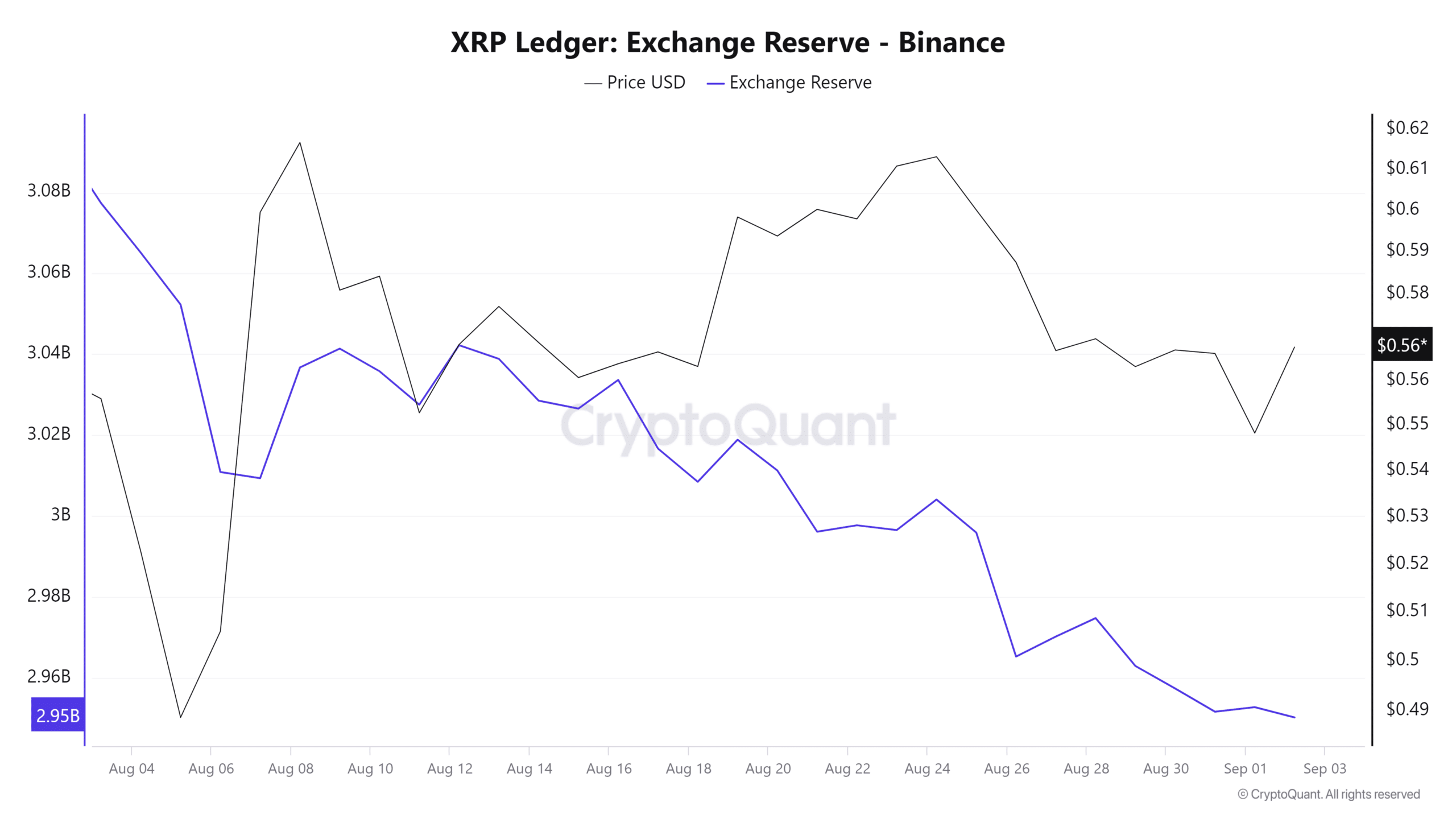

Statistics in the chain

According to data from on-chain analytics firm CryptoQuant, XRP’s exchange rate reserve was at its lowest level, potentially supporting this bullish outlook.

A drop in foreign exchange reserves or a lower level indicated that investors or whales were collecting tokens from the exchanges, leading to a continued decline in reserves.

Source: CryptoQuant

Furthermore, CryptoQuant’s XRP exchange inflow was relatively lower than other days, indicating a buying opportunity.

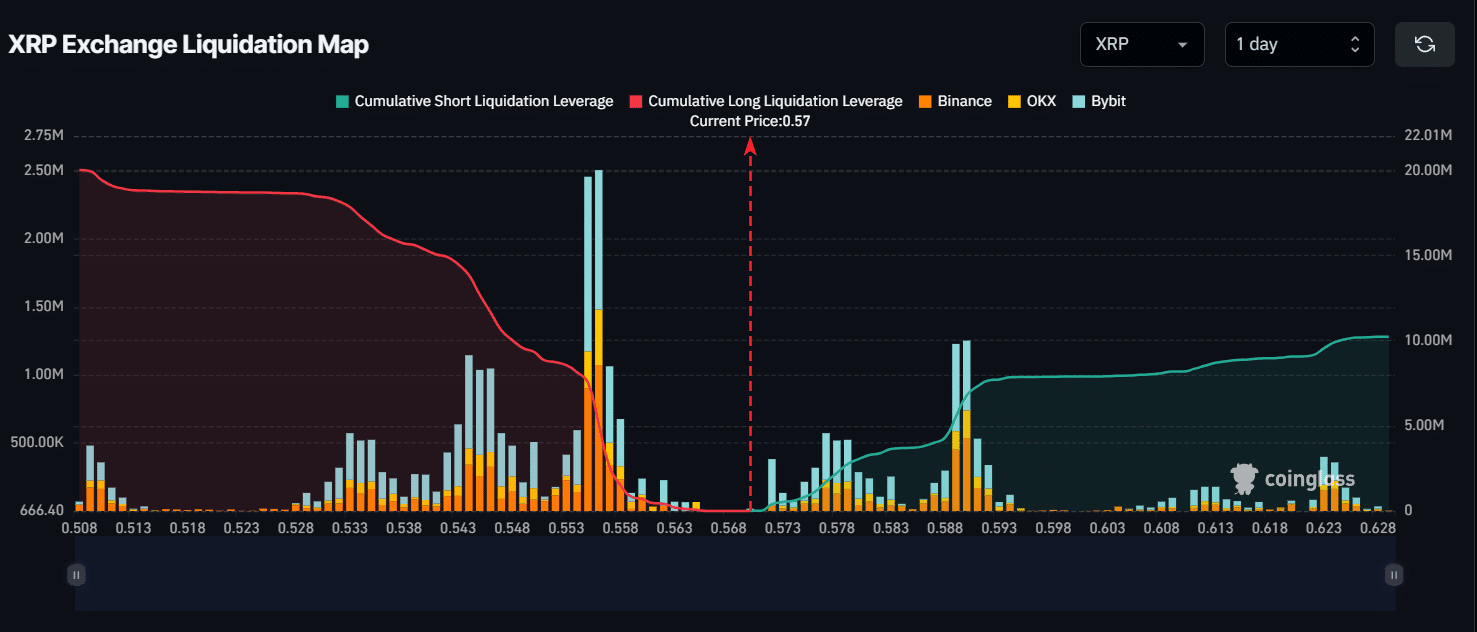

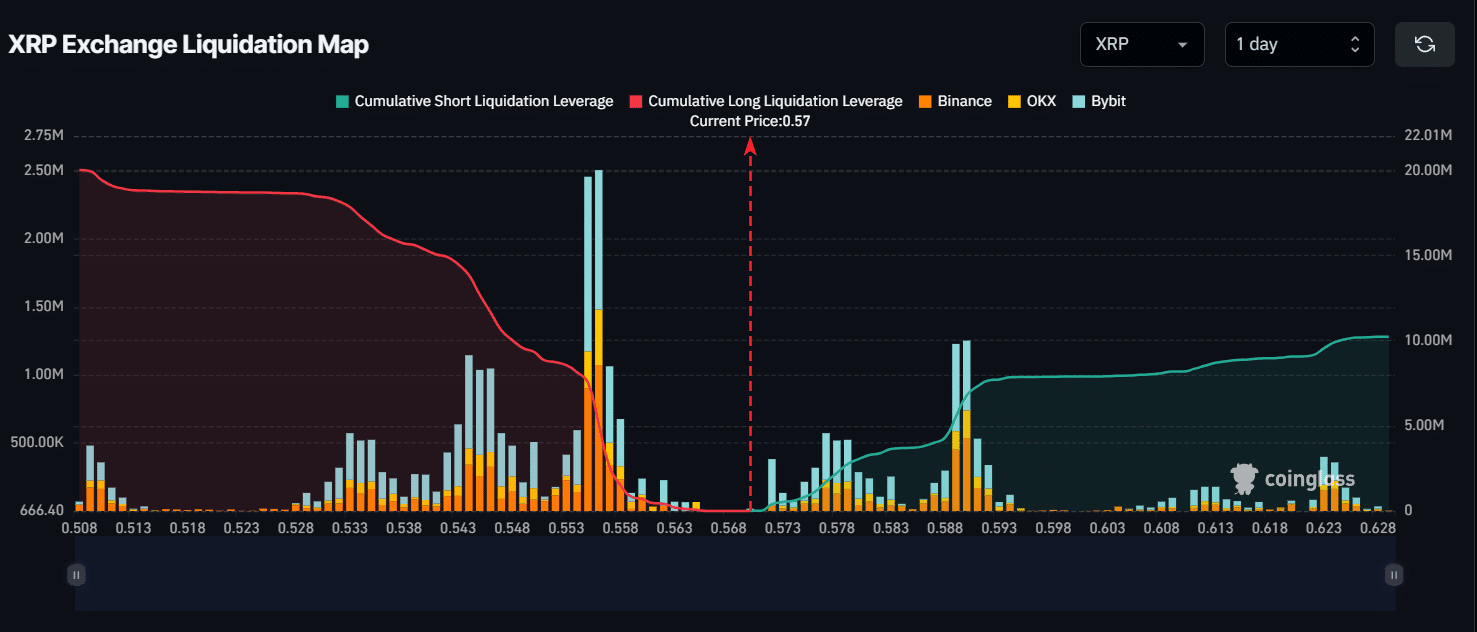

Currently, the key liquidation levels are around $0.555 on the downside and $0.59 on the upside, as traders at these levels are over-indebted, according to the CoinGlass data.

If market sentiment changes and the XRP price rises to the $0.59 level, short positions worth nearly $6.8 million will be liquidated.

Read Ripple’s [XRP] Price forecast 2024–2025

Conversely, if sentiment remains bearish and the price falls to the $0.555 level, long positions worth approximately $7.6 million will be liquidated.

Source: Coinglass

So at the time of writing, bulls dominated the asset as they had the potential to liquidate short positions.