- Ripple is accelerating plans to launch its RLUSD stablecoin

- It faces competition from giants like USDT and USDC

Ripple recently revealed further developments regarding the launch of its stablecoin.

Despite this update, which can be seen as positive for the ecosystem overall, the response from the XRP market has been remarkably tepid so far.

Ripple begins stablecoin testing

Ripple has made progress with its stablecoin, Ripple USD (RLUSD), as detailed in a blog post dated August 9. The company initiated beta testing of RLUSD on two major blockchain networks: the XRP Ledger (XRPL) and the Ethereum mainnet.

Furthermore, Ripple has highlighted that RLUSD is pegged at a 1:1 ratio against the US dollar. Furthermore, it is fully backed by a combination of US dollar deposits, short-term US government bonds and other cash equivalents. This support is intended to ensure that the stablecoin maintains its value and stability in the market.

However, Ripple has also clarified that RLUSD is not currently available for public purchase or trading. The stablecoin will only become available after the beta testing phase has been completed and all necessary regulatory approvals have been obtained.

Ripple’s competitors

The stablecoin market, which represents a multi-billion dollar sector within the cryptocurrency landscape, is highly competitive and dominated by a few major players. As Ripple prepares to launch its stablecoin – Ripple USD (RLUSD) – it faces the challenge of competing with established stablecoins such as Tether (USDT) and USD Coin (USDC).

Basically express time data CoinMarketCap indicated that the total market capitalization of stablecoins exceeded $170 billion. Furthermore, Tether (USDT) controls a majority of this market with a staggering market cap of over $115 billion, making it the most dominant stablecoin. Furthermore, USD Coin (USDC) occupies the second position, with a market capitalization of over $34 billion.

Other stablecoins such as DAI and First Digital USD (FDUSD) also hold significant shares, with market capitalizations of over $5 billion and $1.9 billion respectively.

How XRP reacted to the news

Despite the potentially exciting news about Ripple, the market reaction to XRP seemed muted.

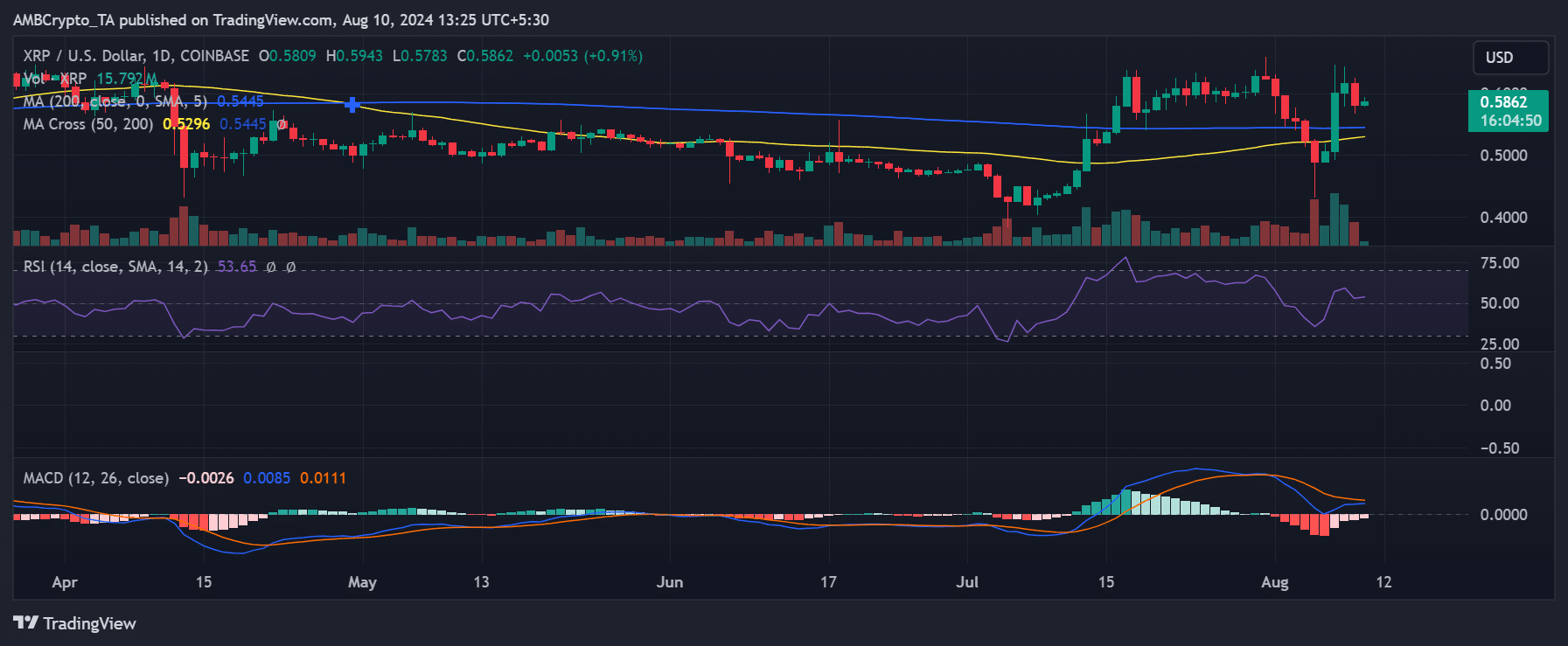

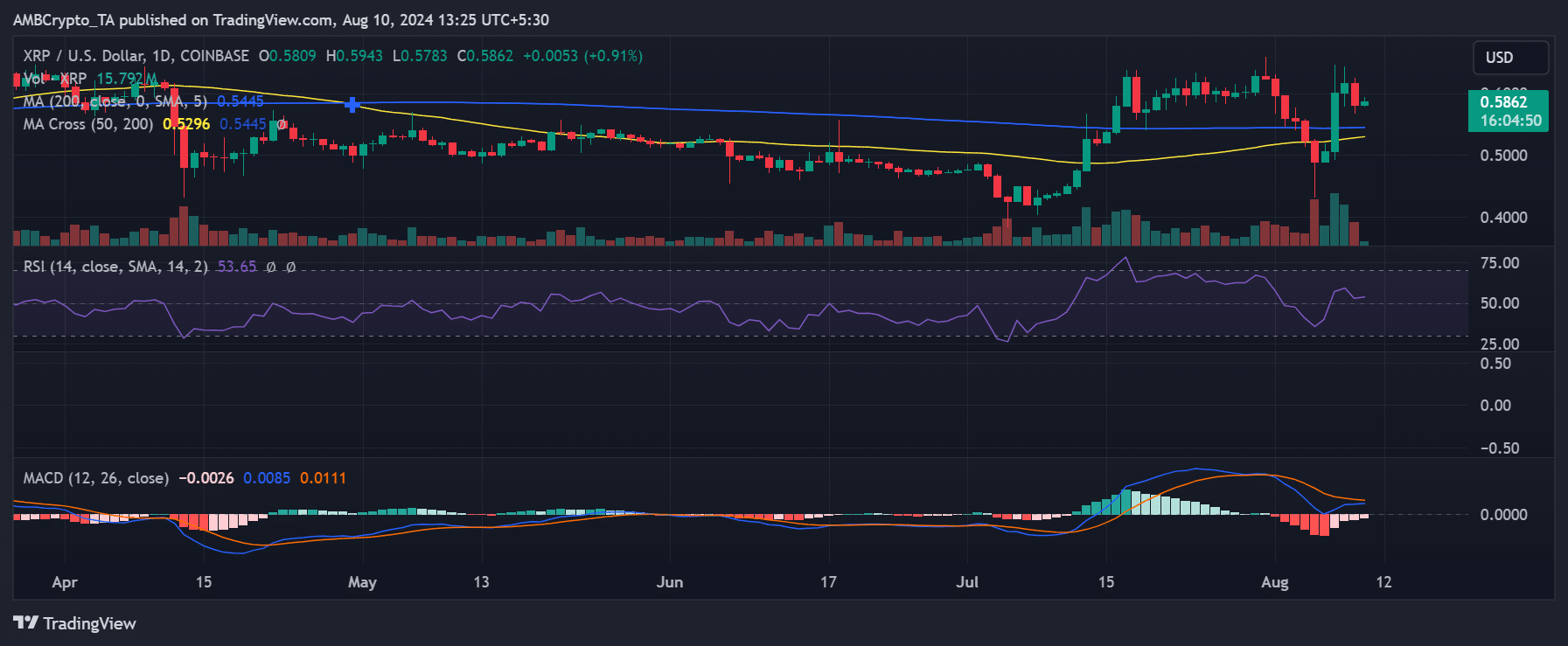

AMBCrypto’s analysis of the daily chart showed that the price of XRP registered a significant decline of 5.81% at the end of trading on August 9. This decline caused the price to drop from approximately $0.61 to approximately $0.58.

Source: TradingView

At the time of writing, XRP was trading with a marginal increase of less than 1% and hovering around the $0.58 level. This lack of a positive price suggests that the market has not yet fully absorbed the potential implications of the new stablecoin.

It could also mean that other market factors overshadow this development.

How derivatives traders moved

The lack of enthusiasm among traders for XRP was further reflected in the funding rate data of Mint glass. At the time of writing, XRP’s funding rate stood at -0.0030%, indicating bearish sentiment among market participants.

– Realistic or not, here is the XRP market cap in terms of BTC

A negative funding rate usually means that shorts are paying longs to keep their positions open. This can also be interpreted as a sign that more traders are betting against the price of XRP than against it.