The XRP price is facing an extremely pivotal moment, which could become a make-or-break moment for the cryptocurrency. After the XRP token surged nearly 100% following the summary verdict in the case between Ripple Labs and the U.S. Securities and Exchange Commission (SEC), just 43 days after the verdict, profits are virtually nil, it reported NewsBTC.

However, this is far from the worst. The recent price drop has pushed XRP to key support levels that must be held at all costs to avoid another deep drop. At the same time, there is hope thanks to the formation of an extremely rare gold cross on the 1-week chart.

Golden Cross: A Beacon for XRP Bulls?

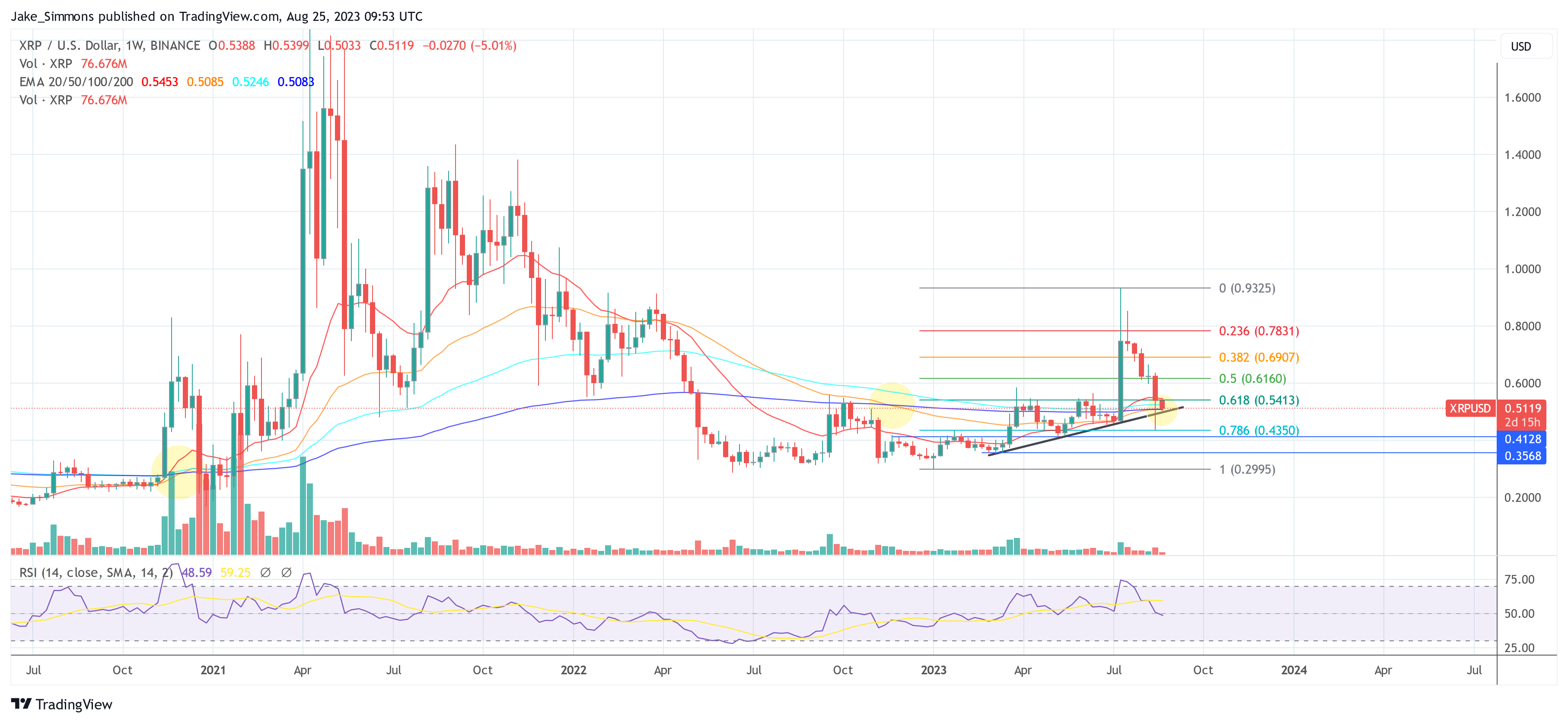

As of August 25, 2023, XRP is at $0.5115. The weekly chart reveals the much-discussed golden cross, a phenomenon where a short-term moving average outperforms a long-term average, often indicating a shift from a bearish to a bullish trend. In the case of XRP, the 50-week EMA has moved above the 200-week EMA.

This movement is usually seen as a harbinger of an impending upward trajectory. However, the price of the tokens is teetering just above the 200-week EMA, set at $0.5083. A weekly close below this number could spell trouble.

Not only would this undermine this crucial indicator, but it could negate the significance of the Gold Cross. In addition, the uptrend line (black), which has been intact since early January, could be in jeopardy if XRP drops below $0.50 on a weekly basis.

Against this background, the golden cross on the weekly chart is a beacon of hope. Still, the risks are palpable. Should the token cross the $0.50 threshold on a weekly time frame, a sharper decline appears imminent, potentially plummeting to the Fibonacci level of 78.6 at $0.4350.

Before XRP might reach its year low of just under USD 0.30, XRP might find support at USD 0.41 and USD 0.36. As in previous weeks, news of the legal battle between Ripple and the SEC is the most powerful catalyst for an XRP price rally. While the SEC’s preliminary injunction is currently being reviewed by Judge Torres, the trial will not take place until mid-April next year.

A historical perspective

Remarkably, XRP has only seen one gold cross per week in its history. This was at the end of November 2020.

XRP experienced a 196% increase in three weeks. However, as we all know, the rally of XRP was prematurely thwarted by the US Securities and Exchange Commission’s lawsuit against Ripple Labs and the declaration of the XRP token as a security. That’s why the gold cross failed to materialise, while the price plummeted.

Probably the next two weeks will tell if the gold cross chart pattern will happen this time.

Featured image of Medium, chart from TradingView.com