Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

The price of XRP has gone by 4.7% in the last 24 hours, so that a High -volatility pattern That has defined a lot of March. In the midst of this decline, however, Some see opportunitiesWith a popular analyst who identifies an interesting reversing pattern that the tide could change into a bullish process.

Related lecture

Inverse head and shoulder pattern appears on the XRP graphic

XRP has expanded his decline Run from $ 2.47 in the last 24 hours. Local, XRP has currently fallen by 13.8% in the last three days and now looks like it can easily break below $ 2.10.

Crypto analyst Egrag Crypto took on Social Media Platform X to emphasize what he most likely called inverse head and shoulders “pattern that is currently unfolding at the daily period of XRP. The pattern, which has been developing since the beginning of March, is now in the last phases of forming the second shoulder. As such, this phase can see even further in the short term, because XRP may fall again to complete the structure of the second shoulder before a breakout rally.

If confirmed, the inverted head and shoulders would lead to a strong bullish reversal, that is becomes considerable Given the recent price racement of XRP. According to Egrag Crypto, the measured step of completing this formation can send the price to a price range between $ 3.7 and $ 3.9.

Analyst says that XRP could always reach high in 90 to 120 days

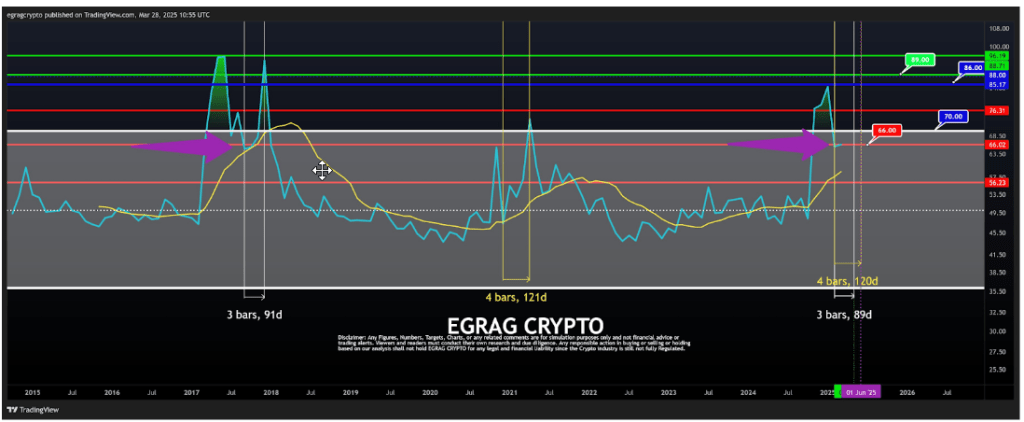

The inverted head and shoulder analysis is part of a bullish prospect that suggests that the XRP price can reach a new of all time within the next 90 to 120 days. This prediction, also made by Egrag Cryptois based on a recurring pattern observed in XRP’s Relative Strength Index (RSI) on earlier bull markets.

He pointed out that during the Cycli 2017 and 2021 the RSI indicator on XRP showed two different peaks, with the second peak between 90 to 120 days after the first peak. The second RSI peak in 2017 took place approximately 120 days after the first peak. A similar scenario took place in 2021, although the interval between the first and second RSI Highs was just 90 days shorter. This trend is the scene for a historical increase that could coordinate with the outbreak of the current reverse head and shoulder setup.

So far in this cycle, XRP has already completed its first RSI peak, so high Since 85.17 by the end of 2024. After this, the RSI went into a long cooldown phase and immerses a low point of 65. At the time of writing, the RSI is around 66, and a bouncer is expected from here, who peaks somewhere around June.

Related lecture

RSI usually increases with increased market participation, capital inflow and Bullish price movement. If the trend plays again within the next 90 to 120 days, the RSI of XRP could peak again around June. At the time of writing, XRP acts at $ 2.12, with 4.7% in the last 24 hours.

Featured image of Gemini Imagen, Graph of TradingView