- XRP’s MVRV and MDIA were similar in August and September 2023.

- The social figures were not entirely positive.

Ripple [XRP] failed to hold the short-term support zone at $0.5 over the past two days. The frenzied selling activity behind Bitcoin [BTC] saw many altcoins falter at key support levels, and XRP was no different.

The criticism that the Ripple network has little use and deserves classification as a “zombie token” has been a hard pill to swallow for long-term investors. On the other hand, swing traders could benefit from the recent turn of events.

What do the on-chain metrics show for XRP prices?

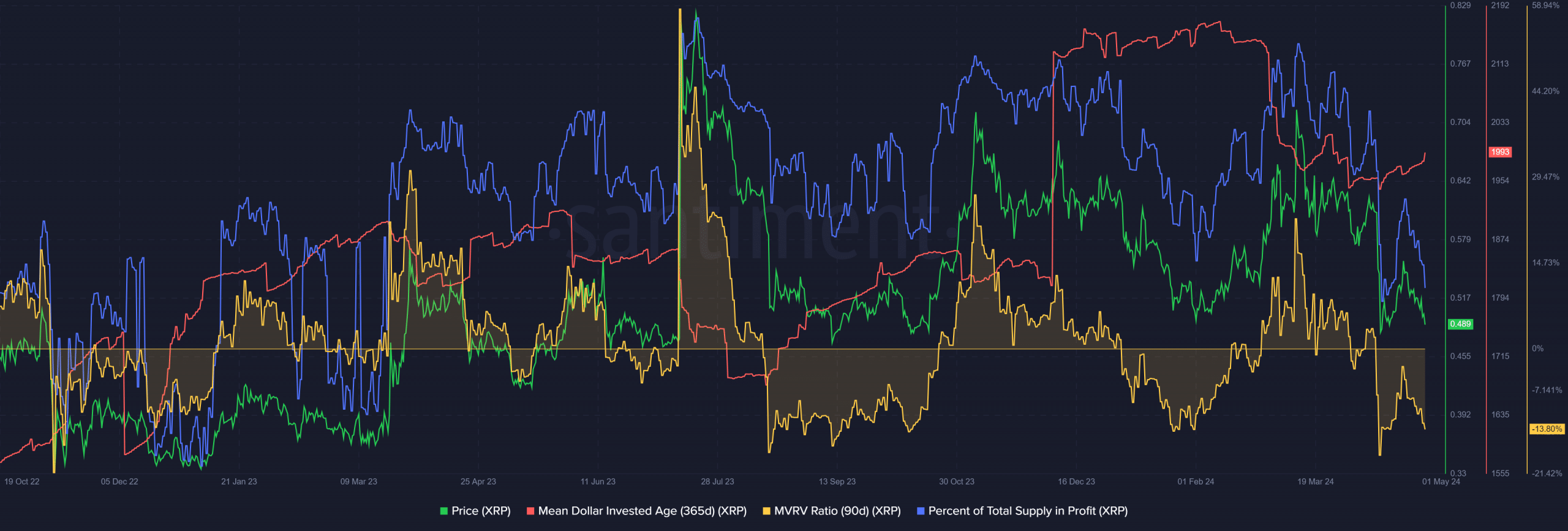

The percentage of total profit offered fell from 92% on March 12 to 72.6% at the time of writing. This was understandable given the 32.6% losses XRP has suffered over the past six weeks. Yet the Mean Dollar Invested Age (MDIA) appeared to be turning around.

This was a welcome sight. It indicated that accumulation was underway again. Furthermore, the MVRV ratio showed that XRP was deeply undervalued. Holders did this through a significant loss.

In August and September 2023, the MVRV ratio was below -10%, but the MDIA slowly increased. During this period, XRP prices consolidated at the $0.48 support zone before recovering.

The price, MDIA and MVRV ratio repeated what they did in September 2023. If the MDIA can continue to move higher, this could give bulls a good reason to bid up the token.

The social statistics were uninspiring

Social volume saw a slight decline in April compared to March levels. Social dominance was also lower and only had a brief peak in early April. Together they showed that the social media engagement behind XRP has weakened.

Realistic or not, here is the market cap of XRP in terms of BTC

The three-day weighted sentiment, on the other hand, was positive. However, sentiment was also positive at the beginning of April, when prices rebounded from $0.56 to $0.63.

It emphasized that market sentiment, no matter how powerful, could change in an instant.