In the midst of continuous market uncertainty, XRP, the native token of Ripple Labs, also registered a price decline, comparable to other important assets such as Bitcoin (BTC) and Ethereum (ETH). However, it seems to have control and its price cannot fall further.

On March 20, 2025, after sudden sentiment shifts, the total market fell in particular. In the middle of this, XRP registered a price decrease of 4% and has now reached a crucial level.

XRP Technical analysis and upcoming levels

According to the technical analysis of experts, XRP has recently witnessed a bullish breakout of a cup and handle pattern, along with a falling triangle.

Due to the continuing fall in the market, the Active has successfully re -tested the Breakout area at the level of $ 2.40 and goes up again. However, this breakout area also arrives with the 200 exponential advancing average (EMA) on the four-hour period.

Based on recent price action and historical patterns, if it applies to $ 2.38 level, there is still hope that XRP can rise considerably and possibly reach the level of $ 3.50. In the meantime, if it does not hold this level and closes a four -hour candle under $ 2.38, it can fall by 13% to reach $ 2.05 in the future.

Current price momentum

XRP is currently being traded near $ 2.42 and has registered a price fall of more than 4% in the last 24 hours. During the same period, however, because of the Bearish market sentiment, traders and investors, they participated in the active one, which caused a 20% decrease in trade volume.

Traders’ $ 67 million WOOTY BETS on the short side

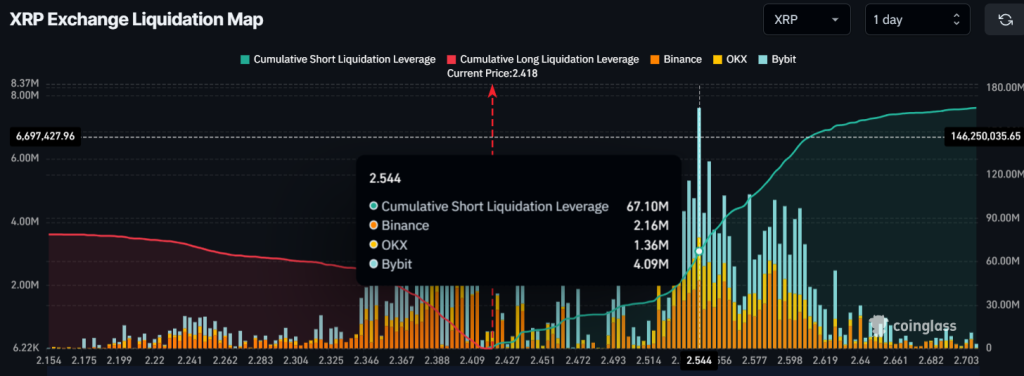

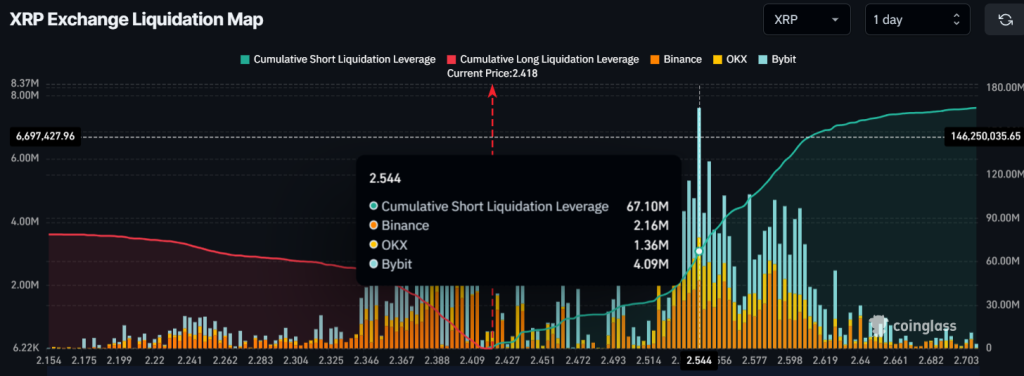

Despite the Bullish Breakout and the current price-de-Heritage, intraday traders seem to follow the current market trend and they bet strongly on the short side, as reported by the uncleaning analysis company Coinglass.

Data shows that traders are currently used too much at $ 2.40, with $ 26 million in long positions. In the meantime, $ 2.54 is again an over-delivered level, with traders for $ 67 million in short positions. This clearly indicates that trader’s utiment is bearish and there is a strong possibility that it can actively consolidate in the vicinity of this level.