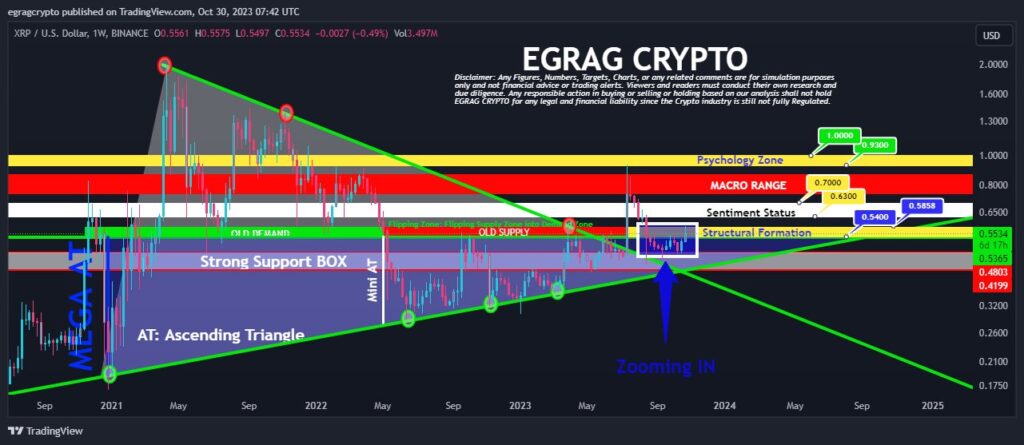

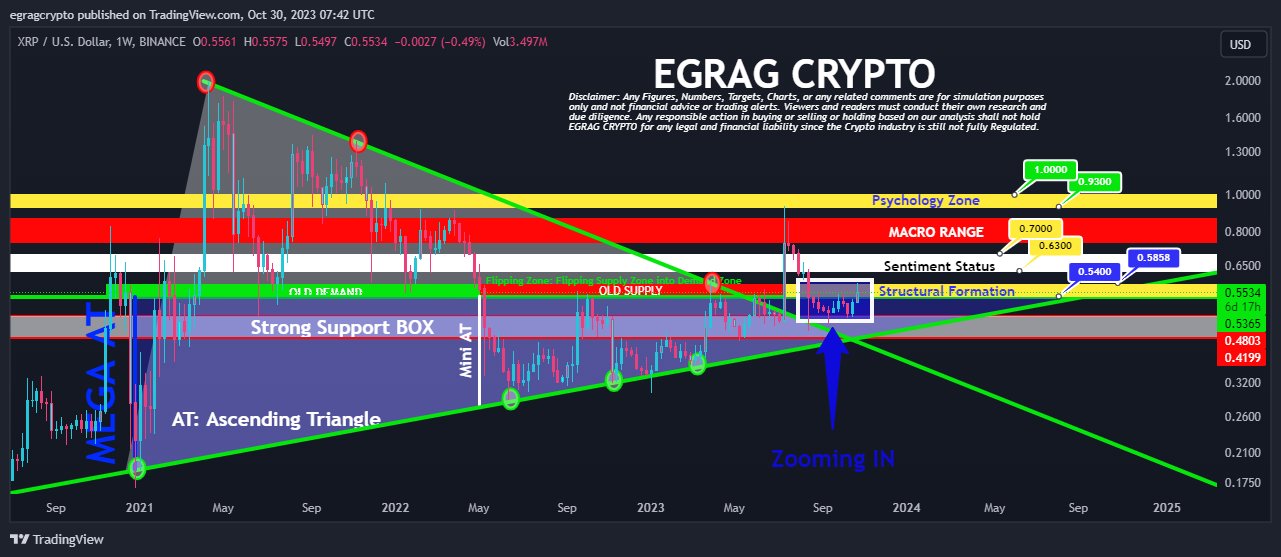

In a detailed analysis Shared on social media today, renowned crypto analyst Egrag points out several bullish indicators in the XRP price structure, pointing to the potential for an impending breakout. Egrag evaluated different time frames and identified a series of technical patterns and formations that support the bullish outlook.

XRP is showing strong bullish structural signs

“Last week’s candle closed within the boundaries of the yellow structural formation,” Egrag tweeted regarding the weekly XRP/USD chart, highlighting the significance of recent moves within the time frame. This observation is key to understanding the underlying market structures that influence the coming price action.

The implication? If another weekly candle were to confirm its position within this formation, the chances of a continuation of the bullish trend could increase significantly. “To confirm a continuation of the bullish trend, we need to see a weekly candle close with a full body within this structure,” Egrag added.

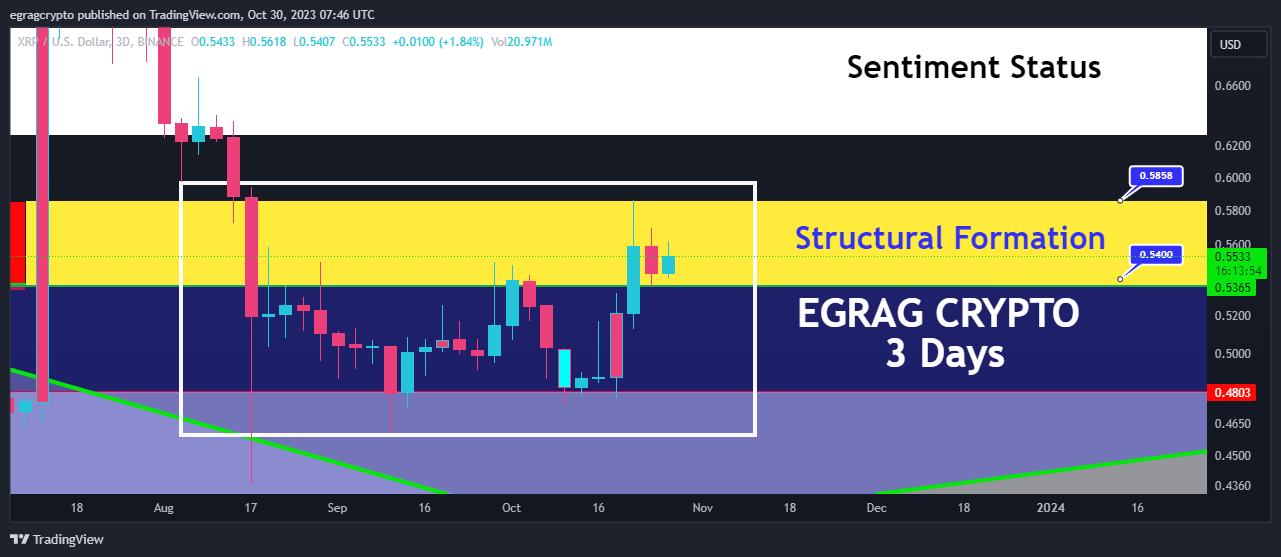

Then his insights extend further to the three-day chart, where he astutely notes: “In just 16 hours, XRP is poised to complete the second full body candle within the structural formation, indicating strong bullish sentiment.” This short-term projection underlines a sense of momentum that appears to be growing within the XRP market.

The 1-day chart also caught Egrag’s attention. He highlighted the impending completion of the seventh full-body candle within the current structure, stating that this indicates an “extremely bullish trend.” This observation suggests that XRP’s bullish behavior is not just a fleeting phenomenon, but has consistency across different time frames.

For traders with a penchant for shorter time frames, Egrag’s insights into the 12-hour chart are particularly striking. Although there have been multiple closes within the structural formation, he emphasized the importance of continued momentum: “The current candle and the next are crucial because they form a symmetrical triangle.”

Elaborating on the implications of this pattern, he said: “Typically, symmetrical triangle breakouts have a 50/50 chance, making this a decision point for XRP.”

XRP Price Targets

Going back to an October 27 tweet, Egrag had demarcated key price zones, highlighting the range of “$0.54 to $0.58” as a make-or-break threshold. Additionally, he cited the “$0.63-$0.70” range as a crucial indicator of shifts in market sentiment.

For those who keep an eye on the psychological dimensions of trading, Egrag’s mention of the “0.93-$1” bracket is noteworthy. He warned traders about this zone and advised them: “Stick to your plan and resist the temptation to let emotions or impatience dictate your actions.”

In short, Egrag’s comprehensive analysis combines technical data with traders’ sentiment and psychology, providing a nuanced and detailed perspective for those invested in XRP. The coming days will likely be watched with bated breath as traders anticipate the next big move.

At the time of writing, XRP was trading at $0.5595.

Featured image from Shutterstock, chart from TradingView.com