Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

XRP is confronted with a crucial moment after not testing the resistance level of $ 2.60, with a price action that now tends to the critical demand. Token continues to exchange sideways in a wide range, which reflects the growing uncertainty, since the wider crypto market is confronted with renewed sales pressure. Despite a strong performance in recent weeks, Bulls are struggling to maintain the momentum, and the inability to push higher has left XRP vulnerable for further consolidation or disadvantage.

Related lecture

The general risk-off sentiment of the market makes it difficult for Altcoins such as XRP to establish a clear direction. Investors remain careful and bulls must now defend important support zones to prevent a deeper correction from being caused. XRP is approaching a critical demand area that can determine the short -term process.

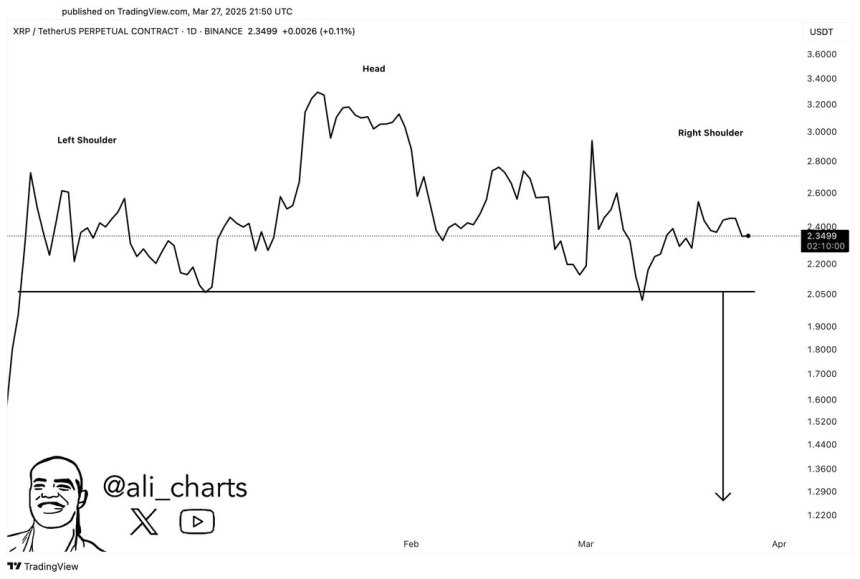

Crypto analyst, Ali Martinez, shared insights on X, pointing to a potentially bullish scenario if XRP can break above $ 3. According to Martinez, such a movement would invalid the current main and shoulder pattern on the graph, which means that the prospects are effectively reversed in favor of the bulls.

XRP is confronted with an important outbreak test in the midst of market insecurity

XRP is approaching a critical point in its price structure, where an outbreak above the key levels could cause a large upward trend. However, investors remain careful, with a lot of worries that the current setup can be a bullfall – especially given the unstable macroom environment. Since the end of January, the financial markets have confronted with a growing turbulence, fed by fears of trade war and erratic policy behavior by US President Donald Trump. This uncertainty has weighed heavily on risk assets, including cryptocurrencies, and continues to prevent the formation of clear trend across the board.

The price promotion of XRP reflects these wider market decisions. Although the token has shown resilience, it remains locked in a wide range, unable to build a long -term bullish momentum. The recent failure to break above the resistance level of $ 2.60 has been added to the concern of investors, because the sales pressure seems to be back on the market.

Martinez weighed the situation, Emphasize a technical level That could define the short -term process of XRP. According to Martinez, if XRP can break above $ 3 marking, this would invalidate the current head-and-shoulder pattern on the graph-a pattern that is usually associated with trend domains. Such a movement would turn the market front views around and open the door for a large meeting.

However, until that breakout occurs, the main and shoulder structure remains in the game and the downward risks cannot be ignored. Investors are closely monitoring such as XRP near critical support and resistance levels, knowing that the next breakout or breakdown can form the direction of the coming weeks. For now, XRP remains trapped in a tight battle between Beerarish print and bullish potential.

Related lecture

Bulls defend important support for $ 2.20

XRP is currently trading at $ 2.22 after losing the critical level of $ 2.40, which is in line with both the 4-hour 200 advancing average (MA) and the exponential advancing average (EMA). This breakdown has weakened the short -term momentum and placed bulls in a defensive position as the sales pressure starts to build. The level of $ 2.20 is now as an important support zone that must be defended to prevent a deeper correction.

In order to regain strength and to switch the momentum back in favor of the bulls, XRP has to win the level of $ 2.35 in the upcoming sessions. A movement above this resistance zone would indicate renewed purchase interest and possibly cause a push back to the range of $ 2.60. Until that time, price promotion remains vulnerable, with investors looking closely for confirmation.

Related lecture

However, if XRP does not exceed $ 2.20, the market could see a sharp decrease in the direction of the $ 2.00 – a psychological and structural support level that has held in earlier corrections. Such a step would probably confirm Bearish Dominance in the short term and further delay any possible outbreak. As the volatility continues to build, the coming hours can be crucial for the trend direction of XRP.

Featured image of Dall-E, graph of TradingView