Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

XRP has received a considerable momentum in recent days and has placed a sharp 24% rally since last week when Bullish Sentiment returns to the wider crypto market. With Bitcoin that is held above $ 100k and Ethereum recloses the $ 2,200 marking, altcoins such as XRP start to show strength after months of modest performance. Analysts now ask for a potential outbreak, and emphasize the importance of XRP that recovers the most important resistance levels in the coming days to confirm a continuing movement.

Related lecture

Refueling this optimism is new data from Glassnode that reveals a dramatic increase in the open interest of XRP Futures. The metric has risen more than $ 1 billion in just one week and rose from $ 2.42 billion to $ 3.42 billion – an increase of 41.6%. This peak suggests a growing wave of speculative importance and directional conviction among traders.

While Leverage is building, all eyes are focused on the next movement of XRP to determine whether this momentum can evolve to a complete rally. The rise in open interest in addition to price valuation often indicates a persistent bullish intention, so that weight is added to calls for a continuous increase. With the volatility that returns to the Altcoin market, XRP could prepare for one of the most critical pimples in months.

XRP leads with a strong momentum and rising leverage

XRP comes up as one of the strongest artists on the market, which shows remarkable resilience during recent Downtjes and now shows a clear force in the current bullish environment. After consolidating due to fleeting conditions, XRP has risen above the level of $ 2.50 and positions itself firmly as a leader under large Cap Altcoins. The price promotion remains tight, whereby Bulls continues to test the $ 2.60 zone, while bears cannot push the price under the new support levels that are formed near $ 2.35.

This price compression, combined with wider market optimism, suggests that XRP may be preparing for a big step. With Bitcoin who consolidates crucial resistance zones in the vicinity of his all-time highlights and Ethereum tests, analysts pay a lot of attention to the XRP process. The Altcoin market is heated and the technical structure of XRP refers to a bullish expansion phase if the current levels are maintained or recovered with volume.

Supporting these bullish prospects is recently Glassnode dataIt shows that the open interest of XRP Futures has risen by more than $ 1 billion in the past week. It rose from $ 2.42 billion to $ 3.42 billion – an increase of 41.6% – with a price rally from $ 2.14 to $ 2.48.

This increase in leverage underlines the growing speculative interest and strong directional conviction among traders. Increased open interest, in particular in combination with upward price movement, often signals continuing momentum and institutional participation. With XRP firm above the most important support and signs of renewed investor confidence, the following few sessions can be crucial to determine whether XRP will finally break out in a new macro trend.

Related lecture

Price promotion signals strength in the midst of Marktmomentum

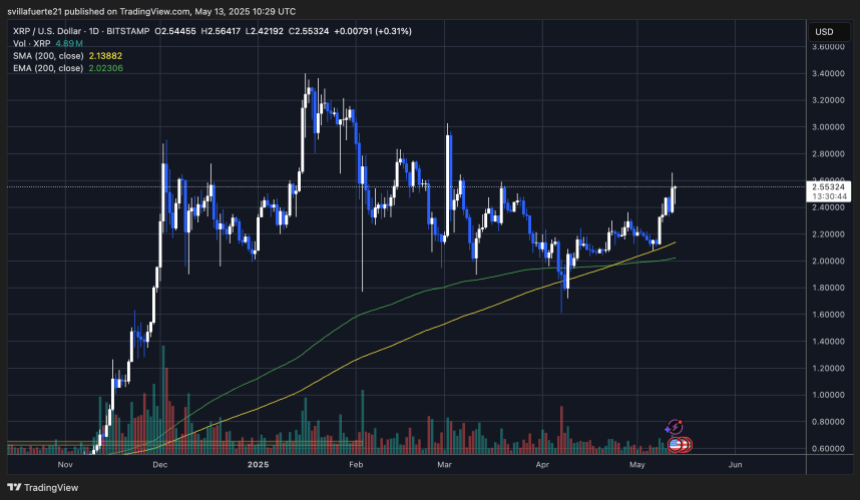

XRP shows a strong bullish momentum while it remains higher trends, which is currently traded around $ 2.55. The graph reveals an established uptrend, with XRP that recently breaks above the most important resistance levels and above both the 200-day simple advancing average (SMA) and the exponentially advancing average (EMA) (EMA), currently $ 2.13 and $ 2.02 respectively. This coordination of progressive averages under the current price reinforces the Bullish structure.

In the past two weeks, XRP has risen more than 24%, which confirms higher lows and higher highlights in the process. After briefly storing at $ 2.60, the price now consolidates with a low volatility just below that level – the potential for a new outbreak when buying pressure is resumed. The volume was also picked up considerably during the first stage of this movement, which indicates a strong interest from market participants.

Related lecture

The next resistance level to view is almost $ 2.80, which marked a large rejection zone earlier this year. On the other hand, the $ 2.35 zone has now become a strong support and would be a critical level for bulls to defend the momentum.

Featured image of Dall-E, graph of TradingView